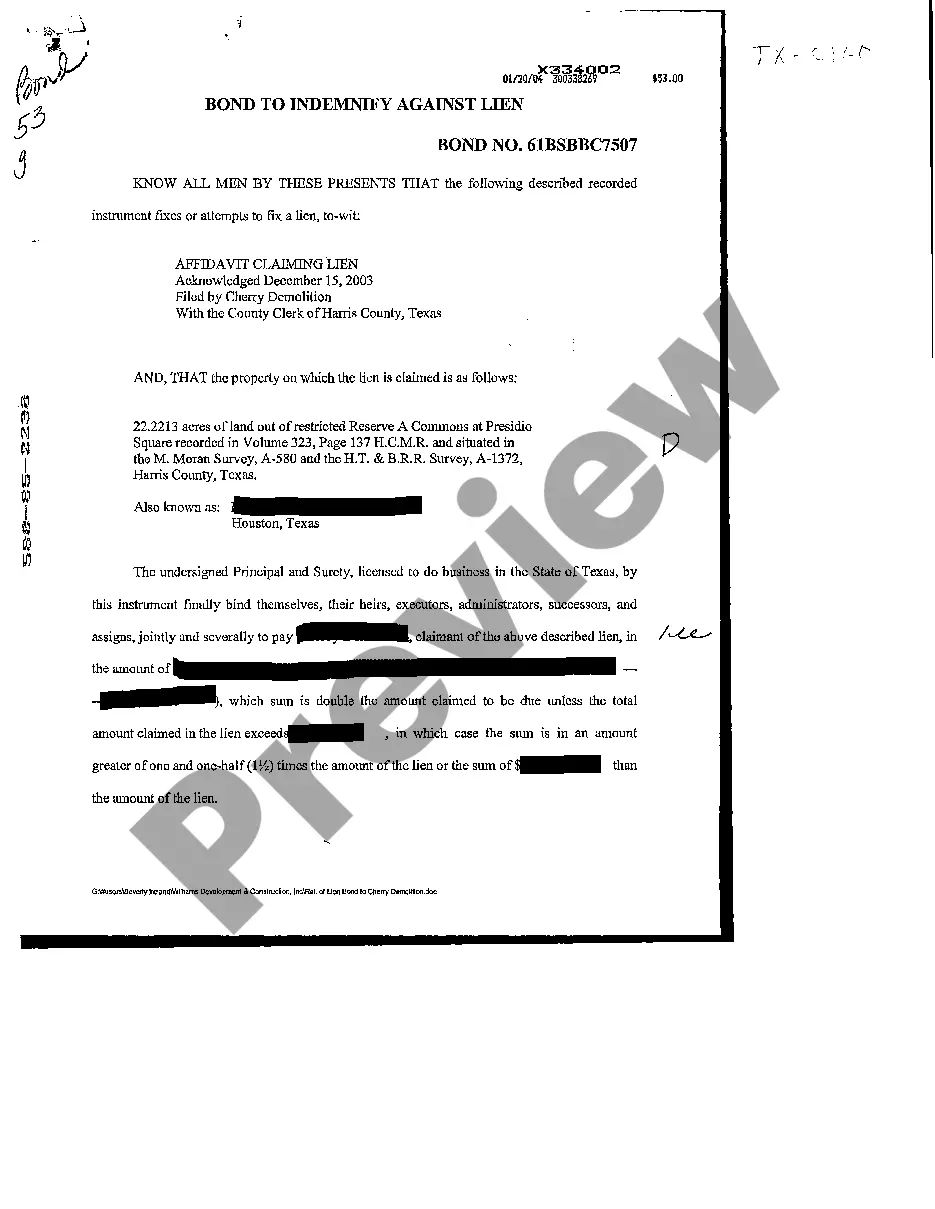

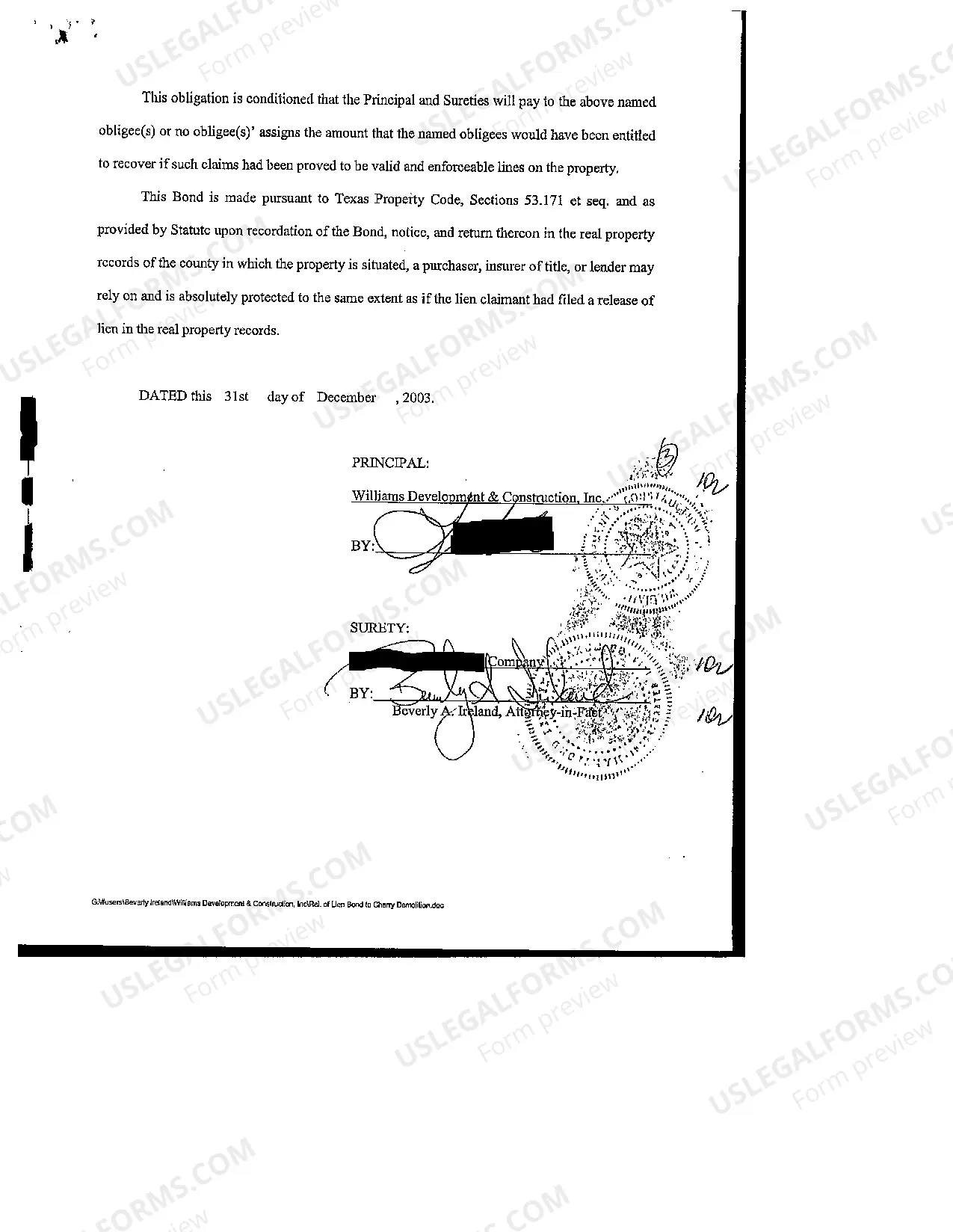

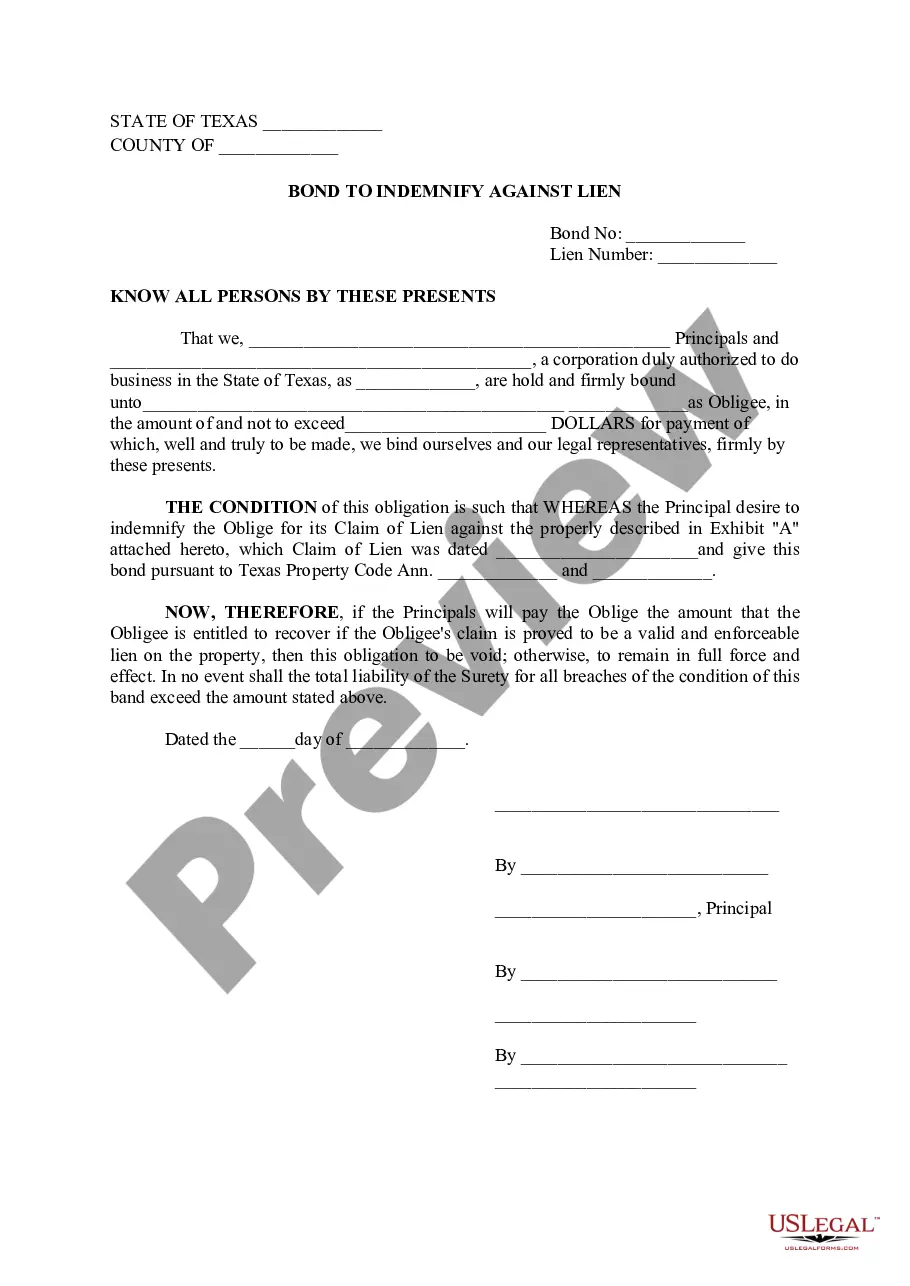

Plano Texas Bond to Indemnify Against Lien

Description

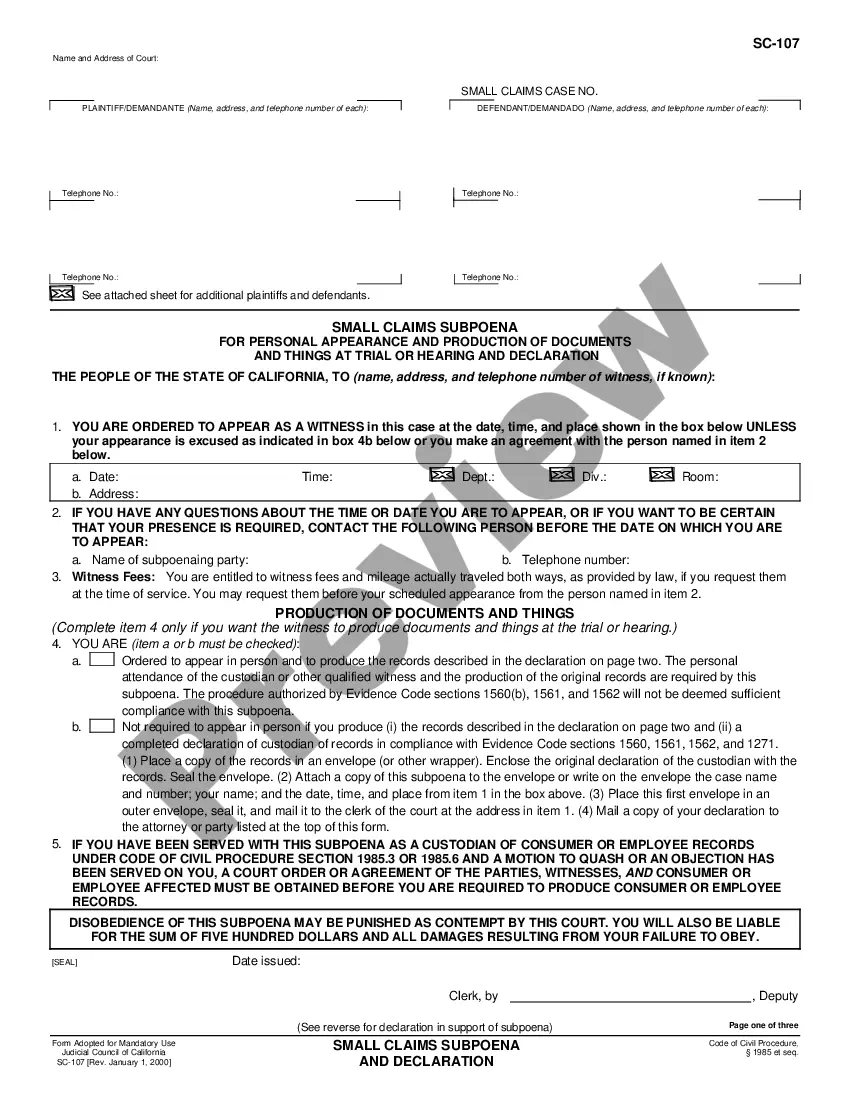

How to fill out Texas Bond To Indemnify Against Lien?

Do you require a trustworthy and cost-effective legal forms provider to obtain the Plano Texas Bond to Indemnify Against Lien? US Legal Forms is your preferred solution.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to progress your divorce in court, we have you covered.

Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are tailored to meet the requirements of specific state and county laws.

To retrieve the form, you must Log In to your account, find the necessary form, and click the Download button next to it.

If the form does not meet your legal needs, restart the search.

Now you are ready to set up your account. Then select a subscription plan and complete the payment. Once the payment is processed, download the Plano Texas Bond to Indemnify Against Lien in any of the provided file formats. You can revisit the website whenever you need and redownload the form at no additional cost.

- Please be aware that you can download your previously acquired document templates at any time from the My documents section.

- Are you unfamiliar with our platform? No problem.

- You can establish an account in just a few minutes, but first, ensure that you do the following.

- Verify that the Plano Texas Bond to Indemnify Against Lien complies with the regulations of your state and local jurisdiction.

- Review the form's specifications (if available) to understand who and what the form is suitable for.

Form popularity

FAQ

Bonding around a lien means securing a bond that allows a property owner to remove or mitigate the impact of a lien on their property. This process helps clarify ownership and protects against financial losses tied to the lien. Utilizing a Plano Texas Bond to Indemnify Against Lien facilitates the resolution of disputes, allowing you to proceed with property transactions without the burden of outstanding claims. This approach can enhance your property's marketability and reduce legal complications.

A bond to indemnify is a financial instrument that protects one party from losses incurred due to another party's actions or failures. This type of bond plays a crucial role when managing real estate transactions, particularly when a lien is present. By obtaining a Plano Texas Bond to Indemnify Against Lien, you can ensure that any unexpected claims do not jeopardize your investment. It provides peace of mind and can facilitate smoother property dealings.

An indemnity lien is a legal claim against a property to secure the payment for a debt or obligation that may arise from a dispute. When you secure a Plano Texas Bond to Indemnify Against Lien, you can prevent such liens from affecting your property’s value and ownership. This type of lien ensures that any legal issues related to the property do not lead to significant financial loss for you. Therefore, it is essential for property owners to understand indemnity liens and how they interact with bond agreements.

A bond is a financial guarantee that ensures the completion of a project or payment of a debt. In contrast, a bond indemnity provides protection against losses caused by a third party. The Plano Texas Bond to Indemnify Against Lien serves as a tool to secure your interests in real estate transactions by protecting you from liens and claims. Understanding these differences can help you make an informed decision regarding risk management.

Blocking a lien typically requires obtaining a Plano Texas Bond to Indemnify Against Lien, which protects your interests while you address the lien's legitimacy. This bond assures the lien claimant that their financial stake is covered during the dispute process. It's important to understand that this does not eliminate the lien but provides flexibility in managing the situation. Consulting with a professional can help you navigate the necessary steps effectively.

Responding to a lien involves acknowledging its existence and taking appropriate steps, such as obtaining a Plano Texas Bond to Indemnify Against Lien. This bond allows you to secure the amount needed for release while disputing the lien if necessary. Maintain clear documentation and communication with the lien claimant as you work towards a resolution. Always consider legal advice to ensure your rights are protected.

To fight a property lien, consider obtaining a Plano Texas Bond to Indemnify Against Lien, which can provide temporary relief while you dispute the lien. Begin by reviewing the lien's validity and gathering evidence to support your case. You may need to file a lawsuit to contest the lien formally. Involving legal counsel can greatly improve your chances of successfully resolving the issue.

Bypassing a lien requires obtaining a Plano Texas Bond to Indemnify Against Lien, which releases the property from the lien's impact. This bond acts as a pledge that protects the lien claimant's interest while allowing you to proceed with property transactions. Engage a legal or bonding professional to guide you through this process, ensuring you fulfill all necessary requirements correctly.

Getting a lien bond in Texas involves applying for a Plano Texas Bond to Indemnify Against Lien through a reputable bonding company or insurance provider. You will need to provide details about your property and the lien in question. The company will assess your application and determine your eligibility based on various factors. Once approved, you will receive the bond, which you can then file with relevant authorities.

To bond around a lien, you will need to obtain a Plano Texas Bond to Indemnify Against Lien, which serves as financial security. This bond ensures that if the lien claimant is entitled to payment, they can receive compensation from the bond amount. Start by working with a qualified bonding company to understand the specific requirements based on your situation. This proactive step can help protect your property and assets.