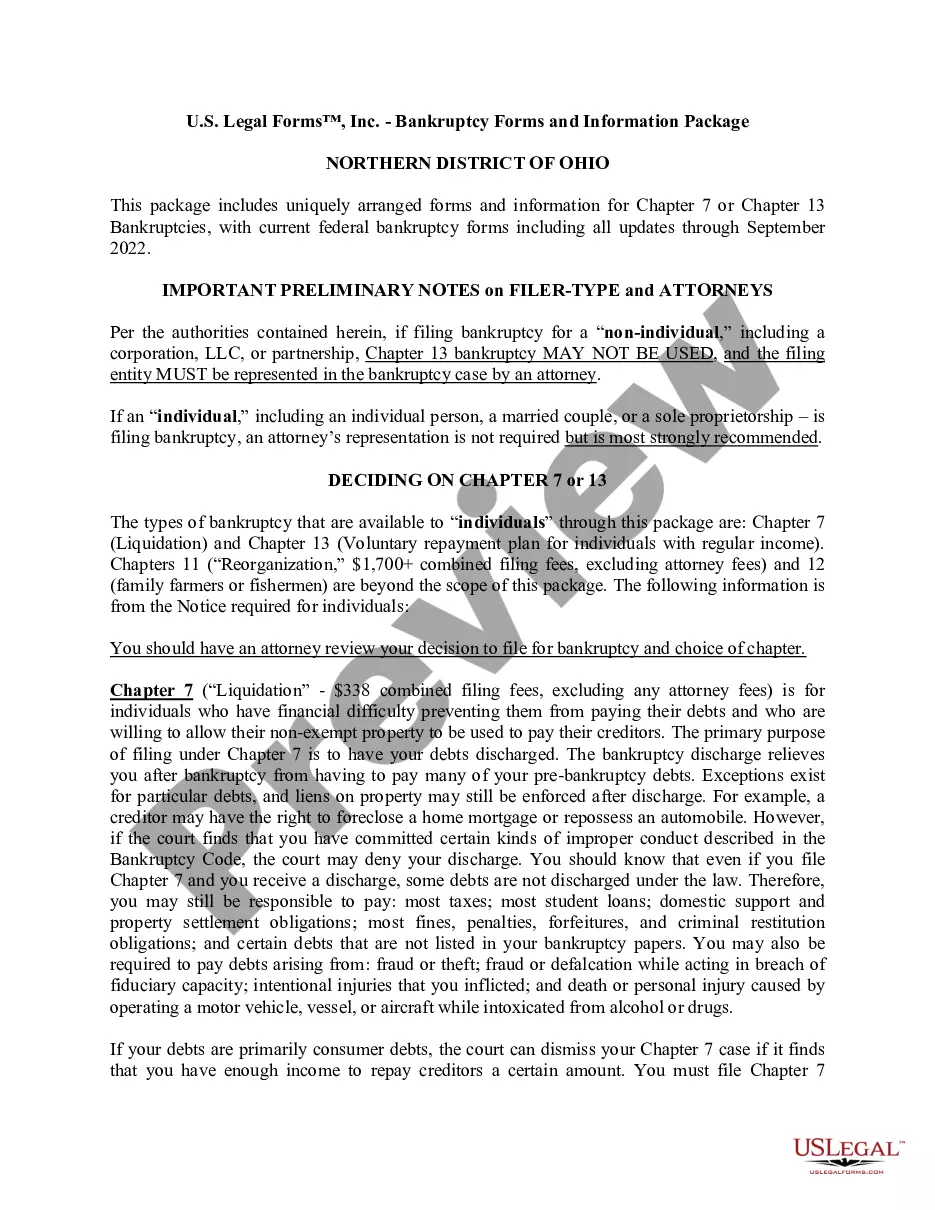

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Ohio Southern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

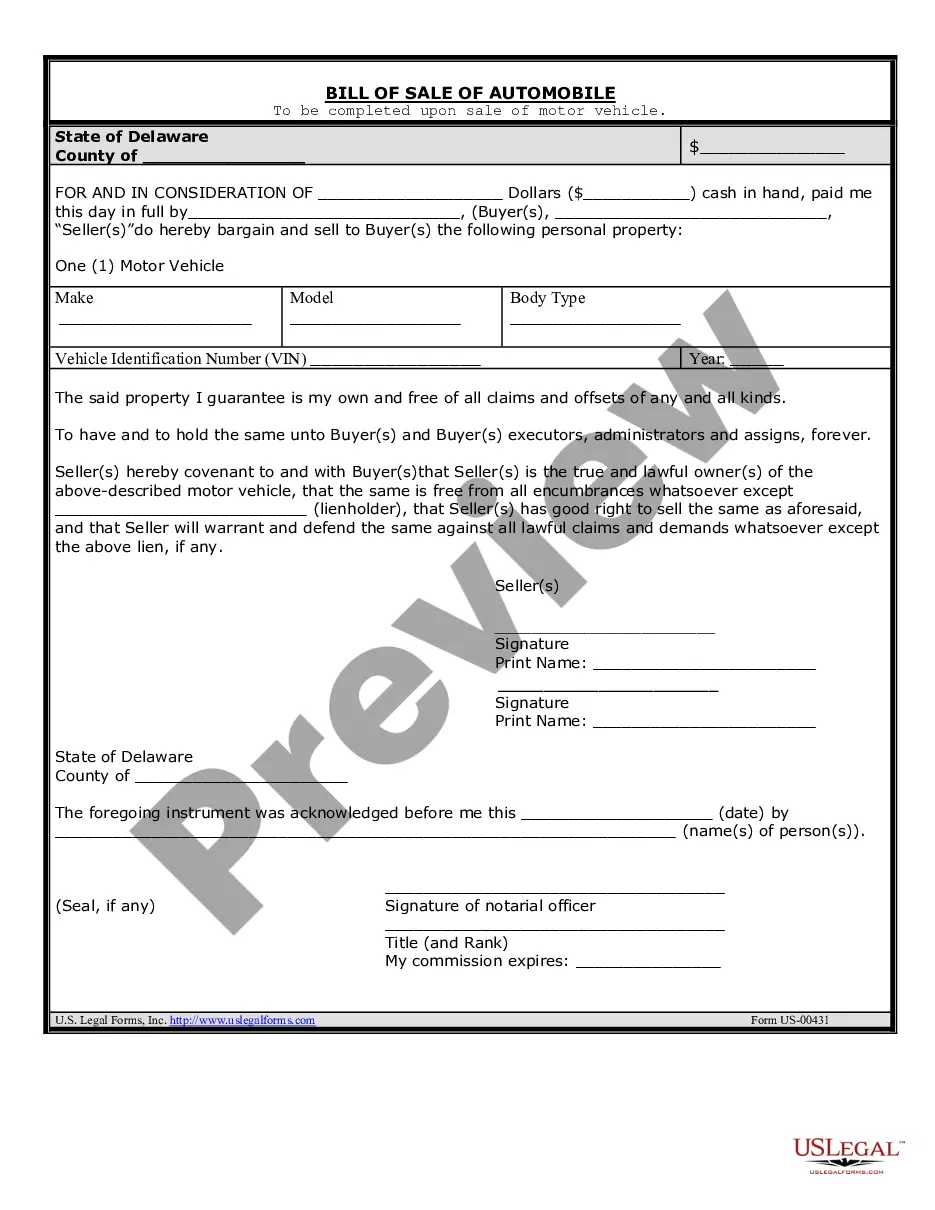

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal documents catering to both individual and professional needs and various real-life scenarios.

All documents are appropriately organized by usage area and jurisdiction, making it simple to find the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13.

Maintaining paperwork organized and in accordance with legal requirements is crucial. Take advantage of the US Legal Forms library to always have essential document templates at your fingertips for any needs!

- For those who are already familiar with our catalog and have utilized it in the past, acquiring the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 requires just a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- The process will involve just a few additional steps for new users.

- Follow the instructions below to commence using the most comprehensive online form catalog.

- Check the Preview mode and form description. Ensure you’ve chosen the proper one that fulfills your requirements and fully complies with your local jurisdiction regulations.

Form popularity

FAQ

Yes, you can file a Chapter 13 bankruptcy on your own, although it involves several steps and specific paperwork. The Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 provides essential forms and information that can support your self-filing efforts. While self-filing is possible, understanding the legal process is crucial to avoid mistakes that could complicate your case.

To file for Chapter 13 bankruptcy, your total unsecured debts must be less than $419,275 and secured debts less than $1,257,850. These limits can change, so it’s essential to verify current figures when considering bankruptcy. Utilizing the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can provide further clarification on eligibility and requirements. This guide ensures you stay informed about necessary debt limits.

Yes, Chapter 13 bankruptcy can be denied under certain circumstances. The court may reject your plan if it does not adhere to legal standards or if you fail to meet specific repayment criteria. It is crucial to prepare your bankruptcy documents carefully, using the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13. A well-structured plan significantly reduces the chance of denial.

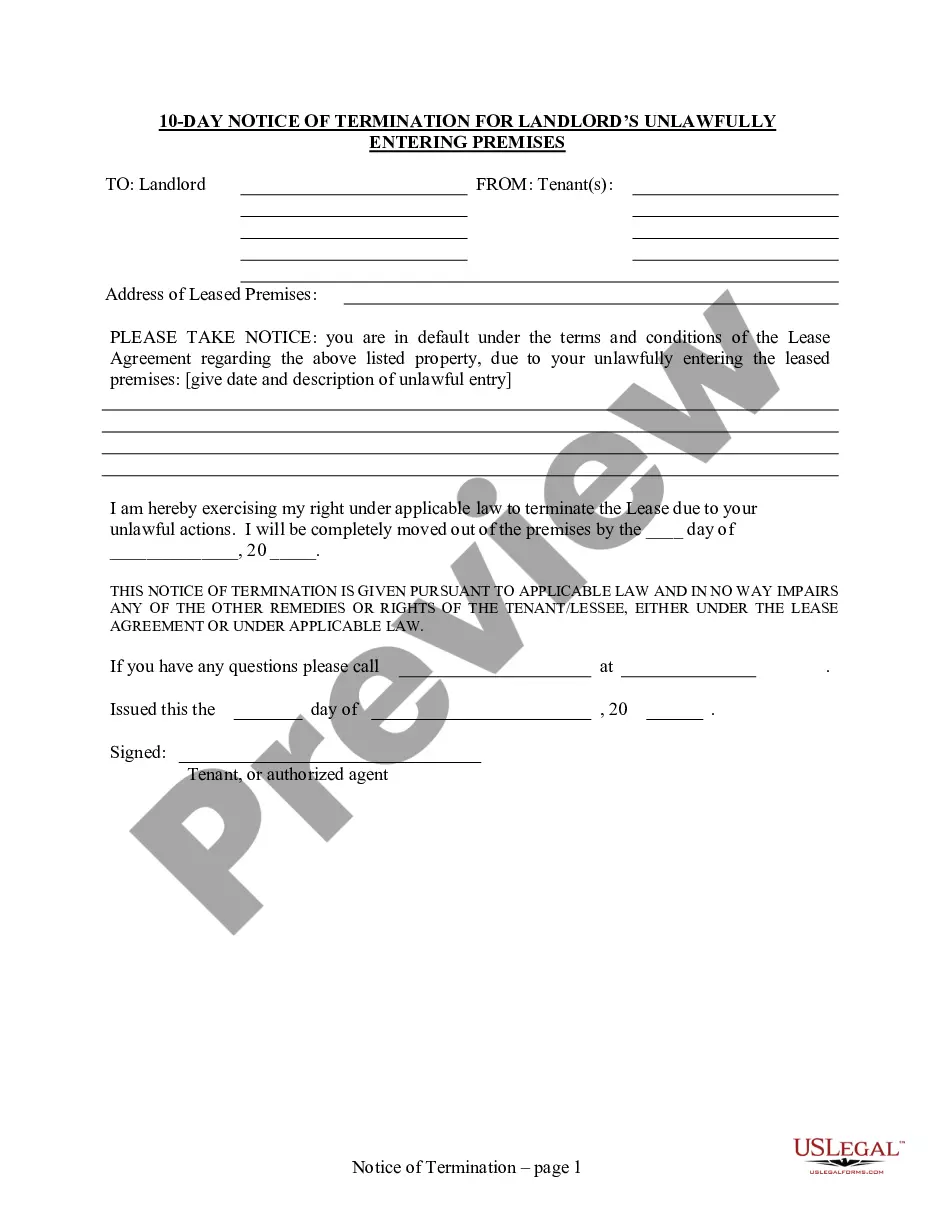

You can obtain the necessary forms to file for bankruptcy through the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13. This package provides all required documentation conveniently in one place. You may also find these forms on the official bankruptcy court website or by consulting a legal professional. Ensuring you have the right forms simplifies the filing process.

When considering the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13, it's essential to understand the differences between the two options. Chapter 7 bankruptcy provides a fresh start by eliminating most unsecured debts, but it may require the liquidation of some assets. On the other hand, Chapter 13 bankruptcy enables you to keep your property while reorganizing your debts into a manageable repayment plan, usually lasting three to five years. Choosing the right chapter depends on your financial situation, and our comprehensive package offers the necessary forms and guidance tailored to your needs.

Certain factors can disqualify you from filing for Chapter 13 bankruptcy. For instance, if you have filed for bankruptcy in the past and failed to complete your repayment plan, or if your unsecured debt exceeds a specific limit, you may not be eligible. The Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 will help you understand these limitations and assess your situation. Using this package can smooth the path to qualifying for a Chapter 13 filing.

As of now, the income limit for Chapter 7 bankruptcy in Ohio is based on the median income for your household size. If your income is below this threshold, you may qualify for Chapter 7. The Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 includes tools to help you determine your eligibility and navigate the income requirements. This package is essential in helping you understand the rules and providing clarity during your bankruptcy process.

Yes, you can file your own Chapter 13 bankruptcy, but it is important to understand the complexities involved. Utilizing the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can assist you in navigating the requirements and procedures. This guide provides detailed instructions for completing the necessary forms and managing your repayment plan. By following this resource, you can increase the likelihood of a successful filing.

To file for Chapter 7, you will need to gather a variety of documents, including your income statements, tax returns for the past two years, and a list of your assets and debts. The Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 will provide you with all the necessary forms and instructions. This package helps ensure you have everything prepared and organized for a smooth filing process. By using this resource, you can simplify your Chapter 7 bankruptcy journey.

Filing bankruptcy yourself in Ohio requires careful preparation and knowledge of the process. You will need to gather your financial documents, complete the necessary forms, and submit them to the appropriate court. Using the Cuyahoga Ohio Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 can greatly assist you in this process, as it provides the essential forms and instructions needed. Additionally, ensuring that you follow all local rules can help streamline your filing experience.