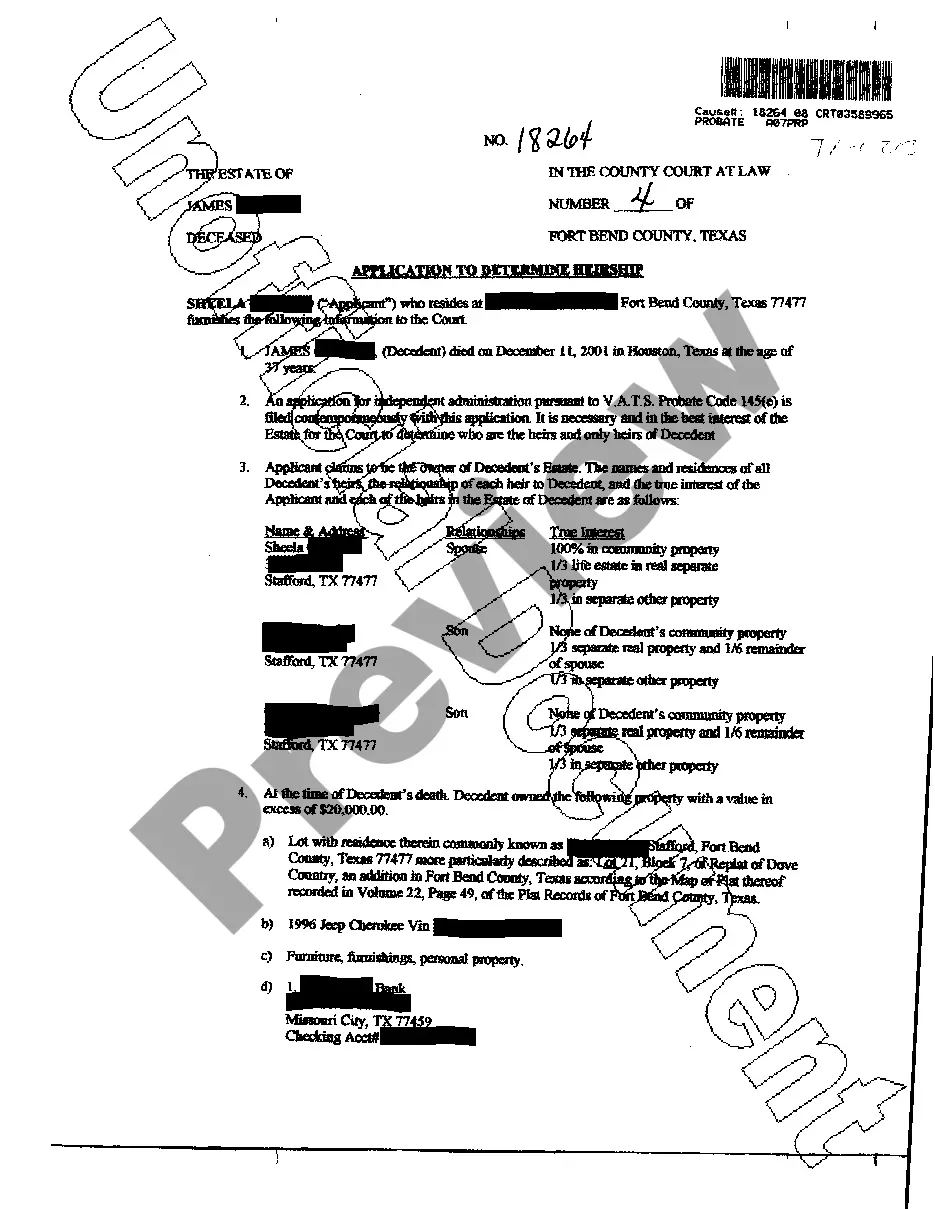

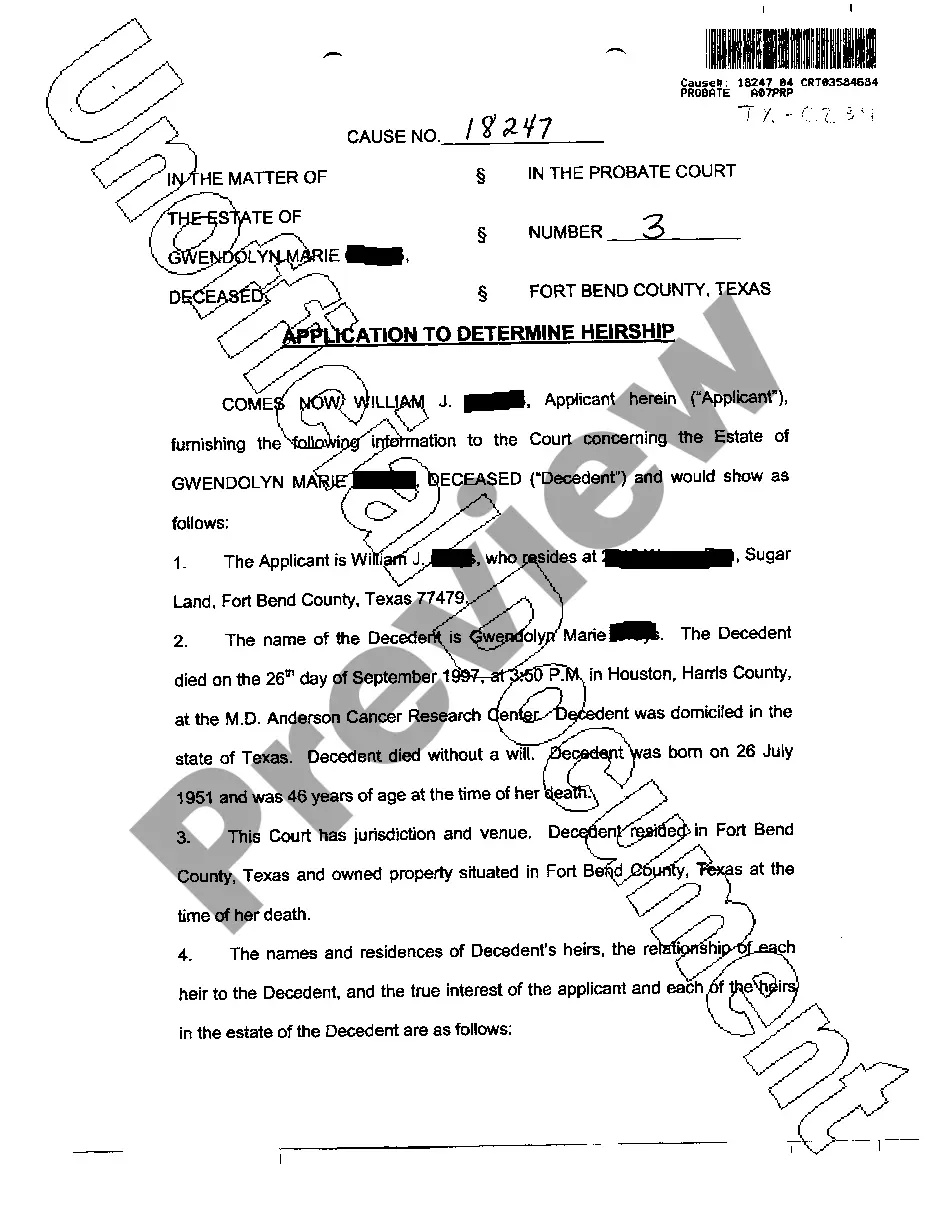

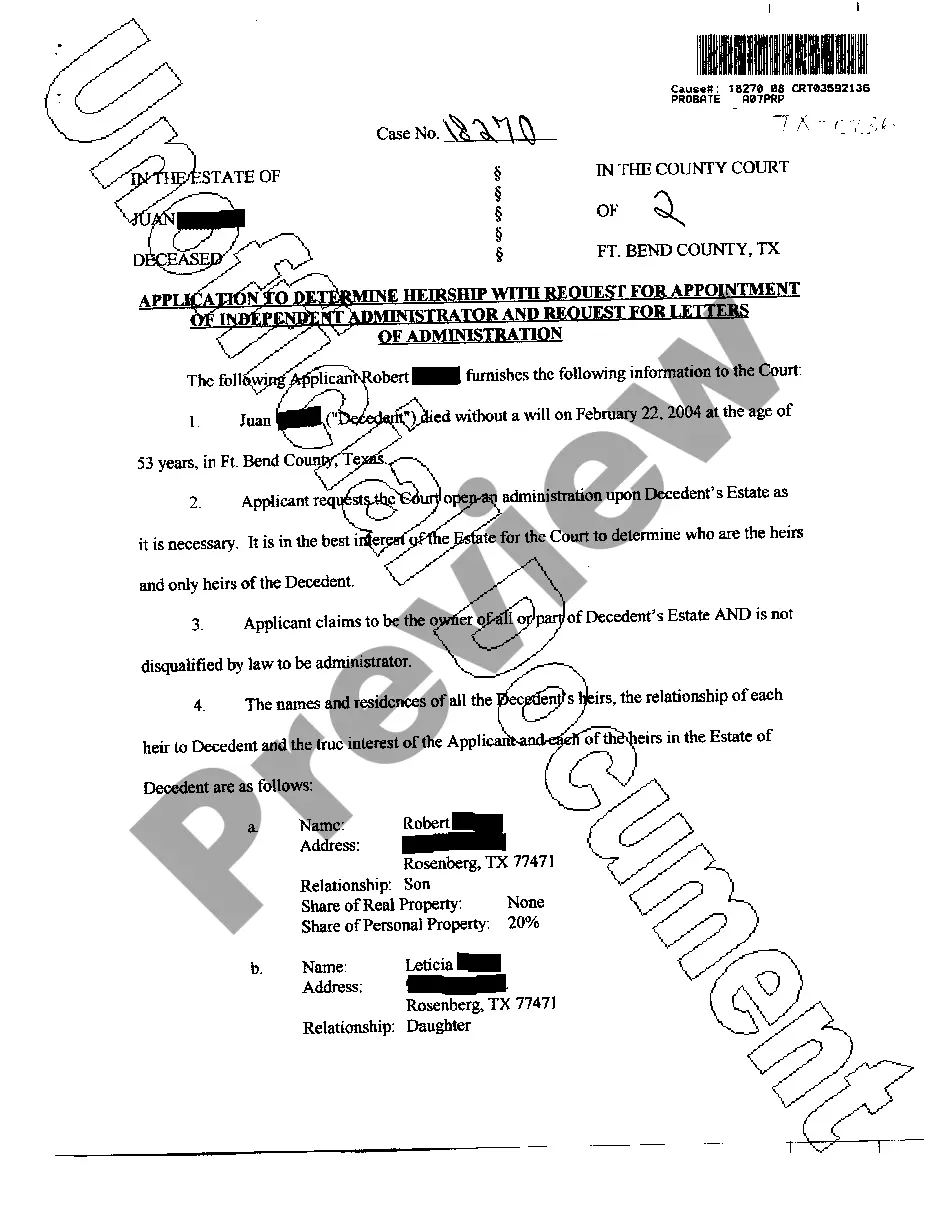

Fort Worth Texas Application to Determine Heirship - Descent

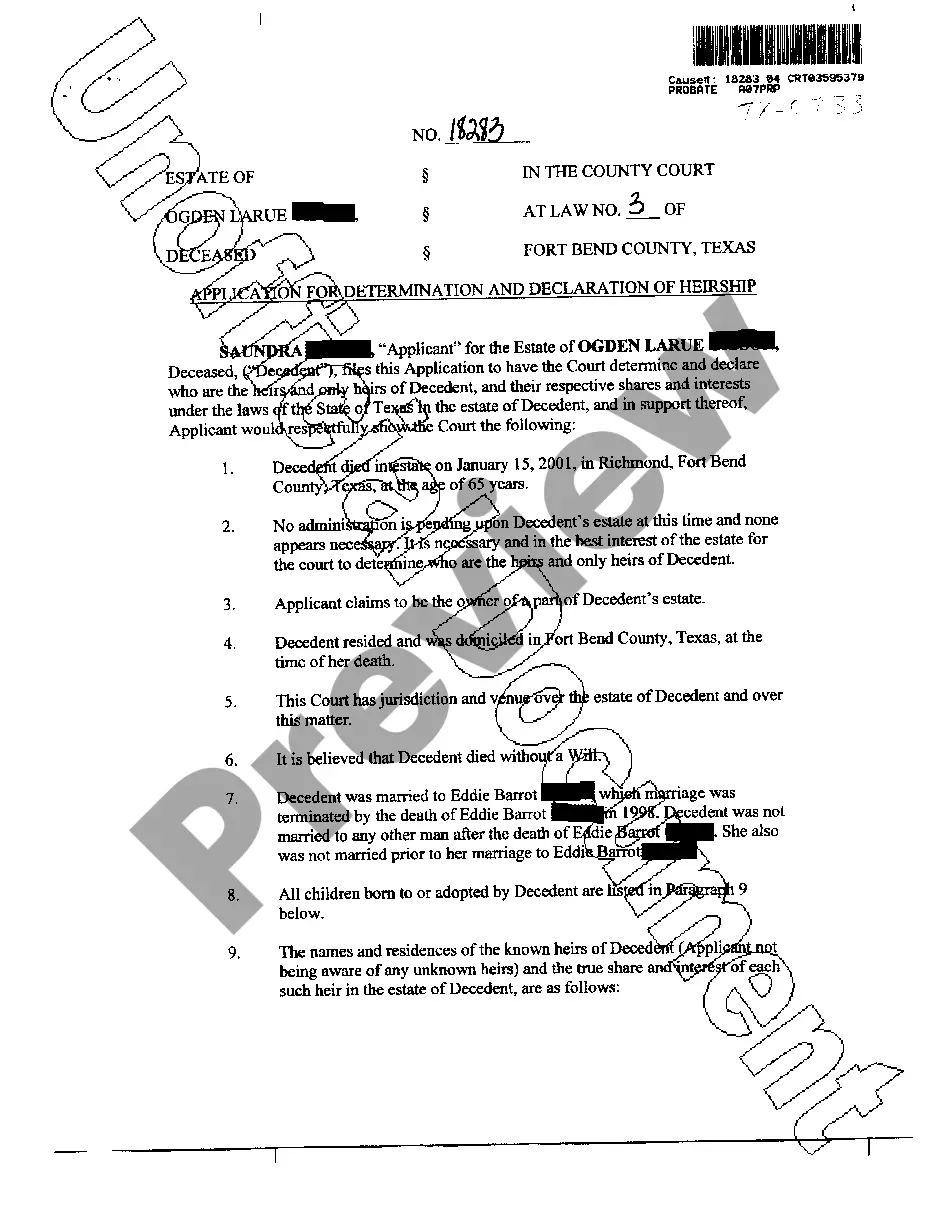

Description

How to fill out Texas Application To Determine Heirship - Descent?

Regardless of one's societal or professional standing, completing legal documents is an unfortunate requirement in the contemporary world.

Frequently, it’s almost impossible for an individual without legal expertise to create such documents from the ground up, primarily due to the complex vocabulary and legal subtleties they entail.

This is where US Legal Forms proves to be useful.

Ensure the document you have selected is tailored to your region as the laws of one state or county do not apply to another.

Review the paper and read through a brief summary (if available) of situations for which the document can be utilized.

- Our service provides a vast repository of over 85,000 ready-to-use, state-specific documents applicable for nearly any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to optimize their time with our DIY papers.

- Whether you need the Fort Worth Texas Application to Determine Heirship - Descent or another document valid in your state or county, US Legal Forms has you covered.

- Here’s how you can quickly obtain the Fort Worth Texas Application to Determine Heirship - Descent using our reliable service.

- If you’re already a member, go ahead and Log In to your account to access the relevant form.

- However, if you are new to our platform, please follow these steps prior to obtaining the Fort Worth Texas Application to Determine Heirship - Descent.

Form popularity

FAQ

Filing an Application to Determine Heirship in Texas All heirs must sign the application or must be personally served with the application. If there are potentially unknown heirs of the deceased, the court requires that notices be posted in newspapers as well as at the courthouse.

Step 1 ? Gather Information. The law requires you to wait thirty (30) days before you file a small estate affidavit.Step 2 ? Prepare Affidavit.Step 3 ? Identify Witnesses.Step 4 ? Get Forms Notarized.Step 5 ? File with Probate Court.Step 6 ? Distribute Affidavit.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the ?AFFIANT?.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

The surviving spouse automatically receives all community property. Separate personal property also goes completely to the surviving spouse, while separate real property is split down the middle between the surviving spouse and the deceased's parents, siblings or siblings' descendants, in that order.

Can I file an Affidavit of Heirship with the Probate courts? No, these documents should be filed in the County Clerk Official Public Records Office located in room B20 at 100 W. Weatherford, Fort Worth, Texas.

If a you are single and die without a will in Texas, your property will be distributed as follows: Your estate will pass equally to your parents if both are living. If one parent has died, and you don't have any siblings, then your estate will pass to your surviving parent.

When do you use an affidavit of heirship? An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

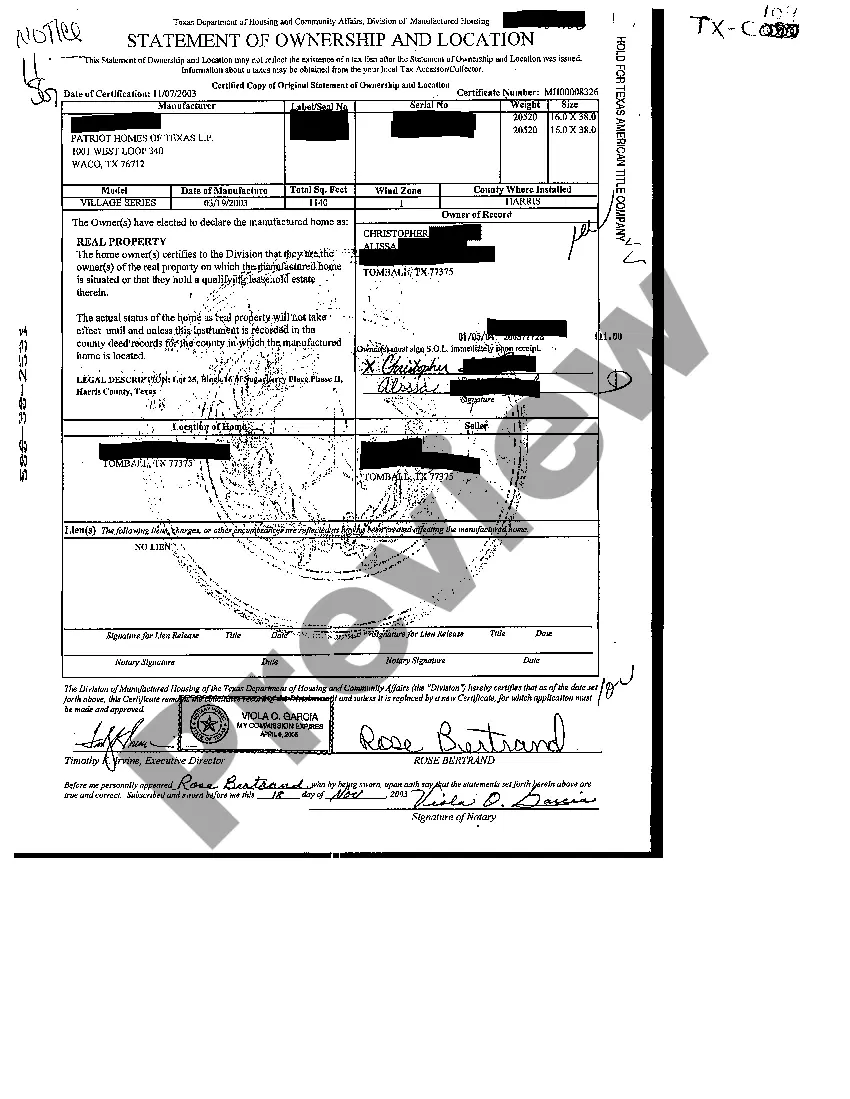

Affidavit of Heirship for Texas Property. Using a properly recorded Affidavit of Heirship, the Texas property records and the property tax records are updated to transfer the property from the deceased's name to the names of the heirs at law without probate.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county. The first page usually costs more than the other pages.