Pima Arizona Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Legal statutes and guidelines in every region vary across the nation.

If you aren't an attorney, it can be challenging to navigate the different standards when drafting legal paperwork.

To prevent expensive legal help while preparing the Pima Addendum for Release of Liability regarding FHA, VA, or Conventional Loans, and Restoration of a Seller's Entitlement for VA Guaranteed Loans, you require a validated template that is applicable in your area.

This is the simplest and most cost-effective method to access current templates for any legal needs. Discover everything with just a few clicks and maintain your documentation neatly organized using US Legal Forms!

- That's when the US Legal Forms platform becomes incredibly useful.

- US Legal Forms is a reliable resource for millions, offering over 85,000 legal templates specific to each state.

- It's an excellent choice for professionals and individuals seeking DIY templates for various personal and business situations.

- All forms can be reused multiple times: once you select a template, it stays in your profile for future reference.

- Thus, if you possess an account with an active subscription, you can simply Log In and re-download the Pima Addendum for Release of Liability regarding FHA, VA, or Conventional Loans, Restoration of a Seller's Entitlement for VA Guaranteed Loans from the My documents section.

- For new users, additional steps are needed to obtain the Pima Addendum for Release of Liability concerning FHA, VA, or Conventional Loans, Restoration of a Seller's Entitlement for VA Guaranteed Loans.

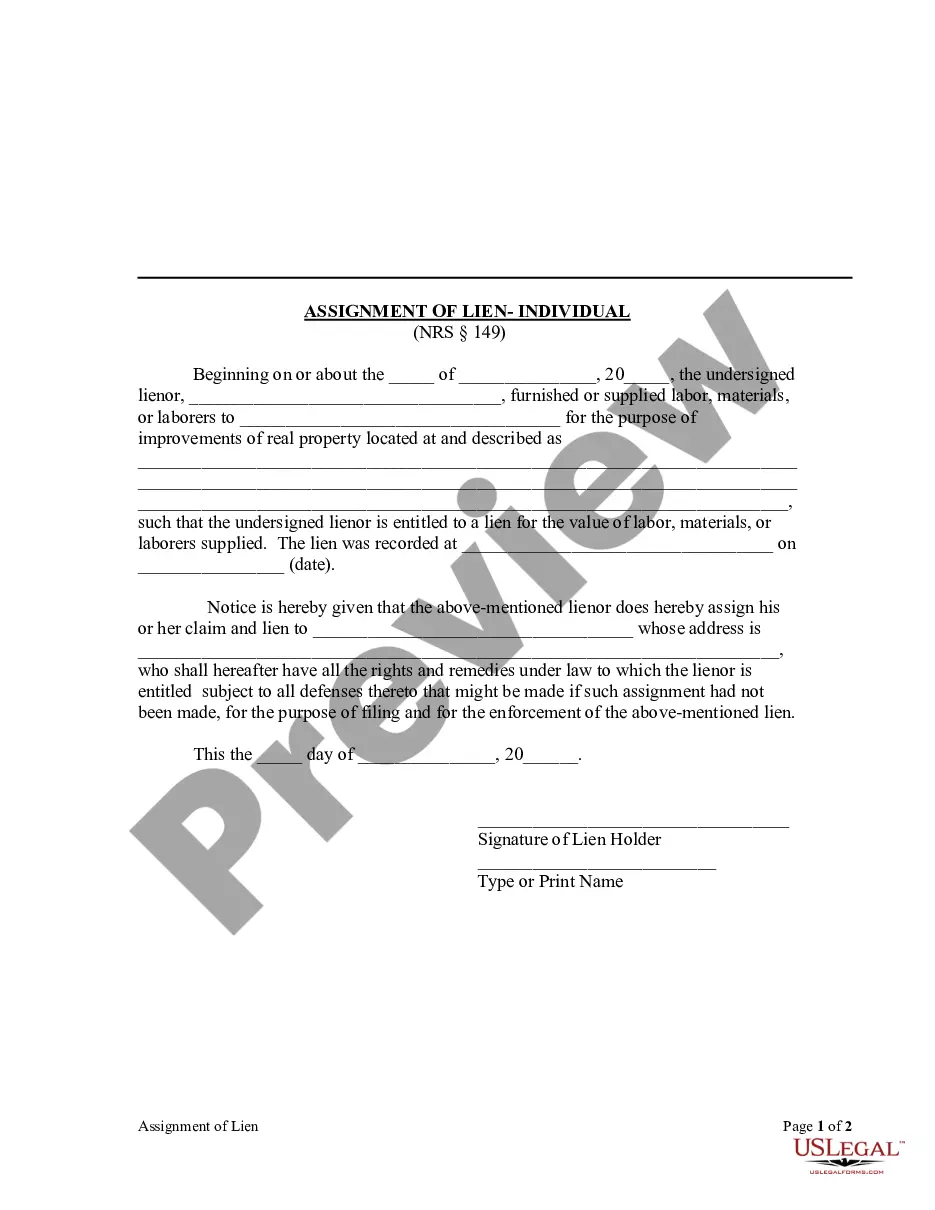

- Review the content of the page to ensure you've located the correct sample.

- Utilize the Preview option or examine the form description if one is provided.

- Search for another document if there are discrepancies with any of your requirements.

- Press the Buy Now button to acquire the template once you've found the right one.

- Choose one of the subscription plans and log in or create a new account.

- Decide how you would like to pay for your subscription (via credit card or PayPal).

- Select the format in which you wish to save the file and click Download.

- Finalize and sign the template in writing after printing it or complete the process electronically.

Form popularity

FAQ

A Veterans Affairs Request for and Authorization to Release Medical Records or Health Information, or VA Form 10-5345, is a document that will allow the collection of treatment records for doctors or any health care provider, once their active duty is completed if they have ever been treated at any Veteran's Facility

FHA addendums add provisions and enhance protections already on a purchase agreement. They protect the FHA buyer and lender from misrepresentations and can also protect a buyer's deposit.

VA Loans Are Transferable The biggest benefit of VA loan assumption is that the person assuming the loan doesn't have to be a qualified veteran or current service member. As long as the person assuming the loan meets the lender's financial VA loan requirements, they'll be approved and able to take over the loan.

The FHA amendatory clause gives you the right to back out of buying a home without losing any money if the value doesn't at least match the sales price. It's just one of many disclosures you'll sign if you take a loan backed by the Federal Housing Administration (FHA).

FVAC means Fortress Value Acquisition Corp., a Delaware corporation. Sample 1. FVAC s IPO means FVAC's initial public offering, consummated on , through the sale of 34,500,000 units (including 4,500,000 units sold pursuant to the underwriters' exercise of their over- allotment option) at $10.00 per unit.

Veterans with VA mortgages can have their VA home loan assumed by someone else, also called a VA loan assumption. If your plans, goals, or needs changed and you need to get out of a VA loan one option is to sell your home but an alternative option is an assumable mortgage, a buyer takes over the loan.

-The VA releases you in writing from liability on the loan. -You sell the property to an eligible veteran with sufficient loan entitlement who agrees to assume your loan and substitute his or her loan entitlement for yours.

But when assuming a VA loan, the new borrower will not need to meet any military service requirements. With that, non-veterans can assume a VA loan. As with the original loan, the new borrower will need to prove their financial qualifications to the lender.

An important thing to know about VA loans is that they are assumable. This means that a borrower can take over the terms of an existing VA loan, even if they are not eligible to take out a VA loan for themselves. With that, the home buyer will have the same mortgage payment the home seller had.

This means that veterans and non-veterans could assume a VA home loan. Nowadays, there are two ways to assume a VA loan. 1. The new buyer is a qualified veteran who substitutes his or her VA eligibility for the eligibility of the seller.