Portland Oregon Cost Estimate and Schedule Data Sheet

Description

Form popularity

FAQ

An example of cost estimation could involve a contractor evaluating a residential remodeling project. The contractor would assess materials, labor, and time needed, culminating in a total estimated cost. This process can be documented through a Portland Oregon Cost Estimate and Schedule Data Sheet, which provides a structured overview of the financial expectations. You can find templates and examples on the uslegalforms site to help you craft effective estimates.

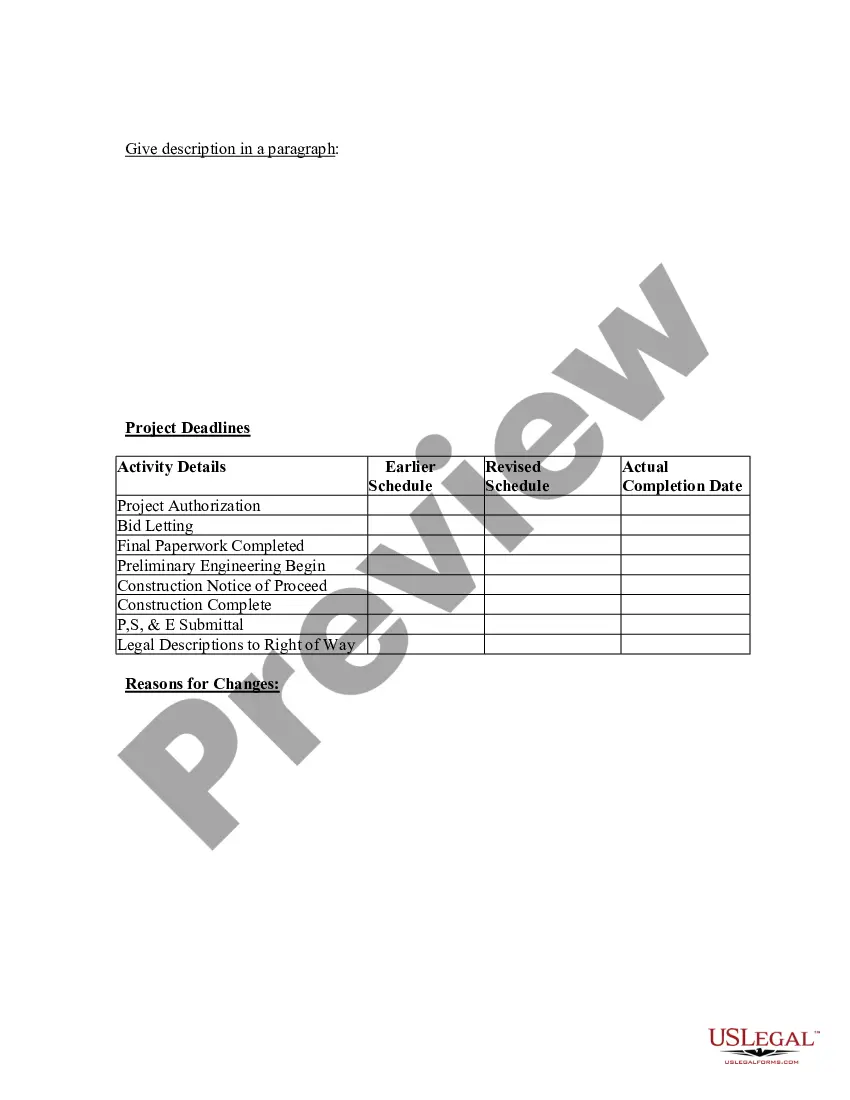

To write a cost estimate report, start by outlining the project details, including scope and timeline. Next, categorize costs into labor, materials, and overhead, providing clear explanations for each. Lastly, present your findings in an organized format, utilizing a Portland Oregon Cost Estimate and Schedule Data Sheet to enhance clarity and professionalism. Consider using the resources at uslegalforms to guide your report formatting.

The formula for a cost estimate typically involves adding direct costs, indirect costs, and profit margin. Direct costs include materials and labor, while indirect costs cover overhead expenses. For a comprehensive Portland Oregon Cost Estimate and Schedule Data Sheet, ensure that you accurately calculate each component to provide a reliable figure. You can use tools or templates available on the uslegalforms platform to streamline this process.

Yes, Oregon requires estimated tax payments for residents and non-residents with Oregon source income who owe a specific amount of tax. This requirement helps ensure that taxpayers meet their obligations throughout the year. Make sure to analyze your financial situation using the Portland Oregon Cost Estimate and Schedule Data Sheet to find out if you need to make these payments.

The tax form for SHS (Self-Employment Health Insurance) in Portland typically involves the Oregon personal income tax forms. You should use Form 40 or Form 40N, depending on your residency status. For detailed breakdowns and estimates, refer to the Portland Oregon Cost Estimate and Schedule Data Sheet, which can guide you specifically through these forms.

Certain individuals are exempt from making estimated tax payments, mainly those who owe less than a specified amount in taxes. Furthermore, taxpayers who had no tax liability in the previous year may also be exempt. It is advisable to check the Portland Oregon Cost Estimate and Schedule Data Sheet to confirm your eligibility for an exemption.

You can mail your Oregon estimated tax payments to the appropriate address listed on the Oregon Department of Revenue website. It is important to ensure that your payment is sent to the right location to avoid delays. If you're using the Portland Oregon Cost Estimate and Schedule Data Sheet, it may also provide information relevant to mailing your payments correctly.

Whether you need to file the Oregon form or WR depends on your individual tax circumstances. Typically, individuals who have income subject to Oregon tax must file the appropriate form when submitting their tax returns. This is essential for proper reporting, especially if you're considering details outlined in the Portland Oregon Cost Estimate and Schedule Data Sheet.

In the United States, various states require estimated tax payments, including Oregon. If you are a resident or have income from Oregon sources, you likely need to make these payments. It's crucial to consult the Oregon tax guidelines, particularly in relation to your Portland Oregon Cost Estimate and Schedule Data Sheet, for the specific requirements that apply to your situation.

The cost to build a house in Portland, Oregon is typically estimated at about $150 to $400 per square foot, heavily influenced by the materials, layout, and finishes you choose. It's essential to factor in additional costs for permits and fees, which can substantially affect your overall budget. To create a more precise financial outline, refer to the Portland Oregon Cost Estimate and Schedule Data Sheet available at US Legal Forms, giving you a comprehensive view of what to expect.