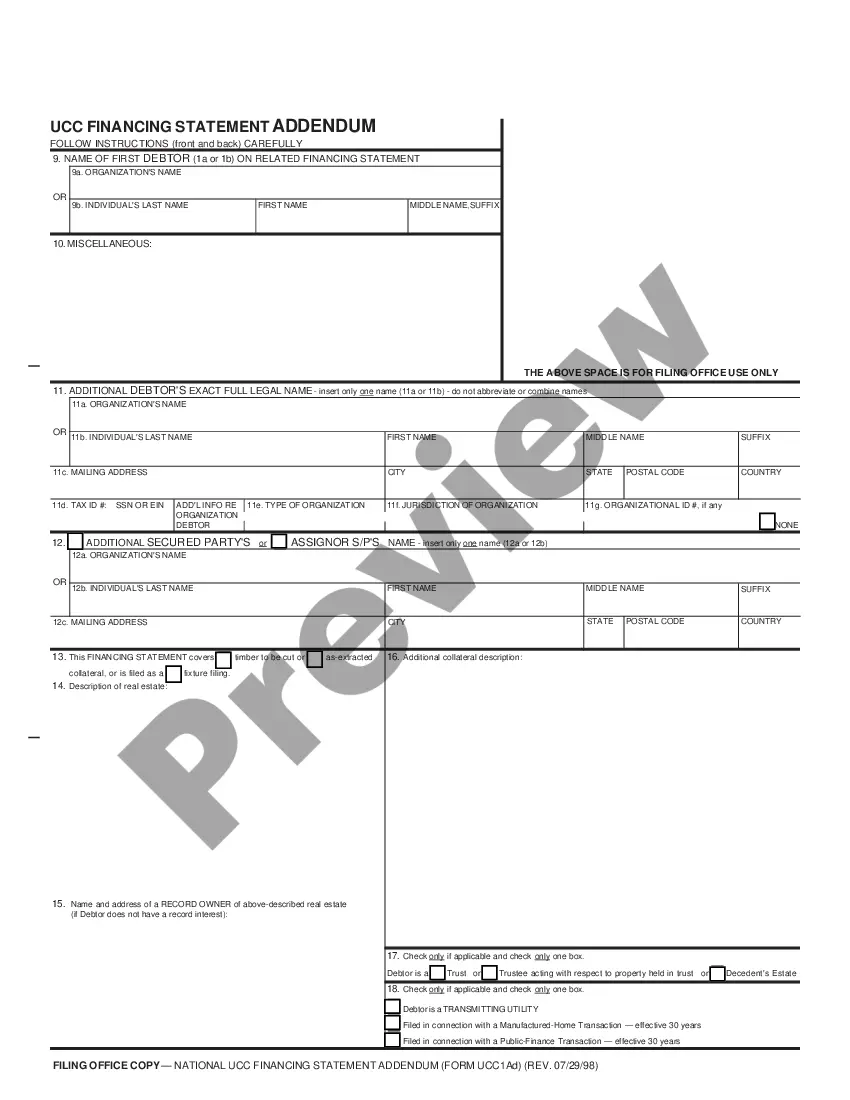

UCC1 - Financing Statement - Texas - For use until August 1, 2013. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Austin Texas UCC1 Financing Statement

Description

How to fill out Texas UCC1 Financing Statement?

We consistently endeavor to minimize or evade legal complications when engaging with subtle law-related or financial concerns.

To achieve this, we seek out attorney services that, generally speaking, are very expensive.

Nevertheless, not all legal challenges are of equal intricacy. The majority of them can be managed by ourselves.

US Legal Forms is an online directory of current DIY legal documents that cover various topics from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from the My documents tab. The procedure is just as simple if you’re not familiar with the website! You can set up your account in a matter of minutes. Ensure you verify that the Austin Texas UCC1 Financing Statement complies with the laws and regulations of your state and region. Additionally, it’s essential to review the form’s outline (if available), and if you identify any inconsistencies with your initial expectations, look for an alternative form. Once you’ve confirmed that the Austin Texas UCC1 Financing Statement is suitable for your situation, you can choose the subscription option and continue to payment. Then you can download the form in any format that is available. For more than 24 years of our existence, we’ve assisted millions of people by providing ready-to-customize and current legal documents. Take full advantage of US Legal Forms now to conserve effort and resources!

- Our platform enables you to take charge of your matters without requiring the assistance of a lawyer.

- We offer access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, which significantly eases the search process.

- Utilize US Legal Forms whenever you need to acquire and download the Austin Texas UCC1 Financing Statement or any other form swiftly and securely.

Form popularity

FAQ

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

UCC liens are used when a creditor wants to give notice to other lenders of its interest in a debtor's property. A UCC-1 financing statement is generally filed with the debtor's secretary of state when a loan is originated. Lenders can attach UCC liens to a wide range of assets, including: Inventory.

The financial statement serves a similar purpose as recording a deed for real property: registering debt with a state so other creditors and the government can track legitimate security interests in property.

A UCC filing creates a lien against the collateral a borrower pledges for a business loan. The uniform commercial code is a set of rules governing commercial transactions. When a business owner receives financing secured by collateral, a lender can file a UCC lien against the assets pledged by the business owner.

A request for a certified search of the UCC records must be submitted in writing to one of the Clerk of Court offices. The fee for the search is $30 per debtor name. The Secretary of State offers subscriptions to the UCC database for an annual fee of $400.

Normally a UCC-1 Financing Statement expires five years from the date of filing. If the loan has not been paid off, the lender may file a continuation, extending the financing statement for an additional five years. If the lender changes names or ownership, an assignment may be filed to show the new lender's name.

In Texas you can search for UCC-1 filings made against your company through a website provided by the Texas Secretary of State's office. There is a very small fee for conducting this search. Normally a UCC-1 Financing Statement expires five years from the date and time of filing as indicated on the UCC-1 form.

All UCC's that are filed with the County Clerk are valid for (5) years. Any statement that expires may be continued with the Secretary of State. If the statement remains effective past July 01, 2002, a new UCC will need to be filed. Please direct any questions to the Texas Secretary of State.

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.