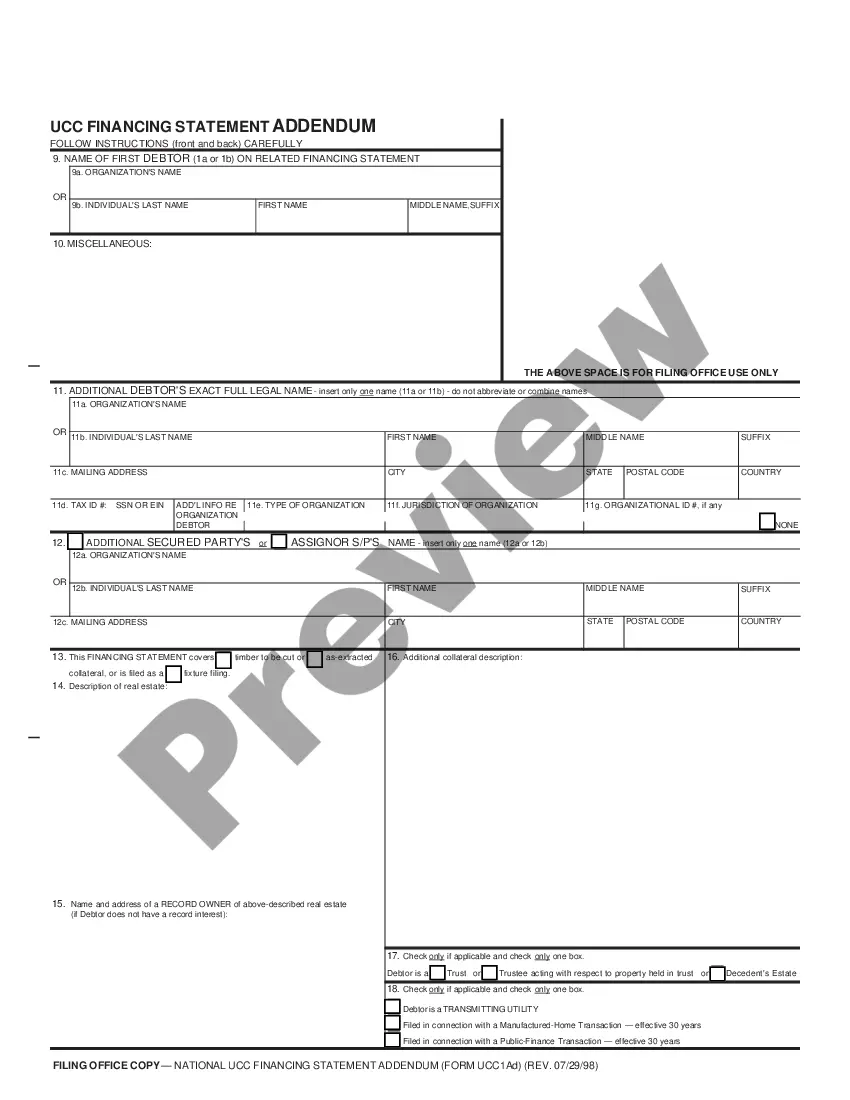

UCC1 - Financing Statement Addendum - Texas - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Austin Texas UCC1 Financing Statement Addendum

Description

How to fill out Texas UCC1 Financing Statement Addendum?

Utilize the US Legal Forms and gain instant access to any form sample you desire.

Our user-friendly platform with a vast selection of templates streamlines the process of locating and acquiring almost any document sample you require.

You can download, complete, and validate the Austin Texas UCC1 Financing Statement Addendum in a matter of minutes instead of spending hours online searching for the suitable template.

Using our assortment is an excellent way to enhance the security of your document filing.

If you haven’t created a profile yet, follow the steps outlined below.

Access the page with the template you need. Ensure that it is the document you were searching for: verify its title and description, and utilize the Preview feature when available. Otherwise, use the Search bar to find the appropriate one.

- Our expert legal professionals routinely examine all the documents to ensure that the forms are suitable for a specific area and comply with current laws and regulations.

- How can you obtain the Austin Texas UCC1 Financing Statement Addendum.

- If you currently possess a subscription, simply Log In to your account.

- The Download button will appear on all the files you access.

- Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

Effective July 01, 2001, all UCC filings are to be made with the Texas Secretary of State. County Clerks will no longer take UCC filings. This does not affect UCC's filed in the Real Property office. Only terminations will be filed by the County Clerk's office.

The Office of the Secretary of State is the central filing office for the receipt, filing, indexing and recordation of financing statements and other documents provided for under the Uniform Commercial Code and certain other lien notice statutes.

Texas has adopted the following Articles of the UCC: Article 3: Negotiable instruments: UCC Article 3 applies to negotiable instruments. It does not apply to money, to payment orders governed by Article 4A, or to securities governed by Article 8.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

How to complete a UCC1 (Step by Step) Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Form UCC3 is used to amend (make changes to) a UCC1 filing. The required information is: An acknowledgement name and address. (Recommended for return copy of the filing.)