The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Fort Worth Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents for both personal and business purposes, covering numerous real-world scenarios.

All the papers are systematically categorized by usage area and jurisdictional domains, making it as straightforward and swift as ABC to locate the Fort Worth Texas Dissolution Package for Dissolving a Corporation.

Maintaining documentation clear and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates for any requirements readily available!

- Review the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that aligns with your requirements and fully adheres to your local jurisdiction regulations.

- Search for an alternative template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to find the correct one.

- If it meets your criteria, proceed to the following step.

Form popularity

FAQ

Summary chart for terminating a Texas entity. Texas Domestic Entity TypeGoverned by BOCFeeFor-profit or professional corporation that neither commenced business nor issued sharesForm 651 Word, PDF$40For-profit or professional corporation that commenced business and/or issued sharesForm 651 Word, PDF$405 more rows

In exchange for getting back their investment (in full or part), the shareholders return their shares to the company, which are then canceled. If a company returns any money to its shareholders while still having a debt outstanding, the creditor can sue, and the shareholders may have to return the received amounts.

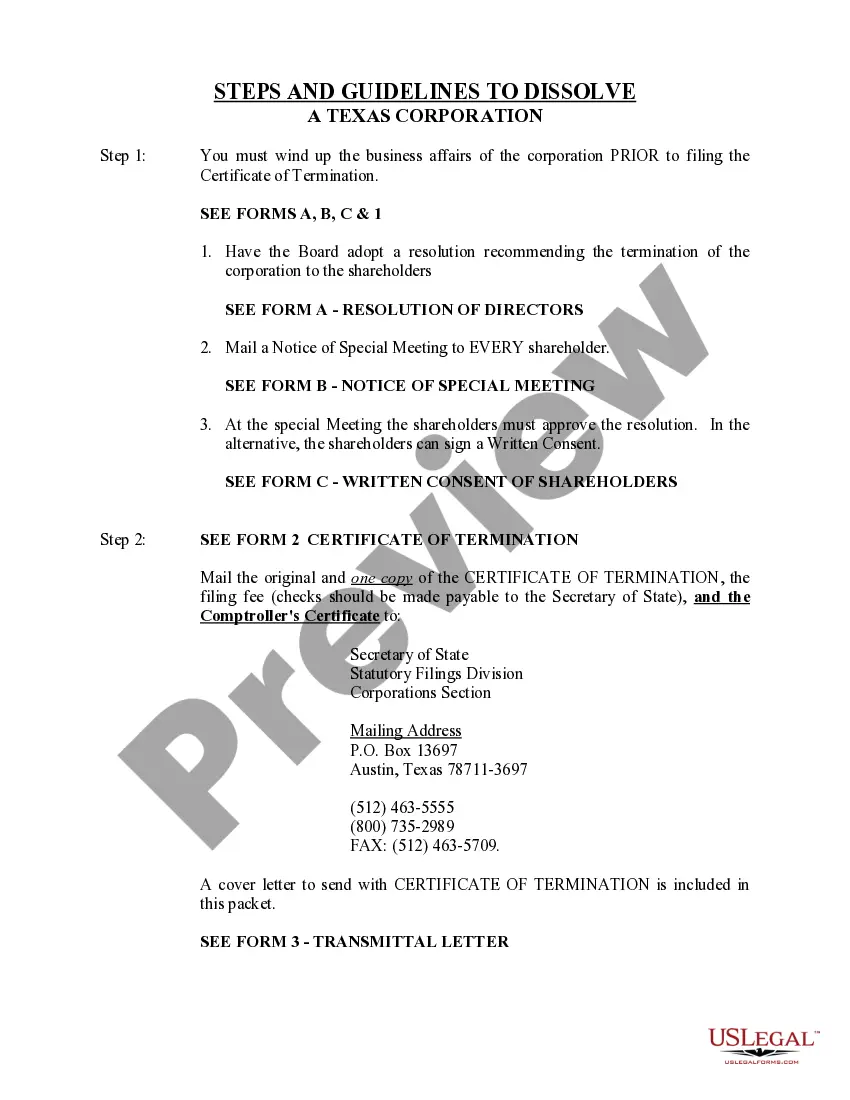

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

How much does it cost to dissolve a California business? There is no fee to file the California dissolution forms.

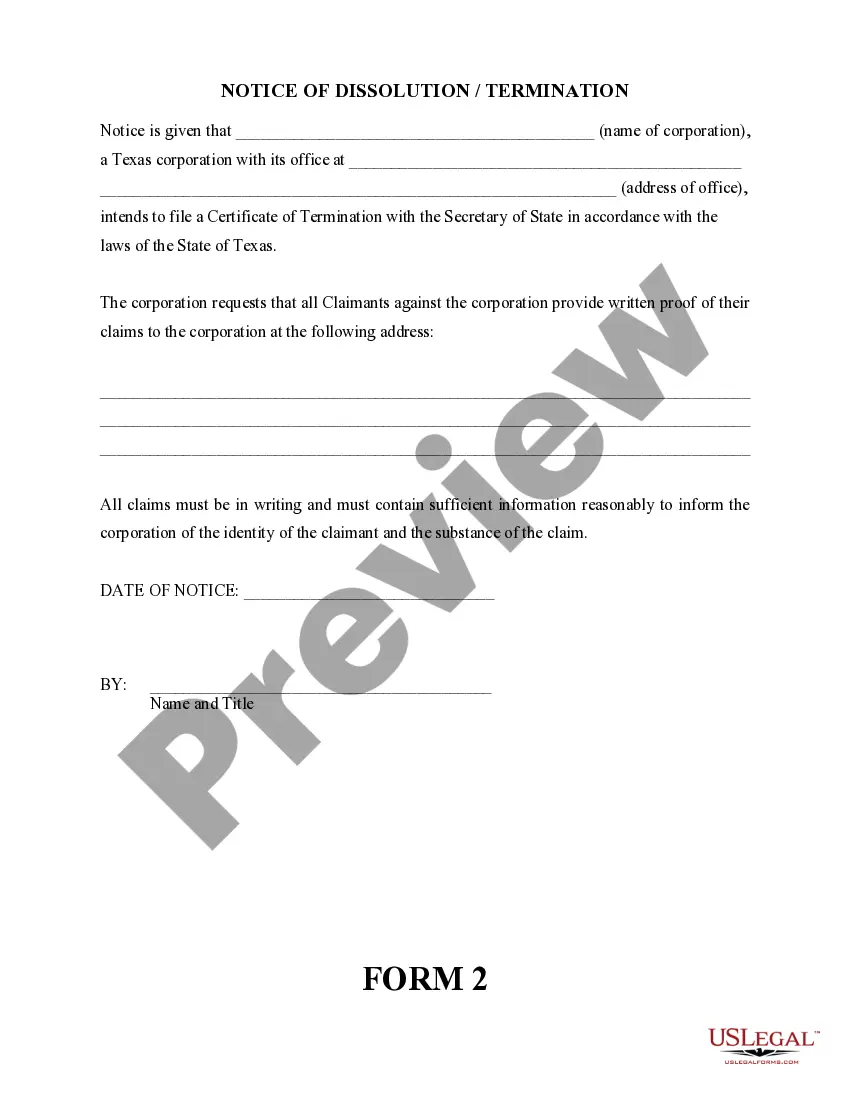

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

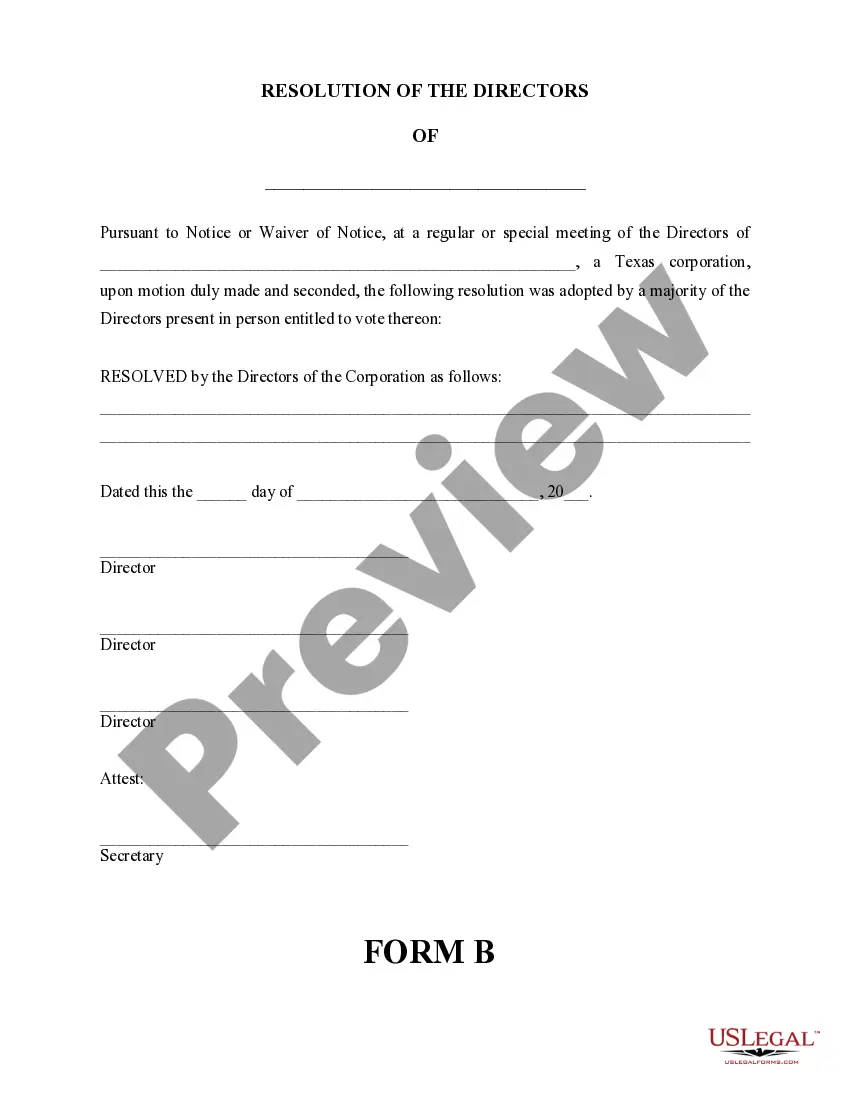

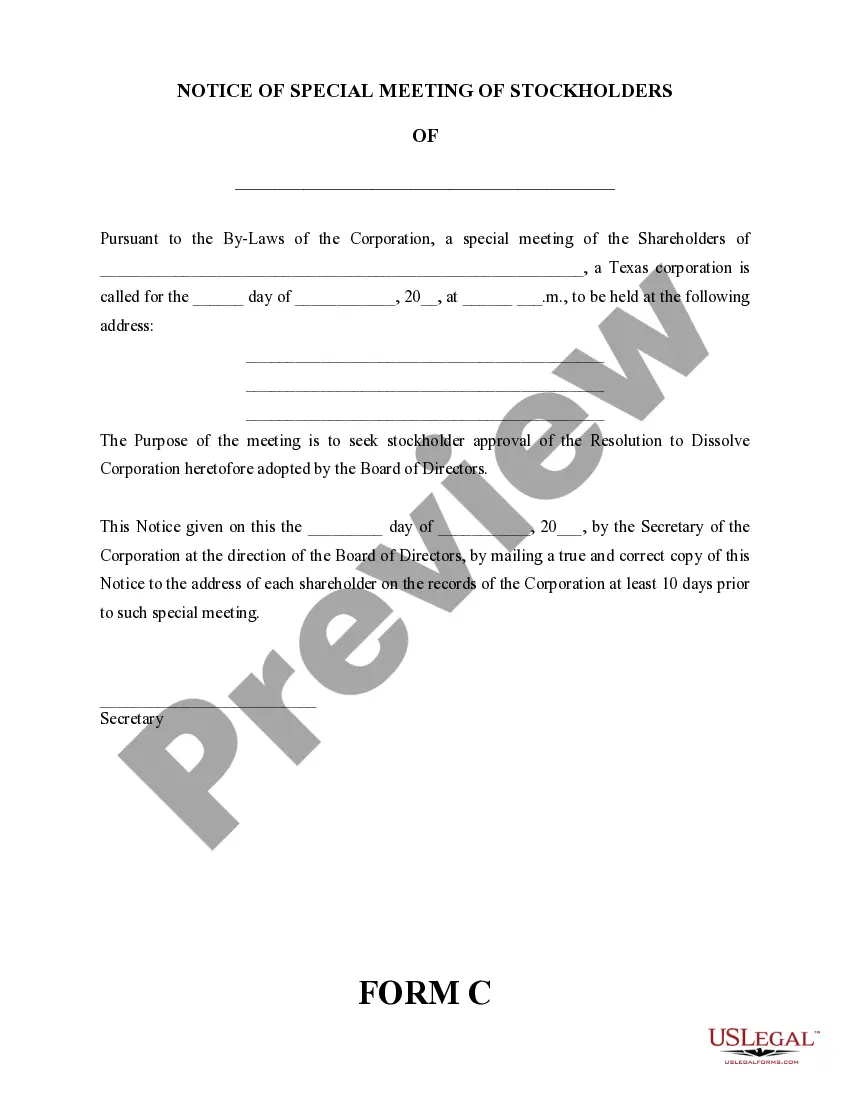

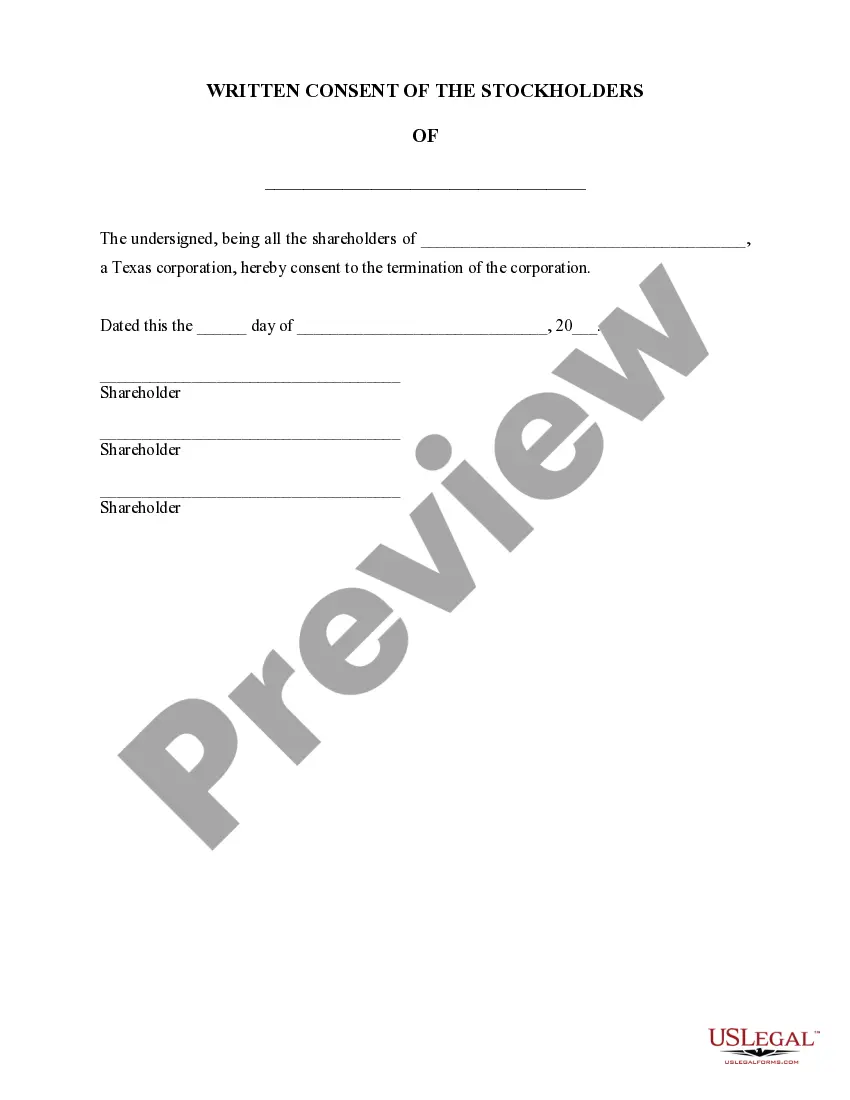

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

How do you dissolve a Texas corporation? To dissolve your Texas corporation, you file Form 651 Certificate of Termination of Domestic Entity and accompany that with a tax clearance certificate from the Texas Comptroller of Public Accounts indicating that all taxes have been paid by the entity.

The business entity must: File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return. Check the applicable Final Return box on the first page of the return, and write ?final? at the top of the first page.