Salt Lake Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

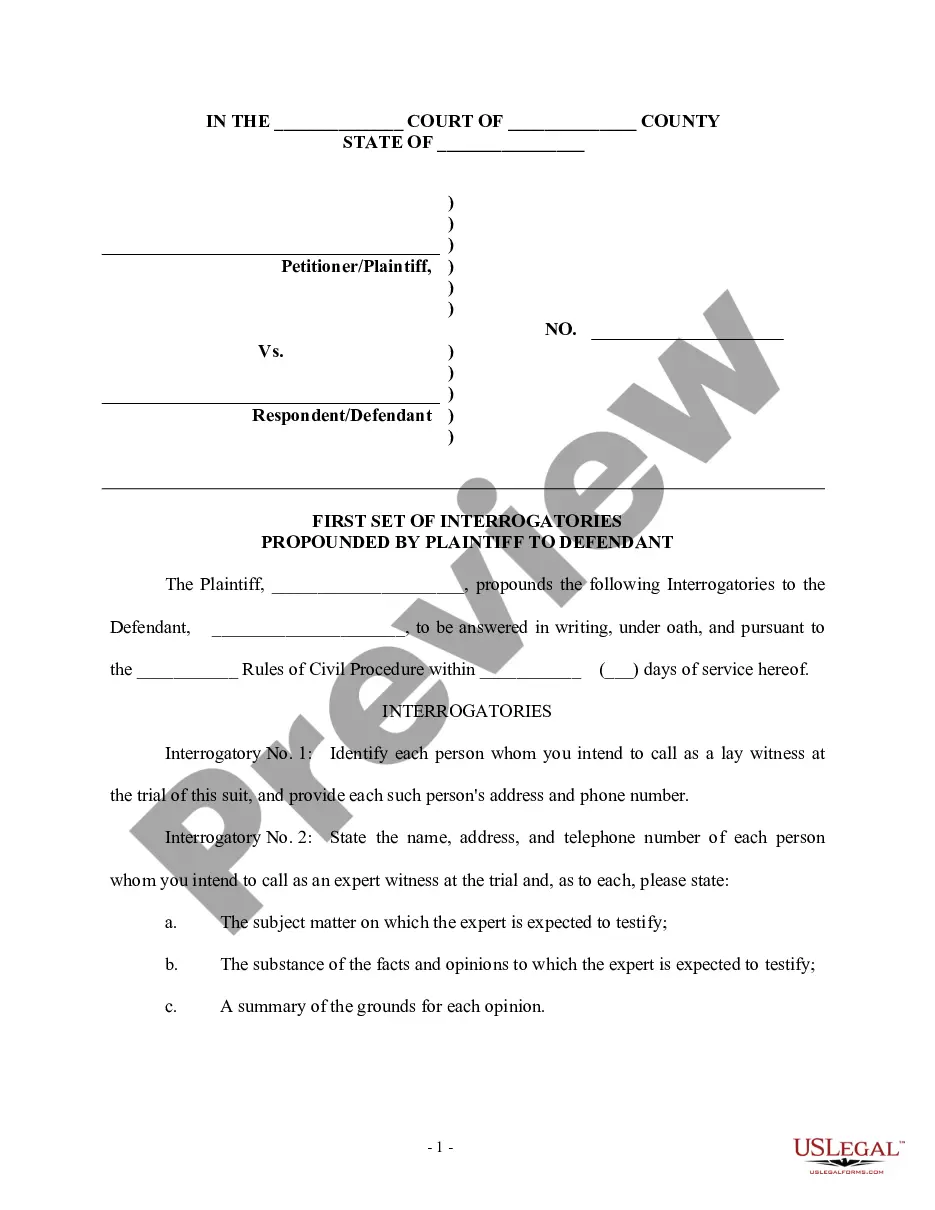

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Drafting legal documents can be a hassle.

Moreover, if you choose to engage a legal expert to create a commercial agreement, papers for ownership transfer, prenuptial agreement, divorce documents, or the Salt Lake Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, it could cost you a significant amount.

Browse through the page and check that there is a sample for your locality. Inspect the form description and utilize the Preview option, if it's available, to confirm it’s the template you need. Don’t fret if the form doesn’t meet your needs - search for the correct one in the header. Once you identify the necessary sample, click Buy Now and select the most applicable subscription. Log In or register for an account to buy your subscription. Make a payment using a credit card or via PayPal. Choose the file format for your Salt Lake Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust and download it. When completed, you can print it and fill it out on paper or upload the samples to an online editor for quicker and more convenient completion. US Legal Forms permits you to use all documents acquired multiple times - your templates can be found in the My documents tab in your profile. Give it a try today!

- So what is the most effective way to conserve time and money while producing valid forms that fully comply with your state and local regulations.

- US Legal Forms represents an excellent option, whether you seek templates for personal or business purposes.

- US Legal Forms boasts the largest online collection of state-specific legal documents, offering users the latest and professionally validated forms for various scenarios consolidated all in one location.

- Thus, if you require the most current version of the Salt Lake Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, you can conveniently find it on our site.

- Acquiring the documents requires very little time.

- Those with an existing account should confirm the validity of their subscription, Log In, and select the template using the Download button.

- If you haven't signed up yet, here’s how you can obtain the Salt Lake Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Form popularity

FAQ

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to disclaim, or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

A disclaimer is a procedure whereby a beneficiary (including an estate or trust) may chose to give up a right to an asset by signing a written document so stating.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Provisions for the marital disclaimer trust must be included in the deceased spouse's will or trust in order for the surviving spouse to benefit from the disclaimed assets during the surviving spouse's lifetime; otherwise, the disclaimed assets will pass directly to the next beneficiaries named in the will or trust.

A Disclaimer means any writing which declines, refuses, renounces, or disclaims any interest that would otherwise be taken by a beneficiary. The procedure for creating a disclaimer according to California Probate Code Section 278-286, 288 is as follows: 1.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estateusually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Proper estate planning is designed to financially provide for your surviving beneficiaries while also reducing or eliminating estate taxes. A disclaimer trust helps married couples to maximize their estate tax exemption limits. It also can provide financially for the surviving spouse and children.