Plano Texas Truth In Lending Disclosures

Description

How to fill out Texas Truth In Lending Disclosures?

If you are looking for a pertinent form template, it’s impossible to find a superior location than the US Legal Forms website – likely the most exhaustive online collections.

With this collection, you can obtain thousands of form samples for business and personal purposes categorized by types and areas, or keywords.

Utilizing our advanced search functionality, locating the most current Plano Texas Truth In Lending Disclosures is as simple as 1-2-3.

Receive the form. Select the format and save it on your device.

Make modifications. Complete, alter, print, and sign the obtained Plano Texas Truth In Lending Disclosures.

- If you are already familiar with our platform and possess an account, all you need to do to access the Plano Texas Truth In Lending Disclosures is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the guidelines outlined below.

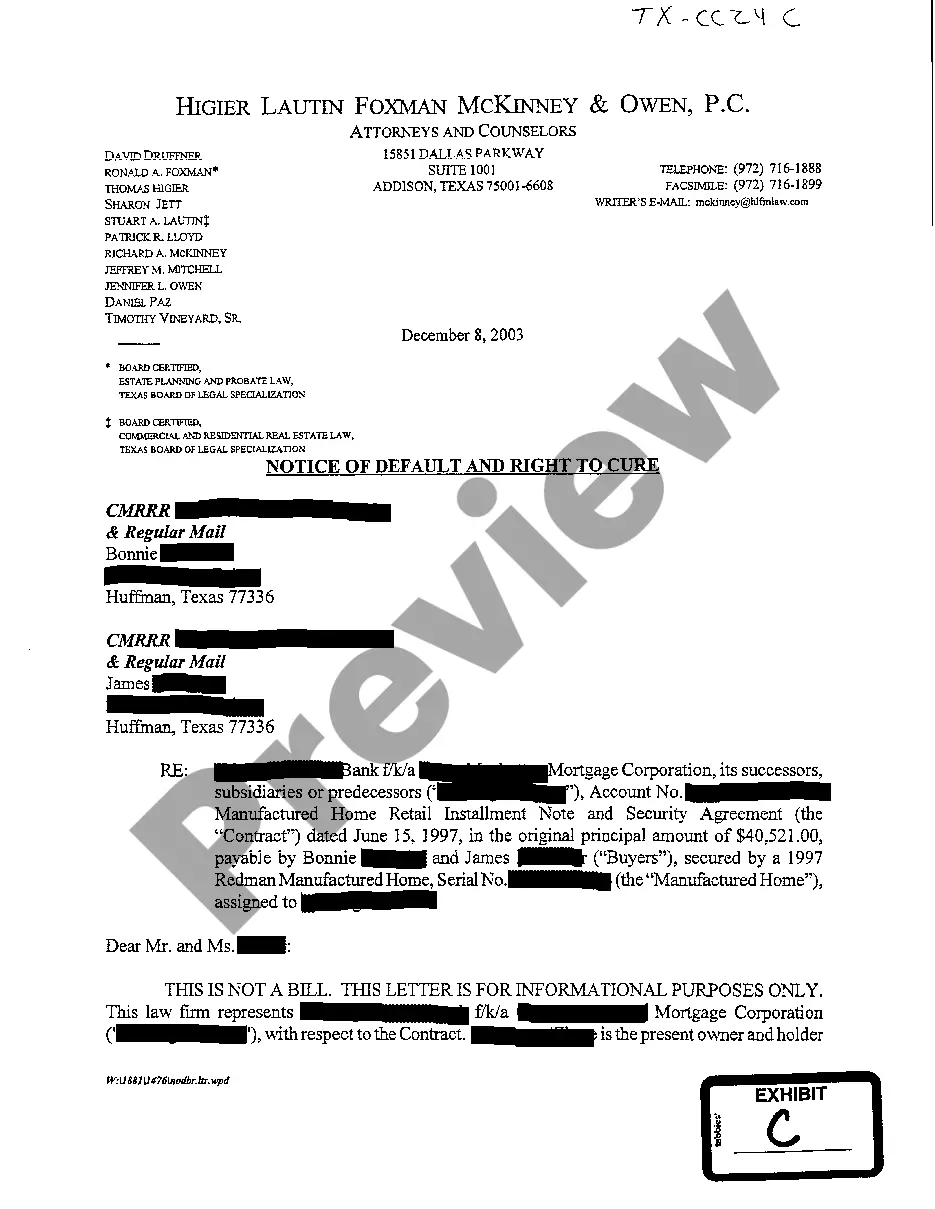

- Ensure you have selected the form you require. Review its details and utilize the Preview function to examine its content. If it doesn’t fulfill your needs, utilize the Search option at the top of the page to find the suitable document.

- Verify your choice. Choose the Buy now option. After that, pick your desired subscription plan and provide the necessary details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

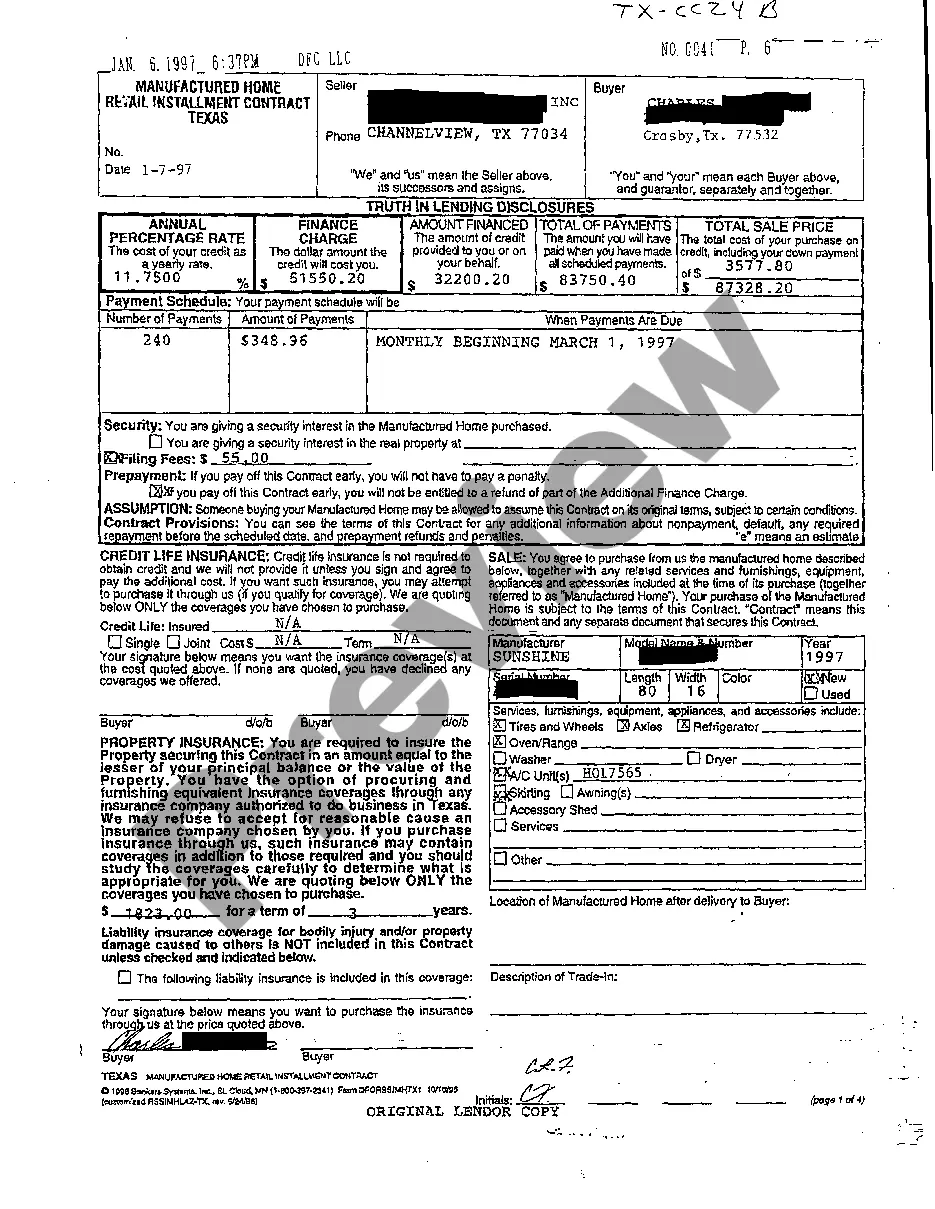

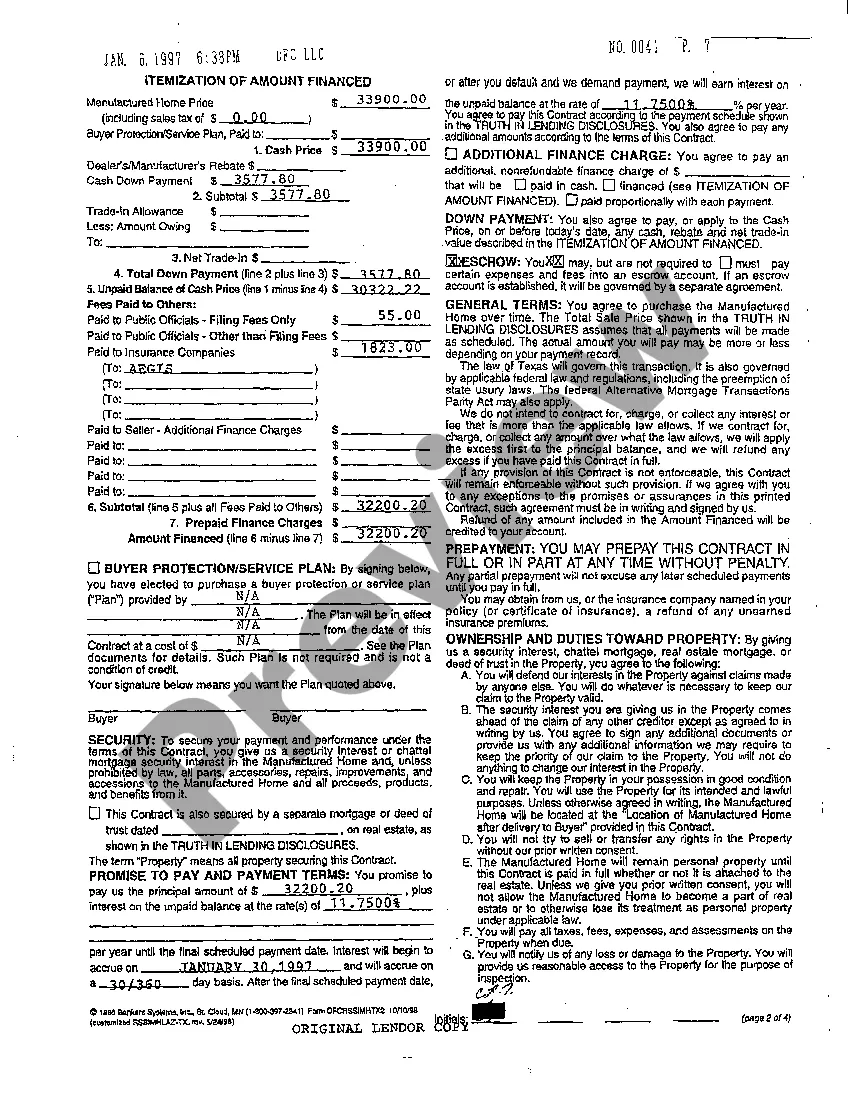

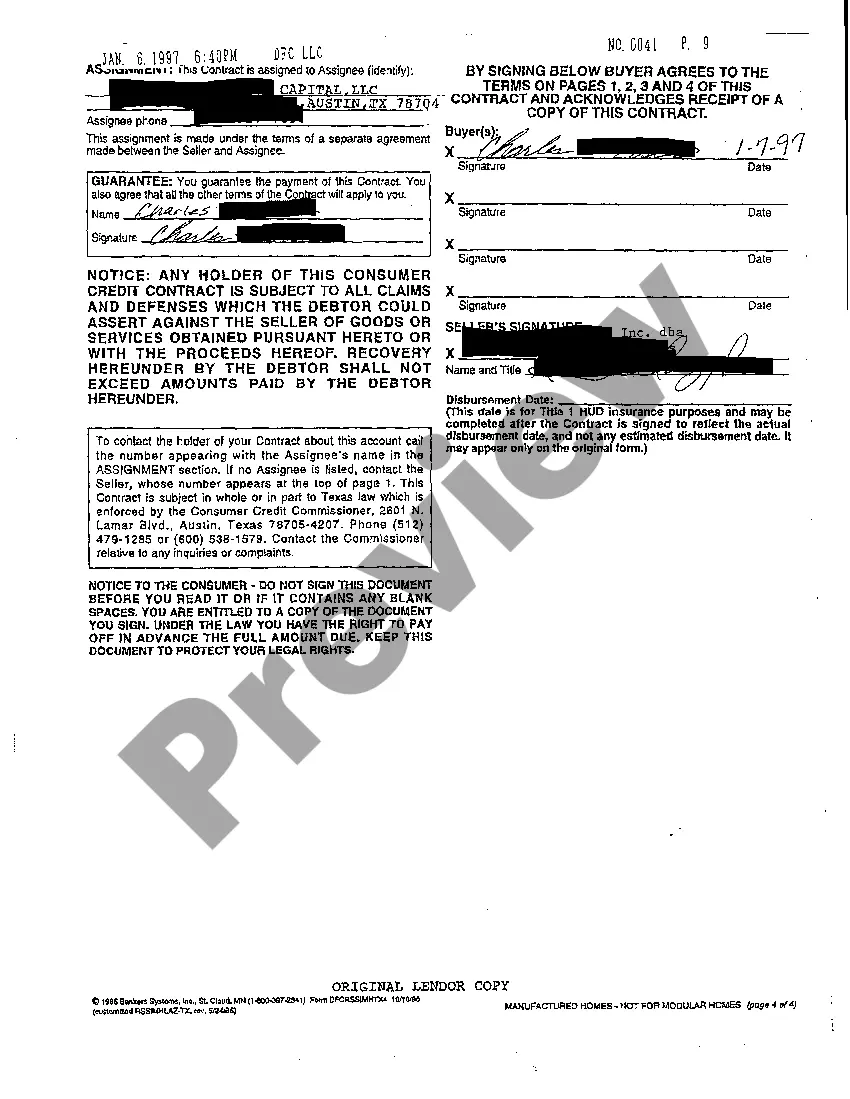

Under the Truth in Lending Act, lenders must disclose important information to borrowers. This includes the annual percentage rate (APR), finance charges, total amount financed, payment schedule, total payments, and any late payment fees. Understanding these disclosures helps you make an informed decision about loans. For residents in Plano, Texas, Truth In Lending Disclosures ensure transparency in lending practices.

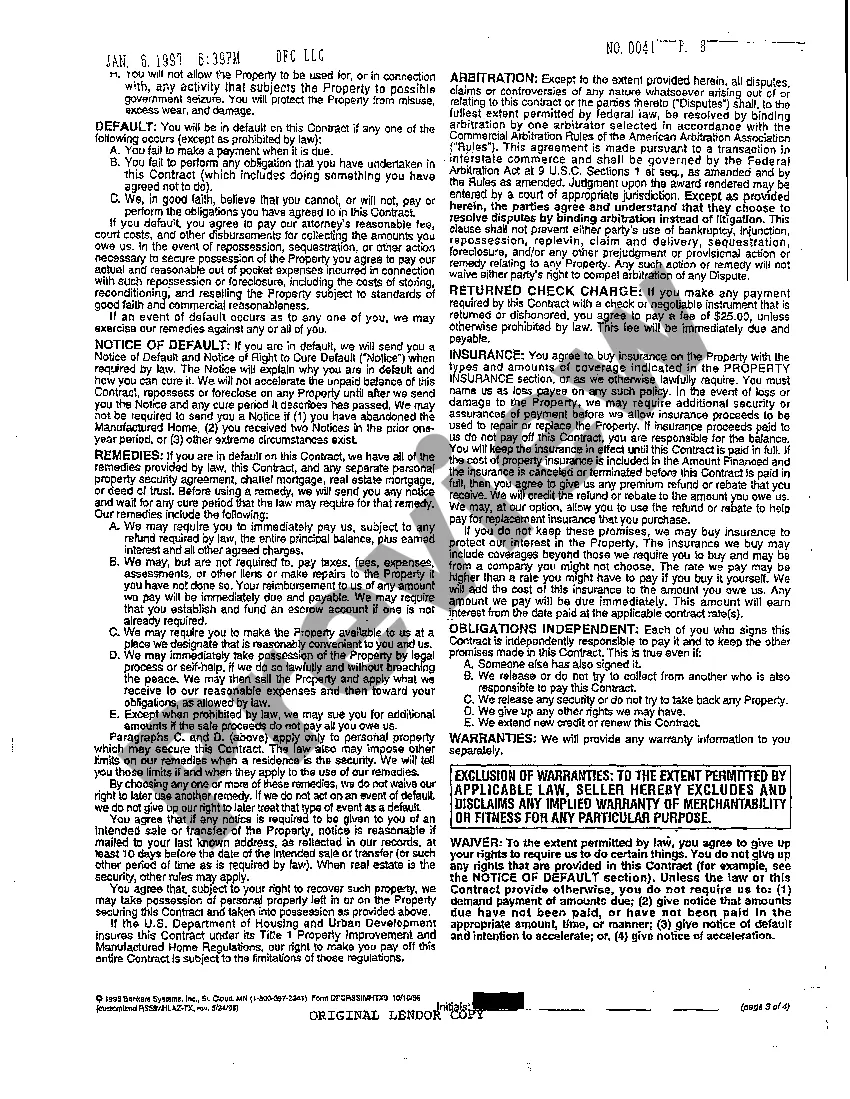

One integral aspect of TILA that often leads to violations is the method of calculating finance charges. If a lender miscalculates the total costs associated with borrowing, they may present misleading information to the borrower. This can create significant issues for consumers who rely on accurate disclosures to understand their loans in Plano, Texas. Choosing resources like USLegalForms can offer clarity and guidance on Plano Texas Truth In Lending Disclosures, ensuring you recognize your rights.

The most common violation of the Truth in Lending Act (TILA) is failing to provide accurate disclosures related to finance charges or the annual percentage rate (APR). Many lenders overlook the requirement to clearly present these figures in Plano Texas Truth In Lending Disclosures. This can lead to borrowers making uninformed decisions about their loans. Understanding these disclosures is crucial for protecting your rights.

inLending Disclosure Statement provides information about the costs of your credit. Effective October 3, 2015, for most kinds of mortgage loans a form called the Loan Estimate replaced the initial TruthinLending disclosure, and a Closing Disclosure replaced the final TruthinLending disclosure.

Required Written Disclosures Annual percentage rate (APR): The yearly percentage rate that applies to the cost of credit. Finance charges: The total amount of interest and fees that you'll pay over the life of a loan in dollars.

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices.

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Credit card issuers are required to give consumers at least a 45-day notice before charging a higher interest rate and at least a 21-day ?grace period? between receiving a monthly statement and a due date for payment.