Middlesex Massachusetts Contractor's Final Affidavit of Payment to Subcontractors

Description

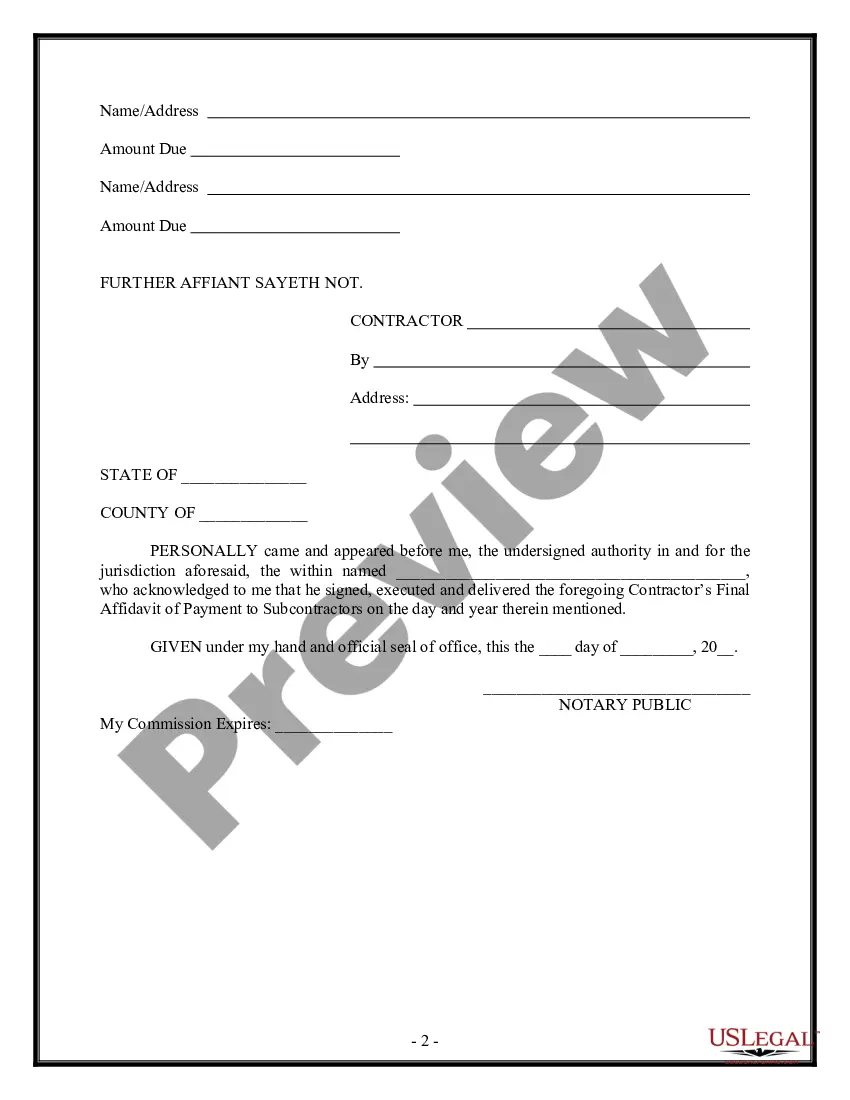

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

Regardless of whether you plan to launch your enterprise, engage in a contract, request an update for your identification, or settle family-related legal matters, you must organize specific documentation that complies with your local statutes and regulations.

Finding the appropriate documents may consume a significant amount of time and effort unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 expertly crafted and validated legal forms for any personal or business need. All documents are categorized by state and specific usage, making it quick and easy to select a document such as the Middlesex Contractor's Final Affidavit of Payment to Subcontractors.

Forms available on our site can be reused. With an active subscription, you have access to all of your previously obtained documents at any time in the My documents section of your profile. Stop spending time on an endless hunt for current official documents. Join the US Legal Forms platform and maintain your paperwork organized with the largest online collection of forms!

- Ensure the sample meets your individual requirements and state legal guidelines.

- Review the form description and examine the Preview if available on the page.

- Use the search box above to find additional templates by entering your state.

- Click Buy Now to acquire the document once you find the correct one.

- Select the subscription plan that best fits your needs in order to advance.

- Log in to your account and complete the payment using a credit card or PayPal.

- Download the Middlesex Contractor's Final Affidavit of Payment to Subcontractors in your preferred file format.

- Print the document or fill it out and sign it electronically using an online editor to save time.

Form popularity

FAQ

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

The following steps can help contractors get the payments they are owed.Create Solid Contracts. A solid contract is the strongest weapon in your arsenal.Optimize Your Contracts.Send Invoices for Progress Payments.Use Preliminary Notices & Conditional Lien Waivers.5 Seek Payment After the Project is Completed.

Make sure you've classified your workers correctly, and determined whether they're legally contractors, freelancers, or regular employees. select a suitable payment method and agree on the payment terms with your worker. gather the right documentation for the IRS.

A payment schedule should contain all of the information you need to plan out anticipated and actual payments:The name of the contractor or vendor.Description of the work or materials.Amount of the payment due.Due date for the payment.Actual amount paid.Actual payment date.Payment method.Notes.

Since 1099 workers aren't on payroll, you will need to manually pay them via check or an online solution such as PayPal or Venmo. To further simplify things, you can also use payroll services & software like QuickBooks to automatically track invoices for each independent contractor and make payments.

Prior to filing a lien, a lienor who does not have a direct contract with the owner, must serve the owner with a Notice to Owner.

Learn more about California's 20-day preliminary notice. In California, GCs must file a mechanics lien within 90 days from the completion of the project as a whole. However, if a notice of completion or cessation was filed, the deadline is shortened to 60 days from the date such notice was filed.

If you make cash payments to independent contractors, the first thing you should know is that there is nothing inherently illegal about doing so. Cash is still a perfectly good form of payment. If you have cash on hand and want to use it to pay your contractors, then you can absolutely do so.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.