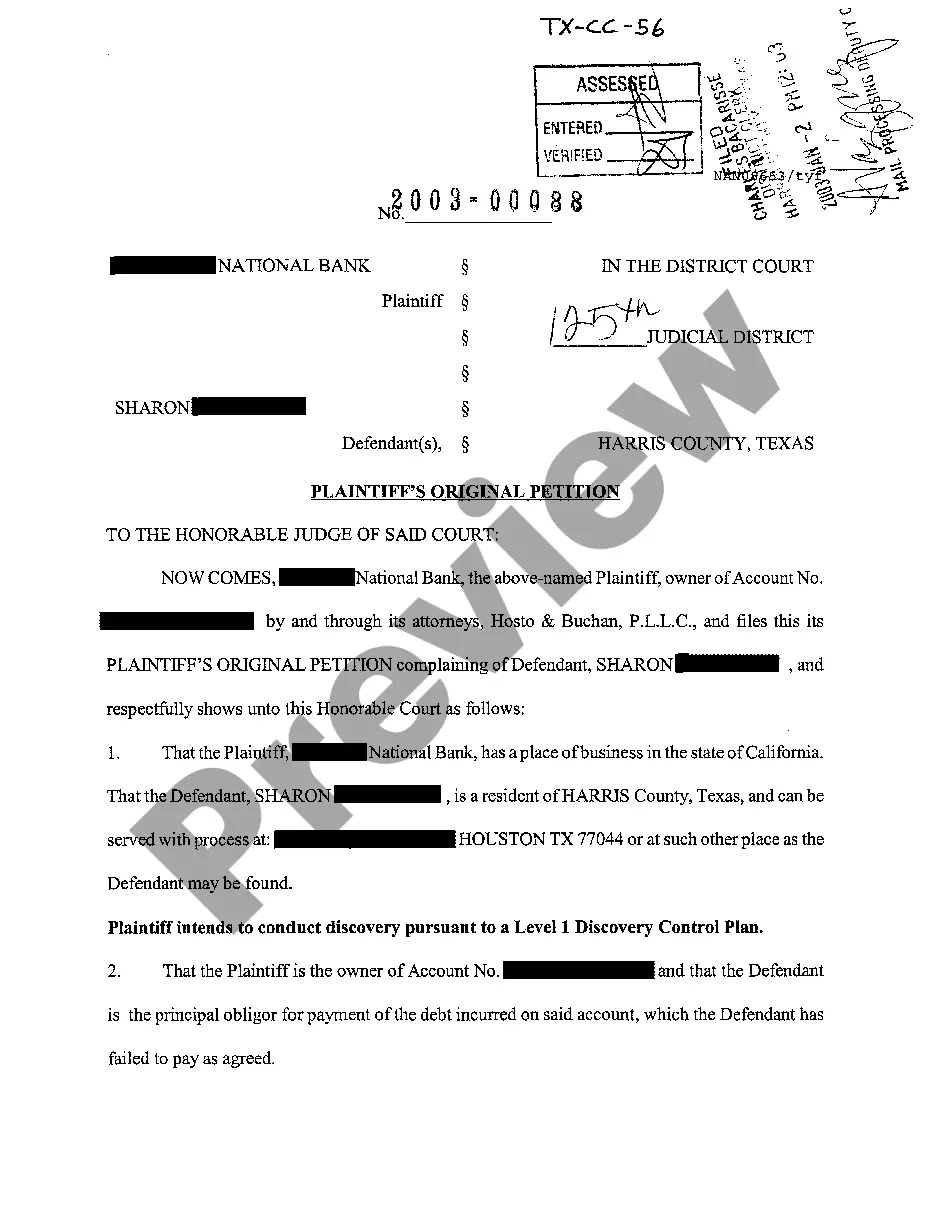

Tarrant Texas Plaintiff's Original Petition for Debt Collection

Description

How to fill out Texas Plaintiff's Original Petition For Debt Collection?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our valuable website, with an extensive collection of documents, enables you to discover and acquire almost any document sample you need.

You can download, complete, and verify the Tarrant Texas Plaintiff's Original Petition for Debt Collection in merely a few minutes rather than spending hours on the internet searching for a suitable template.

Employing our library is an excellent tactic to enhance the security of your document submissions.

If you have not yet created an account, adhere to the following guidelines.

Locate the form you require. Ensure it is the form you intended to find: verify its title and description, and utilize the Preview feature when available. Otherwise, make use of the Search option to find the desired one.

- Our knowledgeable legal experts consistently review all documents to ensure that the templates are pertinent to a specific region and adhere to current laws and regulations.

- How can you obtain the Tarrant Texas Plaintiff's Original Petition for Debt Collection.

- If you already possess a subscription, simply sign in to your account. The Download option will be visible on all the samples you examine.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

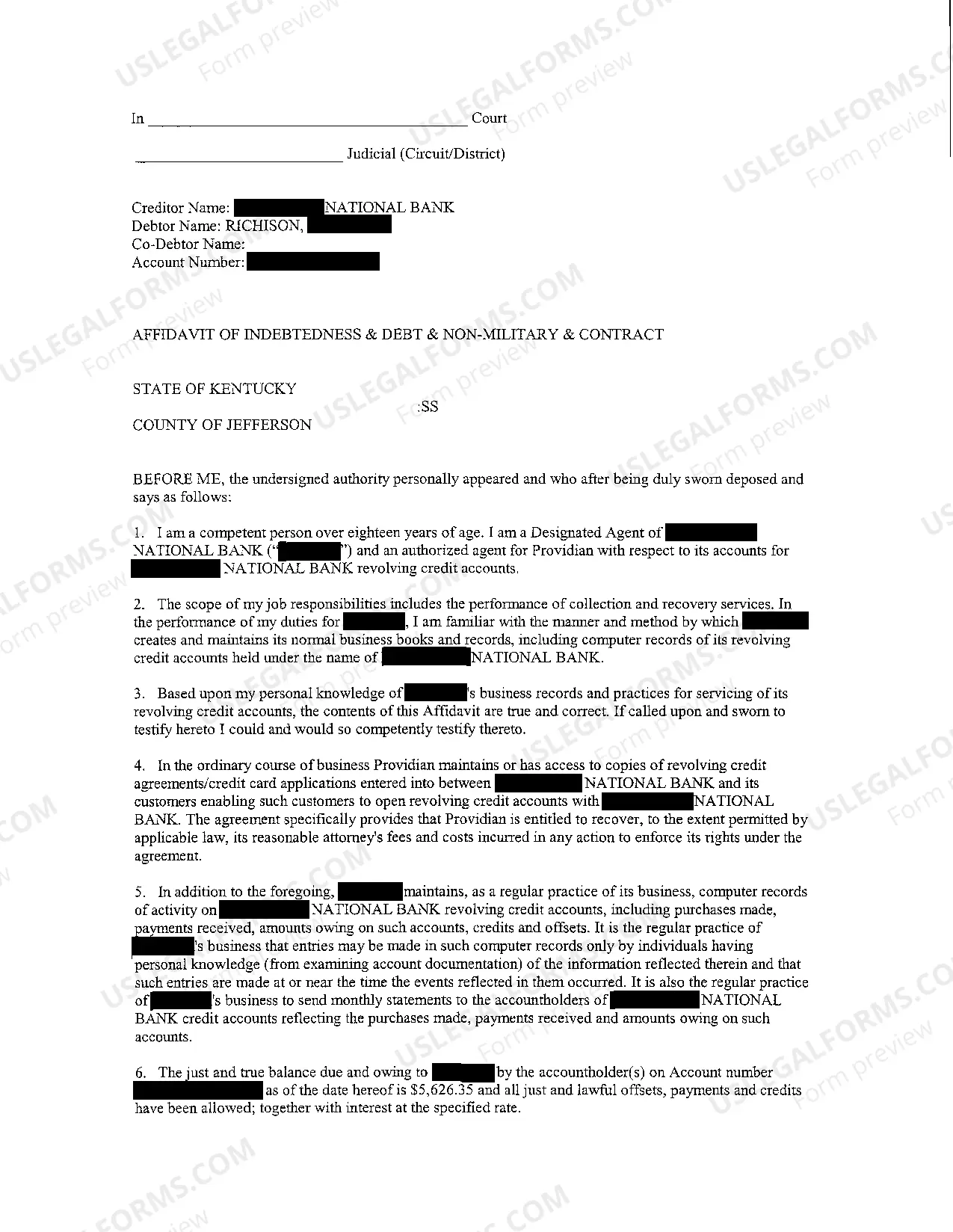

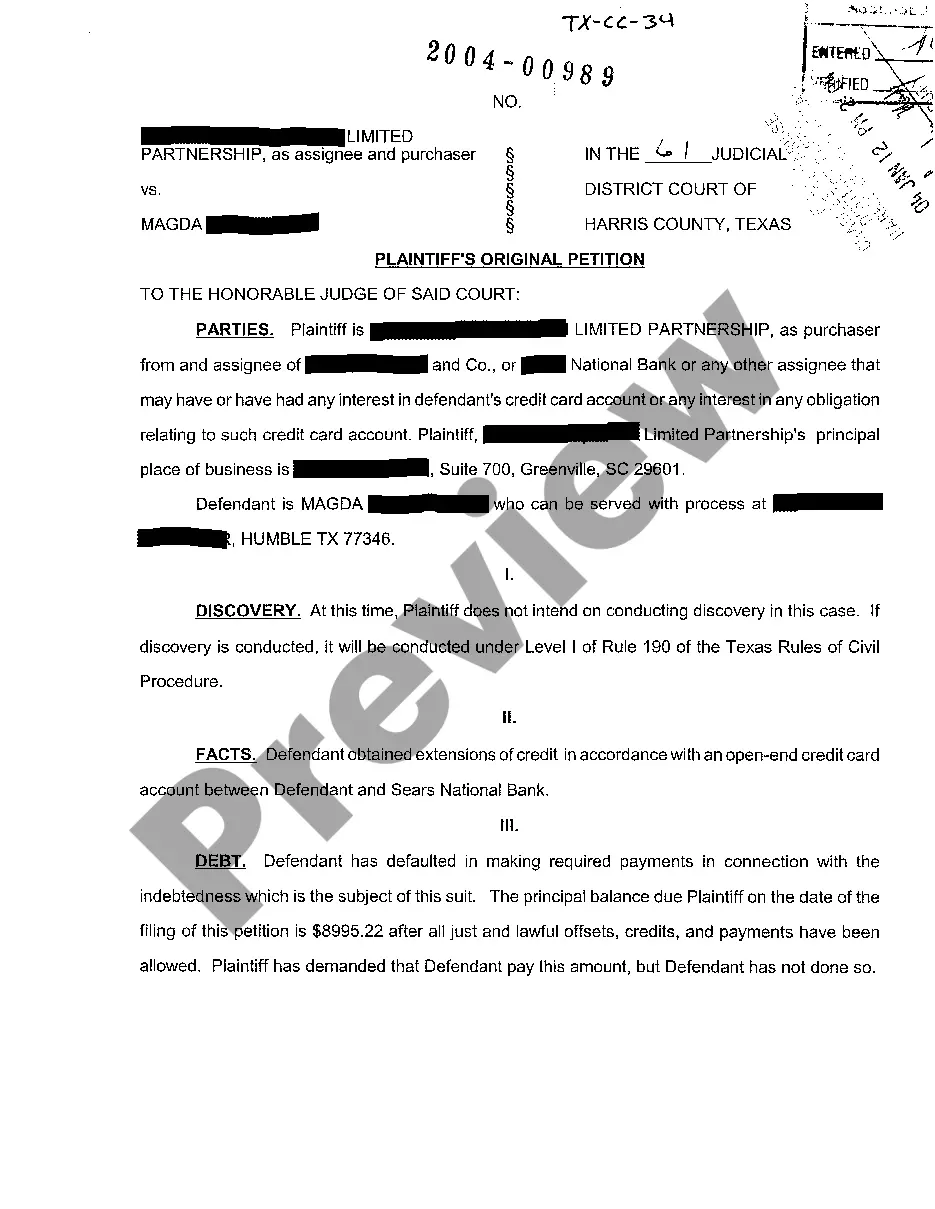

A debt claim case is a lawsuit brought to recover a debt by an assignee of a claim, a debt collector or collection agency, a financial institution, or a person or entity primarily engaged in the business of lending money at interest.

File the Answer If you choose to send your Answer document in the mail, follow these steps: Print two copies of your Answer. Mail the original copy to the court via certified mail. Mail the other copy to the plaintiff's attorney via certified mail.

A) How Taken, Time: A party may appeal a judgment in an eviction case by filing a bond, making a cash deposit, or filing a Statement of Inability to Afford Payment of Court Costs with the justice court within five days after the judgment is signed.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

In Texas, you can either file your Answer online using a specific form or write a letter to the court. Whatever your method of response, your reply should deny the allegations, thereby putting the burden of proof on the plaintiff, leaving the debt collector with the burden to provide evidence that the debt is valid.

File the Answer If you choose to send your Answer document in the mail, follow these steps: Print two copies of your Answer. Mail the original copy to the court via certified mail. Mail the other copy to the plaintiff's attorney via certified mail.

The 3 Steps to respond to a debt lawsuit Respond to every paragraph in the Complaint. The Complaint includes several numbered paragraphs that lay out the lawsuit against you.Assert your Affirmative Defenses.File the Answer with the court and the plaintiff.

To serve papers such as an Answer after the case is filed, send them by certified mail, fax, or hand delivery. If the document was filed electronically through eFile Texas, the document may be served electronically if eFile Texas has the other side's email address. Get a receipt if you hand deliver.

You must submit an original and one copy of the complaint, plus a copy for each defendant being sued. 2. Filing Fee: A filing fee of $402.00 is required to file a complaint. A person who cannot afford to pay this fee may request to proceed ?in forma pauperis? (referred to as ?IFP?).