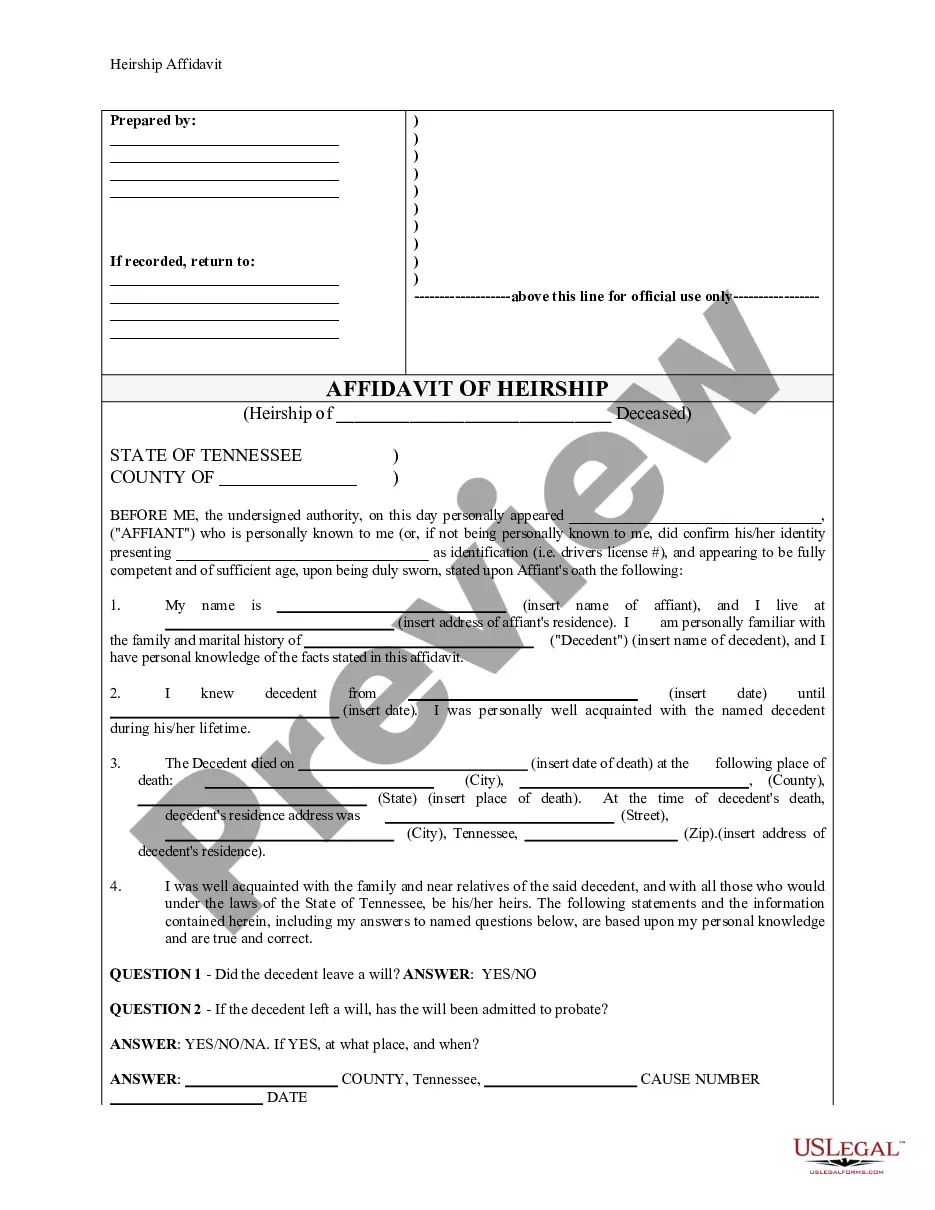

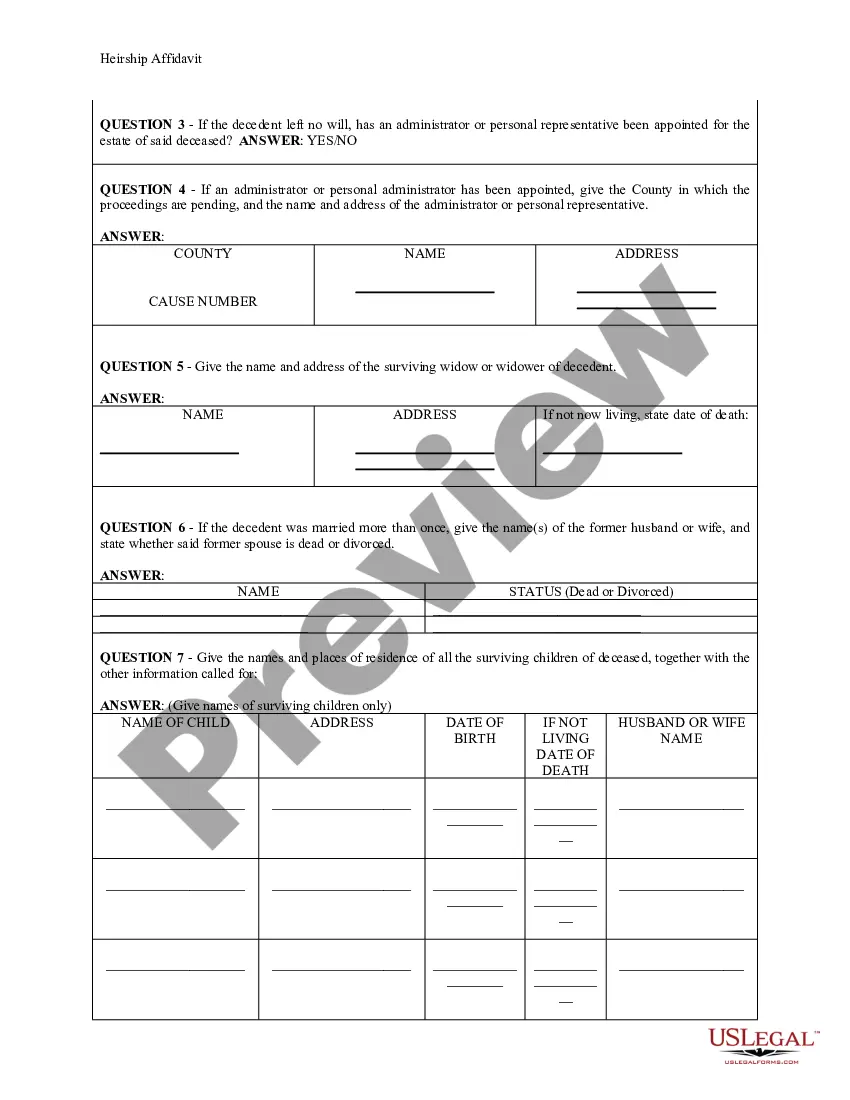

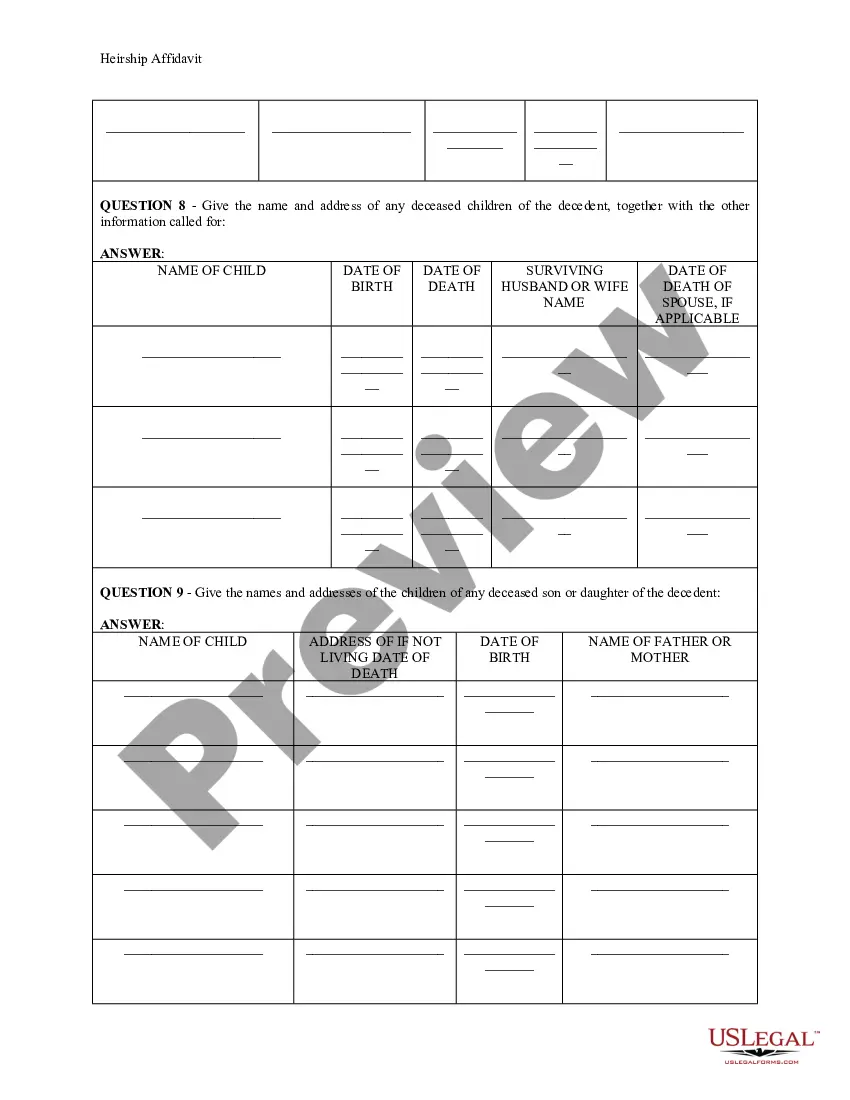

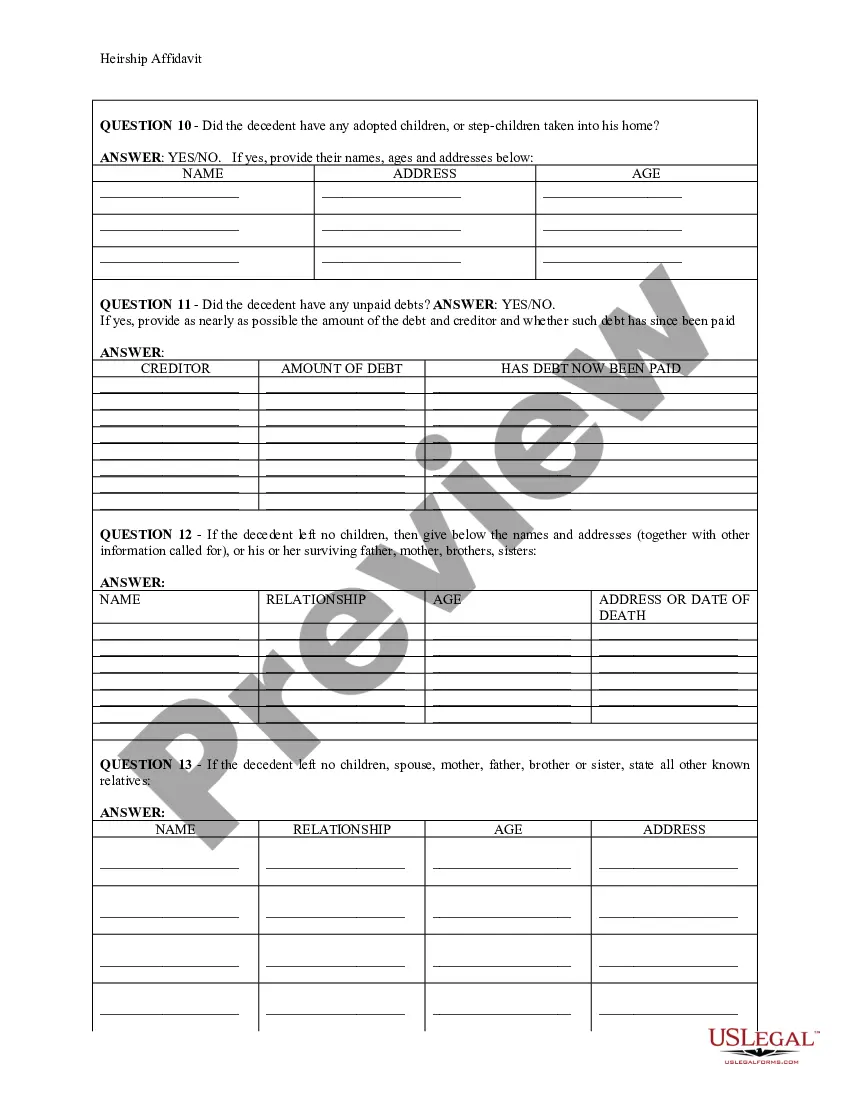

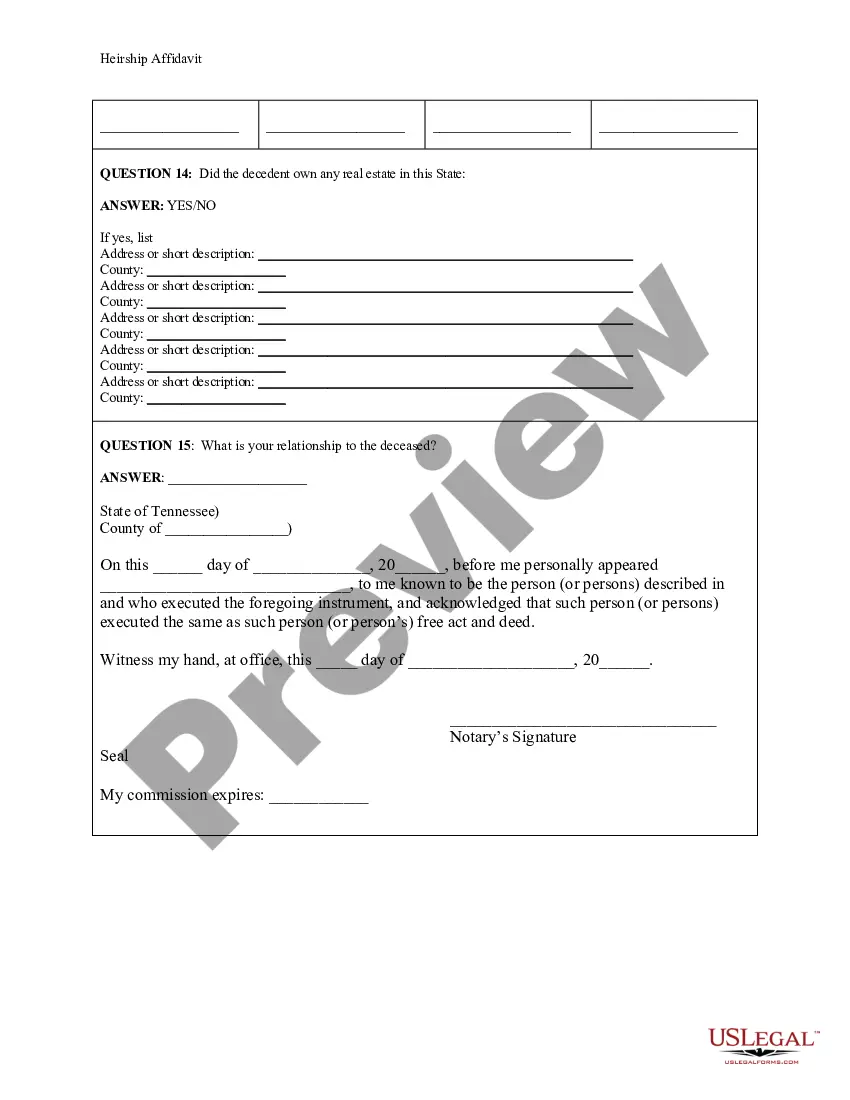

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Memphis Tennessee Heirship Affidavit - Descent

Description

How to fill out Tennessee Heirship Affidavit - Descent?

Capitalize on the US Legal Forms and gain immediate entry to any document you desire.

Our advantageous website, featuring a vast array of documents, simplifies the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and sign the Memphis Tennessee Heirship Affidavit - Descent in just a few moments instead of spending hours online searching for the correct template.

Employing our collection is an excellent method to enhance the security of your document submission.

If you do not have an account yet, follow the instructions below.

Access the page with the template you require. Verify that it is the document you were searching for: check its title and description, and use the Preview function when available. If not, use the Search field to find the one you need.

- Our experienced legal specialists consistently review all records to confirm that the forms are pertinent to a specific state and compliant with new laws and regulations.

- How can you access the Memphis Tennessee Heirship Affidavit - Descent.

- If you have a subscription, simply Log In to your account. The Download option will be available on all documents you examine.

- Additionally, you can retrieve all previously saved records from the My documents menu.

Form popularity

FAQ

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.

Under Tennessee law of descent and distribution the term ?next of kin? means the persons most nearly related to the decedent by blood. A decedent's spouse and next of kin make up the group of people entitled to inherit from a decedent's estate when a decedent dies without a will.

If a family member has recently passed away owning real property, there may not be a need for a full probate administration. Instead, Tennessee law allows for the filing of a muniment of title and an affidavit of heirship to transfer property.

It is very often a husband, wife or civil partner, or someone that you live with. It does not have to be a blood relative; it can be a good friend. You can give the name of more than one next of kin.

How to Write Identify all heirs of the estate. Your legal name and address. List your relationship with the decedent. Timeline of relationship. Name of any/all spouses including date(s) or marriage, divorce, and death (if any) Name of any/all children including date(s) or marriage, divorce, and death (if any)

As noted above, under Tennessee intestacy law, your heirs will be your spouse and/or your relatives. This may present an issue if you are legally divorced from, or otherwise not married to, your significant other/partner.

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.

Children If the deceased person's spouse or civil partner passed away before them, their next of kin would be their children, if they had any. If the children are younger than 18, they cannot be named as next of kin - in this case, their parents would be given the responsibility.

If your loved one did not have a will, their estate will be divided according to Tennessee law. It provides that a surviving spouse and the children of the deceased person are the initial heirs. If the children have also passed away, then their children inherit their share.