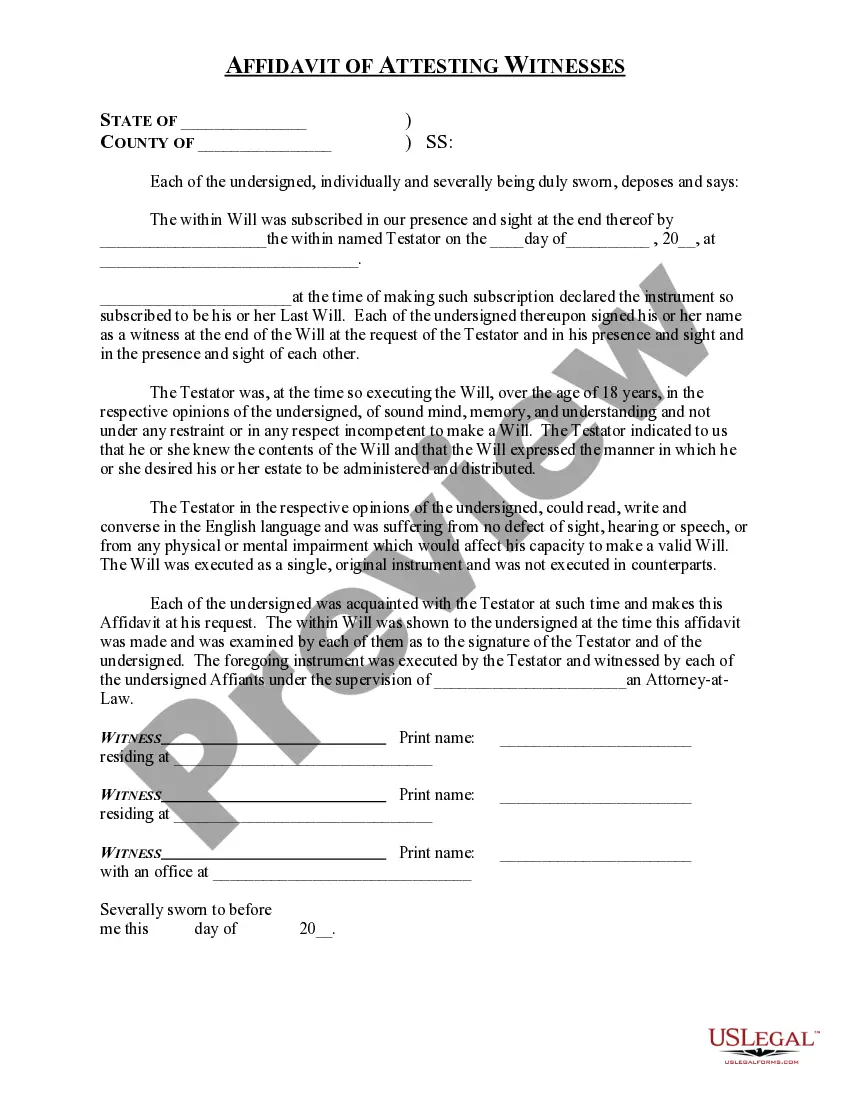

The following form is an affidavit which attests to the proper mailing of papers or documents to a specific person at a specific address.

Fairfax Virginia Affidavit Attesting to the Mailing of Papers or Documents

Description

How to fill out Affidavit Attesting To The Mailing Of Papers Or Documents?

Managing legal documents is essential in today's society.

However, it's not always necessary to obtain professional help to prepare some of them from scratch, such as the Fairfax Affidavit Attesting to the Mailing of Papers or Documents, with a service like US Legal Forms.

US Legal Forms offers over 85,000 documents to choose from in various categories ranging from advance directives to property agreements to dissolution of marriage forms.

Select the payment option, then a necessary payment method, and purchase the Fairfax Affidavit Attesting to the Mailing of Papers or Documents.

Choose to save the document template in any supported file format.

- All forms are categorized by their legitimate state, making the searching process simpler.

- You can also find comprehensive resources and guides on the site to simplify any tasks involved with document execution.

- Here's a guide on how to find and retrieve the Fairfax Affidavit Attesting to the Mailing of Papers or Documents.

- Review the document's preview and summary (if applicable) to grasp a basic understanding of what you will receive after obtaining the form.

- Confirm that the document you select is tailored to your state/county/region as regional laws can influence the legality of certain documents.

- Look for related document templates or restart your search to discover the correct file.

- Click Buy now and create your account. If you already possess one, choose to Log In.

Form popularity

FAQ

Serving an out-of-state defendant in Virginia requires following specific rules. Typically, you must obtain permission from the court and comply with Virginia's service rules. This process can seem overwhelming, but using a Fairfax Virginia Affidavit Attesting to the Mailing of Papers or Documents can streamline your filing process and ensure proper service.

Step 1 Determine Whether a Will Exists. Under Virginia Code § 64.2-601, a will must be admitted to probate, even if it pertains to a small estate.Step 2 Prepare Affidavit. Download the Virginia Small Estate Act Affidavit and fill it out.Step 3 Get Affidavit Notarized.Step 4 Collect the Assets.

Generally, the role and responsibilities of an executor will include actions such as searching for assets belonging to the estate, inventorying those assets, valuing them as of the date of death, reviewing any debts or expenses presented, and ensuring that any required tax returns, whether they are estate or income tax

Compensation for an executor in Virginia is the sole discretion of the court which has jurisdiction over the estate. As a general guideline, an executor is entitled to whatever fee is fixed by the will. Where a specific fee was not fixed, the courts have considered reasonable a fee equal to 5% of the assets.

Who can be an executor of a will? Many people choose their spouse or civil partner, or their children, to be an executor. At least one of your executors will need to be aged over 18 at the time they apply for probate which is a legal document that gives you the right to sort out the affairs of someone who has died.

In Virginia, any estate valued at greater than $50,000 at the time of the owner's passing must go through the probate procedure.

Virginia has no set time limit for settling an estate. You can take the time you need to grieve and get your affairs in order before you settle the estate. However, Virginia courts do generally recommend that you start the process within a week to 30 days after the funeral.

Generally, estates cannot realistically close before six months after the decedent's death because the surviving spouse has the right to make her claim for an elective share within that six months.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

Compensation for an executor in Virginia is the sole discretion of the court which has jurisdiction over the estate. As a general guideline, an executor is entitled to whatever fee is fixed by the will. Where a specific fee was not fixed, the courts have considered reasonable a fee equal to 5% of the assets.