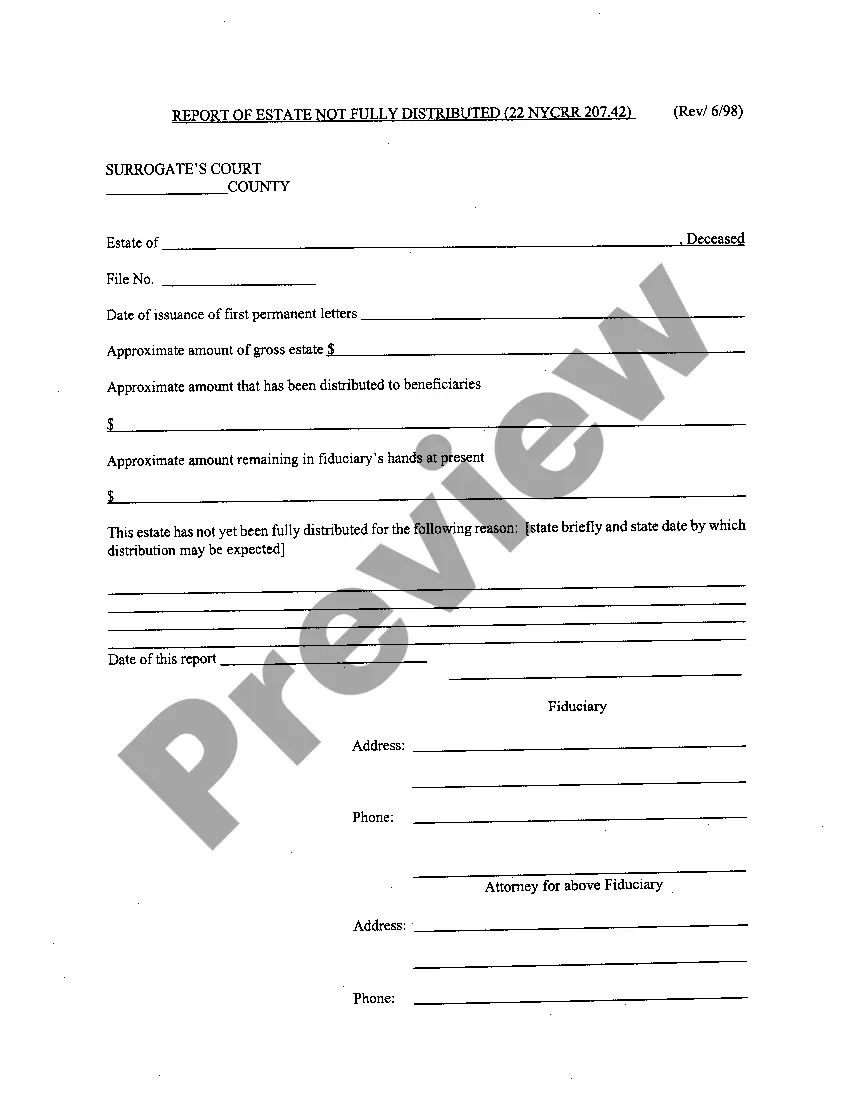

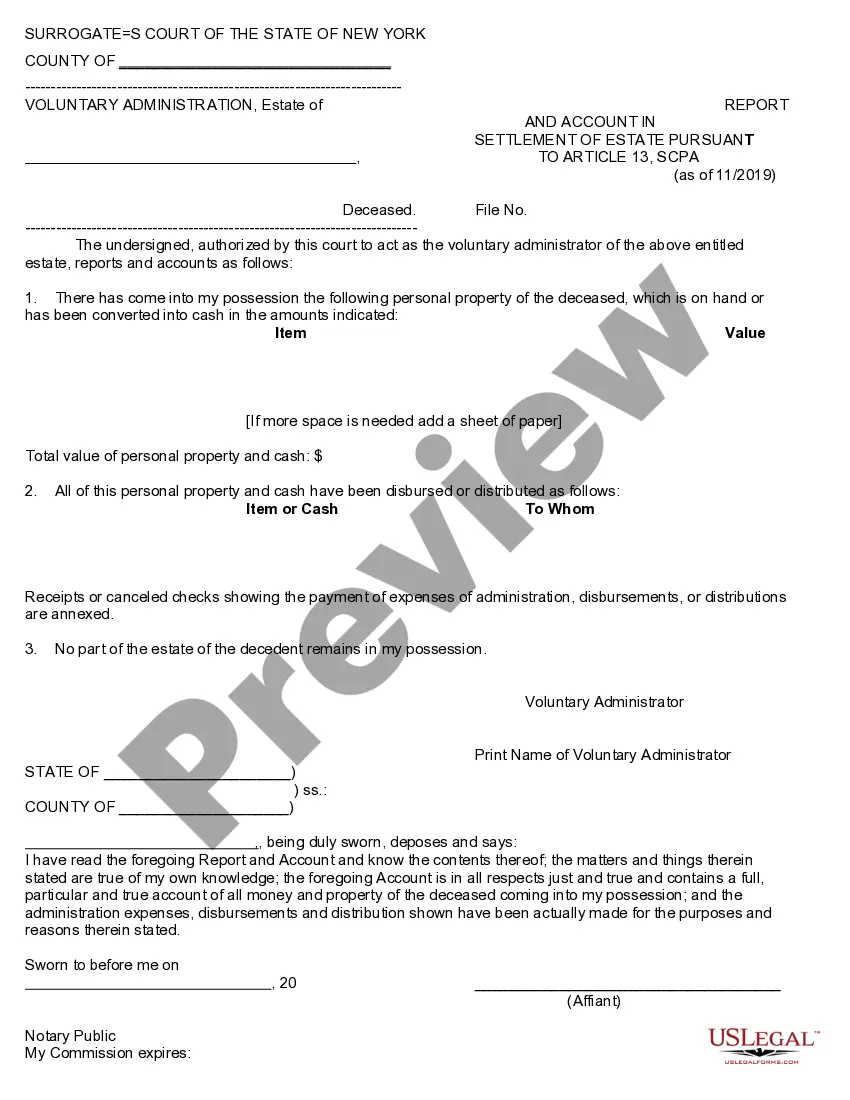

Rochester Report and Account to Settle Small Estate in New York

Description

How to fill out Report And Account To Settle Small Estate In New York?

Do you require a reliable and economical legal forms provider to purchase the Rochester Report and Account to Settle Small Estate in New York? US Legal Forms is your ideal choice.

Whether you seek a simple contract to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our site features over 85,000 current legal document templates for both personal and business needs. All templates we supply are not generic and tailored according to the statutes of specific states and regions.

To obtain the form, you must Log In to your account, find the necessary form, and click the Download button beside it. Please keep in mind that you can retrieve your previously bought document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can set up an account in minutes, but before that, ensure to do the following: Check if the Rochester Report and Account to Settle Small Estate in New York aligns with the regulations of your state and locality. Review the form’s specifics (if available) to understand who and what the form is intended for. Rerun your search if the form isn’t suitable for your legal situation.

Experience US Legal Forms today, and stop wasting your precious time researching legal documents online for good.

- You can now create your account.

- Then choose the subscription plan and move on to payment.

- Once the payment is finalized, download the Rochester Report and Account to Settle Small Estate in New York in any available file format.

- You can return to the website when needed and redownload the form at no additional cost.

- Obtaining current legal forms has never been simpler.

Form popularity

FAQ

In New York, there is no strict time limit imposed for settling an estate; however, it is advisable to proceed without undue delay. Taking prompt action helps to avoid complications and ensures that beneficiaries receive their inheritance in a timely manner. By following the Rochester Report and Account to Settle Small Estate in New York, you can receive essential insights that direct you through the estate settlement process effectively and timely.

Yes, New York does offer a small estate affidavit, which can simplify the process of settling an estate with limited assets. This affidavit allows the executor or administrator to collect and distribute assets without going through the full probate process. To streamline your experience, consider utilizing the Rochester Report and Account to Settle Small Estate in New York. This resource provides comprehensive guidance to help you navigate the small estate procedures efficiently.

Closing an estate account in New York involves ensuring all debts are settled and final distributions are made to heirs. You must complete the required documentation and submit the final accounting to the court for review. The Rochester Report and Account to Settle Small Estate in New York offers guidance on this process, making it easier for you to navigate the necessary steps and close the account effectively.

The rules for settling a small estate in New York stipulate that the estate's total value must not exceed $50,000, excluding real estate. Additionally, executors must provide a full accounting of all assets and debts within this estate. Understanding and adhering to these rules is crucial, and the Rochester Report and Account to Settle Small Estate in New York can serve as a helpful resource in this regard.

While it is possible to settle a small estate in New York without a lawyer, having legal guidance can simplify the process and help avoid potential pitfalls. A lawyer can provide valuable insights into the estate settlement laws that apply to your specific situation. If you choose to go it alone, consider using the Rochester Report and Account to Settle Small Estate in New York for support and clarity.

To settle a small estate in New York, you start by gathering the deceased's assets and debts. Next, you must complete the small estate affidavit to initiate the settlement process. By leveraging resources such as the Rochester Report and Account to Settle Small Estate in New York, you can access the necessary forms and guidance to accurately navigate this important task.

The time it takes to settle a small estate in New York can vary, but it usually ranges from a few months to a year. Factors that influence this timeline include the complexity of the estate and the efficiency of the executors. Adopting tools like the Rochester Report and Account to Settle Small Estate in New York can expedite the process, ensuring that everything proceeds smoothly.

In New York, a small estate generally refers to an estate with a total value of $50,000 or less for individual assets, excluding real property. This definition makes it easier for individuals to handle the estate settlement process. Utilizing the Rochester Report and Account to Settle Small Estate in New York can help clarify the specific requirements and streamline your efforts.

An estate in New York consists of all assets owned by a deceased person. This includes real estate, bank accounts, investments, and personal belongings. Understanding the components of an estate is critical when preparing the Rochester Report and Account to Settle Small Estate in New York. Comprehensive documentation of these assets ensures a smoother settlement process and clearer distribution to beneficiaries.

In New York, after probate is initiated, you typically have about seven months to settle the estate. However, this timeframe can extend if complications arise, such as disputes or additional asset valuations. Utilizing a Rochester Report and Account to Settle Small Estate in New York can streamline the process and ensure compliance with local regulations. It’s crucial to manage this timeline carefully to avoid penalties.