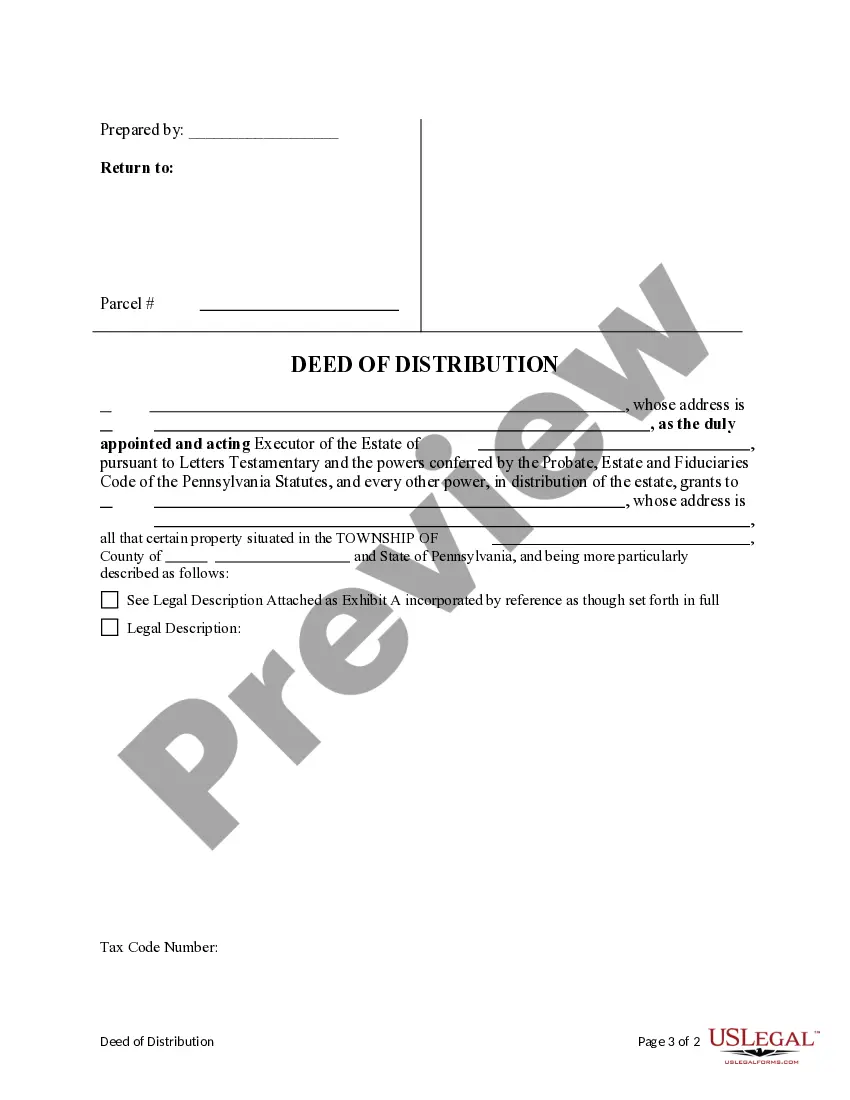

This form is a Deed of Distribution where the Grantor is the executor or personal representative of an estate and the Grantee is the beneficiary of the estate or purchaser of the real property. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual

Description

How to fill out Pennsylvania Deed Of Distribution - Executor / Personal Representative To Individual?

We always strive to reduce or avert legal problems when engaging with intricate legal or financial issues. To achieve this, we enlist legal services that are typically quite costly.

Nonetheless, not every legal concern is as complicated. Many can be managed independently.

US Legal Forms serves as an online repository of current DIY legal documents encompassing anything from wills and powers of attorney to incorporation articles and petitions for dissolution.

Our platform empowers you to handle your affairs independently without requiring a lawyer's services. We provide access to legal form templates that are not always readily available. Our templates are specific to states and regions, which significantly eases the search process.

Ensure to verify whether the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual adheres to your state's and area's laws and regulations.

- Utilize US Legal Forms whenever you need to acquire and download the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual or any other form promptly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the form, you can always re-download it from the My documents tab.

- The procedure is equally straightforward if you are unfamiliar with the platform! You can set up your account within minutes.

Form popularity

FAQ

You do not necessarily need an attorney to transfer a deed in Pennsylvania, as individuals can manage this themselves. However, consulting an attorney can help clarify the process and ensure that you comply with all legal requirements. If you choose to proceed without legal help, utilizing resources like US Legal Forms can help streamline the preparation of the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

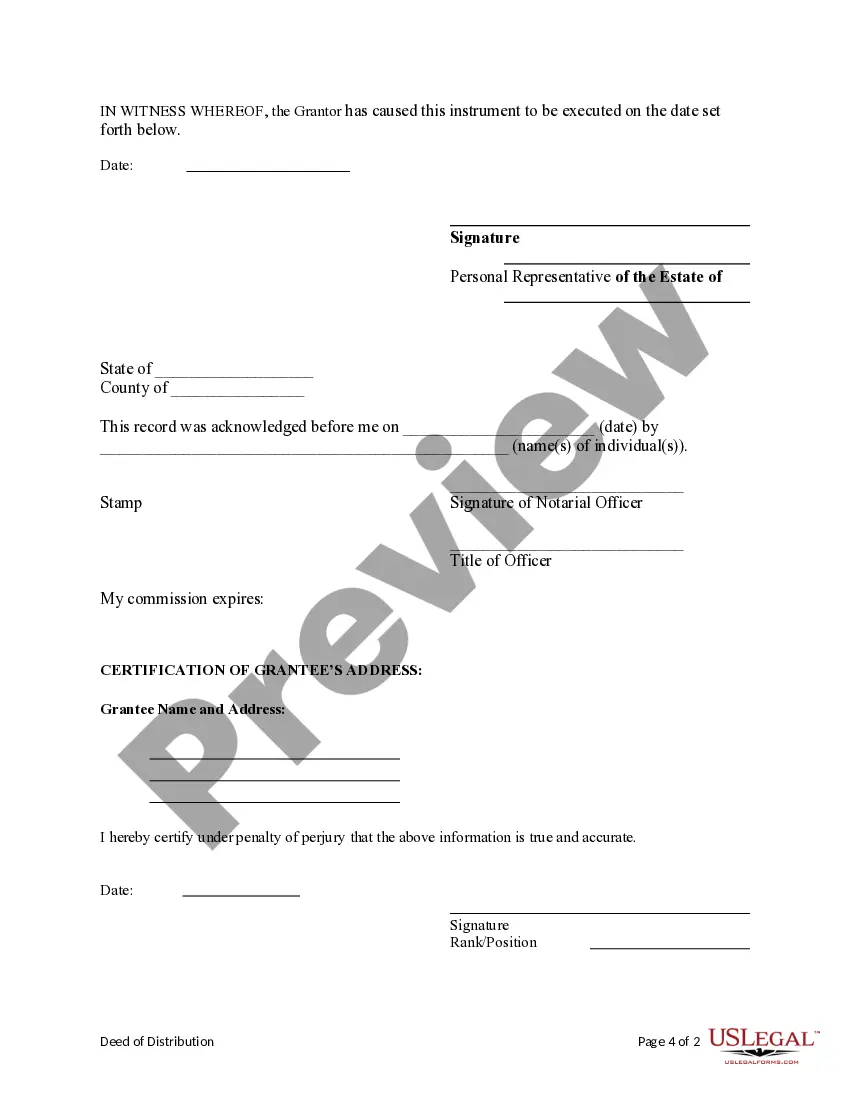

The best way to add someone to a deed is by executing a new deed that clearly outlines the names of the individuals involved. Ensure all parties involved agree to the change and comply with state regulations. Notarizing the new deed and recording it with your local county office are essential steps in this process. If you prefer guidance, consider using US Legal Forms for the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

Yes, you can add someone to a deed without a lawyer in Pennsylvania, but it is important to understand the legal implications. By handling the process yourself, you save on legal fees, but you should ensure you follow the state’s regulations and complete the necessary paperwork accurately. If you want to simplify this process, consider using platforms like US Legal Forms, which provide the required templates for the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

To add someone to the deed of a house in Pennsylvania, you must complete a new deed form. You will need the existing deed, along with the details of the person you wish to add. After filling out the new deed, you must sign it in front of a notary and then record it at your local county office. This process can be crucial in cases involving the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

To add someone to a deed in Philadelphia, you must prepare a new deed that indicates the new owner. This process typically involves drafting the deed, signing it in front of a notary, and filing it with the appropriate county office. For guidance, utilizing services like US Legal Forms can simplify the process and ensure compliance with the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual documentation.

In Pennsylvania, both terms are used interchangeably when referring to the individual responsible for administering an estate. Whether labeled an executor or a personal representative, their functions remain the same. This understanding is vital for anyone dealing with the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

Choosing the right executor is crucial for effective estate management. The ideal executor is someone who is responsible, organized, and trustworthy, as they will handle all financial matters and ensure that the estate is distributed according to the will. It’s essential that they understand the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual to execute their duties effectively.

Yes, in Pennsylvania, the terms 'personal representative' and 'executor' refer to the same role. Both are appointed to administer the estate according to the wishes laid out in the will. Understanding this distinction can help individuals better navigate the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

An executor of an estate in Pennsylvania has a responsibility to settle the debts of the deceased. This liability typically lasts until the estate is fully settled, which can vary based on the complexity of the estate and the number of claims. Executors should be aware of potential claims that may arise and manage these appropriately to ensure they fulfill their obligations under Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.

To change your personal representative for an estate, you will need to revoke their authority through a new legal document or a formal request to the probate court. It is important to communicate your intentions to the current representative and the court. Using tools from platforms like US Legal Forms can aid in drafting necessary documents that comply with the requirements of the Philadelphia Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual.