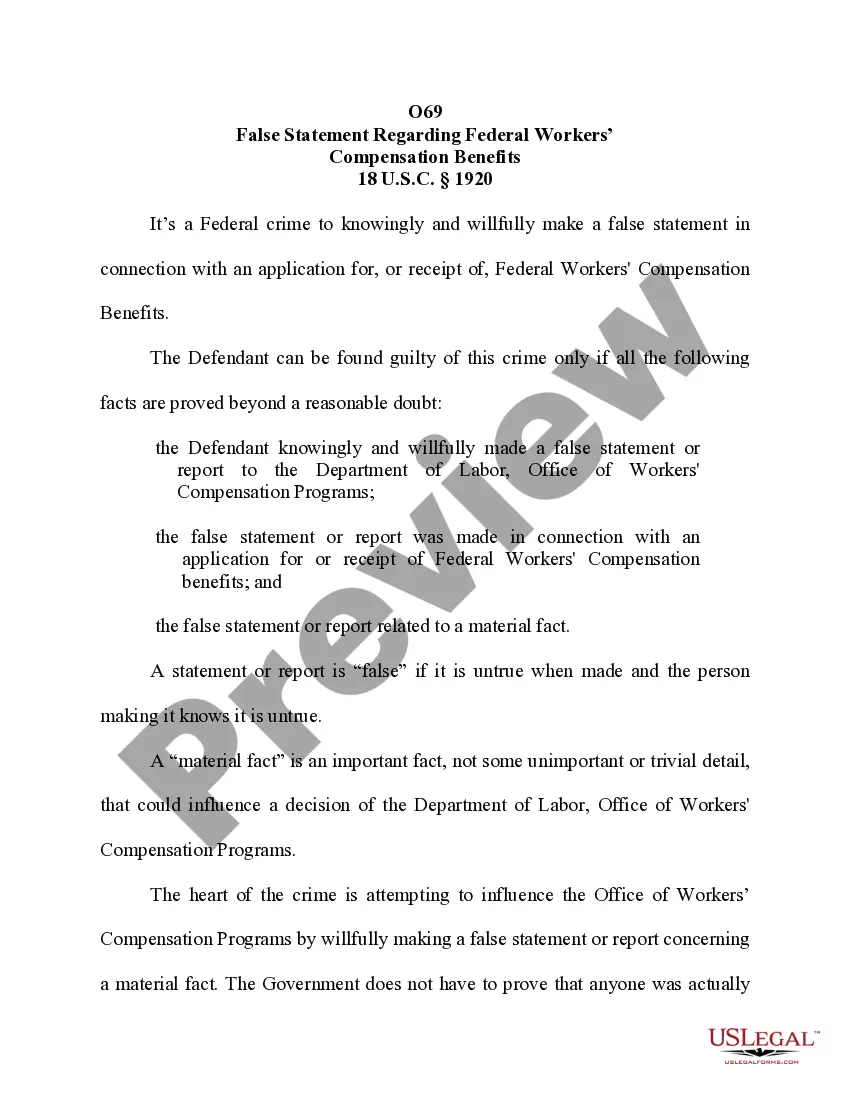

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

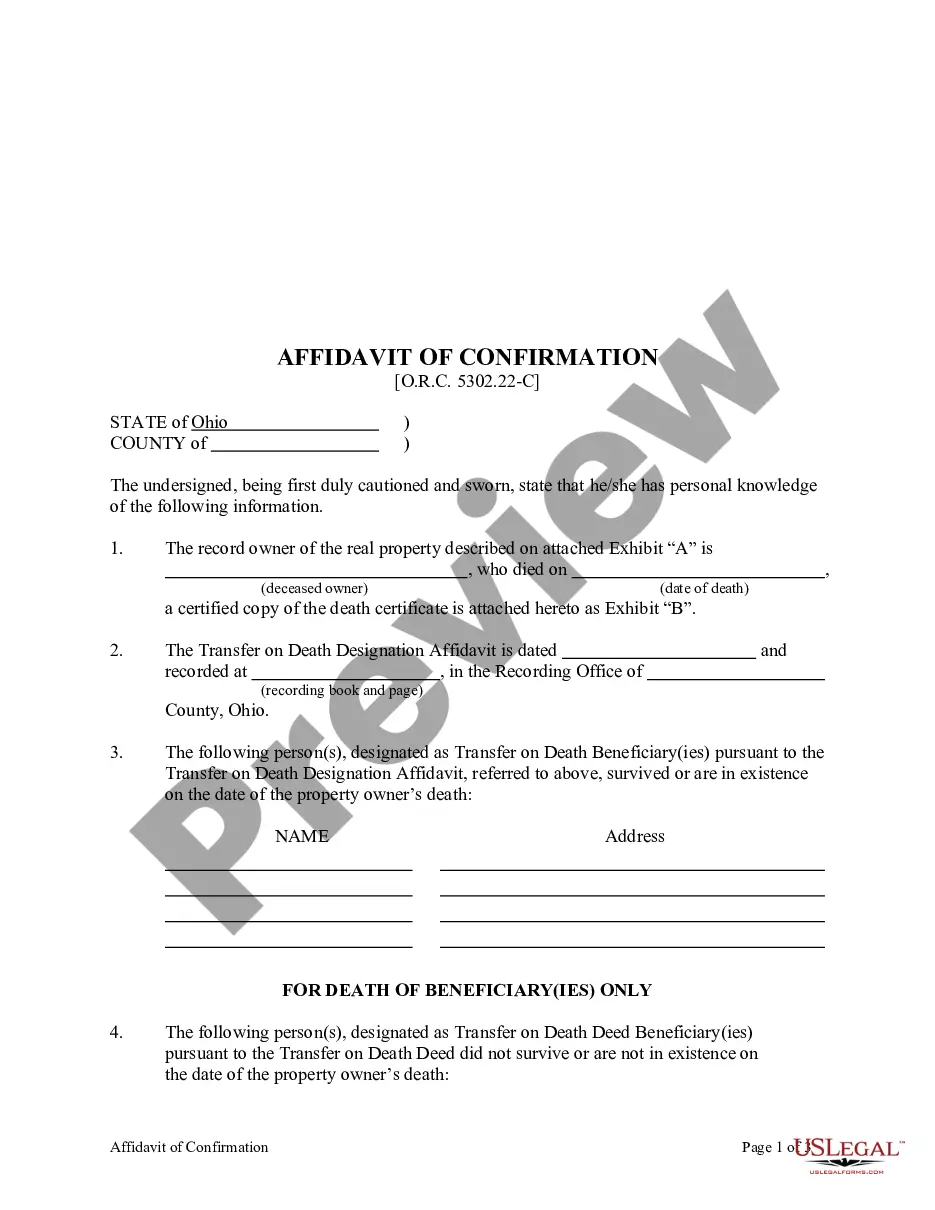

Kings New York Acceptance of Claim and Report of Past Experience with Debtor

Description

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

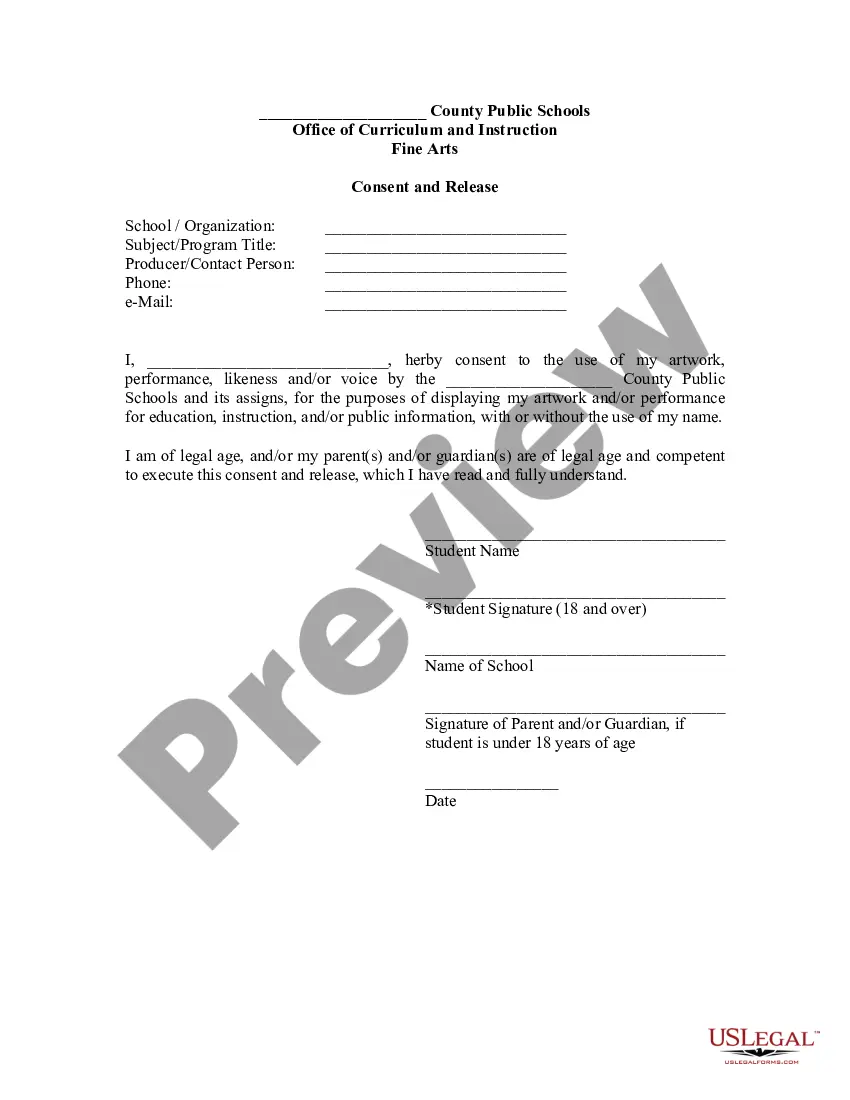

Creating documents for business or individual purposes is continually a significant obligation.

When forming a legal agreement, a public service demand, or a power of attorney, it is crucial to consider all federal and state regulations relevant to the particular area.

Nonetheless, smaller counties and even towns also possess legislative measures that must be taken into account.

Review that the template meets legal standards and click Buy Now.

- All these particulars render it arduous and time-consuming to prepare Kings Acceptance of Claim and Report of Past Experience with Debtor without specialized assistance.

- It is simple to avoid squandering funds on lawyers preparing your documents and generate a legally sound Kings Acceptance of Claim and Report of Past Experience with Debtor independently, utilizing the US Legal Forms online library.

- It is the most extensive online inventory of state-specific legal documents that are professionally verified, ensuring their legitimacy when selecting a template for your county.

- Previously registered users only need to Log In to their accounts to retrieve the necessary document.

- If you do not have a subscription yet, follow the step-by-step guidelines below to obtain the Kings Acceptance of Claim and Report of Past Experience with Debtor.

- Browse the page you've opened and verify if it contains the sample you require.

- To do this, utilize the form description and preview if these features are provided.

Form popularity

FAQ

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you havesuch as late payments or settled debtsthe better.

Collection agencies will typically report to the credit bureaus every month, like most other types of tradelines on your credit report. Therefore, if you have a collection account, you will most likely see the collection agency reporting your account to the credit bureaus once a month.

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

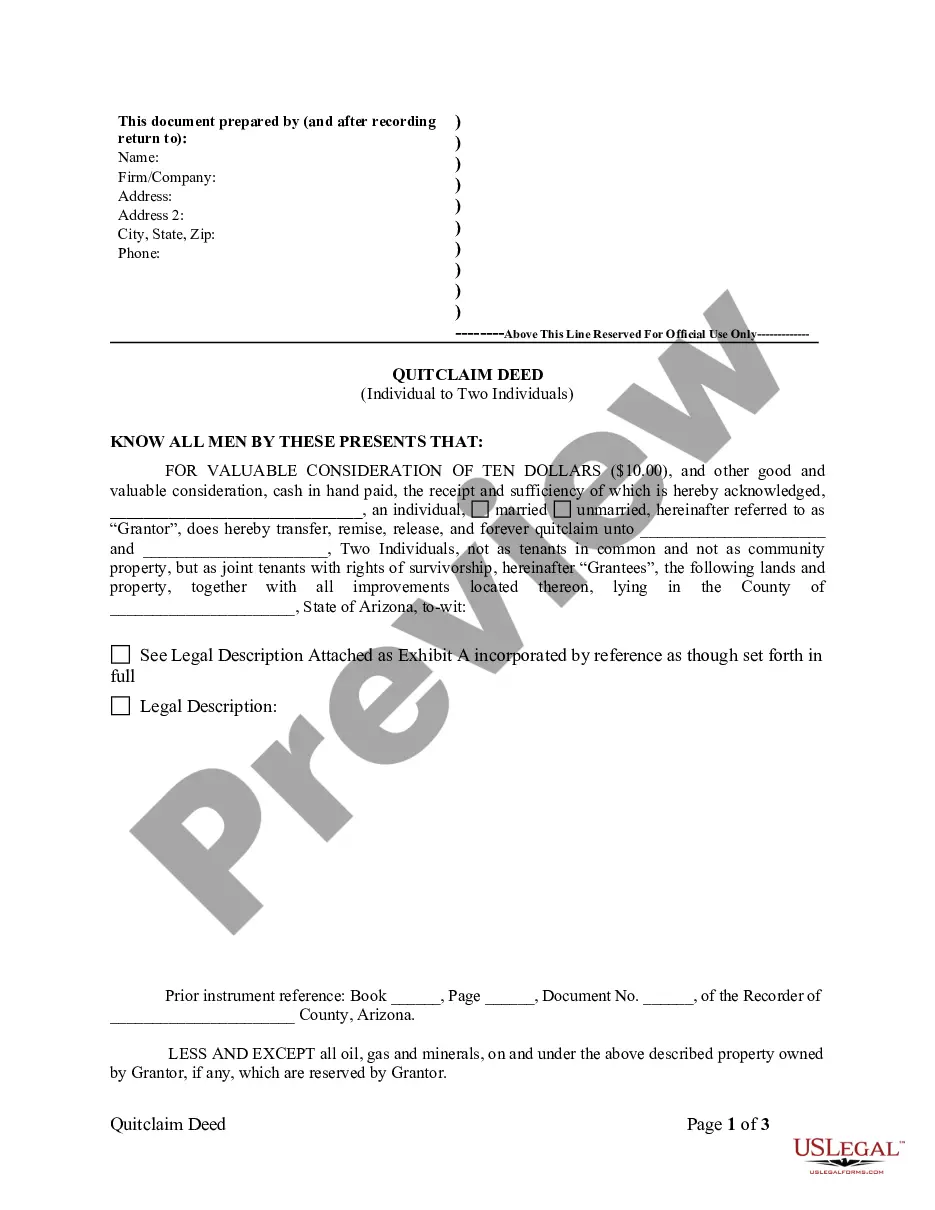

After seven years, most collections accounts should fall off your credit reportso if you're closing in on seven years, just hang on. The impact on your credit score is probably already lessened. After the collection account disappears, your credit score might improve.

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice.

When an account becomes seriously past due, the creditor may decide to turn the account over to an internal collection department or to sell the debt to a collection agency. Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your credit report.

There is no grace period before a collection account becomes eligible for reporting. The agency can continue to report to credit bureaus about your delinquent debt for seven years plus 180 days from the point the account is placed in collections.

A late payment record can pop up on your credit report when you forget or are unable to pay a bill by the due date. The creditor can report your late payment to the credit bureaus (Experian, Equifax and TransUnion) once you're 30 days behind, and the late payment can remain on your credit reports for up to seven years.

If a bill collector cannot locate you, it is allowed to reach out to third parties, such as relatives, neighbors or your employer, but only to find you. They aren't allowed to disclose that you owe a debt or discuss your finances with others.