This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of an individual's social or professional standing, completing law-related documents is an unfortunate requirement in today’s professional landscape.

Often, it’s nearly impossible for someone without legal knowledge to create such documentation from the ground up, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms provides assistance.

Confirm that the template you discovered is tailored to your locality, considering that the regulations of one state or region may not apply to another.

Examine the document and review a brief outline (if available) outlining situations in which the document can be utilized.

- Our platform features an extensive assortment of over 85,000 ready-to-use state-specific templates suitable for virtually any legal matter.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who aim to enhance their efficiency by utilizing our DIY documents.

- Whether you're searching for the Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property or any other paperwork valid in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property swiftly via our dependable platform.

- If you are already an existing user, you can simply Log In to your account to retrieve the necessary form.

- However, if you are new to our site, please make sure to follow these steps before downloading the Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property.

Form popularity

FAQ

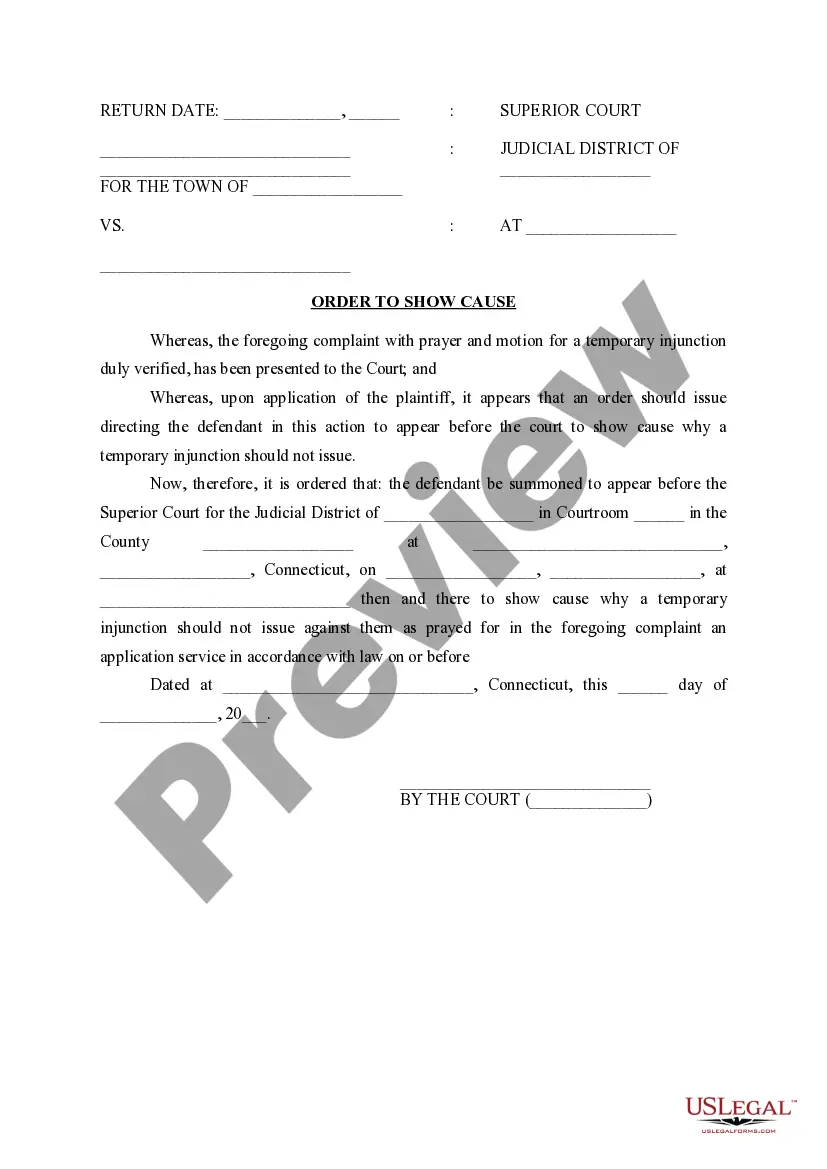

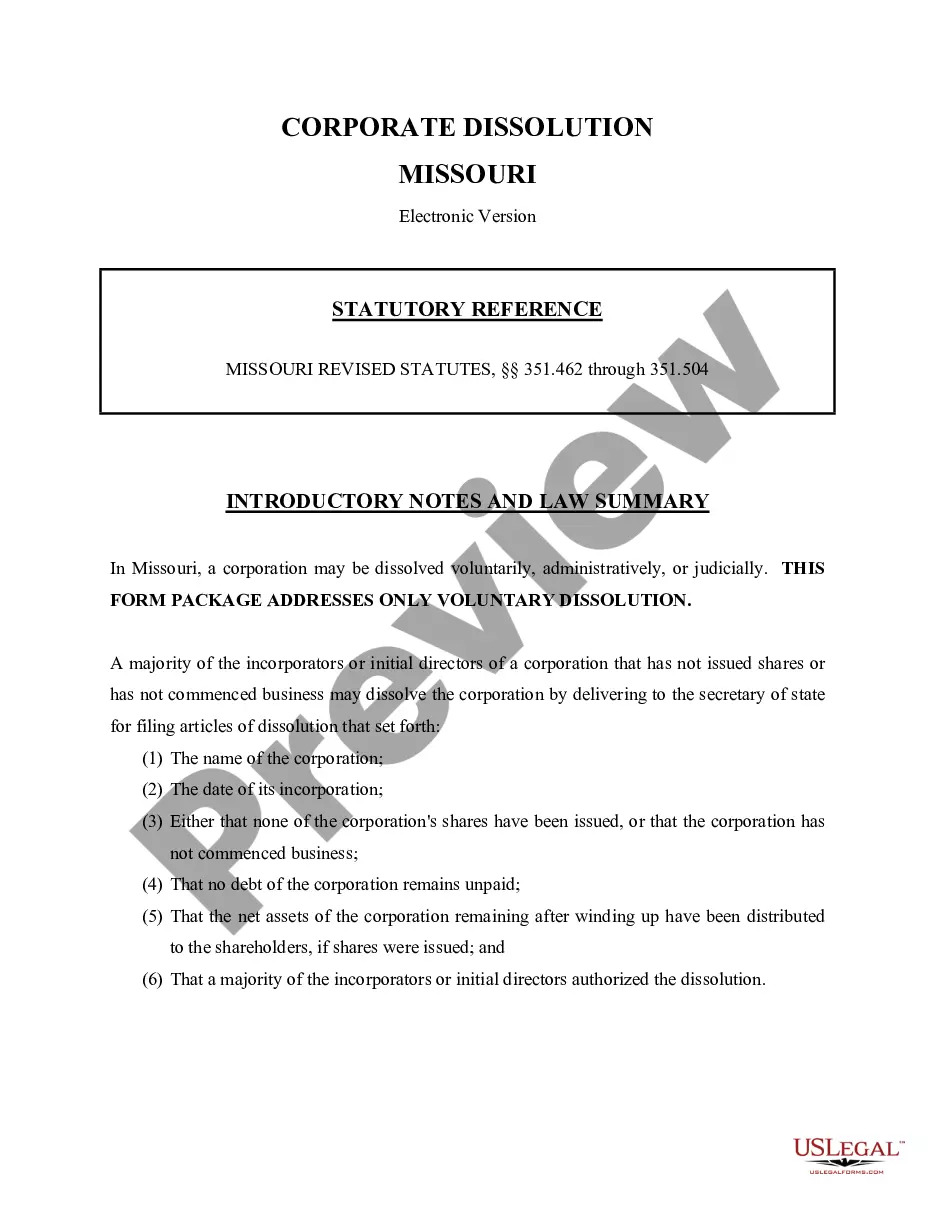

In Texas, a promissory note does not need to be recorded, but doing so can provide legal protection. Recording the note may help establish priority over any competing claims to the secured property. For those dealing with a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property, recording can enhance the security of the transaction. Using US Legal Forms can guide you through this process effectively.

The format of a promissory note should include essential elements like the title, date, lender’s and borrower’s names, the principal amount, interest rate, and repayment terms. Consistently organizing these details ensures clarity and legality. You might want to adjust this to reflect a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property. Employing platforms like US Legal Forms provides structured outlines for creating compliant notes.

Yes, a properly executed promissory note can hold up in court, provided it meets legal requirements in Texas. For a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property, ensuring the document includes all necessary details enhances its enforceability. In disputes over repayment, courts generally recognize these notes as legitimate contracts. Therefore, taking care of the documentation can safeguard your financial interests.

A promissory note is secured by collateral, which can be real property, vehicles, or other valuable assets. In the context of a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property, the personal property serves as assurance for the lender. If the borrower defaults, the lender has the right to claim the collateral to recover losses. This adds a layer of security that benefits both parties involved.

The two main types of promissory notes are secured and unsecured notes. A secured promissory note, like the Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property, is backed by collateral, which reduces the lender's risk. An unsecured note, on the other hand, does not have collateral backing and poses a higher risk for lenders, often leading to higher interest rates. Understanding these types is crucial for making the right choice.

In Texas, a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property typically remains valid for four years. This validity period starts from the maturity date of the note. After this period, the note may become unenforceable unless a legal action is taken beforehand. It’s essential to understand these timeframes to make informed financial decisions.

While promissory notes do not always need to be recorded, filing a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property provides additional legal protection. Recording the note can establish your rights against third parties and serve as public notice of the debt. Depending on your situation, recording may also affect the enforceability of your note. Consider consulting with uslegalforms for guidance on the recording process and other legal formalities.

Yes, it is important to report your Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property for tax purposes. Typically, the lender must report interest income, while the borrower keeps track of their payments. This ensures compliance with tax laws and helps both parties maintain accurate financial records. Using a platform like uslegalforms can help you manage these reports effectively.

Yes, a promissory note can be secured by real property, adding an extra layer of assurance for the lender. However, if your focus is on personal property, the Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property typically garners attention. Regardless, understanding the nuances of property security can be facilitated by using platforms like uslegalforms to ensure compliance with state laws.

A promissory note is considered valid in Texas when it meets legal requirements and includes essential details. It must be in writing, signed by the borrower, and clearly outline the terms of repayment. When creating a Laredo Texas Installments Fixed Rate Promissory Note Secured by Personal Property, ensuring these elements are present makes the document enforceable.