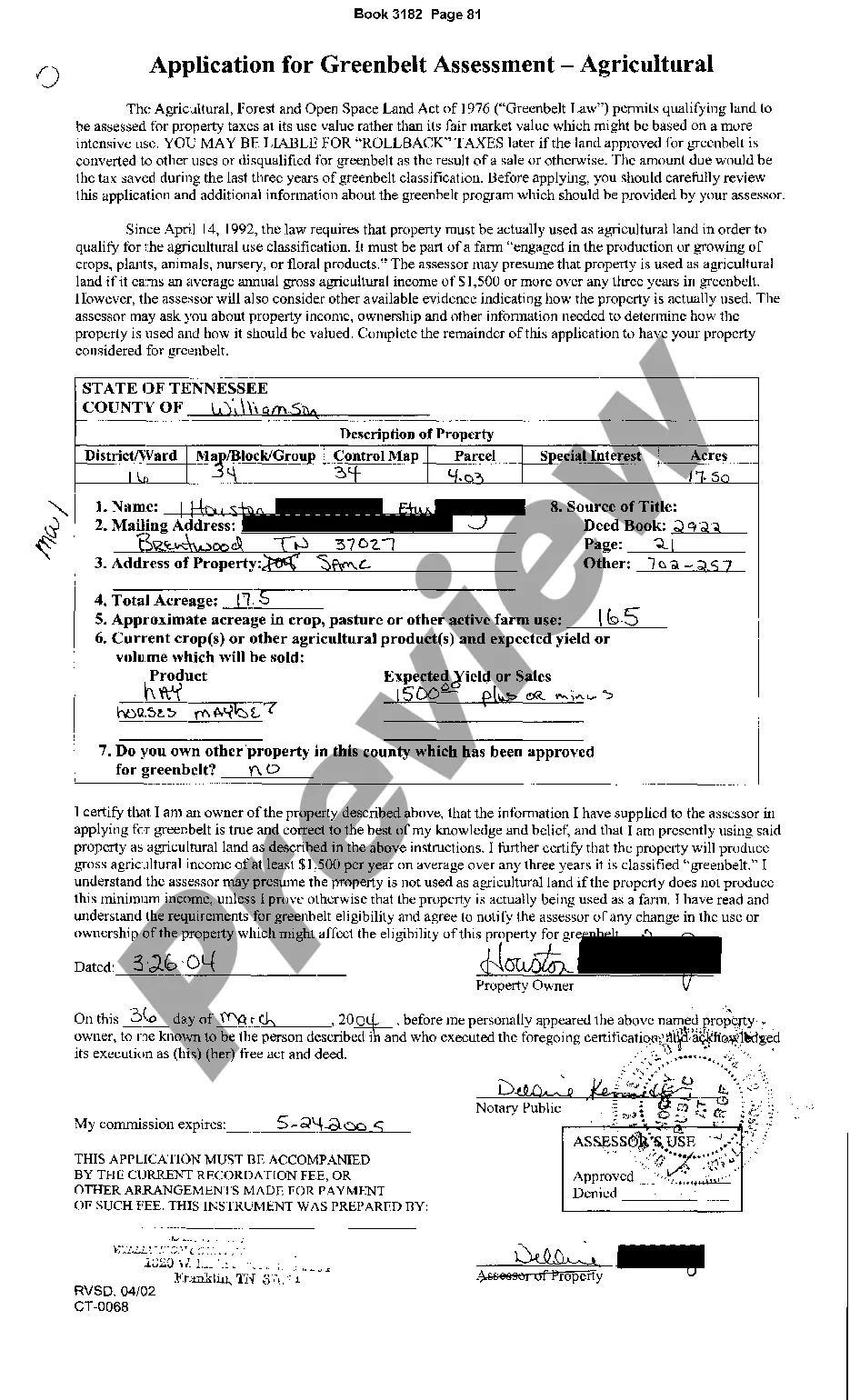

Memphis Tennessee Greenbelt Assessment

Description

How to fill out Tennessee Greenbelt Assessment?

Utilize the US Legal Forms and gain immediate access to any sample document you require.

Our user-friendly site with thousands of templates simplifies the process of locating and obtaining nearly any document sample you need.

You can download, complete, and sign the Memphis Tennessee Greenbelt Assessment in just a few minutes instead of spending hours searching the web for the right template.

Using our collection is a superb method to enhance the security of your document submissions.

If you do not have an account yet, follow the instructions below.

Our company is always here to assist you in any legal situation, even if it’s merely downloading the Memphis Tennessee Greenbelt Assessment.

- Our experienced legal experts consistently review all documents to verify that the forms are suitable for a specific state and comply with current laws and regulations.

- How can you obtain the Memphis Tennessee Greenbelt Assessment.

- If you possess a subscription, simply Log In to your account. The Download option will be activated on all the samples you review.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

In November 2006, Tennessee voters approved an amendment to Article II, Section 28 of the Tennessee Constitution giving the General Assembly the authority by general law to authorize counties and/or municipalities to implement a local option property tax freeze for taxpayers 65 years of age or older.

Overview of Tennessee Taxes Tennessee has some of the lowest property taxes in the U.S. The median annual property tax paid by homeowners in Tennessee is $1,220, about half the national average. The average effective property tax rate in Tennessee is 0.64%.

Tennessee counties with the lowest property taxes, also based on average effective rate, are: Cumberland County: 0.38% Fayette County: 0.40% Sevier County: 0.41%

Agricultural Land Requirements for Greenbelt Consideration A parcel must have at least fifteen (15) acres, including woodlands and wastelands which form a contiguous part thereof, constituting a farm unit engaged in the production or growing of crops, plants, animals, nursery, or floral products.

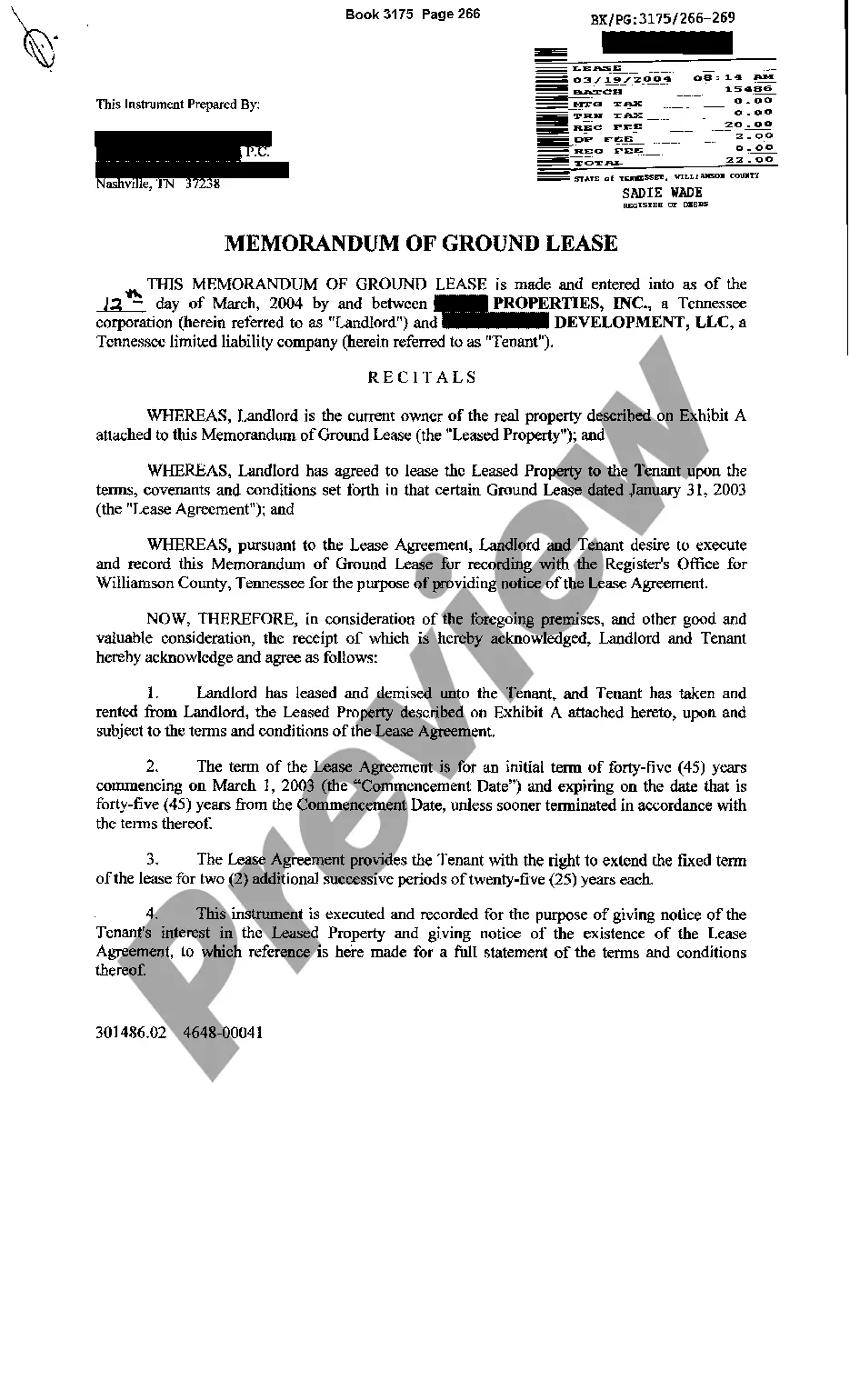

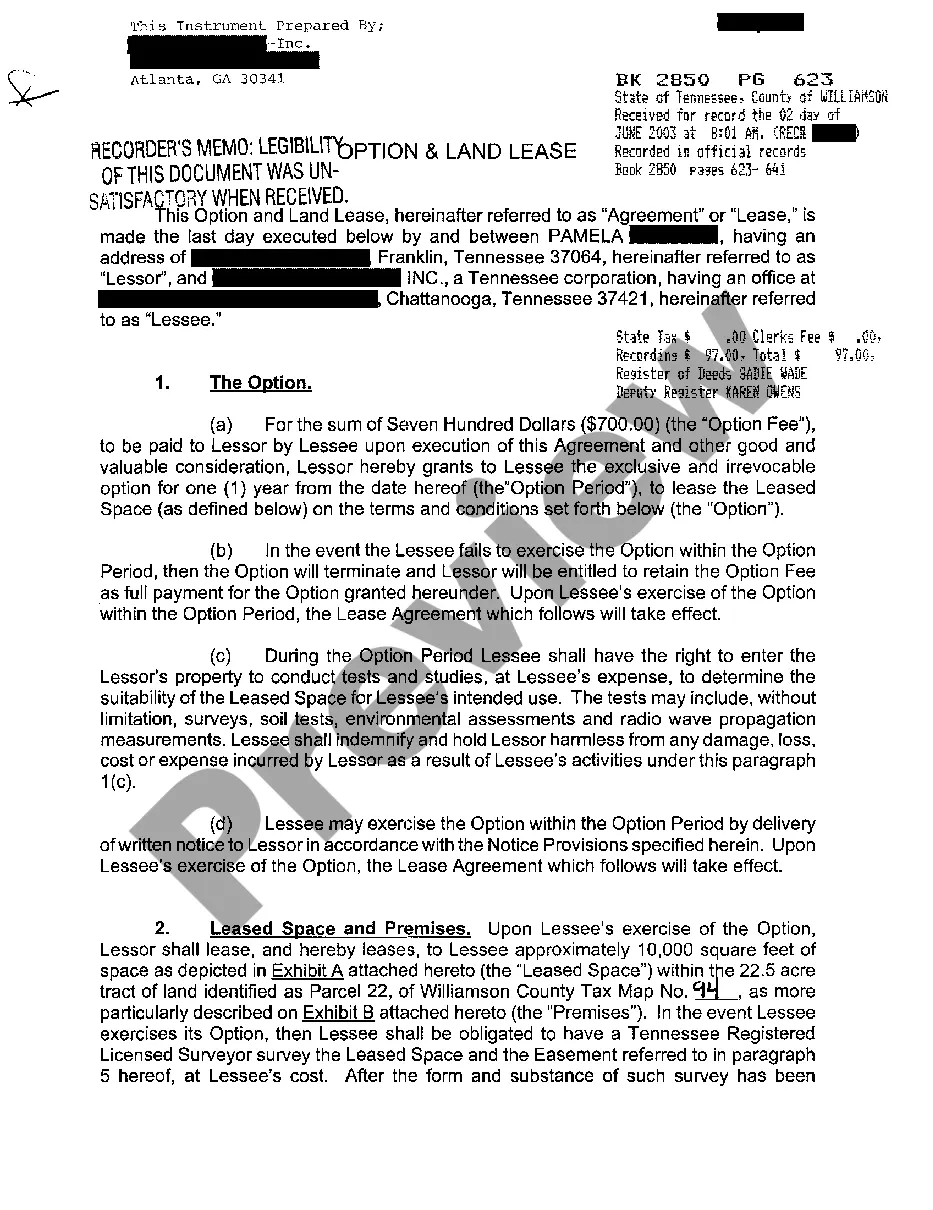

Yes. In order to have land classified as agricultural, forest, or open space, an owner must file an application with the assessor of property in the county where the property is located. Where can I get the application?

The ASSESSMENT RATIO for the different classes of property is established by state law (residential and farm @ 25% of appraised value, commercial/industrial @ 40% of appraised value and personalty @ 30% of appraised value). The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

Typically, the amount of property tax owed is based on what the property would be worth on the open market. However, the Agricultural, Forest, and Open Space Land Act of 1976, better known as the ?Greenbelt Law,? allows certain land to be taxed on its present use instead.

Despite this there are a number of companies around London and the UK offering parcels of Green Belt land for sale. Companies buy up rural land, sub-divide it into plots, and then sell it on to investors on the basis that if planning permission is given their initial investment will see a massive rise.

Tennessee law requires every county to undergo a countywide revaluation of all real property on a 4-, 5-, or 6-year reappraisal cycle.

Buildings which are to be used for agriculture or forestry. Facilities associated with outdoor sports or recreation. Facilities for cemeteries.