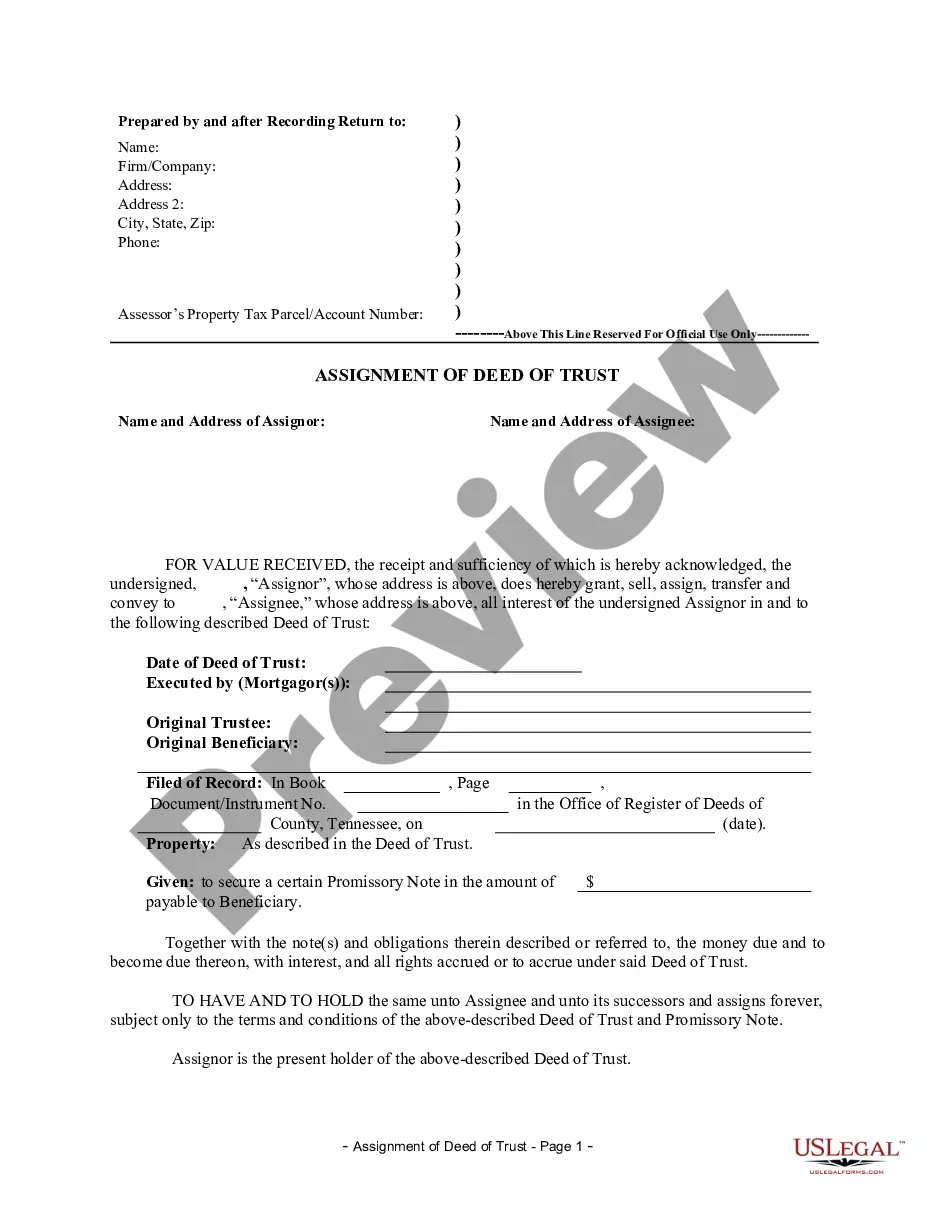

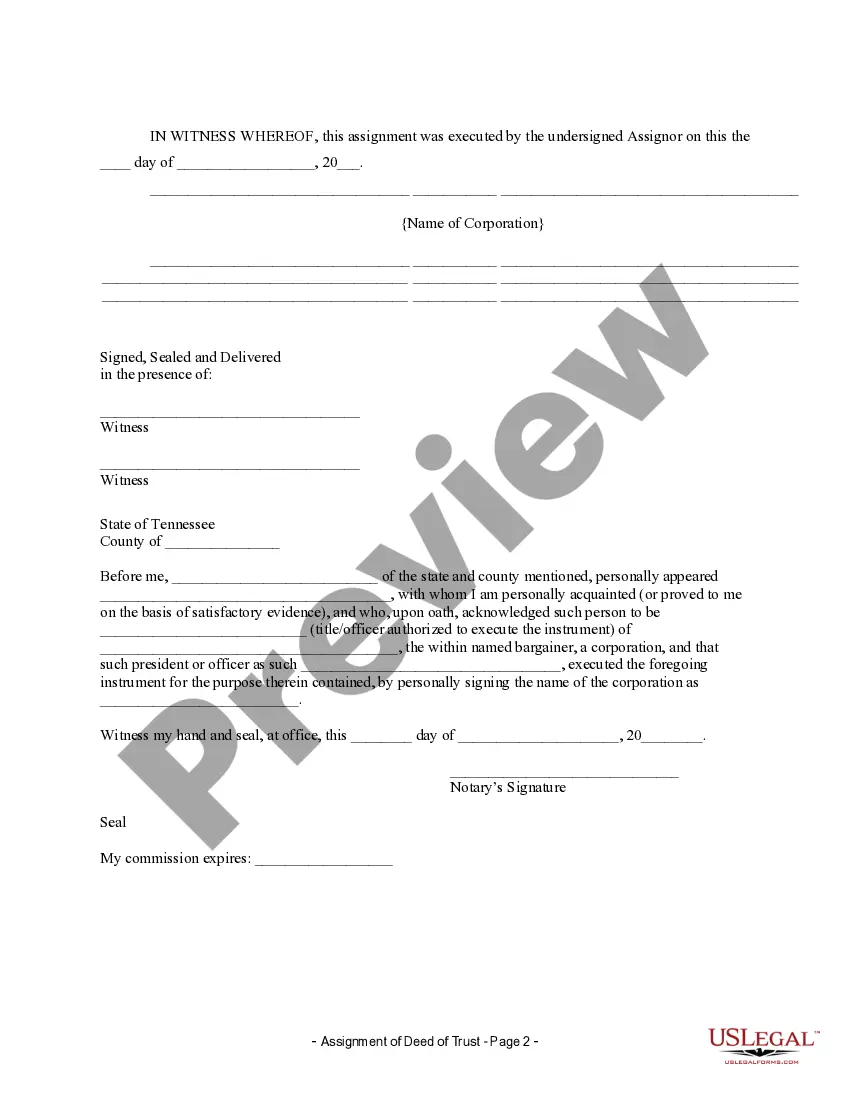

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Tennessee Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It is a digital collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are correctly categorized by usage area and jurisdiction, making it simple and straightforward to find the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder.

Maintaining documentation organized and in accordance with legal requirements is highly important. Utilize the US Legal Forms library to consistently have necessary document templates for any need right at your fingertips!

- Check the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that fits your needs and fully complies with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it fits, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

In Tennessee, a quit claim deed works by allowing the grantor to convey their interest in a property without guaranteeing that any property rights actually exist. This means the grantee accepts the title as it is, which can be risky but beneficial for quick transfers or family situations. When considering the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, a quit claim deed can expedite transactions necessary for managing corporate assets. Understanding its functionality can help you navigate real estate dealings with confidence.

In Tennessee, anyone can draft a deed, but it is advisable to seek assistance from a qualified attorney or a title company to ensure compliance with local laws. Professionals can provide the necessary expertise to create a legally binding document that avoids ambiguities. This is especially important when dealing with the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, as proper documentation is crucial for protecting your interests. Utilizing platforms like USLegalForms can help streamline this process, ensuring accuracy and legal soundness.

The primary beneficiaries of a quitclaim deed are typically the grantees, who receive any interest in the property that the grantor holds. This type of deed is beneficial when transferring property among family members or as part of a larger real estate transaction. In the case of the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, it facilitates swift transfers essential for corporate financing. Consequently, understanding who benefits can guide individuals in making informed choices.

A quit claim deed contains the names of the parties involved, the legal description of the property, and the date of the transfer. It explicitly states that the grantor relinquishes any claims to the property without any warranty of title. This document is valuable in the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, as it simplifies the transfer process, particularly in corporate real estate transactions. Having a clear quit claim deed ensures smooth transition and helps to clarify ownership.

A corporate Assignment of Deed of Trust is a legal document that transfers the beneficial interest in a deed of trust from one party to another. This assignment is essential for corporate lenders, as it ensures that rights concerning the property are properly transferred. In the context of the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, it provides assurance that lending institutions can protect their investments. Understanding this concept strengthens your position in property dealings.

A quit claim deed in Rutherford County, Tennessee, typically includes the names of the grantor and grantee, a description of the property, and the signature of the grantor. It clearly states that the grantor is transferring any interest they may have in the property, but it does not guarantee that the title is clear. This legal document plays a key role in the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, as it can help transfer property titles smoothly, which is crucial for corporate transactions. Always ensure your documents are well-prepared to avoid future disputes.

The corporate assignment of deed of trust means that a corporation officially transfers its claim and rights on a deed of trust to another party. This action is common in real estate and finance, particularly with the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder. It allows the new holder to manage and enforce the terms of the mortgage, ensuring a clear chain of ownership and accountability.

Corporate assignment of a mortgage is a formal process where one corporation transfers its interest in a mortgage to another. This ensures that the rights and responsibilities associated with the Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder are upheld. Typically, it is documented and registered with the appropriate local authority to maintain transparency and protect the interests of all parties involved.

Typically, the original lender and the new lender must sign the Assignment of deed of trust. In the case of Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, the corporate lender's authorized representative will usually sign, ensuring the transfer is legally binding. It's crucial for all parties involved to understand their responsibilities during this process to avoid legal complications.

Lenders often prefer a deed of trust because it can facilitate a quicker foreclosure process compared to a traditional mortgage. In Murfreesboro Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, this feature allows lenders to recover their investments more effectively if borrowers default. Additionally, deeds of trust often offer more security to lenders, making them a favorable choice.