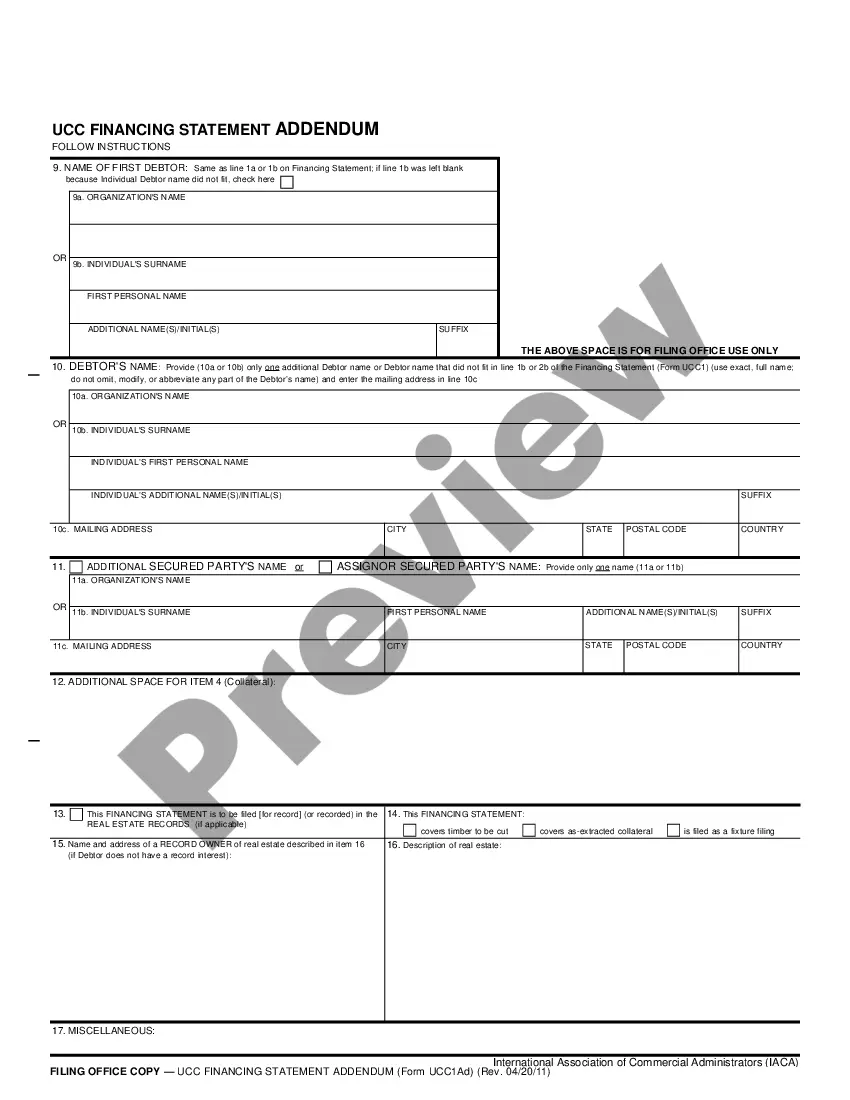

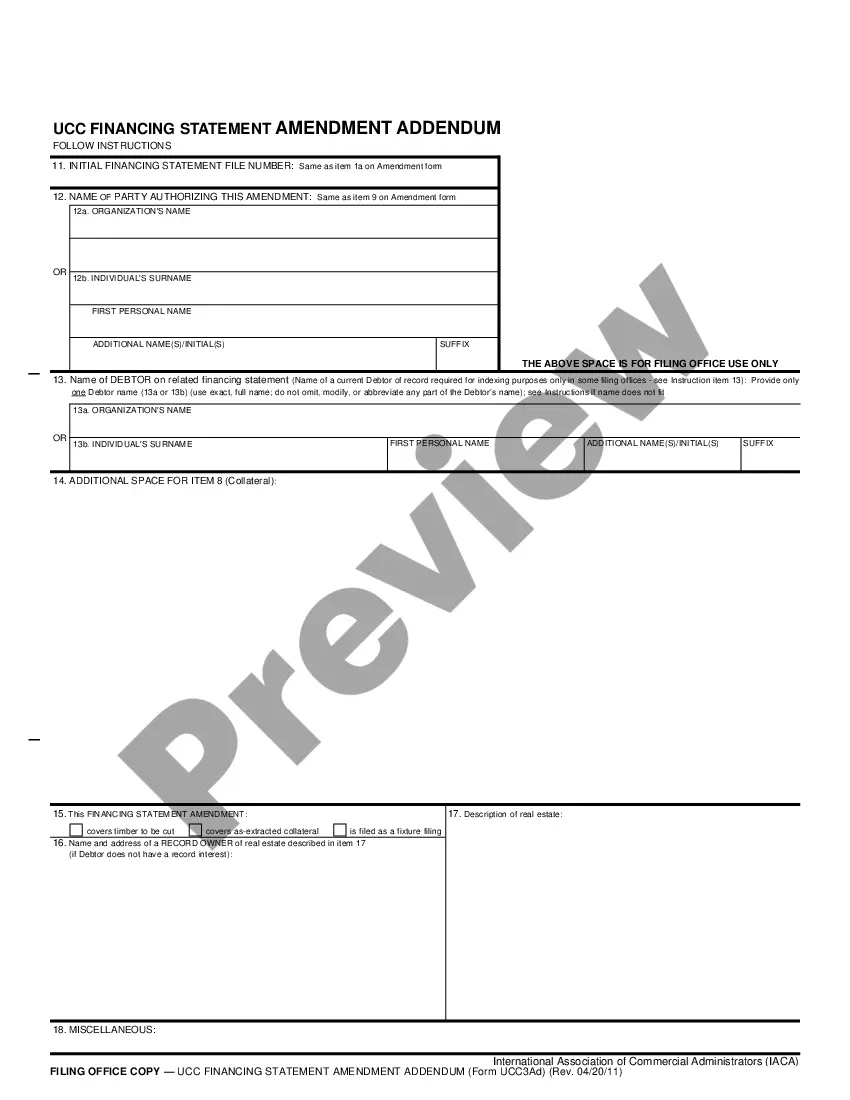

This Uniform Commercial Code form, a UCC1-AD - Financing Statement - Texas, is for use in the documentation of personal property as collateral for a loan, and related matters.

Austin Texas UCC1-AD - Financing Statement

Description

How to fill out Texas UCC1-AD - Financing Statement?

If you are looking for a legitimate form, it’s challenging to discover a superior service than the US Legal Forms site – likely the most extensive collections online.

With this collection, you can obtain a vast array of form examples for both commercial and personal uses categorized by type and area, or key terms.

Utilizing our sophisticated search feature, acquiring the newest Austin Texas UCC1-AD - Financing Statement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the account registration process.

Acquire the template. Choose the format and save it on your device.

- Additionally, the pertinence of each file is verified by a team of qualified attorneys who consistently assess the templates on our platform and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Austin Texas UCC1-AD - Financing Statement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions provided below.

- Ensure you have located the form you need. Review its overview and use the Preview feature to inspect its contents. If it doesn’t meet your requirements, utilize the Search function at the top of the page to find the suitable file.

- Confirm your selection. Click the Buy now button. After that, choose your desired pricing option and enter your details to create an account.

Form popularity

FAQ

The financial statement serves a similar purpose as recording a deed for real property: registering debt with a state so other creditors and the government can track legitimate security interests in property.

The Office of the Secretary of State is the central filing office for the receipt, filing, indexing and recordation of financing statements and other documents provided for under the Uniform Commercial Code and certain other lien notice statutes.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

UCC liens are used when a creditor wants to give notice to other lenders of its interest in a debtor's property. A UCC-1 financing statement is generally filed with the debtor's secretary of state when a loan is originated. Lenders can attach UCC liens to a wide range of assets, including: Inventory.

Texas has adopted the following Articles of the UCC: Article 3: Negotiable instruments: UCC Article 3 applies to negotiable instruments. It does not apply to money, to payment orders governed by Article 4A, or to securities governed by Article 8.

Effective July 01, 2001, all UCC filings are to be made with the Texas Secretary of State. County Clerks will no longer take UCC filings. This does not affect UCC's filed in the Real Property office. Only terminations will be filed by the County Clerk's office.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.