Montgomery Maryland Guaranty of Open Account — Alternate Form is a legally binding document that provides assurance and protection to creditors involved in open account transactions. This form serves as an additional layer of security in guaranteeing the payment of debts or obligations owed by one party (the debtor) to another (the creditor). By signing this guaranty, a third party (the guarantor) agrees to assume the responsibility of the debtor's liabilities in the event of default. The Montgomery Maryland Guaranty of Open Account — Alternate Form is designed to outline the terms and conditions under which the guarantor will be held accountable for the debtor's debts. These terms typically include specifics regarding the nature of the debt, the amount owed, interest rates, payment schedules, and any additional fees. This alternate form of the Montgomery Maryland Guaranty of Open Account offers variations to suit different situations or preferences. The available types of Montgomery Maryland Guaranty of Open Account — Alternate Form may include: 1. Limited Guaranty: This type imposes restrictions on the guarantor's liability, limiting the amount or duration of the guarantee. It provides a level of protection by mitigating the guarantor's potential financial exposure. 2. Unconditional Guaranty: In contrast, this type imposes no such limitations and holds the guarantor fully responsible for fulfilling the debtor's obligations. The guarantor agrees to pay the debts in full, regardless of the debtor's ability to do so. Creditors often prefer unconditional guarantees due to the higher level of security they provide. 3. Individual Guaranty: This form applies to cases where an individual takes on the role of the guarantor, assuming personal liability for the debtor's debts. 4. Corporate Guaranty: In contrast to an individual guaranty, a corporate guaranty involves a business entity assuming the responsibility for the debtor's debts. This type of guaranty shields the guarantor's personal assets by limiting liability to the assets of the corporation. These different forms of the Montgomery Maryland Guaranty of Open Account — Alternate Form allow flexibility in tailoring the agreement to the specific needs and risk tolerance of all parties involved. It is crucial for all parties to carefully review and understand the terms and obligations outlined in the guaranty before entering into such an agreement. Seeking legal advice is highly recommended ensuring compliance with Montgomery Maryland's laws and regulations.

Montgomery Maryland Guaranty of Open Account - Alternate Form

Description

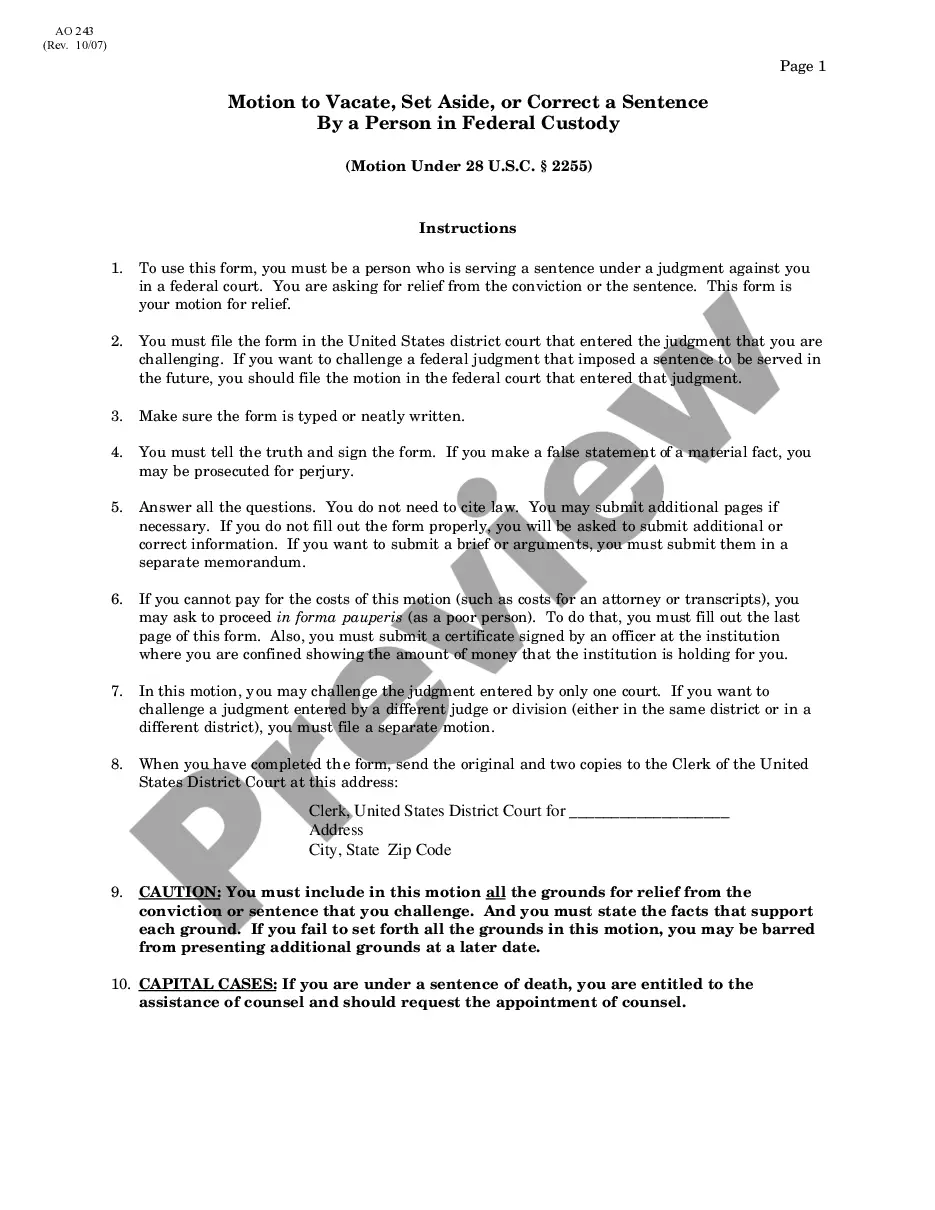

How to fill out Montgomery Maryland Guaranty Of Open Account - Alternate Form?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, finding a Montgomery Guaranty of Open Account - Alternate Form suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Montgomery Guaranty of Open Account - Alternate Form, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Montgomery Guaranty of Open Account - Alternate Form:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Montgomery Guaranty of Open Account - Alternate Form.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

For fully cash-secured facilities, with a customer limit up to $100,000, a Bank Guarantee can be in your hands within 5 8 business days.

When can a bank guarantee be called on? If a bond is unconditional, and intended to be cash equivalent, it can (subject to the below exceptions) be called on by the beneficiary upon written demand to the issuing institution, without regard to the underlying construction contract.

Any person who has a good financial record is eligible to apply for BG. BG can be applied by a business in his bank or any other bank offering such services. Before approving the BG, the bank will analyse the previous banking history, creditworthiness, liquidity, CRISIL, and CIBIL rating of the applicant.

Understand the Process of Bank GuaranteeFirst, an applicant will ask for a loan from a beneficiary or creditor.While applying for the loan, these 2 parties will agree that a bank guarantee is necessary.Then, the applicant will request a bank to provide a bank guarantee for the loan taken from the creditor.More items...

First, an applicant will ask for a loan from a beneficiary or creditor. While applying for the loan, these 2 parties will agree that a bank guarantee is necessary. Then, the applicant will request a bank to provide a bank guarantee for the loan taken from the creditor.

To be enforceable, Bank Guarantees must be an original that has been executed by the bank issuing the Bank Guarantee. In terms of a Deed of Release, the deed must not only be executed, but must be executed correctly to be enforceable.

Documents Required to apply for a bank guarantee are Request Letter and Counter Indemnity cum Memorandum relating to charge over fixed deposit duly stamped (Franking as per respective State Stamp Act). Bank Guarantee text. Board Resolution for Private Limited Company/Limited Company.

A Bank Guarantee is an undertaking by the Bank that payments to your customers and suppliers will be met, without tying up working capital. The Bank holds your cash or assets as security for the guarantee. You provide your supplier with the guarantee instead of cash.

To request a guarantee, the account holder contacts the bank and fills out an application form where you identify the amount needed for the guarantee and reasons for which you are applying for the guarantee.

Annual Fee2.5% of the guarantee amount or $200, whichever is greater. First payment due before the guarantee is issued.