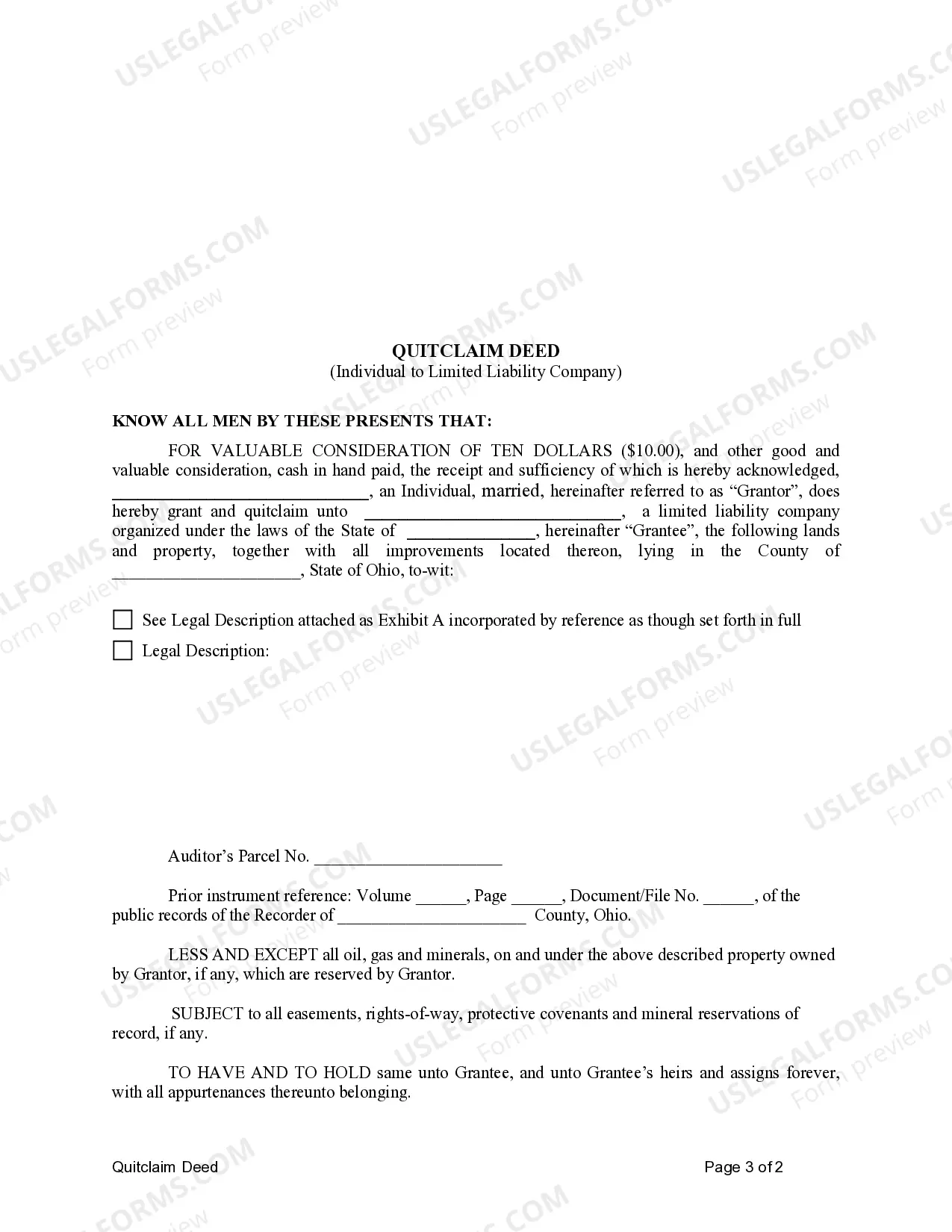

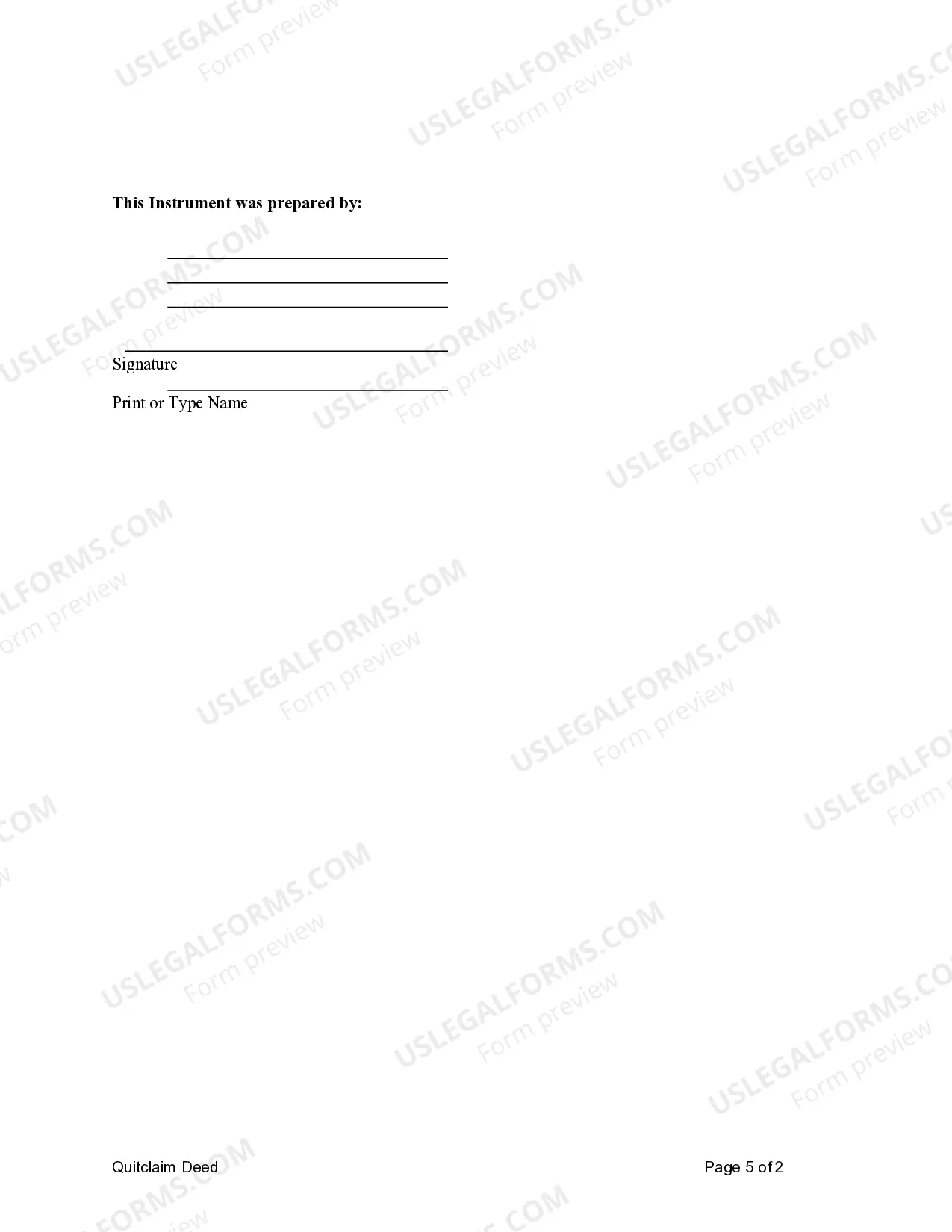

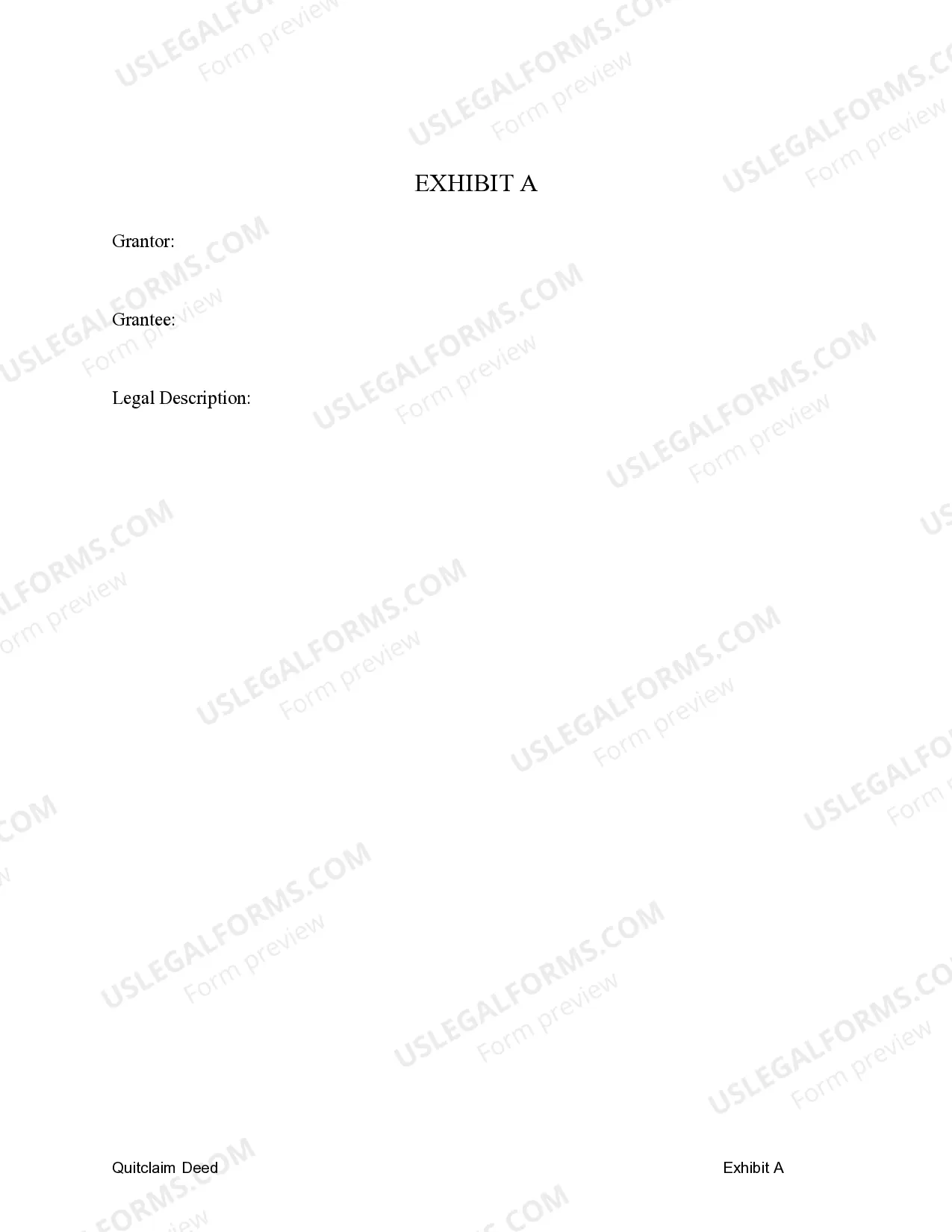

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Columbus Ohio Quitclaim Deed from Individual to LLC

Description

How to fill out Ohio Quitclaim Deed From Individual To LLC?

Finding authenticated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s a web-based collection of over 85,000 legal documents for both personal and professional purposes, addressing various real-world scenarios.

All forms are accurately categorized by usage area and jurisdiction, making the search for the Columbus Ohio Quitclaim Deed from Individual to LLC as simple as 1-2-3.

Keep your documentation organized and compliant with legal standards. Utilize the US Legal Forms library to always have critical document templates readily available for any requirements!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the right one that fits your requirements and aligns with your local jurisdiction regulations.

- Look for another template, if necessary.

- Should you encounter any discrepancies, use the Search tab above to locate the correct document. If it satisfies your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

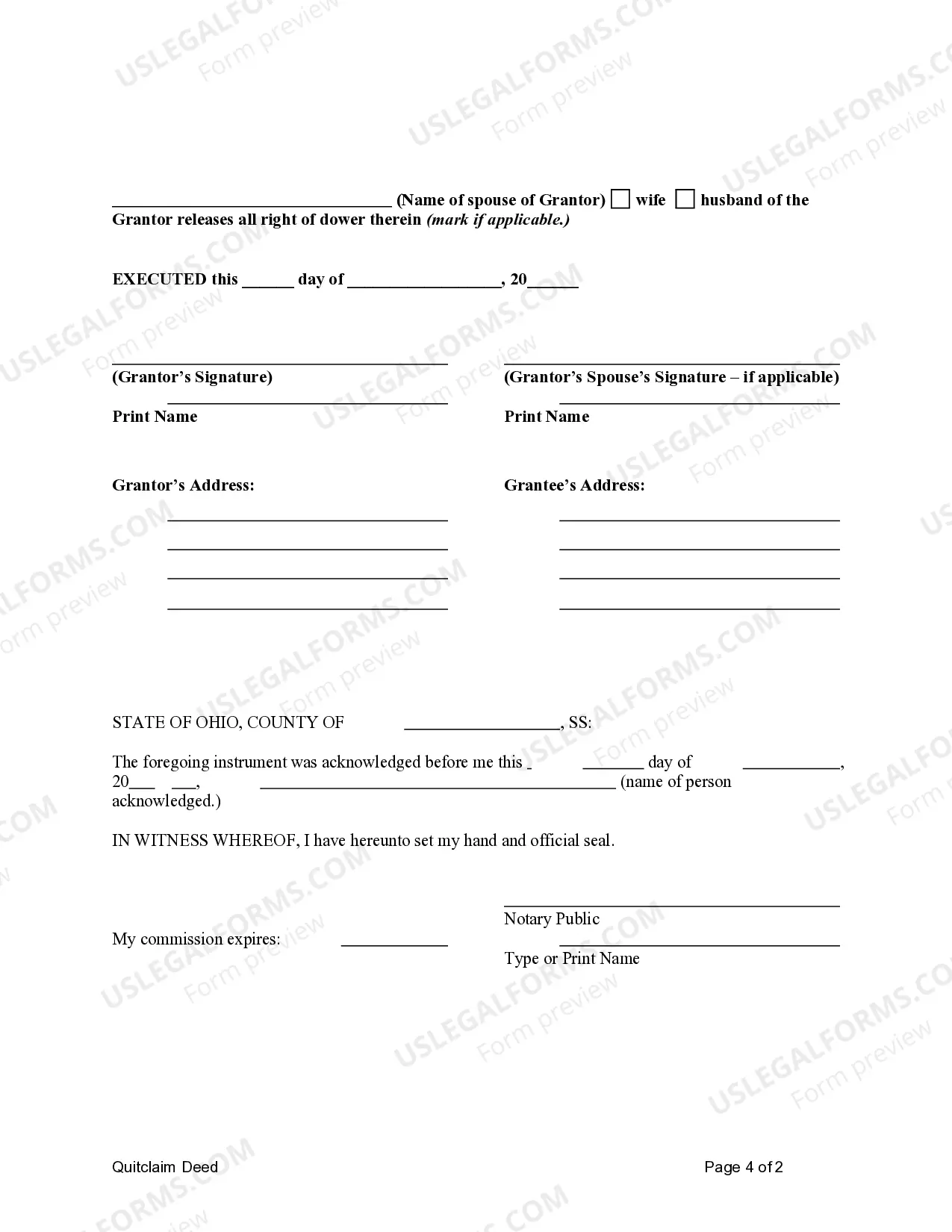

Yes. As of February 1, 2002, Ohio law no longer requires two witnesses to the signing of the seller's quitclaim deed or to other transfers of title to real property such as a mortgage or land contract. You can create a valid deed as long as an authorized public notary notarizes it.

The Deed Transfer Department transfers the owner's name and address on the real estate tax list and duplicate. The department also collects the transfer tax/ conveyance fee ($4.00 per $1,000 of sale price) and the transfer fee ($. 50 per parcel).

The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. Yes, you may have liability insurance, but if someone is seriously injured on your property, they can sue you personally for medical expenses and damages above and beyond the limits of your policy.

As of February 1, 2002, Ohio law no longer requires two witnesses to the signing of the seller's quitclaim deed or to other transfers of title to real property such as a mortgage or land contract. You can create a valid deed as long as an authorized public notary notarizes it.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

To transfer title, you must deliver the executed and acknowledged deed to the grantee. This means that you must give up control over the deed during your lifetime and intend to transfer title to the grantee. To complete the transfer, the grantee must accept the delivered deed.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

Typical Quitclaim Fees 50 per parcel number (the number of parcels multiplied by $. 50). The conveyance fee varies by county and is usually between $1 and $4. For example, in Franklin County, the conveyance fee is $3 per every $1,000 of the real property or manufactured home sale price.

Transferring real property from individual to LLC in Ohio You will need to draft a new deed reflecting the transfer from the individual owner to the Limited Liability Company.You will then need to obtain a ?Statement for Reason for Exemption From Real Property Conveyance Fee? from the county auditor.

§ 5301.25) ? Once completed and acknowledged the quit claim deed must be filed at the County Recorder's Office in the jurisdiction where the land is located. Signing (R.C. § 5301.01) ? A quit claim deed in Ohio is required to be signed in the presence of a notary public.