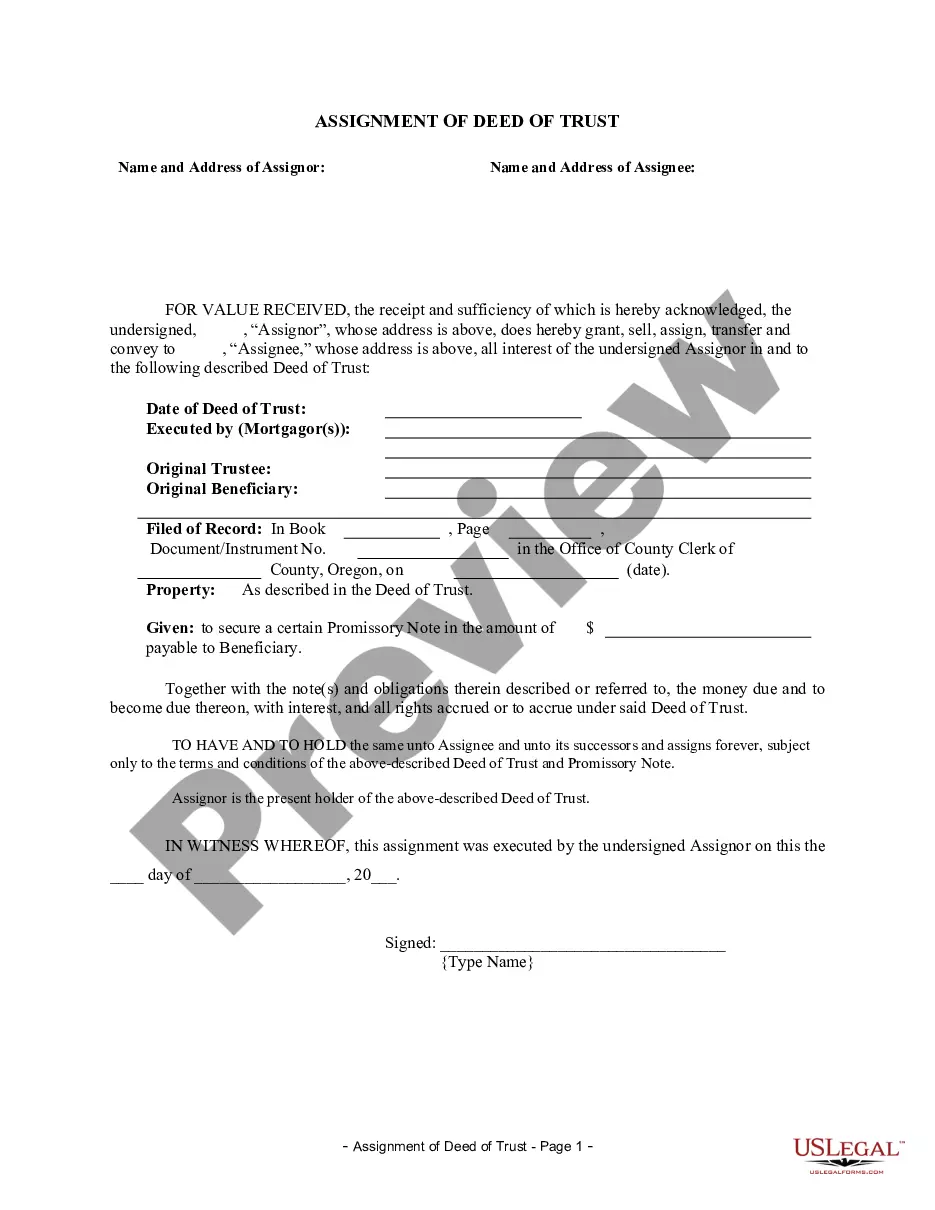

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Oregon Assignment Of Deed Of Trust By Individual Mortgage Holder?

If you have previously utilized our service, sign in to your account and preserve the Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment schedule.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have perpetual access to all the documents you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Make sure you’ve found an appropriate document. Review the description and use the Preview feature, if accessible, to verify if it fulfills your needs. If it does not suit you, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize online professional editors to complete and sign it electronically.

Form popularity

FAQ

Preparing a deed of trust can take anywhere from a few hours to a few days, depending on the complexity of the agreement and the specific property involved. If you have your documents and details ready, it can be even quicker. For those in Eugene seeking an efficient way to handle the Assignment of Deed of Trust by Individual Mortgage Holder, using services like US Legal Forms can expedite the preparation process significantly.

Most states in the U.S. use either mortgages or deeds of trust to secure loans, and the choice often affects foreclosure procedures. States like California, Texas, and Oregon primarily use deeds of trust, while others like New York and Florida rely on traditional mortgages. Understanding where your transaction takes place is key when addressing the Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder.

Oregon is classified as a deed of trust state, which means that most loans secured by real estate use a deed of trust instead of a traditional mortgage. This legal arrangement allows for a more streamlined foreclosure process, benefiting lenders in managing defaults. If you are in Eugene and looking to understand the Assignment of Deed of Trust by Individual Mortgage Holder, knowing this distinction can help simplify your transaction.

Many lenders prefer a deed of trust because it often entails fewer legal complexities during foreclosure. When dealing with an Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder, the lender benefits from having a clear path to recover their investment. Additionally, the involvement of a trustee simplifies the process, allowing lenders to focus on their financing strategies rather than navigating cumbersome legal proceedings.

Choosing a deed of trust can provide benefits that a mortgage may not offer. For those undergoing an Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder, this option often simplifies the process of securing funding for real estate. Moreover, it allows for the involvement of a neutral third party, which can expedite the foreclosure process, making it more appealing to borrowers seeking quicker resolutions.

One significant disadvantage of a deed of trust is that it may involve a more complex foreclosure process compared to a traditional mortgage. If you’re involved in an Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder, this complexity can lead to challenges during property disputes. Additionally, the rights of the borrower and lender can be less clear-cut, as foreclosure may require court intervention, potentially delaying recovery of the owed amount.

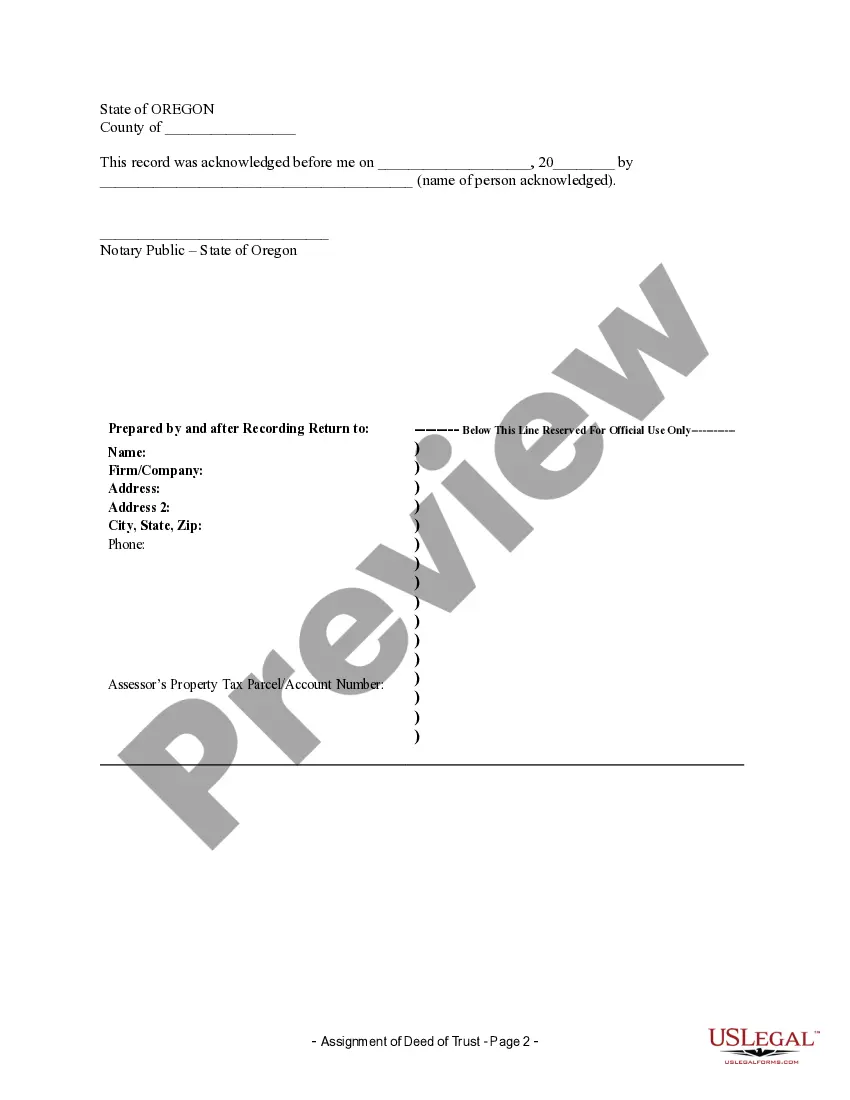

To transfer ownership of a property in Oregon, you start by preparing a deed that specifies the transfer details. After drafting the appropriate documentation, you must sign the deed in the presence of a notary. Next, file the executed deed with the local county recorder's office to make the transfer official. If you’re an individual mortgage holder looking to facilitate this process, consider using the Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder for guidance and legal protection.

To determine if your mortgage is assignable, you should review the terms outlined in your mortgage documents. Many loans have clauses that indicate whether they can be transferred or assigned to another party. If you're unsure, consult with your lender or a real estate professional, especially when considering options like the Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder.

The assignment of a mortgage deed of trust refers to the process of transferring the rights held by the lender to a third party. This is crucial in Henry State, as it enhances the ease of transferring property ownership. By legally assigning these rights, you help facilitate the mortgage's management and payment collection. Understanding this concept is vital in Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder.

An example of an assignment of a mortgage would be a document that transfers mortgage rights from one lender to another lender. For instance, if Lender A assigns their rights over a mortgage to Lender B, the assignment document would specify details such as the original mortgage's terms and the new lender’s information. This transfer is significant in the context of the Eugene Oregon Assignment of Deed of Trust by Individual Mortgage Holder.