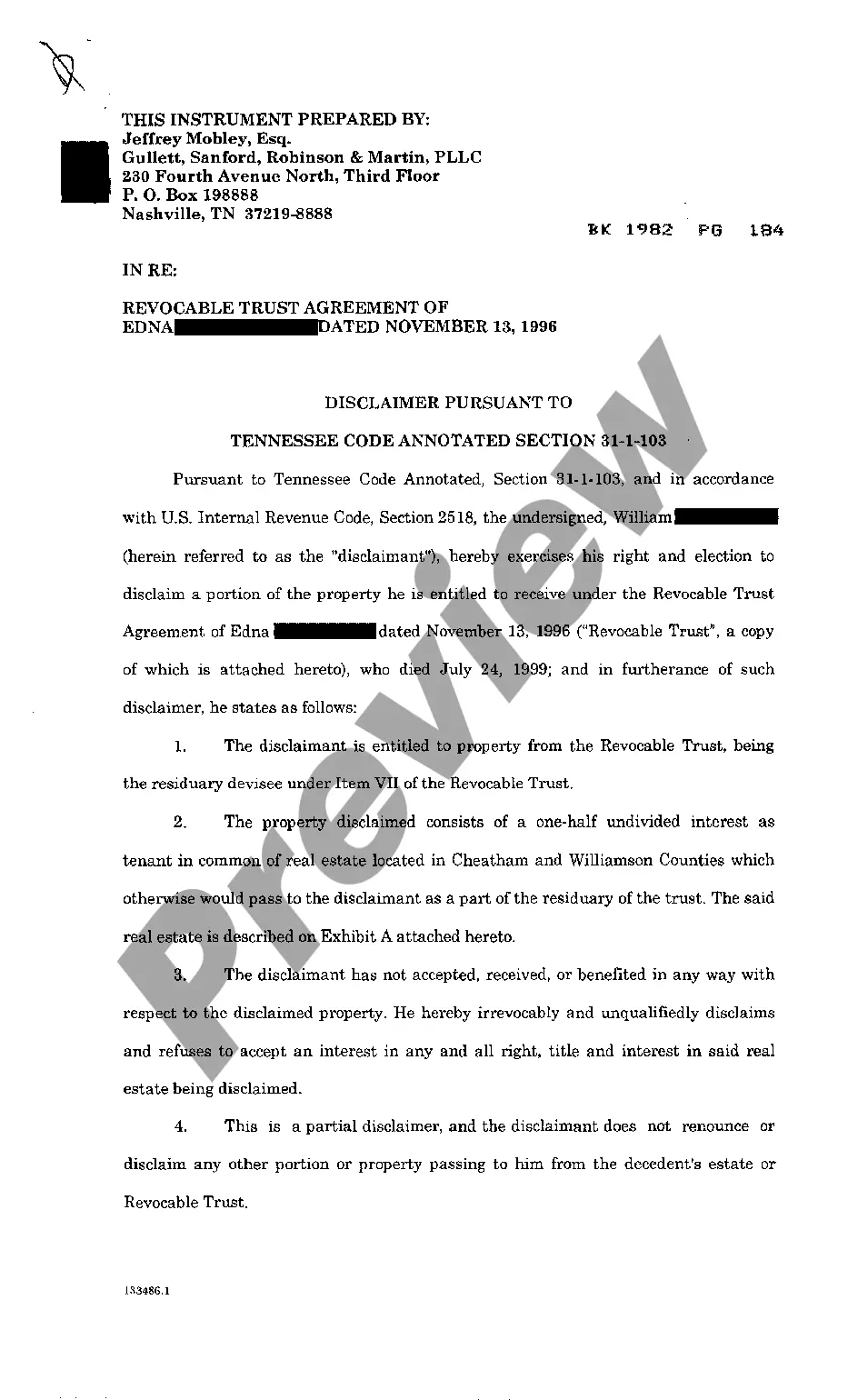

Nashville Tennessee Disclaimer of interest in real property from beneficiary of trust

Description

How to fill out Tennessee Disclaimer Of Interest In Real Property From Beneficiary Of Trust?

If you have previously utilized our service, sign in to your account and retrieve the Nashville Tennessee Disclaimer of interest in real property from the beneficiary of trust onto your device by clicking the Download button. Ensure your subscription remains active. If not, renew it as per your payment scheme.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to all documents you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to effortlessly search for and save any template for your individual or business requirements!

- Ensure you’ve found the correct document. Examine the description and utilize the Preview feature, if available, to confirm it aligns with your requirements. If it does not suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now option and choose a monthly or yearly subscription plan.

- Set up an account and process your payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Nashville Tennessee Disclaimer of interest in real property from beneficiary of trust. Select the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

A person disclaiming their interest in the inheritance, as long as the disclaimer meets the requirements of California law, will be treated as never having owned the transferred property for any state law purposes.

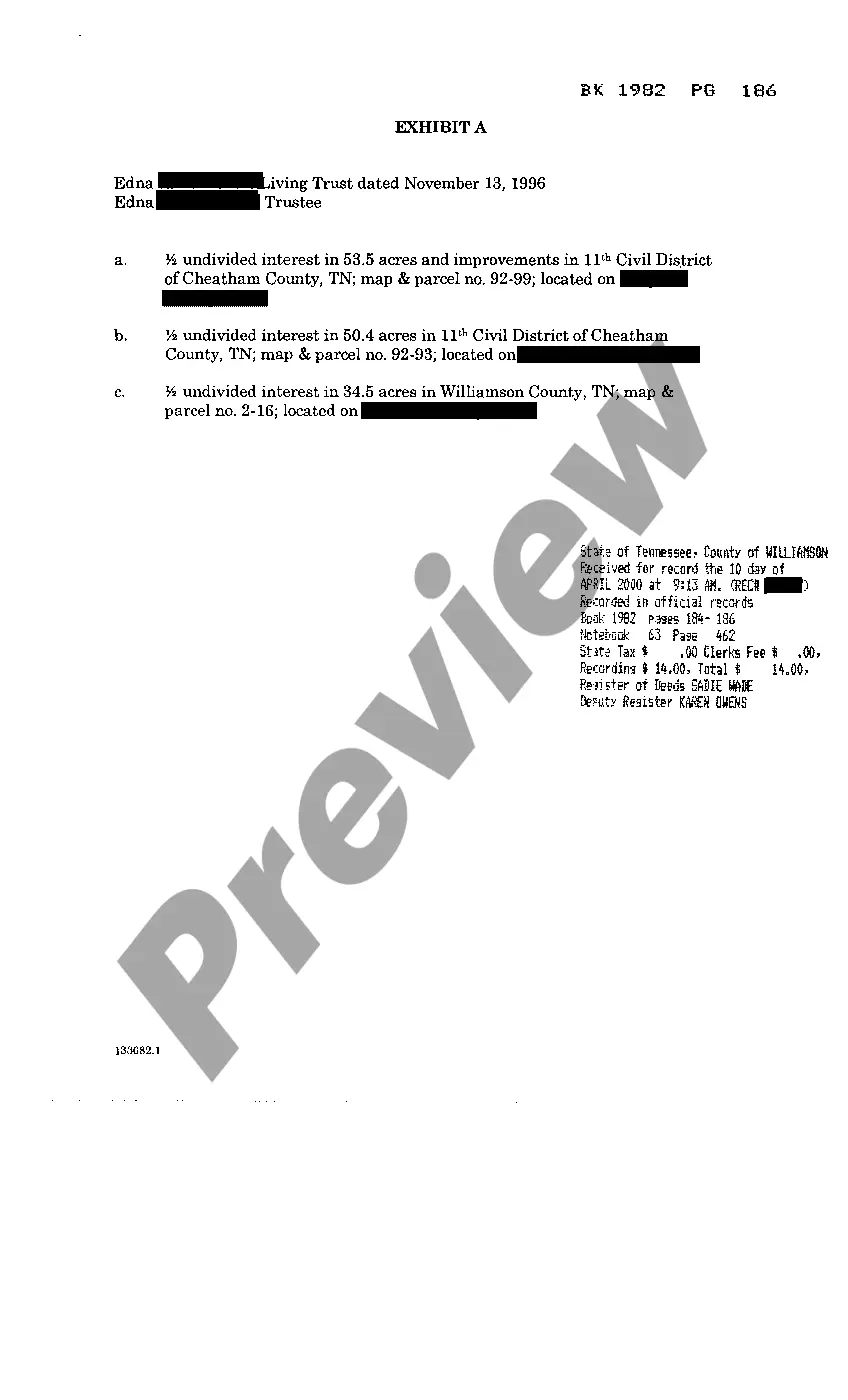

A beneficiary may also choose to disclaim only a percentage of the inherited assets. This is acceptable if the disclaimer meets certain requirements, in which case the asset will be treated as though it never were the property of the original beneficiary.

If the disclaimer is not a qualified disclaimer, for the purposes of the Federal estate, gift, and genera- tion-skipping transfer tax provisions, the disclaimer is disregarded and the disclaimant is treated as having re- ceived the interest. to determine who will receive such in- terest.

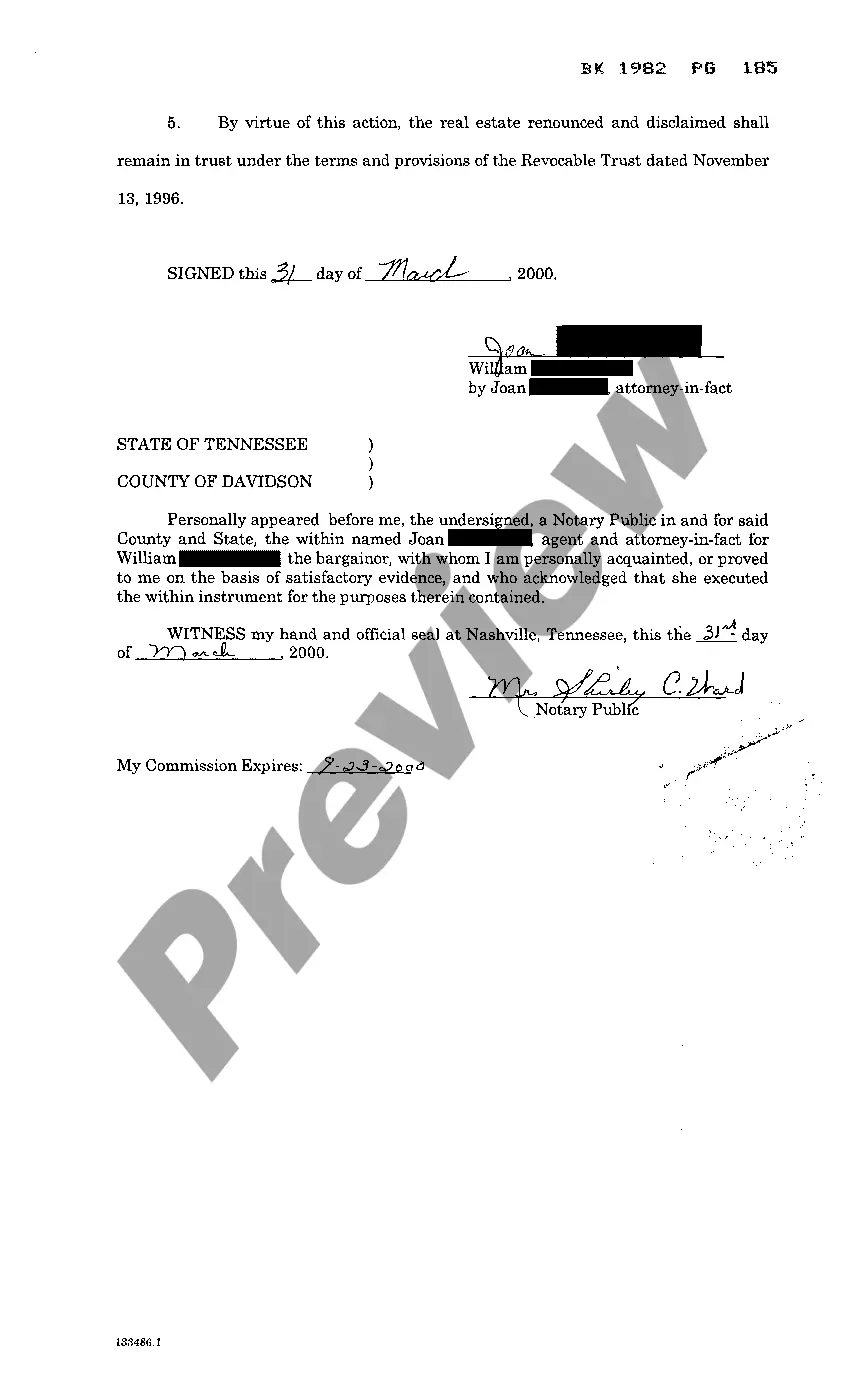

Generally, a disclaimer of this interest must be: (1) made within a reasonable time after knowledge of the existence of the transfer creating the interest to be disclaimed; (2) unequivocal; (3) effective under local law; and (4) made before the disclaimant has accepted the property (Treasury Regulations Section 25.2511

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

A disclaimer trust is a type of trust that contains embedded provisions, usually included in a will, allowing a surviving spouse to put specific assets under the trust by disclaiming ownership of a portion of the estate. Disclaimed property interests are then transferred to the trust, without being taxed.

If a person to whom any interest in property passes by reason of the exercise, release, or lapse of a general power desires to make a qualified disclaimer, the disclaimer must be made within a 9-month period after the exercise, release, or lapse regardless of whether the exercise, release, or lapse is subject to estate

Additionally, a disclaimer must be filed with the trustee or individual responsible for making distributions. A disclaimer can't be made after a beneficiary has accepted the interest she sought to disclaim. Under IRC Section 2511(a), a gift tax is imposed on a transfer in trust.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.