College Station Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

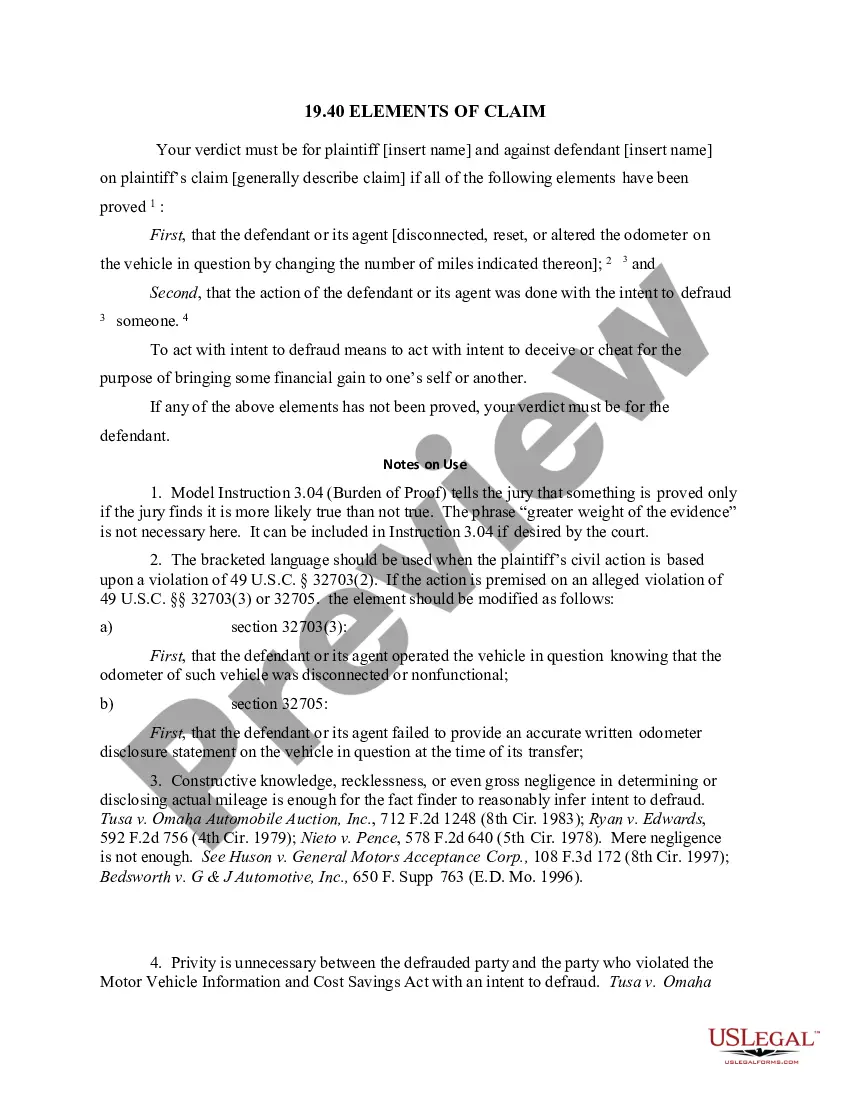

How to fill out Texas Acknowledgment For Proration Of Ad Valorem Taxes?

Irrespective of social standing or professional rank, completing legal documents has become a regrettable necessity in the modern professional landscape.

It is frequently nearly impossible for individuals without legal education to create such documents from scratch, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms comes to aid.

Ensure that the template you have found is applicable to your region, as the rules of one locality do not apply to another.

Review the form and read through a concise description (if available) of the situations for which the document can be utilized.

- Our platform boasts an extensive collection of over 85,000 ready-to-use state-specific papers suitable for nearly any legal matter.

- US Legal Forms also proves invaluable for associates or legal advisors seeking to save time with our DIY documents.

- Whether you require the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes or another form valid in your state or locality, with US Legal Forms, everything you need is readily available.

- Here's how to quickly obtain the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes using our reliable service.

- If you're already a subscriber, feel free to Log In to your account to download the required form.

- However, if you are new to our service, make sure to follow these steps before downloading the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes.

Form popularity

FAQ

An Acknowledgment confirms the signer's identity and intention to sign a document, while a Jurat involves the signer swearing or affirming the truthfulness of the document's contents. In College Station, Texas, an Acknowledgment is often used for deeds and contracts related to taxes, like the Acknowledgment for Proration of Ad Valorem Taxes. Understanding this distinction can simplify your legal processes and contribute to smoother transactions.

To perform an acknowledgement in College Station, Texas, ensure the signer is in the presence of a notary. The signer must declare their identity and intention to sign the document. After the notary verifies the person's identity, they will complete the acknowledgment section. This process is essential for the proper documentation of the Acknowledgment for Proration of Ad Valorem Taxes.

An example of a signed acknowledgment is a document showing that a property owner has acknowledged their understanding of the proration of ad valorem taxes. This typically includes the signer's name, the date of signing, and the notary's signature and seal. Such examples are crucial in legal contexts, especially in College Station Texas Acknowledgment for Proration of Ad Valorem Taxes. US Legal Forms can provide you with templates to create a valid acknowledgment with ease.

To complete an acknowledgement, first ensure that the signer is present, and that they understand the document's content. The notary will then fill out a notarial certificate, which includes details like the date, location, and signature of the notary. For the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes, following local regulations is vital. You can use platforms like US Legal Forms for templates and guidance to make the process smoother.

Key words for an acknowledgement notary include 'notary public,' 'acknowledgment,' and 'execution.' When dealing with a College Station Texas Acknowledgment for Proration of Ad Valorem Taxes, it is essential to use these terms correctly. They will help ensure that your documents are recognized by legal authorities. Clarity in these keywords aids in the processing of your documents efficiently.

Prepaying property taxes at closing provides security for both the buyer and lender, ensuring that property taxes are covered promptly. This is particularly important in College Station, where local tax deadlines must be observed. Staying informed about the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes will aid in managing these prepayments effectively.

In Texas, seniors receive various exemptions that can lower their property tax obligations, especially after age 65. While property taxes do not entirely cease, reductions can make a significant difference. The College Station Texas Acknowledgment for Proration of Ad Valorem Taxes will help clarify how these exemptions apply.

Property taxes are not entirely frozen for seniors in Texas, but eligible seniors can benefit from certain exemptions that reduce their tax burden. These exemptions can provide substantial savings, making it crucial to understand the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes for full benefits.

To avoid the Title Ad Valorem Tax (TAVT) in Georgia, consider exploring exemptions or purchasing vehicles from out-of-state vendors. However, keep in mind that different rules apply in Texas, especially in College Station. Consulting the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes can give you insights into avoiding unnecessary fees.

You're likely paying ad valorem tax to contribute to local services, such as schools, emergency services, and infrastructure. This tax helps maintain the community facilities you rely on. Understanding the implications of the College Station Texas Acknowledgment for Proration of Ad Valorem Taxes can make you more informed about your contributions.