Queens Report and Account to Settle Small Estate in New York

Description

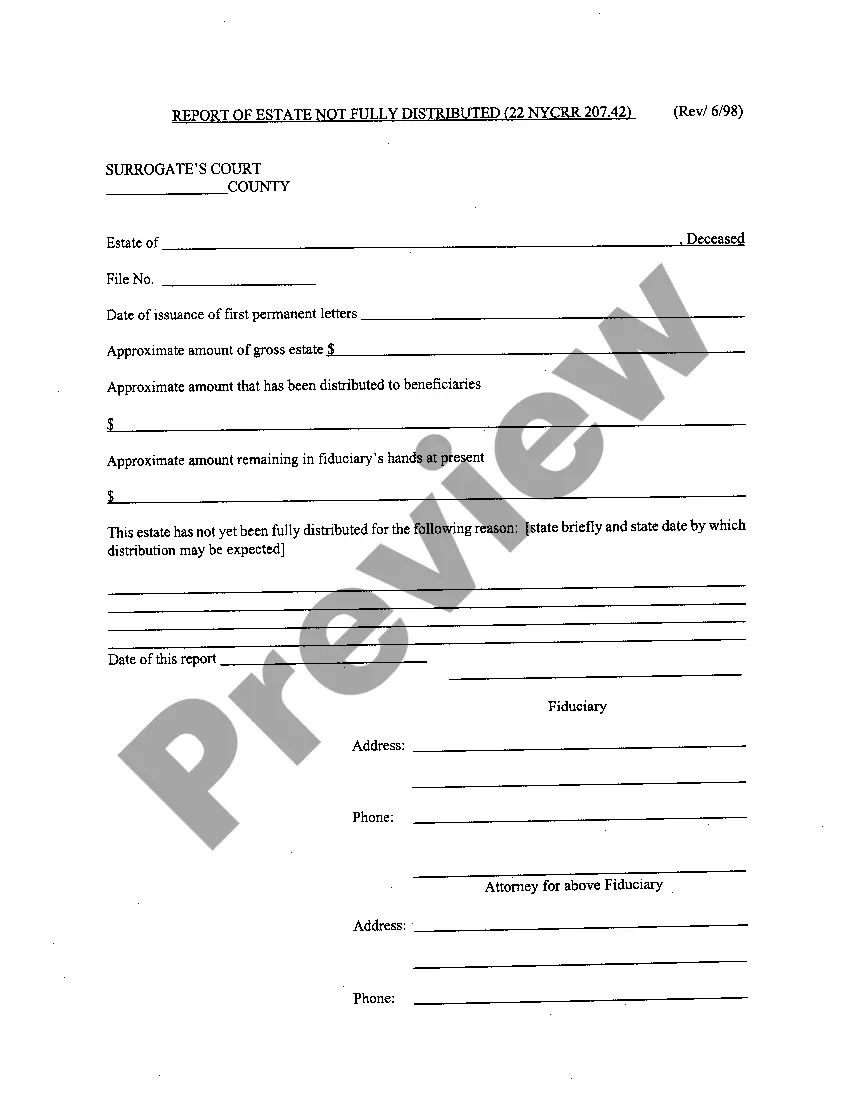

How to fill out Report And Account To Settle Small Estate In New York?

If you have previously engaged our service, Log In to your profile and save the Queens Report and Account to Resolve Small Estate in New York on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Browse through the description and utilize the Preview option, if available, to confirm if it satisfies your needs. If it doesn’t fit, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete a payment. Use your credit card information or the PayPal option to finish the purchase.

- Obtain your Queens Report and Account to Resolve Small Estate in New York. Select the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

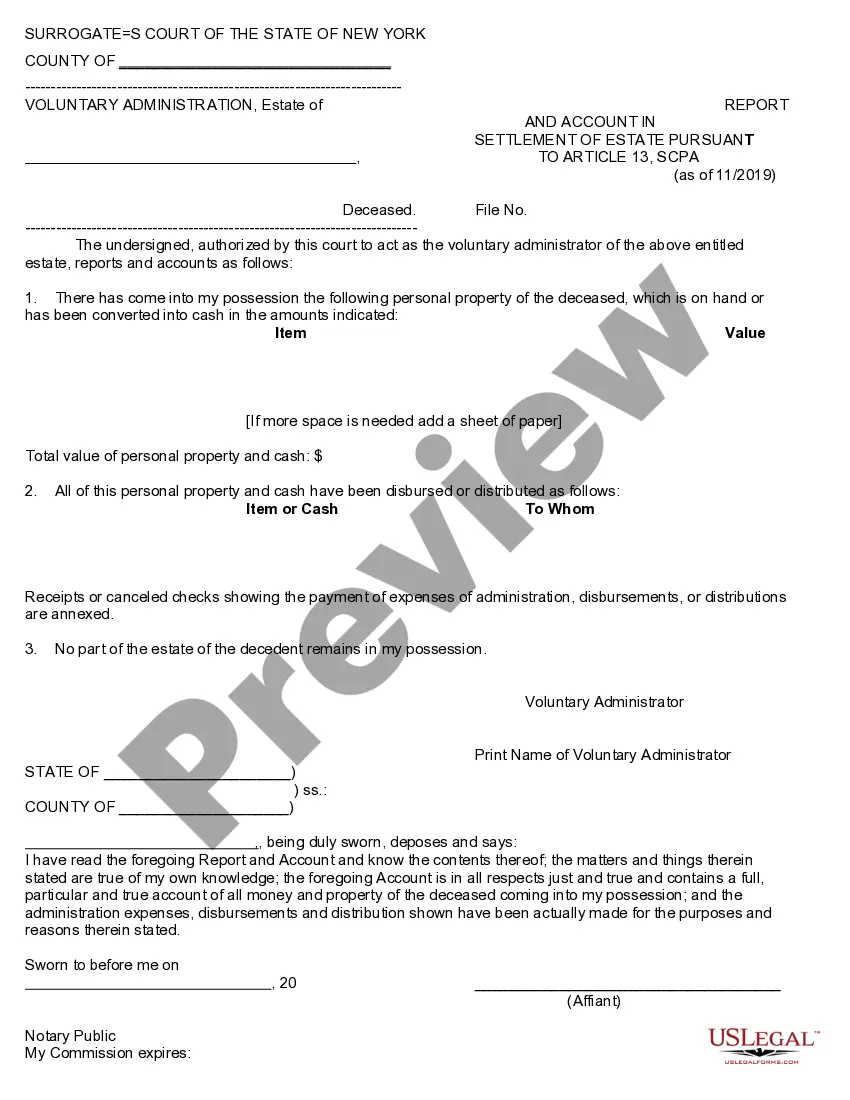

To write a small estate affidavit, start by gathering all necessary information about the deceased and their assets. Clearly state the relationship to the deceased and detail the assets that fall under the small estate threshold in New York. It's crucial to follow the guidelines outlined in the Queens Report and Account to Settle Small Estate in New York, as this document helps streamline the process. Consider using platforms like US Legal Forms, which provide templates and guidance to ensure you complete the affidavit accurately.

The limit for a small estate affidavit in New York is currently set at $50,000 for personal property. If the estate’s value exceeds this amount, you will need to go through the probate process. Ensure you complete the Queens Report and Account to Settle Small Estate in New York accurately to reflect the total value of the estate and facilitate a smooth transition for the beneficiaries.

The threshold for a small estate affidavit in New York is generally for estates valued at $50,000 or less. This allows heirs to claim the deceased's assets without going through full probate. To manage the documentation, utilize resources like USLegalForms for assistance in preparing the necessary Queens Report and Account to Settle Small Estate in New York.

In New York, the threshold for probate typically applies to estates valued at over $50,000 for personal property or $50,000 in real property. If the estate falls below these thresholds, it may qualify for the streamlined small estate process. To effectively manage a small estate, you will need to prepare the Queens Report and Account to Settle Small Estate in New York, making the process more accessible.

While hiring a lawyer is not mandatory to settle an estate in New York, it is often beneficial, especially for complex cases. A lawyer can help navigate legal intricacies and ensure that all documentation, such as the Queens Report and Account to Settle Small Estate in New York, is completed accurately. However, for small and uncomplicated estates, many individuals choose to handle the process themselves.

In New York, you can obtain a small estate affidavit by completing a specific form that details the estate's assets and beneficiaries. This affidavit allows you to collect assets without probate court involvement. To facilitate this process, consider using USLegalForms, which provides templates and guidance on how to effectively create your small estate affidavit and file the Queens Report and Account to Settle Small Estate in New York.

The rules for small estates in New York allow individuals to bypass the full probate process if their estate's value is below $50,000. You must complete a specific form, known as the Queens Report and Account to Settle Small Estate in New York, to initiate the settlement. This process is designed to make it easier for heirs to claim their inheritances swiftly. Familiarizing yourself with these rules can save you time and reduce complications in settling small estates.

In New York, a small estate generally refers to an estate with assets not exceeding $50,000. This includes the total value of all estate assets, excluding real property. If your estate fits this description, you can use the Queens Report and Account to Settle Small Estate in New York to simplify the settlement process. This provides a more straightforward and efficient way to manage smaller estates.

In New York, an executor typically has about 7 months from the date of appointment to settle the estate. However, complex situations may extend this timeline. It is crucial for executors to follow proper procedures, and utilizing a Queens Report and Account to Settle Small Estate in New York can help streamline the process if the estate qualifies. Timely action ensures that beneficiaries receive their assets without unnecessary delays.

In New York State, an estate must exceed $50,000 to qualify for probate. If the estate's value falls below this threshold, it may not need to go through the lengthy probate process. Instead, you may be eligible to file a Queens Report and Account to Settle Small Estate in New York. Using this process can simplify settling smaller estates efficiently.