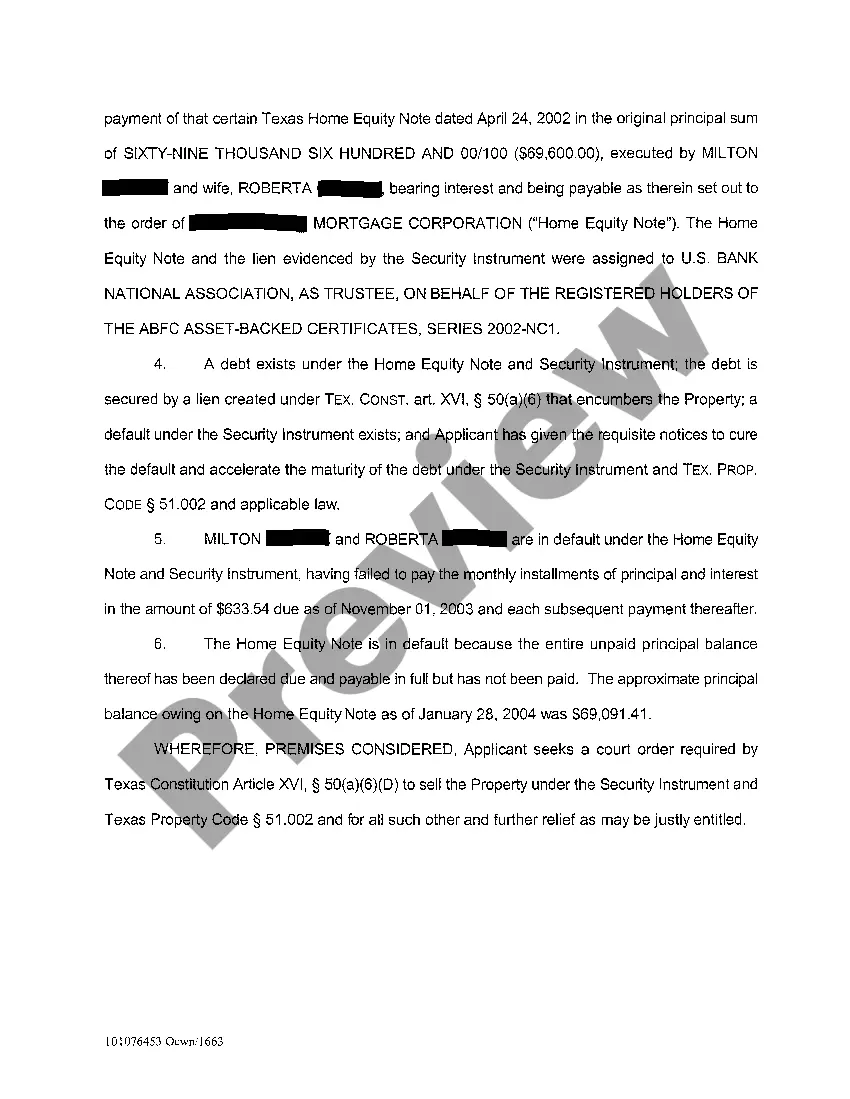

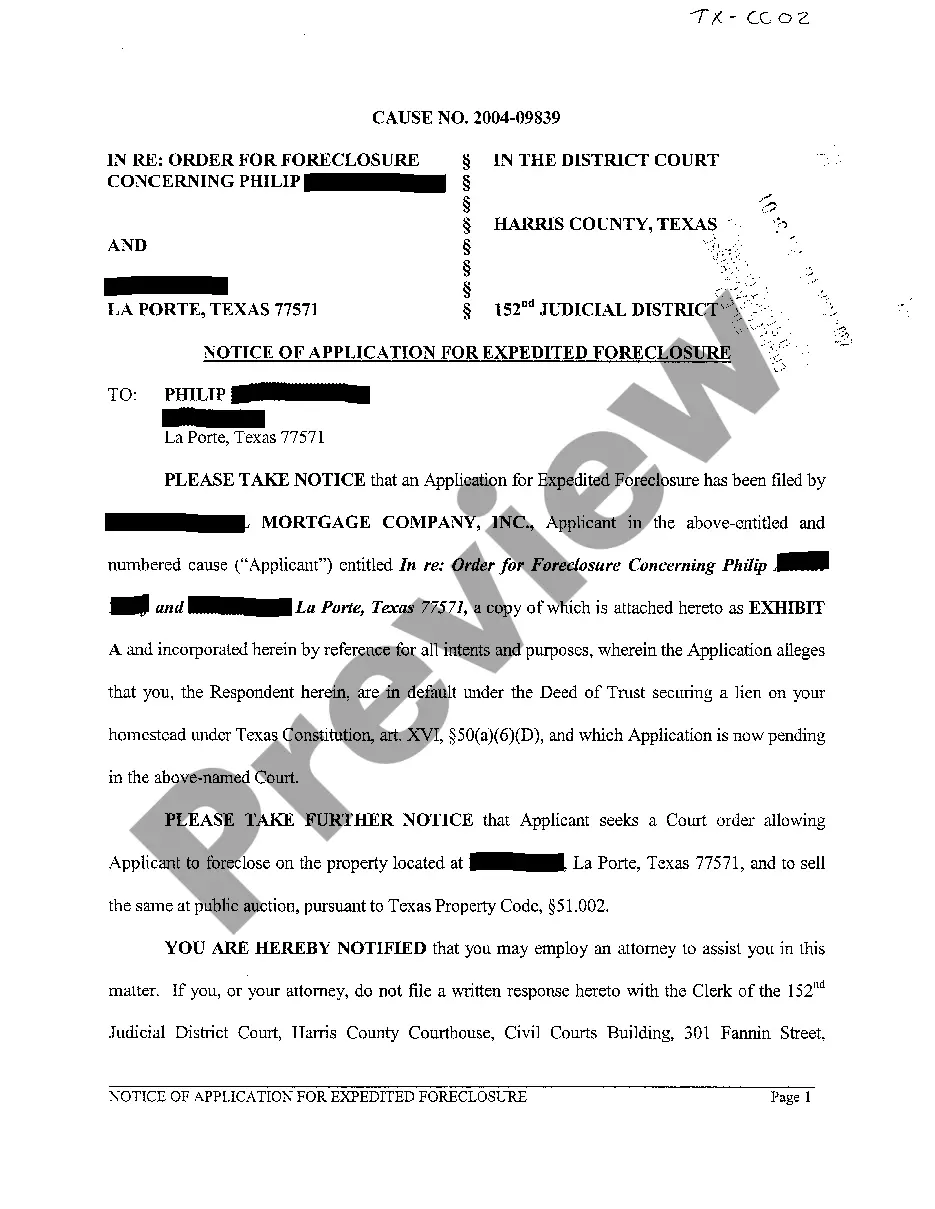

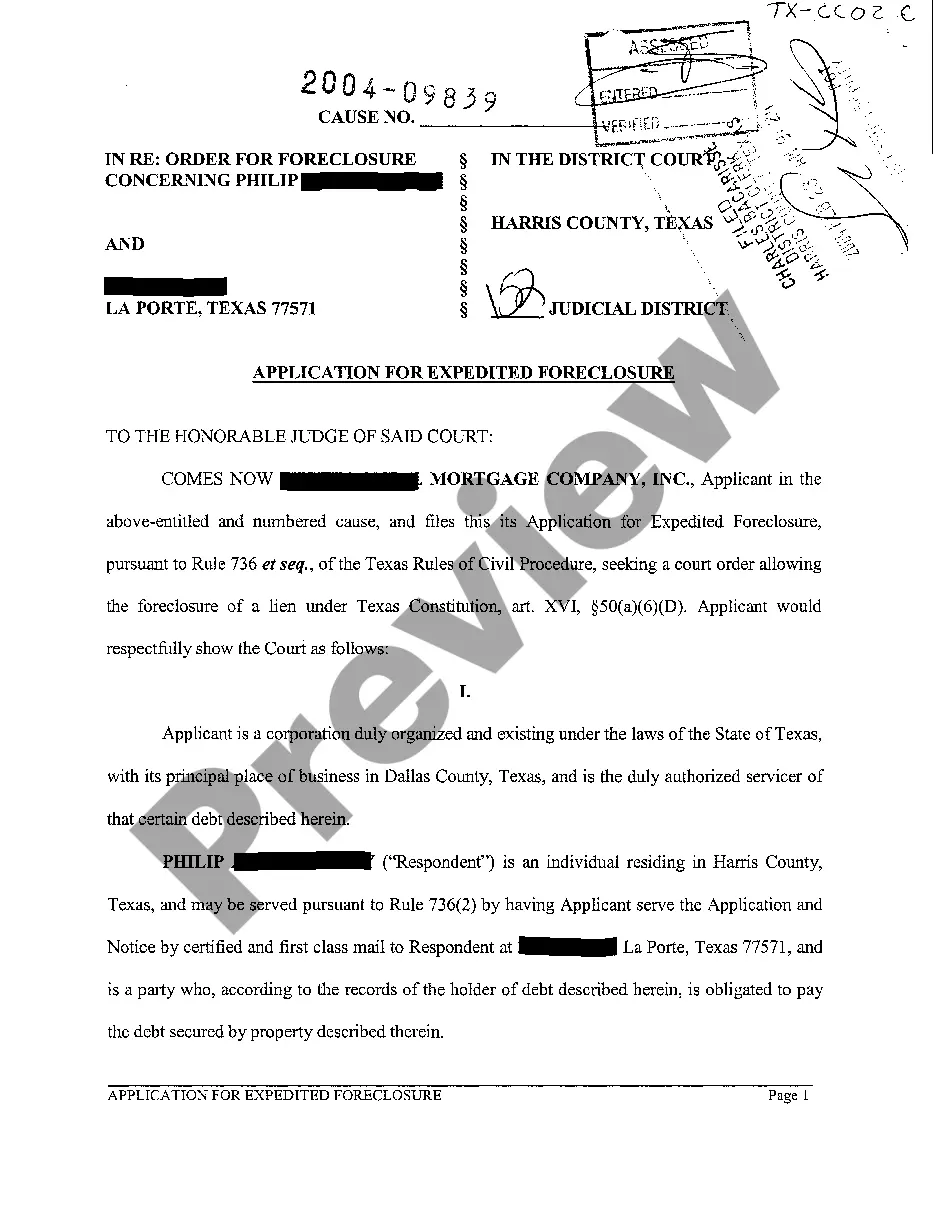

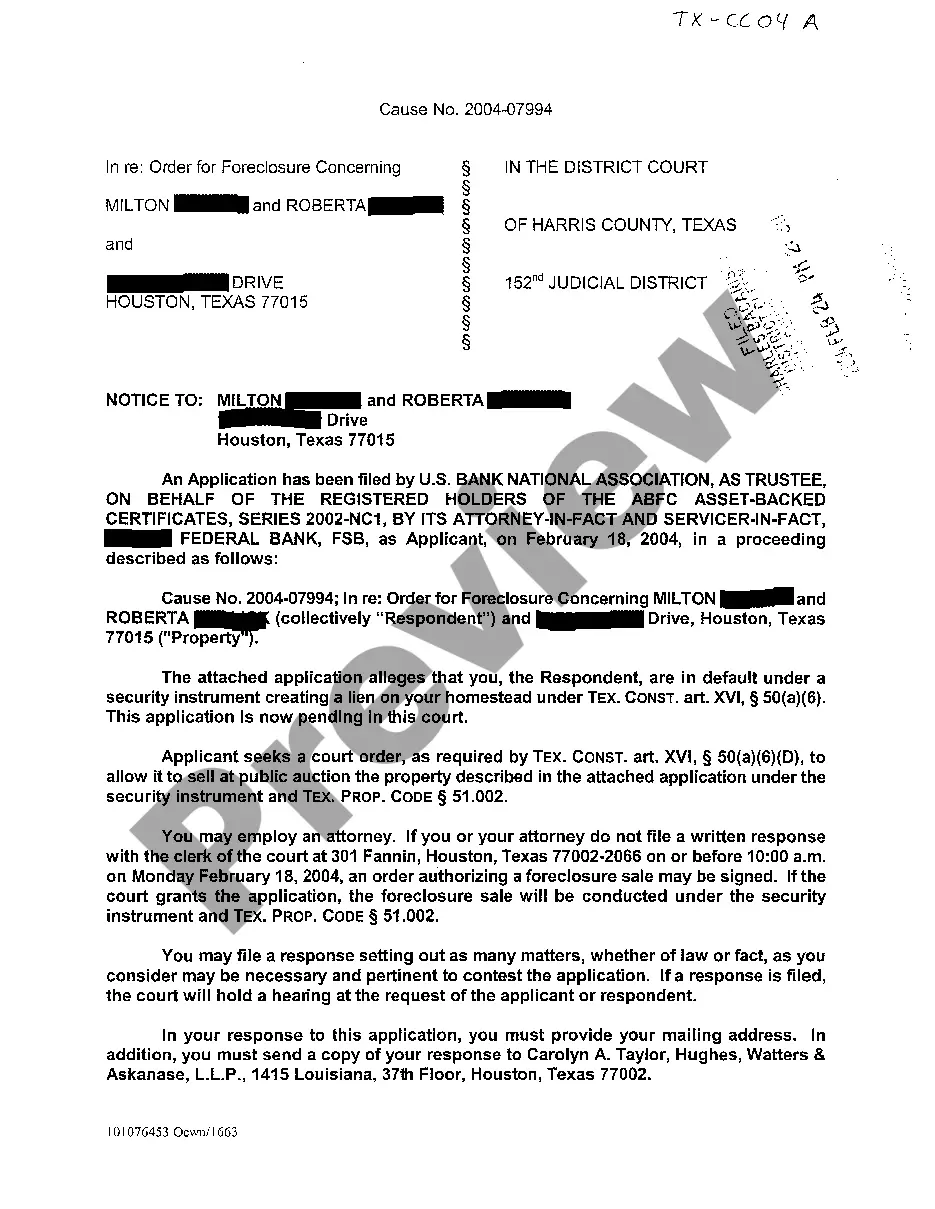

San Antonio Texas Application For Expedited Foreclosure

Description

How to fill out Texas Application For Expedited Foreclosure?

We consistently endeavor to reduce or avert legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek legal remedies that are generally quite expensive.

Nevertheless, not every legal issue is equally complicated; most can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to lose the document, you can always re-download it from within the My documents tab. The process is equally effortless if you’re new to the website! You can register your account within minutes. Make sure to verify if the San Antonio Texas Application For Expedited Foreclosure complies with the laws and regulations of your state and area. Also, it’s vital to examine the form’s outline (if available), and if you notice any inconsistencies with what you were initially seeking, look for an alternative template. Once you’ve confirmed that the San Antonio Texas Application For Expedited Foreclosure is appropriate for you, you can select the subscription plan and proceed to payment. After that, you can download the document in any preferred format. For more than 24 years of our presence in the market, we’ve assisted millions of individuals by providing ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms now to conserve efforts and resources!

- Our collection empowers you to manage your affairs autonomously without needing to consult an attorney.

- We grant access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, making the search process considerably easier.

- Benefit from US Legal Forms whenever you require quick and safe access to the San Antonio Texas Application For Expedited Foreclosure or any other document.

Form popularity

FAQ

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

You can stop a foreclosure in its tracks?at least for a while?by filing for bankruptcy. Filing for Chapter 7 bankruptcy will stall a foreclosure, but usually only temporarily. You can use Chapter 7 bankruptcy to save your home if you're current on the loan and you don't have much equity.

Cure Your Default Under New Jersey law, however, all foreclosures must be judicial, which means they go through the court system (and you can't file a separate lawsuit to challenge foreclosure). You can stop foreclosure by curing a default on your mortgage payments at any time up until the entry of a final judgment.

Typically, it takes about 90 days to foreclose on a Maryland property if the borrower does not object to the foreclosure. If a lender pursues a judicial foreclosure in Maryland then the time frame for foreclosure will vary depending on the court's schedule and orders.

If you are unable to make your mortgage payment: Don't ignore the problem.Contact your lender as soon as you realize that you have a problem.Open and respond to all mail from your lender.Know your mortgage rights.Understand foreclosure prevention options.Contact a HUD-approved housing counselor.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.

Federal regulation issued by the Consumer Financial Protection Bureau that states the mortgage loan obligation must be over 120 days delinquent before initiating a foreclosure action.

4 Ways to Stop Alabama Foreclosure Catch up on past-due balances.Apply for a loan modification.Consider a short sale or deed in lieu of foreclosure.File Chapter 13 Bankruptcy.What about Chapter 7 Bankruptcy?

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.