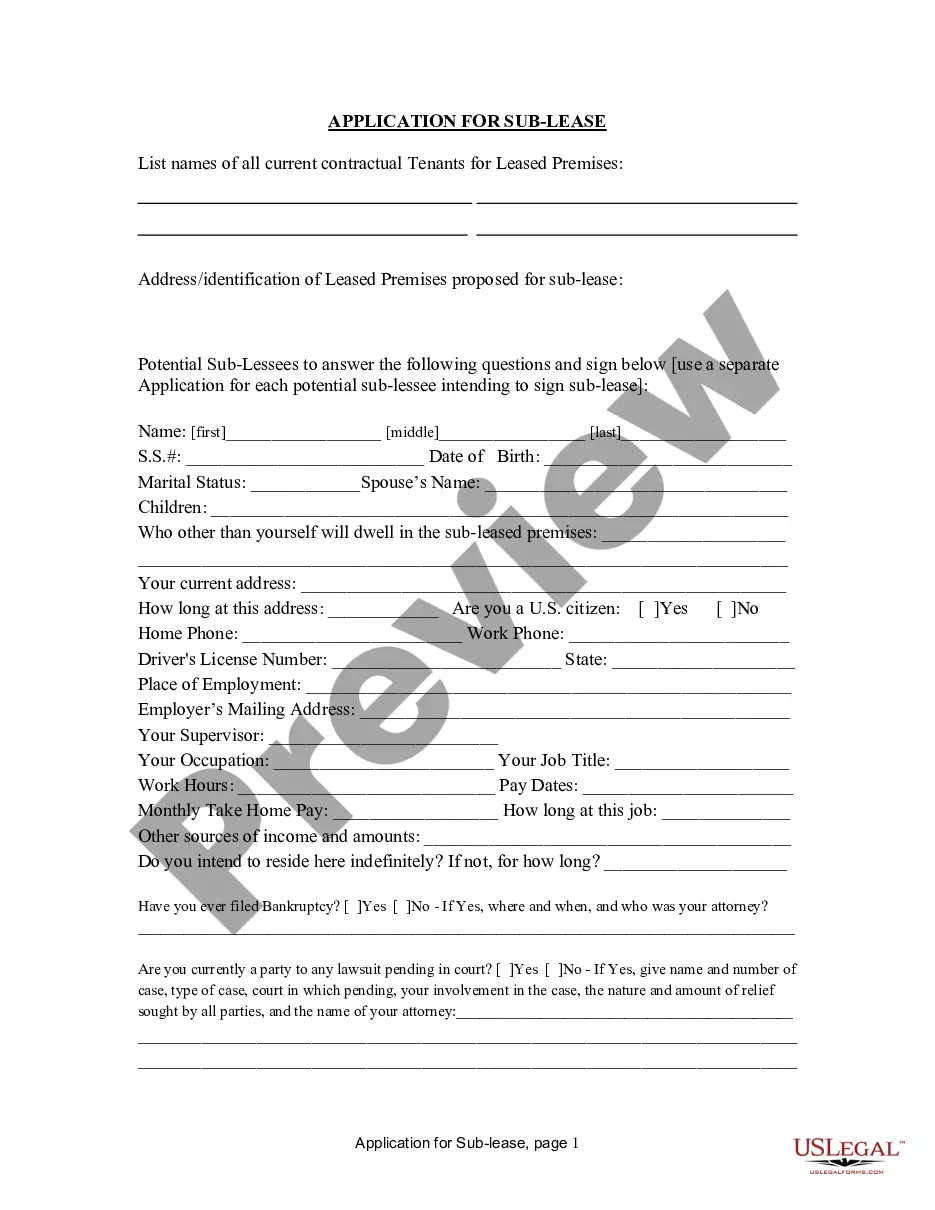

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Corpus Christi Texas Closing Statement

Description

How to fill out Texas Closing Statement?

If you have previously utilized our service, Log In to your account and acquire the Corpus Christi Texas Closing Statement on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your file.

You have continual access to every piece of documentation you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to efficiently locate and secure any template for your personal or business requirements!

- Ensure you have found an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it matches your needs. If it doesn’t fit, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and process a payment. Enter your credit card details or use the PayPal option to finalize the transaction.

- Retrieve your Corpus Christi Texas Closing Statement. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Requesting open records in Corpus Christi, Texas, involves sending a written request to the local government agency that maintains the records. Clearly outline the specific documents you seek, such as your Corpus Christi Texas Closing Statement, to make the process smoother. If navigating these requests seems daunting, USLegalForms is a great resource to guide you in drafting your request efficiently.

To make a Texas open records request, you need to identify the governmental body that holds the information. Afterward, submit a written request detailing the documents you wish to review, including any mention of the Corpus Christi Texas Closing Statement if relevant. Utilizing the appropriate channel ensures that you receive the information promptly and with minimal difficulty.

To obtain open records from the Texas Comptroller, you need to send a specific request in writing. You can do this through mail or email, clearly stating your interest in documents related to the Corpus Christi Texas Closing Statement. This method ensures that your request is processed accurately and in a timely manner, allowing you to access the information you need.

To request open records from the Texas Medical Board, you should submit a written request specifying the documents you want. The request can be made via email, fax, or regular mail, and it’s helpful to reference the needed records such as those related to your Corpus Christi Texas Closing Statement. This ensures that the board understands exactly what you're looking for and can fulfill your request efficiently.

In Texas, you typically have 10 business days to respond to an open records request. This timeframe applies to all governmental bodies, including those in Corpus Christi, Texas. However, if the request involves a complex issue, the response period may be extended. It’s important to provide timely information regarding the Corpus Christi Texas Closing Statement or any other document requested.

A closing statement should be clear, organized, and detailed, showing all financial transactions seamlessly. It typically includes sections for the buyer and seller, clearly itemizing all costs associated with the transaction. This transparency ensures that both parties understand their financial commitments at closing. To create a professional-looking Corpus Christi Texas Closing Statement, consider using uslegalforms.

Generally, the settlement statement is completed by the closing agent or the title company overseeing the transaction. They gather necessary financial data from both the buyer and seller to ensure accuracy. It is crucial for all parties to review this document thoroughly before finalizing the transaction. Using services like uslegalforms can assist in creating an accurate Corpus Christi Texas Closing Statement.