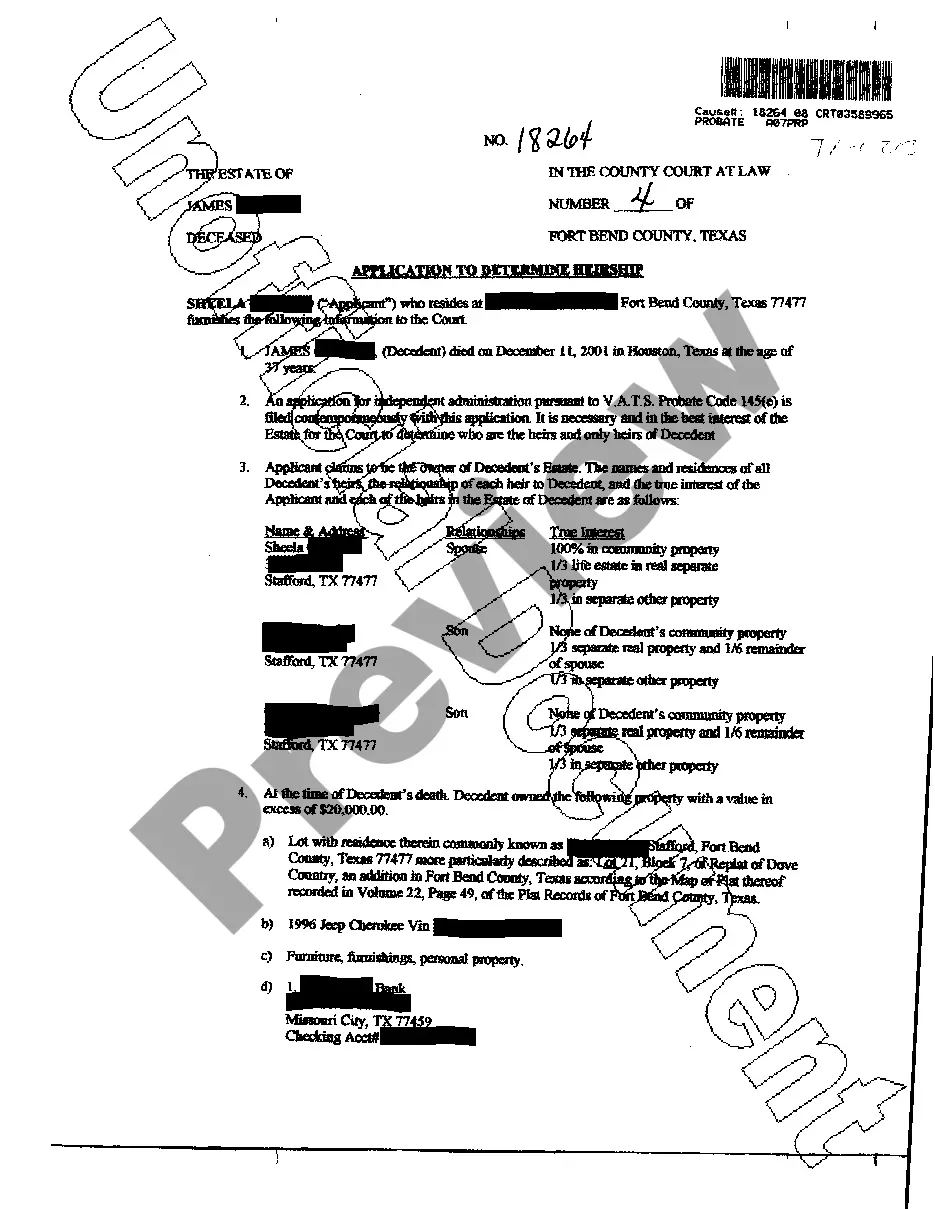

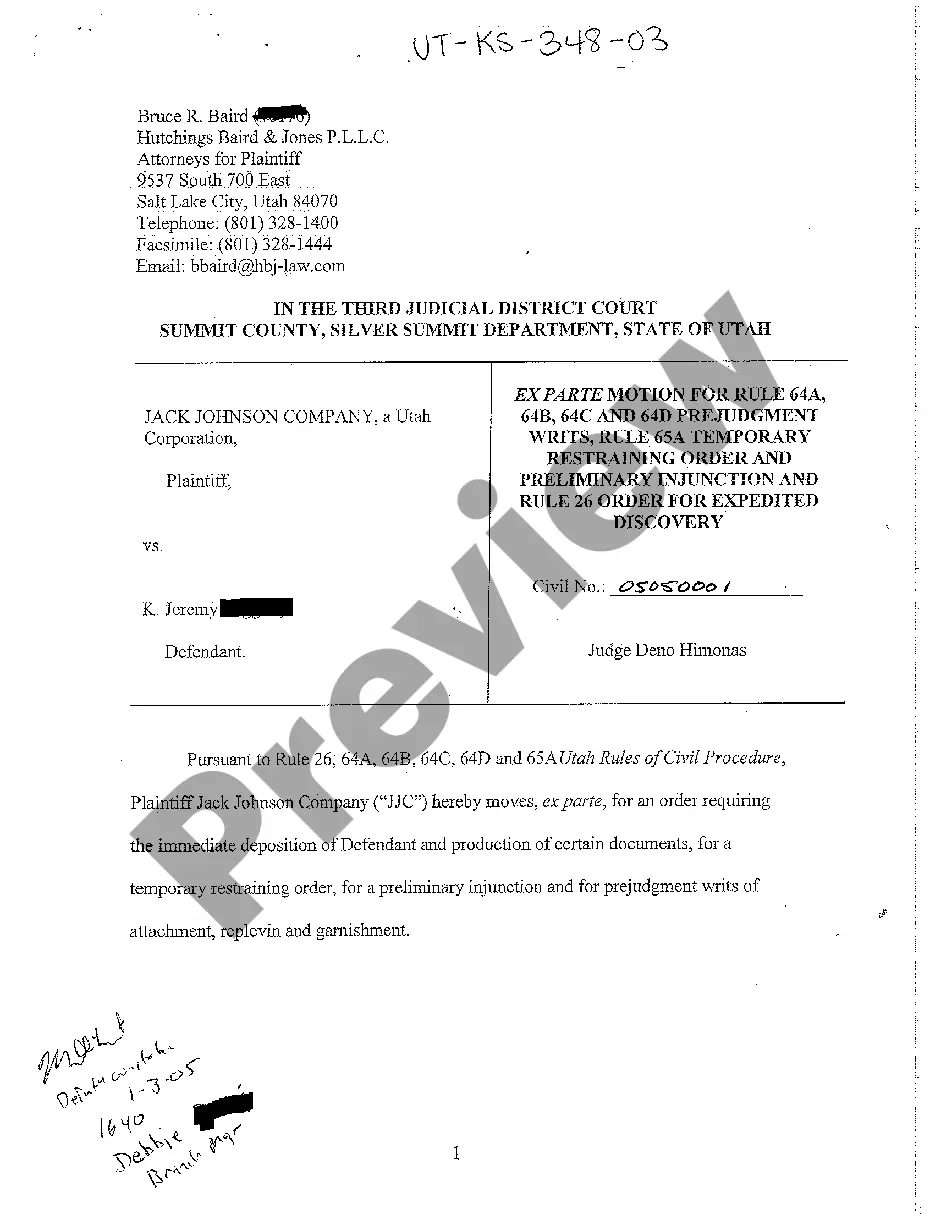

Fort Worth Texas Application to Determine Heirship with Request for Appointment of Independent Administrator

Description

How to fill out Texas Application To Determine Heirship With Request For Appointment Of Independent Administrator?

Locating authenticated templates tailored to your regional statutes can be challenging unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents for both personal and professional purposes as well as various real-world situations.

All the files are accurately organized by usage area and jurisdiction, making it simple and quick to find the Fort Worth Texas Application to Determine Heirship with Request for Appointment of Independent Administrator.

Maintaining documentation orderly and compliant with legal standards is critically important. Utilize the US Legal Forms library to always have vital document templates available at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that fulfills your requirements and fully aligns with your local jurisdiction criteria.

- Look for another template, if necessary.

- If you discover any discrepancies, use the Search tab above to find the correct one.

- If it suits you, proceed to the next step.

Form popularity

FAQ

Can I file an Affidavit of Heirship with the Probate courts? No, these documents should be filed in the County Clerk Official Public Records Office located in room B20 at 100 W. Weatherford, Fort Worth, Texas.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county. The first page usually costs more than the other pages.

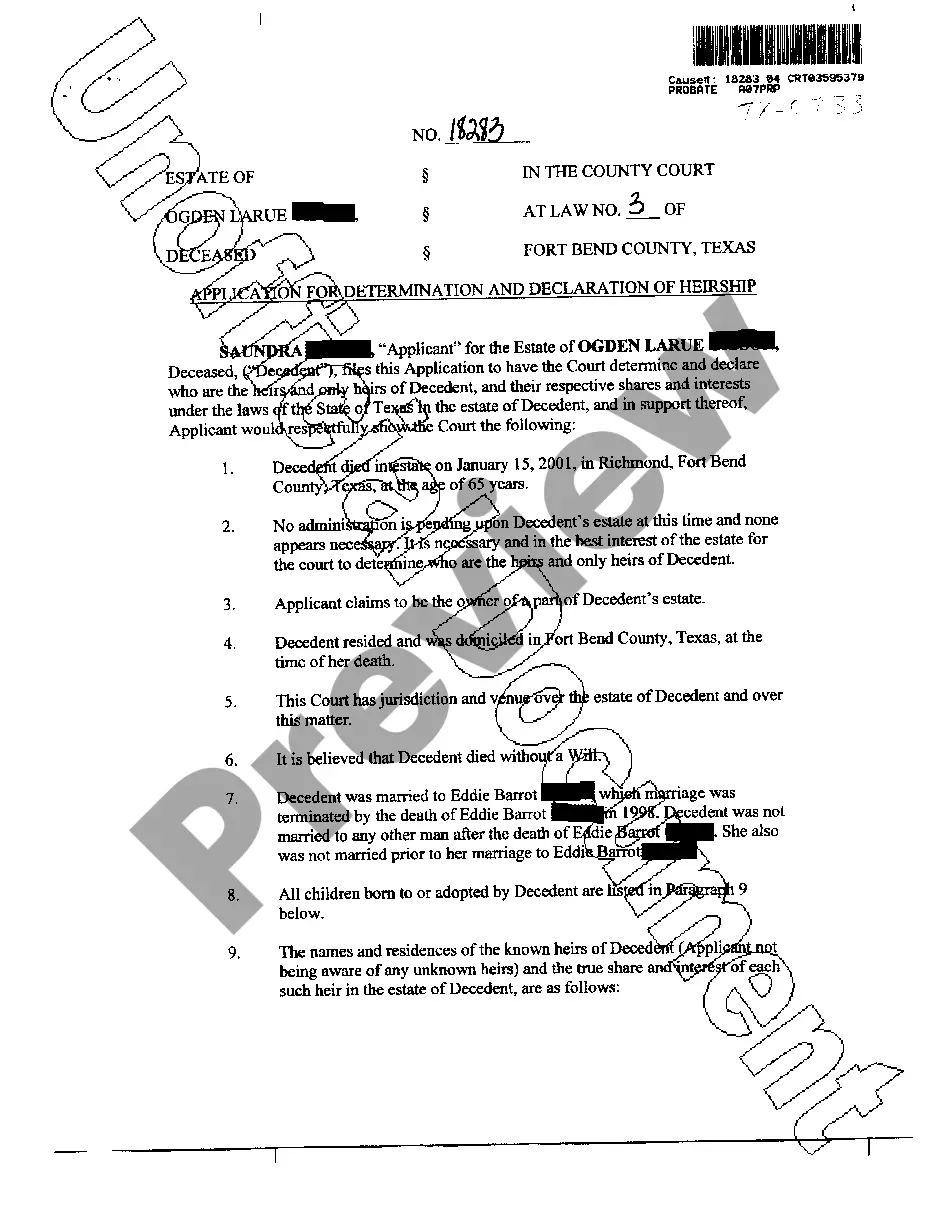

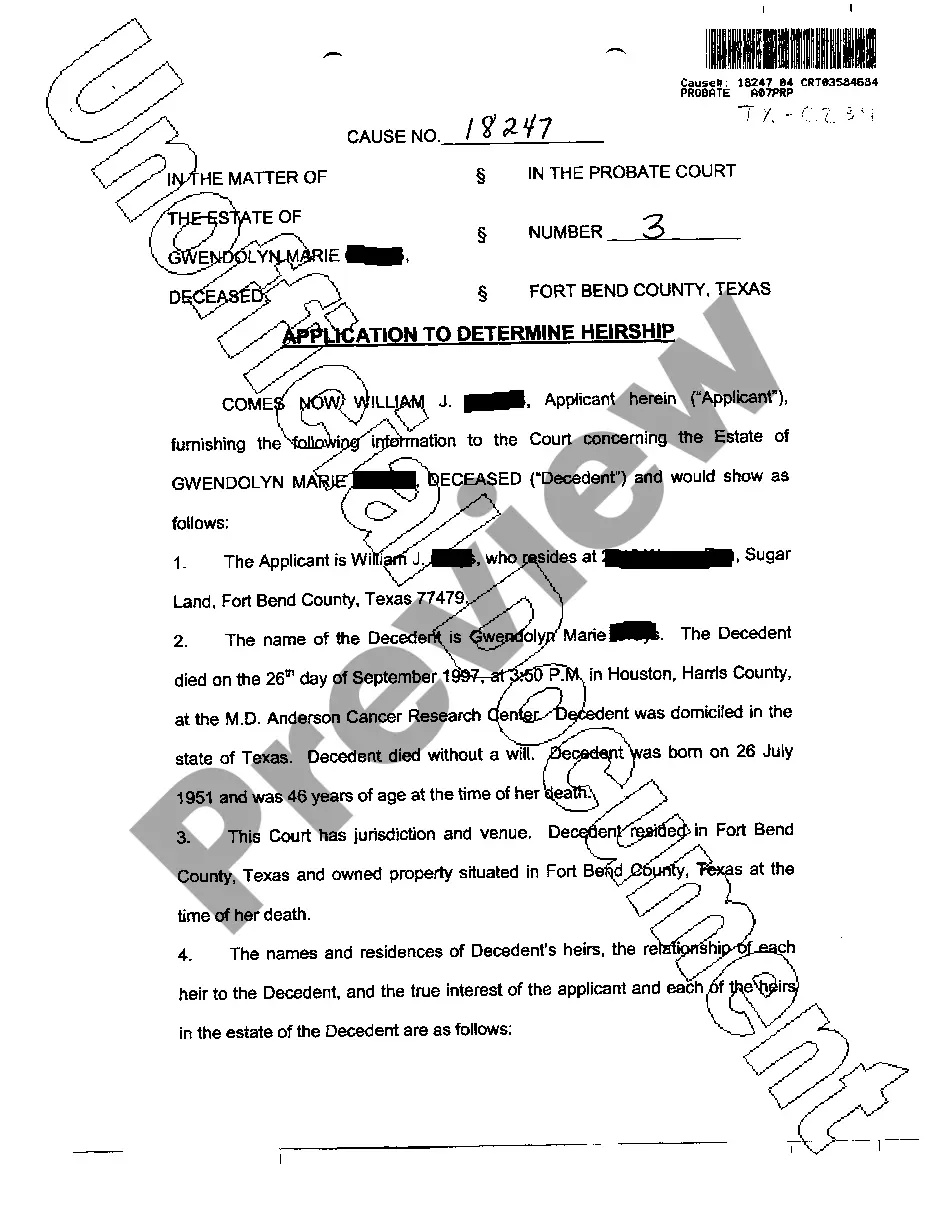

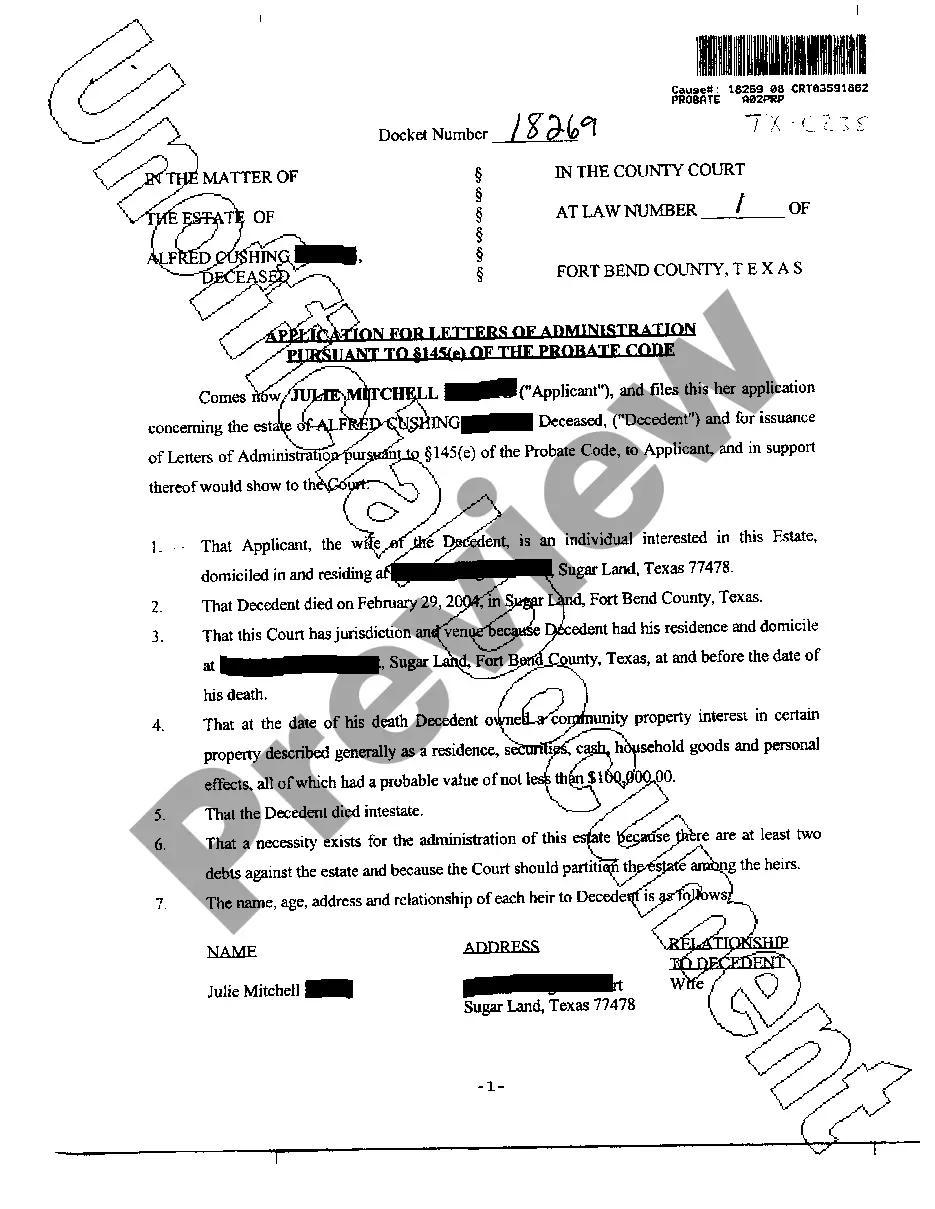

Application for Independent Administration The Application will include, among other things, the decedent's identity, domicile, and date of death, along with a list of all known heirs and the relationship of each heir to the decedent.

By far, the most popular method of probating an estate in Texas is the Independent Probate Administration. In this type of administration, the Court appoints the executor or administrator to work independently of the court's supervision.

Unless limited by the terms of a will, an independent executor, in addition to any power of sale of estate property given in the will, and an independent administrator have the same power of sale for the same purposes as a personal representative has in a supervised administration, but without the requirement of court

An independent administration is a non-court administration. After a person has applied for letters testamentary and been qualified as independent executor by the court, the executor files an inventory of the estate's assets and their appraised value, and a list of claims of the estate.

Letters testamentary or letters of administration give the personal representative the legal authority to administer the decedent's probate estate. The letters provide proof of appointment and qualification of the personal representative of an estate and the date of qualification.

The surviving spouse automatically receives all community property. Separate personal property also goes completely to the surviving spouse, while separate real property is split down the middle between the surviving spouse and the deceased's parents, siblings or siblings' descendants, in that order.

How to get Letters Testamentary or Letters of Administration: First, file an application for probate. You'll need to file with the court in the county in which the decedent died. Notify interested parties.Appear at a hearing.Be appointed by a judge.Perform the duties as an Executor or Administrator.

When do you use an affidavit of heirship? An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).