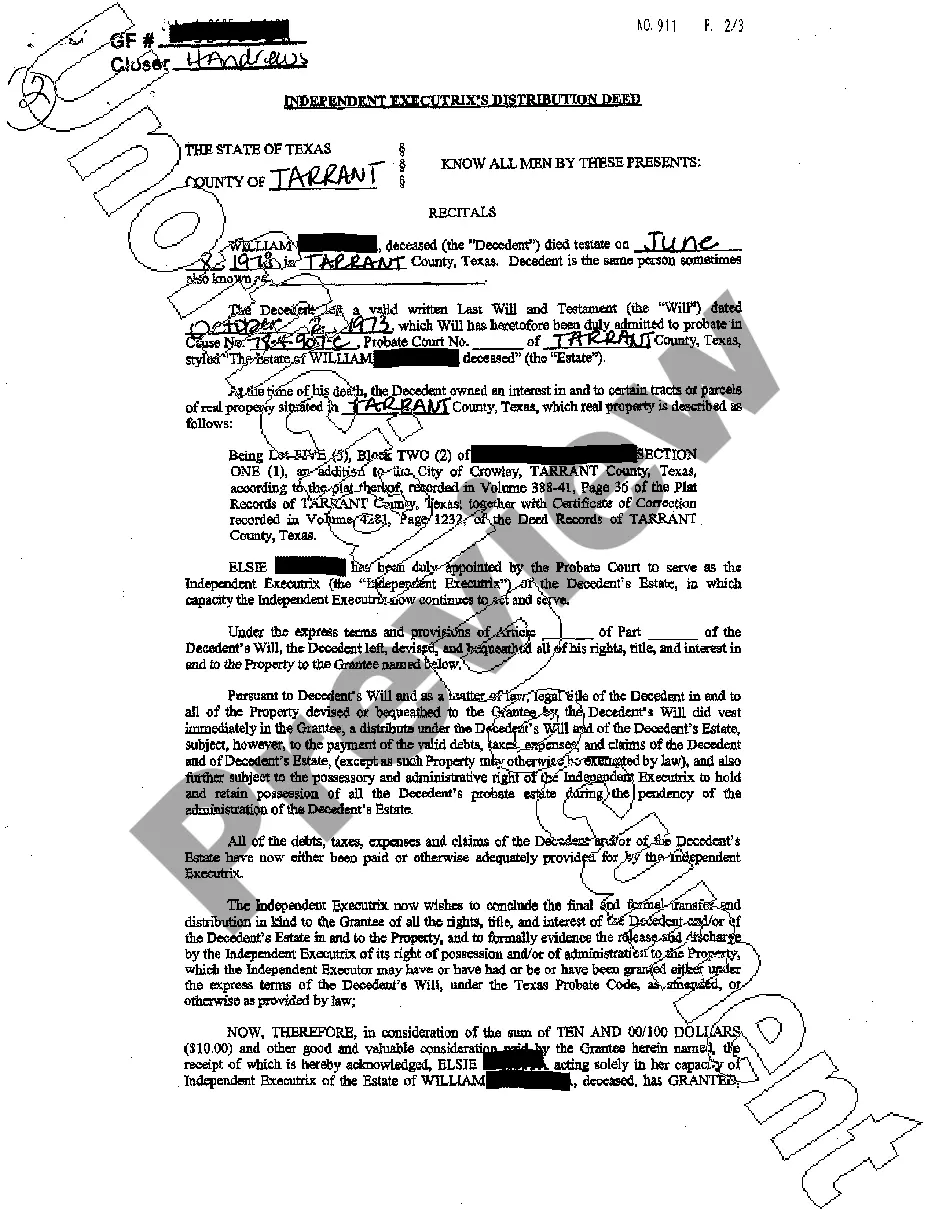

This form is a Distribution Deed whereby Joint Independent Executors transfer real property from the estate of the decedent to the Grantee. This deed complies with all state statutory laws.

Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary

Description

How to fill out Texas Distribution Deed - Joint Independent Executors To An Individual Beneficiary?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our advantageous platform, featuring a vast array of templates, makes it easy to discover and obtain nearly any document sample you desire.

You can download, fill out, and endorse the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary in just a few minutes, rather than spending hours scouring the internet for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submissions.

Get the template you require. Ensure that it is the form you intended to locate: review its title and description, and utilize the Preview feature if it is accessible. If not, use the Search field to find the correct one.

Initiate the downloading process. Click Buy Now and select your preferred pricing plan. Then, register for an account and pay for your order with a credit card or PayPal. Afterward, download the document by selecting the format to receive the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary and modify or sign it according to your needs.

- Our experienced attorneys routinely review all the paperwork to verify that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you obtain the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.

- If you possess an account, simply Log In to your profile. The Download option will be activated for all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow these guidelines.

Form popularity

FAQ

Yes, in Texas, an executor can also be a beneficiary of the estate. This dual role does not create a conflict of interest, as long as the executor acts in accordance with the will and Texas law. When utilizing an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary, it is essential to ensure that the executor's actions benefit the estate and all beneficiaries fairly.

The independent executor law in Texas allows a named executor to manage the estate without court supervision. This means the executor can distribute assets according to the will without seeking court approval for every action taken. When dealing with an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary, this law streamlines the process, making it more efficient for all parties involved.

To transfer ownership from a deceased owner in Texas, you will need the death certificate, the current property deed, and identification of the beneficiaries. Utilizing an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can simplify this process. Additionally, consider consulting with a professional to ensure all legal requirements are met.

Yes, a house can remain in a deceased person’s name in Texas until the estate is settled. This situation may complicate matters for beneficiaries, highlighting the importance of initiating the process through an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary. Taking swift action can lead to a smoother transition of ownership.

Transferring ownership of a property after death in Texas involves filing the appropriate deed, such as a transfer on death deed or a distribution deed. For effective transitions, employing an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary serves as a reliable choice. Make sure to gather all necessary documents and possibly consult a legal expert to avoid complications.

In Texas, you typically have four years to claim property after the death of the owner. This timeframe ensures that beneficiaries can organize their affairs and make necessary claims. If you are processing an Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary, this period is crucial to make sure all rights are protected.

In Texas, individuals who are minors, declared mentally incompetent, or who have felony convictions are disqualified from serving as executors of a will. It's crucial to choose someone capable of navigating the complexities involved in administering an estate. Understanding these qualifications can help you effectively utilize the tools available in the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.

To prove you are the executor of an estate in Texas, you must provide the court with the original will and a court order appointing you as executor. This documentation validates your authority to act on behalf of the estate. The process can often be simplified through the clear guidelines found in the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.

An independent executor in Texas is an executor who administers the estate without court supervision. This role allows for more flexibility and efficiency in managing affairs related to the Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary. Typically, an independent executor can make decisions on behalf of the estate without needing constant approval from a judge.

The best person to serve as an executor of a will is someone trustworthy, organized, and familiar with your financial matters. This individual should be capable of handling complex tasks, such as managing assets and settling debts. Choosing the right person can greatly simplify the process outlined in your Amarillo Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.