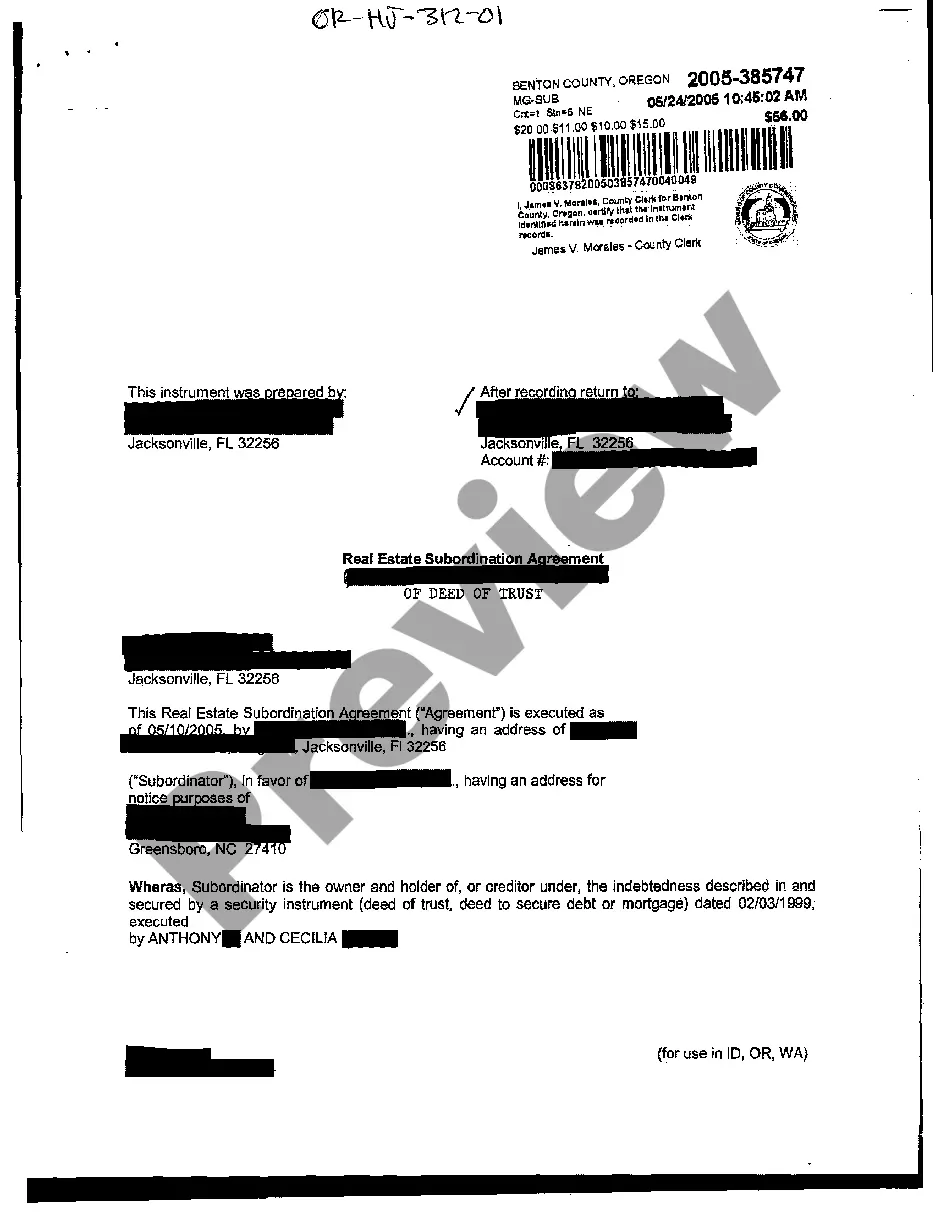

This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

Omaha Nebraska Extension of Loan Closing Date

Description

Form popularity

FAQ

Nebraska does not have an automatic extension policy. Taxpayers must actively file for an extension using its specific forms, like the 4868N, in alignment with the Omaha Nebraska Extension of Loan Closing Date. This ensures you meet your obligations timely. To facilitate this process, consider using uslegalforms for more straightforward filing.

In Nebraska, the general extension period is six months. However, the Omaha Nebraska Extension of Loan Closing Date provides you with additional flexibility if you require more time. You must request this extension properly to avoid facing issues. For guidance, uslegalforms offers comprehensive resources to assist you.

Yes, Nebraska has specific forms available for eFile. This makes it easier to manage your filing needs while adhering to the Omaha Nebraska Extension of Loan Closing Date requirements. eFiling allows you to submit your documents quickly and efficiently. You can access relevant forms through the uslegalforms platform.

To file a tax extension for Nebraska, you should complete and submit Form 4868N. This form can be filed electronically for faster processing, aligning with the Omaha Nebraska Extension of Loan Closing Date strategy. It is crucial to submit the form before your original due date to avoid penalties. Check uslegalforms for an easy filing process.

Nebraska does accept federal extensions for trusts, but you will need to file a Nebraska tax form separately. The Omaha Nebraska Extension of Loan Closing Date applies to various types of filings, including trusts. It’s essential to follow state guidelines along with federal rules. For more detailed help, uslegalforms is a reliable resource.

Yes, you can eFile a Nebraska extension, making the process more convenient and efficient. By utilizing the Omaha Nebraska Extension of Loan Closing Date, you can complete your paperwork online without physical visits. eFiling is a great option that ensures you meet deadlines seamlessly. Use uslegalforms to access eFile options quickly.

The form you need for a Nebraska income tax extension is Form 4868N. This is the official document that allows individuals to extend their filing date for Nebraska income tax. Using the Omaha Nebraska Extension of Loan Closing Date, you can effectively manage your tax obligations and avoid penalties. You can find this form easily on the uslegalforms platform.

Yes, you can file electronically even if you filed an extension. The Omaha Nebraska Extension of Loan Closing Date allows you to use electronic filing to submit your tax information. This process saves time and ensures accuracy in your filings. Consider using the uslegalforms platform for a streamlined electronic filing experience.