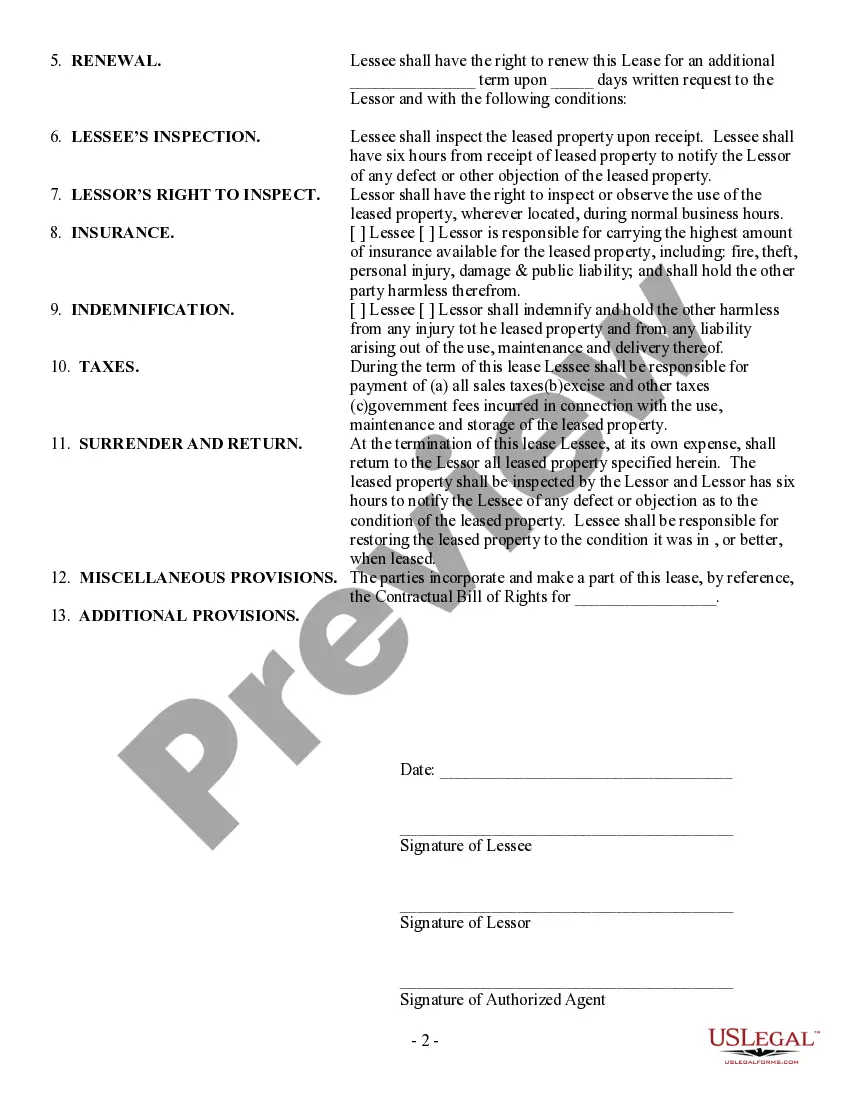

King Washington Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Whether you intend to launch your enterprise, enter into an agreement, apply for your identification renewal, or address family-related legal issues, you must gather specific documentation in accordance with your local statutes and regulations.

Finding the appropriate documents may require significant time and effort unless you utilize the US Legal Forms library.

This service offers users over 85,000 expertly constructed and validated legal templates for any personal or business situation. All files are organized by state and area of use, making it quick and straightforward to opt for a copy like King Simple Equipment Lease.

The documents available in our library are reusable. With an active subscription, you can access all of your previously acquired paperwork at any time in the My documents section of your profile. Stop wasting time on a never-ending search for current official documents. Register for the US Legal Forms platform and keep your paperwork organized with the most comprehensive online form library!

- Ensure the document satisfies your personal requirements and complies with state law regulations.

- Review the form description and examine the Preview if available on the page.

- Utilize the search bar above to find another template relevant to your state.

- Click Buy Now to purchase the sample once you identify the correct one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the King Simple Equipment Lease in your preferred file format.

- Print the document or fill it out and sign it electronically using an online editor to save time.

Form popularity

FAQ

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if: The lessee automatically gains ownership of the asset at the end of the lease.

You can lease expensive equipment for your business, such as machinery, vehicles or computers. The equipment is leased for a specific period; once the contract is up, you may return the equipment, renew the lease or buy it.

After all, landlords want to recover as much money as they can from their commercial real estate investments. They set hefty monthly rents and include critical terms that favor the ongoing management of their properties. However, you can negotiate nearly all the terms in your commercial real estate lease.

Leases are usually easier to obtain and have more flexible terms than loans for buying equipment. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs. Easier to upgrade equipment. Leasing allows businesses to address the problem of obsolescence.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

8 Steps to Negotiate Your Business Equipment Lease.Step 1: Know the difference between want and need.Step 2: Know where you stand as a business.Step 3: Know where you stand as a consumer.Step 4: Initiate contact with leasing companies.Step 5: Comparison shop.Step 6: Get approved.

Equipment leasing is a form of financing that allows business owners to rent equipmentsuch as machinery, vehicles, computers, and morefrom a vendor or leasing company for a specific period of time. At the end of the lease, the business owner must return the equipment, renew the lease, or purchase the equipment.

Use the equation associated with calculating equipment lease payments. Payment = Present Value - (Future Value / ( ( 1 + i ) ^n) / 1- (1 / (1 +i ) ^ n ) / i. In this equation, "i" represent the interest rate as a monthly decimal. Convert the interest rate to a monthly decimal.