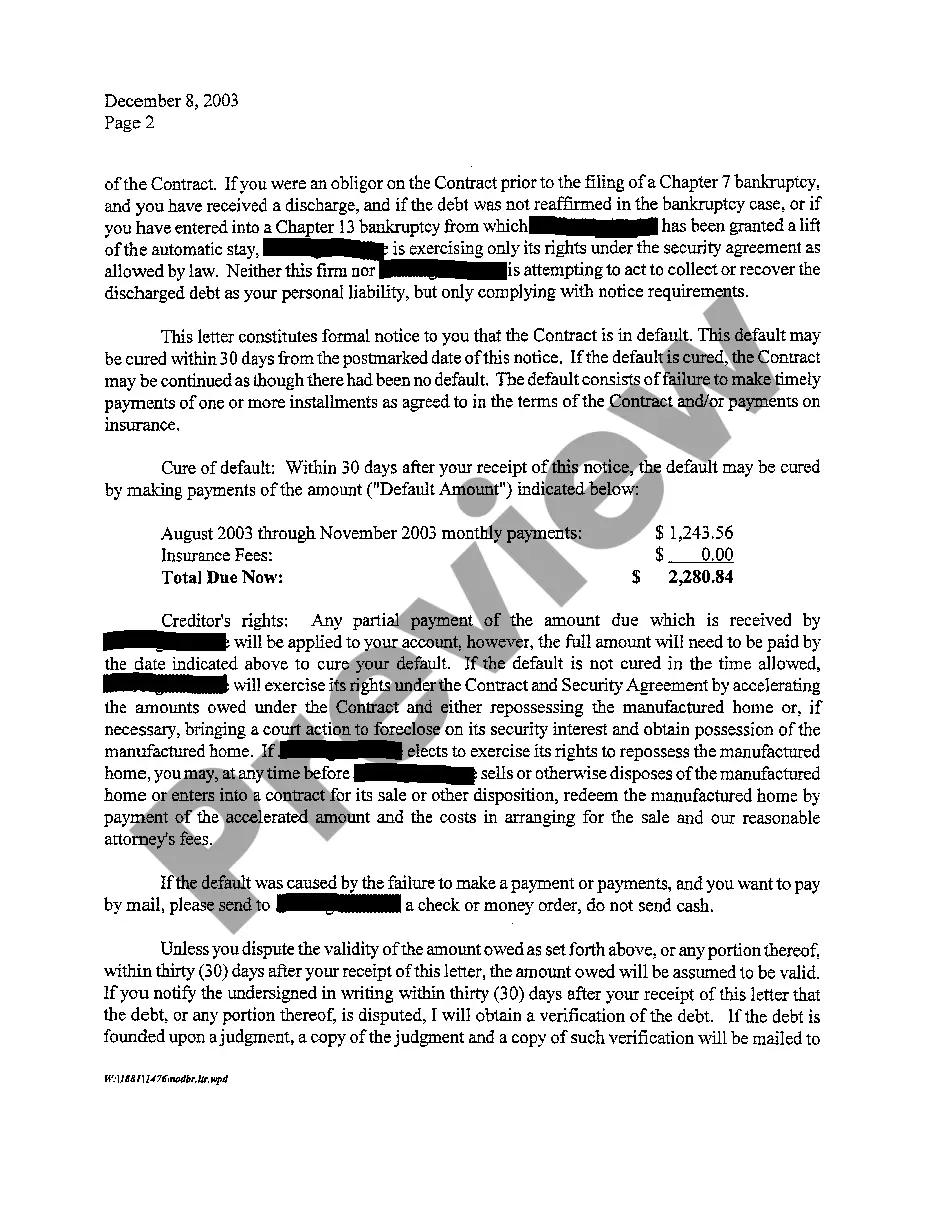

Austin Texas Notice of Default and Right To Cure

Description

How to fill out Texas Notice Of Default And Right To Cure?

Finding validated templates that align with your regional regulations can be difficult unless you utilize the US Legal Forms library. It’s an online repository of over 85,000 legal templates catering to both personal and professional requirements along with various real-world situations.

All documents are systematically arranged by area of application and jurisdiction, making it as simple as pie to find the Austin Texas Notice of Default and Right To Cure.

For those already familiar with our collection and have prior experience, acquiring the Austin Texas Notice of Default and Right To Cure requires merely a few clicks. Simply Log In to your account, select the document, and click Download to store it on your device. New users will need to complete just a few extra steps.

Maintaining organized paperwork that complies with legal standards is extremely important. Take advantage of the US Legal Forms library to always have crucial document templates available for your various needs!

- Examine the Preview mode and form description. Ensure you've chosen the correct one that fits your requirements and fully aligns with your local jurisdiction standards.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan that suits you best. You’ll need to create an account to access the library’s offerings.

- Complete your purchase. Enter your credit card information or utilize your PayPal account to pay for the service.

- Download the Austin Texas Notice of Default and Right To Cure. Store the template on your device for completion and access it via the My documents section of your profile whenever necessary.

Form popularity

FAQ

You can stop a foreclosure in its tracks?at least for a while?by filing for bankruptcy. Filing for Chapter 7 bankruptcy will stall a foreclosure, but usually only temporarily. You can use Chapter 7 bankruptcy to save your home if you're current on the loan and you don't have much equity.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

Notice of Sale Filed, Posted and Mailed ? Next, the law requires at least 21 days' written notice of the date on which the foreclosure sale (auction) is to take place. The 21 days begin from the date the notice is mailed, not the date you receive it.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.

If you are unable to make your mortgage payment: Don't ignore the problem.Contact your lender as soon as you realize that you have a problem.Open and respond to all mail from your lender.Know your mortgage rights.Understand foreclosure prevention options.Contact a HUD-approved housing counselor.

The results showed that the time period for completing a foreclosure was shortest in Texas. It was an average of 159 days, compared to 166 days in Virginia, the next speediest state. This is very fast compared to the national average.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

Can Texan homeowner's stop foreclosure? Yes. In Texas most loans are non-judicial which means the bank does not have to take a foreclosure to court to be approved. The best way to stop and delay a lender from taking your property is to file a lawsuit and get a restraining order.