Columbus Ohio Right of Way Cost Estimate Sheet

Description

Form popularity

FAQ

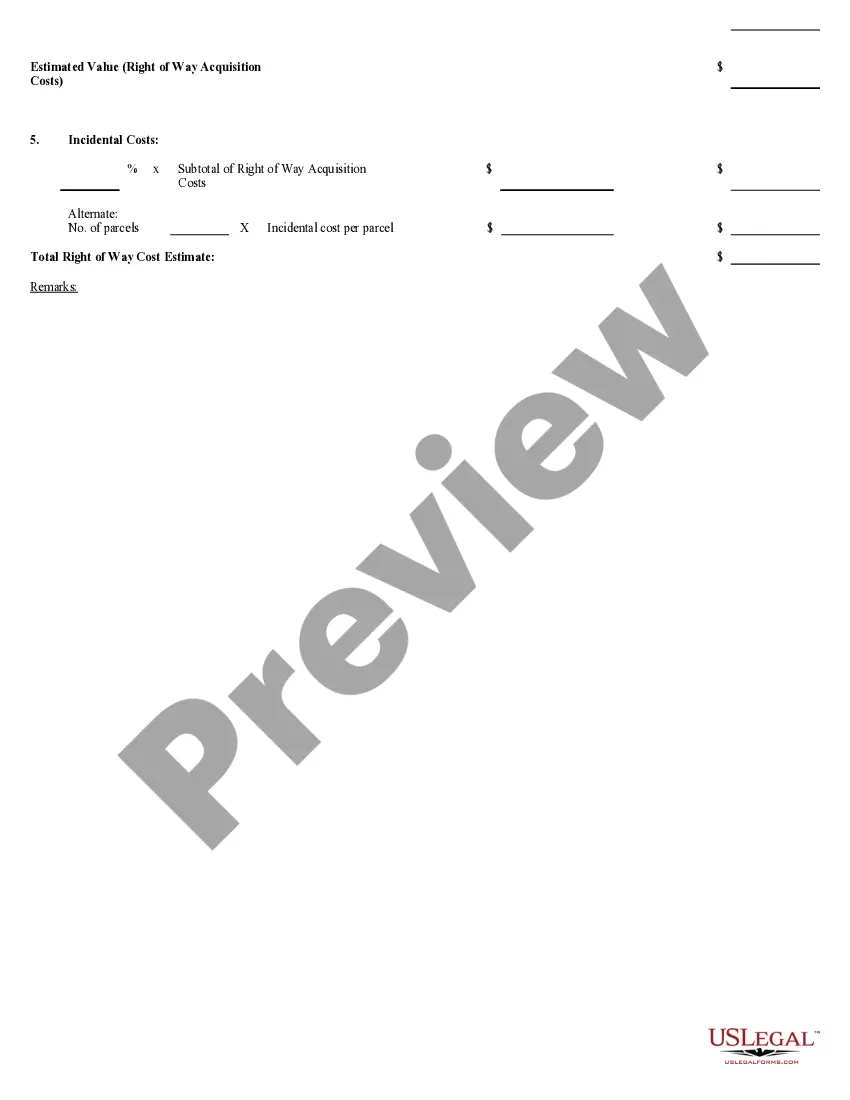

Calculating a project estimate involves assessing all aspects of the project, including time, resources, and costs. You should gather inputs from various stakeholders and review similar past projects for better accuracy. Using the Columbus Ohio Right of Way Cost Estimate Sheet provides a framework to guide your projections, ensuring that you remain on track and within budget. This systematic method can lead to successful project outcomes.

To calculate construction estimates, start by gathering all necessary information about the project scope. Break down the costs into categories such as materials, labor, and permits. Utilizing tools like the Columbus Ohio Right of Way Cost Estimate Sheet can streamline this process, ensuring you capture every detail for an accurate total. This thorough approach minimizes unexpected expenses during the project.

Estimation involves calculating the likely costs for a project based on historical data and current market rates. The formula generally includes fixed costs, variable costs, and a contingency amount. To make estimation more accurate, utilize resources like the Columbus Ohio Right of Way Cost Estimate Sheet. This sheet can help you organize your figures effectively.

The formula for a construction estimate typically involves adding all the direct and indirect costs associated with the project. You need to consider materials, labor, equipment, and overhead. For precise calculations, you can refer to the Columbus Ohio Right of Way Cost Estimate Sheet, which provides structured guidance. By using this template, you can ensure that no crucial element is overlooked.

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.

1. WHO SHOULD FILE THIS RETURN: a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis- ter and report income with the Ohio City Tax Office. b) High School Students 18 years of age and under, working part time, do not have to register with the Ohio City Tax Office.