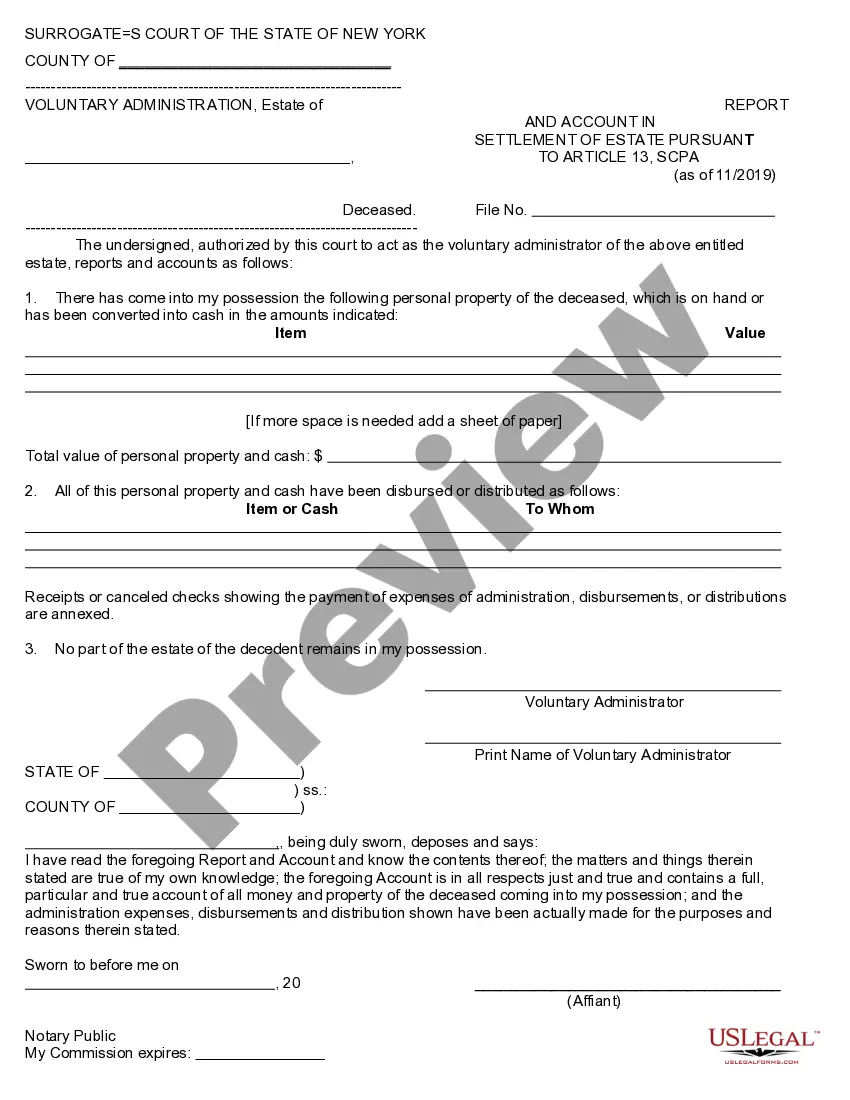

This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42)

Description

How to fill out New York Report Of Estate Not Fully Distributed (22 NYCRR 207.42)?

Are you seeking a dependable and affordable legal forms provider to obtain the Rochester New York Report of Estate Not Fully Distributed? US Legal Forms is your best choice.

Whether you require a straightforward arrangement to establish rules for living together with your partner or a set of documents to facilitate your divorce proceedings in court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business needs. All templates we provide are not generic and are tailored based on the requirements of specific states and counties.

To download the document, you must Log In to your account, find the needed form, and click the Download button next to it. Please remember that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first visit to our platform? No problem. You can easily create an account, but before that, please ensure to do the following.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Rochester New York Report of Estate Not Fully Distributed in any available file format. You can return to the website at any time and redownload the document without any additional costs.

Finding current legal documents has never been simpler. Try US Legal Forms today, and forget about wasting your precious time learning about legal paperwork online once and for all.

- Verify if the Rochester New York Report of Estate Not Fully Distributed complies with the laws of your state and locality.

- Review the form's details (if available) to understand who and what the document is intended for.

- Begin the search over if the form does not suit your legal situation.

Form popularity

FAQ

To close an estate in New York, you'll begin by filing the will with the court and obtaining letters testamentary, if applicable. After that, settle any debts, file necessary tax returns, and distribute the assets to beneficiaries. If you find that the estate is not fully distributed, consider utilizing the Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) to meet legal requirements.

Closing a deceased estate involves several steps, including paying off creditors and distributing remaining assets to the beneficiaries. You should prepare an inventory of assets and debts to facilitate this process. If the estate is not fully distributed, a Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) may be necessary to ensure compliance with state regulations.

To terminate a life estate in New York, you generally need to follow specific legal procedures. These can include obtaining consent from the life tenant and any remaindermen, or filing a petition in court if there is a dispute. Understanding the implications of the Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) can help clarify your responsibilities and options in this process.

While it's not mandatory to have a lawyer to settle an estate in New York, it is often beneficial. A lawyer can provide guidance through the complex legal processes involved, especially if you encounter challenges. If the estate is not distributed, understanding the Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) requires legal expertise that a professional can provide.

To close an estate in New York, you typically need to gather important documents, such as the will, death certificate, and asset information. Additionally, you'll need to settle debts and taxes associated with the estate. If the estate is not fully distributed, you may need to prepare a Rochester New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) to comply with local regulations.

In New York State, an estate should remain open for seven months before distributions are made. After this seven month period, the executor may be able to start making distributions to the beneficiaries, if all expenses and taxes are paid.

The length of time required to complete the probate process varies widely. If all heirs can be located, the will is uncontested, no appraisals are needed, and the debts are easily resolved, probate can be completed in three to six months.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

The easiest way to make the court papers is to use the Small Estate DIY (Do-It-Yourself) Form program. This program walks you step-by-step to complete the paperwork you need and gives you helpful definitions and legal information.

The average length of the basic steps in the probate process in New York include: Appointment as administrator or executor of the estate: About four to six months. Settling the estate: About six to nine months. Closing the estate: About two to three months.