Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will

Description

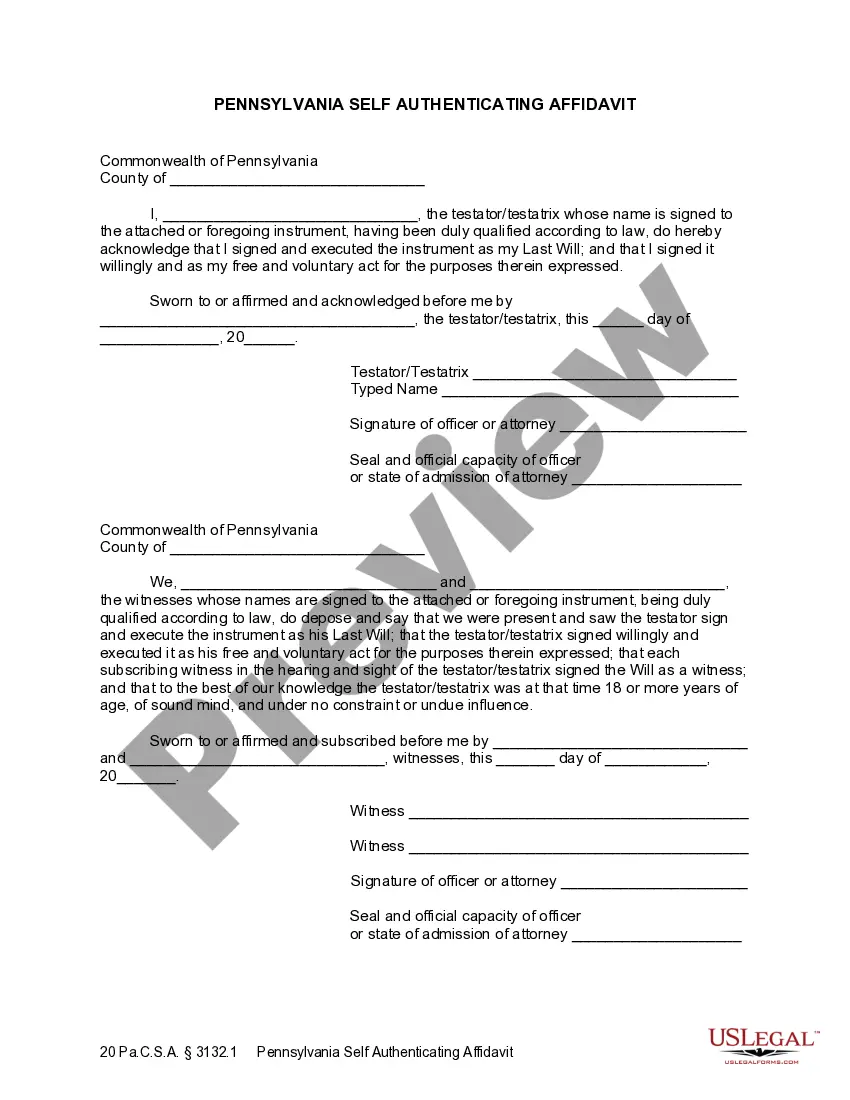

How to fill out Pennsylvania Last Will And Testament With All Property To Trust Called A Pour Over Will?

Acquiring validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

This is an online repository containing over 85,000 legal documents for both personal and professional requirements and various real-life circumstances.

All the files are systematically categorized by usage areas and jurisdictional regions, making the search for the Philadelphia Pennsylvania Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will, as simple and straightforward as ABC.

Make your purchase. Enter your credit card information or utilize your PayPal account to complete the subscription payment. Download the Philadelphia Pennsylvania Legal Last Will and Testament Form with All Property to Trust acknowledged as a Pour Over Will. Save the template on your device to continue its completion and gain access to it in the My documents section of your profile whenever you require it again. Maintaining paperwork organized and compliant with legal standards is of utmost importance. Take advantage of the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- For those already acquainted with our library and who have previously engaged with it, procuring the Philadelphia Pennsylvania Legal Last Will and Testament Form with All Property to Trust, recognized as a Pour Over Will, requires merely a couple of clicks.

- Simply Log In to your account, select the document, and hit Download to save it on your device.

- This process may entail a few additional steps for new users.

- Examine the Preview mode and form description. Ensure you've selected the correct one that aligns with your needs and fully adheres to your local jurisdiction requirements.

- Search for an alternative template, if necessary. Once you notice any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

A last will and testament generally does not supersede a trust. Instead, both documents serve distinct purposes within estate planning. When you utilize a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, the will effectively directs assets into the trust after your death, ensuring that your wishes align with your trust's terms. This creates a comprehensive estate plan that respects both documents.

A will typically does not hold power over a trust; rather, it works alongside it. In the scenario of a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, the will ensures that any assets not placed in the trust during your life will be transferred into the trust upon your passing. This process reinforces the trust's authority, rather than diminishing it.

Yes, a pour-over will is fundamentally linked to a trust. When you create a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, it operates in conjunction with your trust. The will serves to transfer any remaining assets to the trust upon your passing, thus integrating your estate into a single management system. This ensures that all your property is governed by your trust's terms, providing clarity and peace of mind.

Generally, a will does not override a trust if the trust is valid and properly funded. If you create a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, it works alongside your trust rather than replacing it. The will simply directs remaining assets into the trust, which carries out your wishes as specified in the trust documents. It's important to ensure consistency in both documents to prevent any conflicts.

In Pennsylvania, a pour-over will does not completely avoid probate. However, it streamlines the transfer of assets by directing them into your existing trust. So while probate may be necessary, the assets that pour over into your trust are then managed according to its guidelines. This process can ultimately expedite asset distribution following your wishes outlined in the Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will.

over will functions by transferring any remaining assets not already placed in your trust at the time of your death. When you establish a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, it ensures that all remaining properties flow directly into your trust. This means your estate will be managed according to the trust's terms, simplifying the distribution process. By combining both a will and a trust, you secure a smoother transition of assets.

One drawback of a pour-over will is that it requires your assets to go through probate, which can be a lengthy and public process. Although the Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will effectively transfers your assets to a trust, it does not bypass probate. Therefore, your beneficiaries might face delays in accessing their inheritance. To simplify this, consider using the US Legal Forms platform to create a pour-over will tailored to your needs, ensuring a smoother transition of your assets.

The power of a will versus a trust depends on your specific needs and estate planning goals. A trust often offers more control and privacy over asset distribution than a will. When using a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, you can effectively manage your estate while ensuring that your assets are placed in the trust upon your passing. This combination enhances your control over asset management during and after your lifetime.

Typically, a trust takes precedence over a will. This means that assets held in a trust will be distributed according to the terms of the trust, regardless of what your will states. With a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, the intent is clear; any assets that are not in the trust at the time of your passing will be directed into it. Understanding this relationship helps clarify your estate plan and promotes smoother asset distribution.

Generally, a Last Will and Testament does not override a trust. Instead, the will serves to direct assets that are not already placed in a trust. In the context of a Philadelphia Pennsylvania Last Will and Testament with All Property to Trust called a Pour Over Will, it is designed specifically to funnel any remaining assets into the established trust. This mechanism ensures that your assets are managed according to your preferences in the trust document.