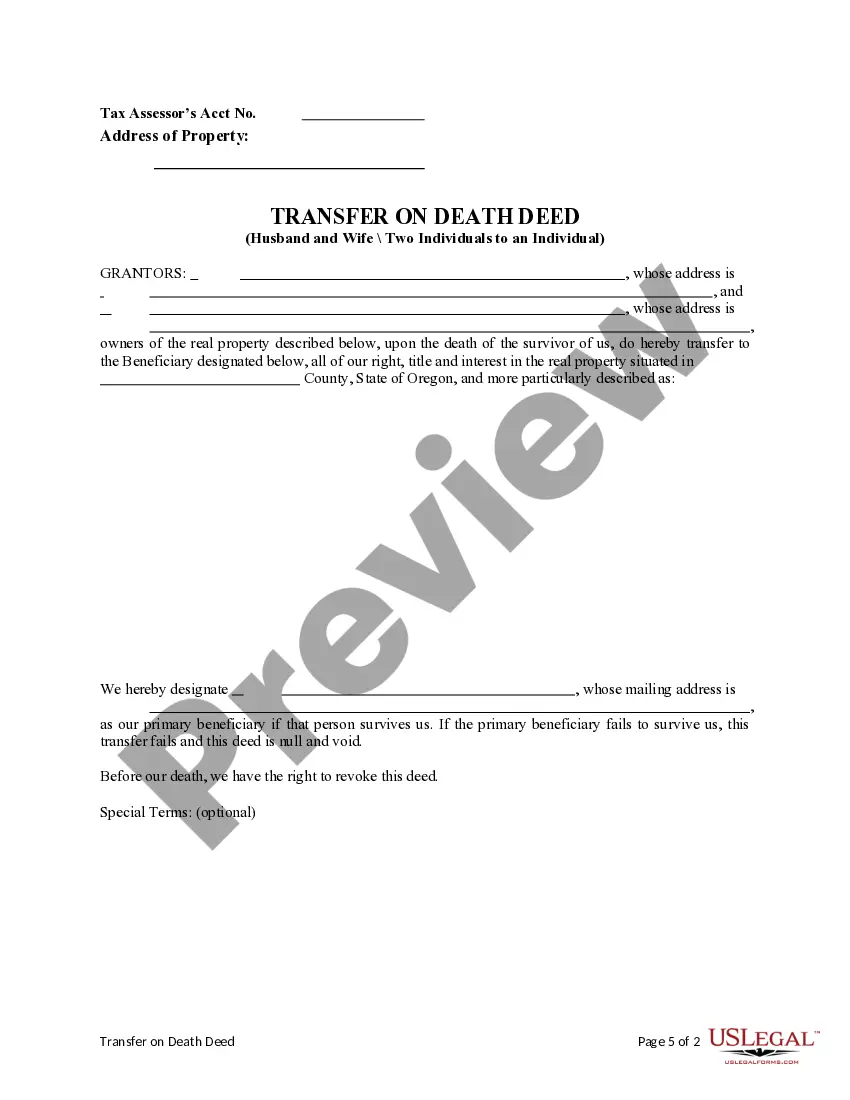

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From Two (2) Individuals Or Husband And Wife To An Individual WITHOUT Provision For Appointment Of Alternate Beneficiary.?

Irrespective of societal or occupational rank, completing legal documents is a regrettable requirement in the contemporary world.

Frequently, it’s nearly unfeasible for an individual lacking legal expertise to formulate such documents from the ground up, predominantly due to the intricate language and legal nuances they involve.

This is where US Legal Forms comes to the aid.

Ensure that the template you have located is appropriate for your region since the regulations of one state or area do not apply to another.

Review the form and examine a brief summary (if available) of scenarios the document can be utilized for.

- Our service presents an extensive compilation with over 85,000 ready-to-use state-specific documents that cater to nearly any legal situation.

- US Legal Forms is also an excellent resource for colleagues or legal advisors who wish to conserve time using our DIY papers.

- Whether you need the Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, or any other document applicable in your state or locality, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary in a few minutes using our reliable service.

- If you are already a current customer, you may proceed to Log In to your account to acquire the required form.

- However, if you are a newcomer to our repository, make sure to adhere to the following steps before downloading the Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Form popularity

FAQ

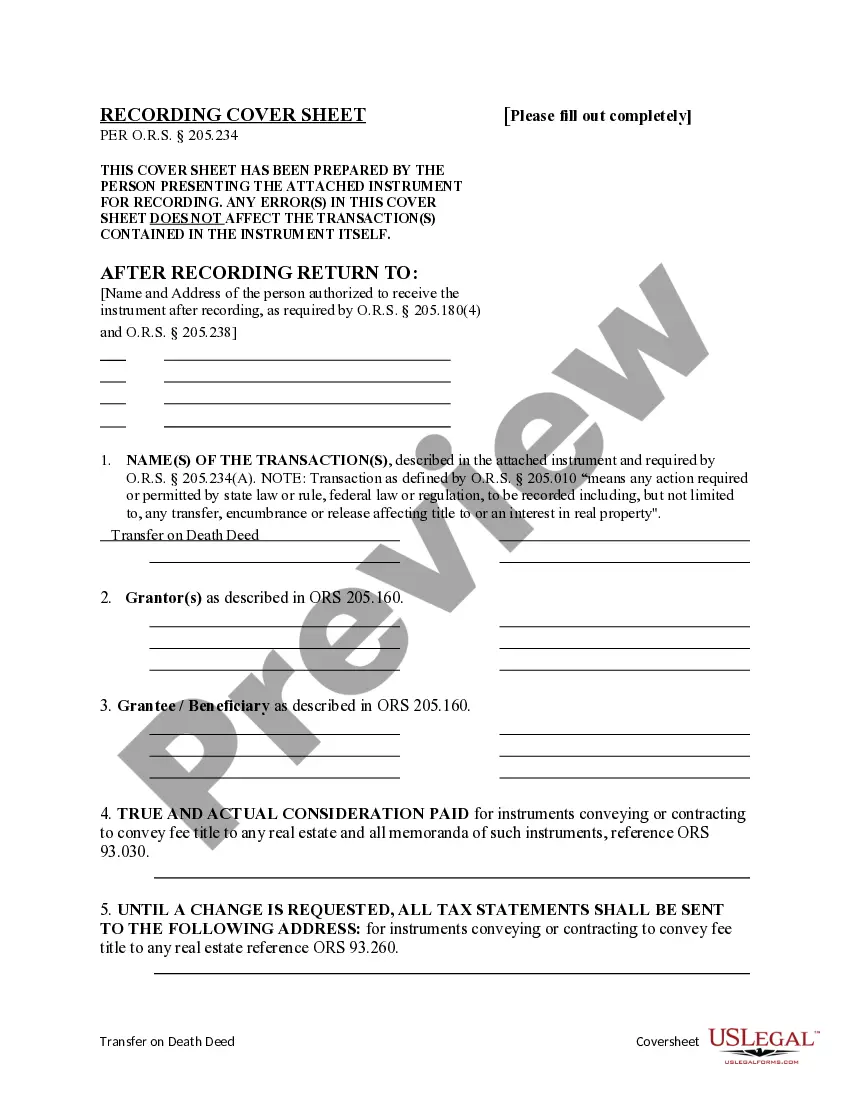

To file a Transfer on Death (TOD) deed in Oregon, you must complete the deed form correctly and ensure it is signed and notarized. Once executed, you'll file the deed with the county clerk's office in the county where the property is located. For assistance, you may refer to US Legal Forms, a valuable source for obtaining a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Yes, Minnesota allows Transfer on Death (TOD) deeds, providing a straightforward way to transfer property upon death. It’s essential to understand that the rules and regulations differ by state. If you're looking for guidance or forms for a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, focusing on local laws is important.

While you are not legally required to have an attorney for a Transfer on Death (TOD) deed, consulting one can be beneficial. An attorney can provide guidance to ensure you meet the specific requirements in Oregon. If you choose to go without legal help, consider using US Legal Forms for trusted and compliant forms for a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

You can obtain a Transfer on Death (TOD) deed through various sources in Gresham, Oregon. Local law offices often provide these documents, or you can use platforms like US Legal Forms for a quick and easy solution. It's crucial to ensure the form aligns with Oregon regulations regarding a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Yes, it is possible to have two beneficiaries on a Transfer on Death (TOD) account. Specifically, for a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, you can list two people to receive the assets. Be mindful that both beneficiaries will need to agree on how to handle the assets when the time comes. Properly documenting their intentions can help avoid disputes.

Generally, a Transfer on Death (TOD) account allows you to designate one or more beneficiaries. In the context of a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, you can indeed specify multiple beneficiaries if desired. However, be cautious when naming more than one, as this may complicate the transfer process. Therefore, clear instructions regarding distributions among beneficiaries are essential.

While hiring an attorney for a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary can be helpful, it is not always necessary. You can complete this process on your own using online resources and forms. However, if you have complex assets or specific concerns, consulting an attorney might provide peace of mind. Overall, make sure to understand the requirements before proceeding.

One key disadvantage of a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is the lack of flexibility. This deed does not allow for changes once it's filed. If circumstances change, such as the passing of the primary beneficiary, your asset might not go to your desired recipient. Additionally, this type of deed may lead to disputes among family members, as it does not provide for alternate beneficiaries, potentially complicating estate distribution.

While hiring a lawyer for a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is not mandatory, it can be very helpful. A legal professional can guide you through the paperwork and help ensure that your intentions are clearly captured in the deed. Using a service like uslegalforms can also provide you with the templates and support needed to navigate this process successfully.

In Oregon, if you wish to create a Gresham Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary to two beneficiaries, the deed should clearly state both beneficiaries’ names. You must also specify how the property will be divided upon your passing. It’s essential to follow proper legal formats to ensure beneficiaries receive their shares without complications.