Rochester New York Pay Notice for Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week) - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Employees Paid A Weekly Rate Or A Salary For A Fixed Number Of Hours (40 Or Fewer In A Week) - Notice And Acknowledgement Of Pay Rate And Payday?

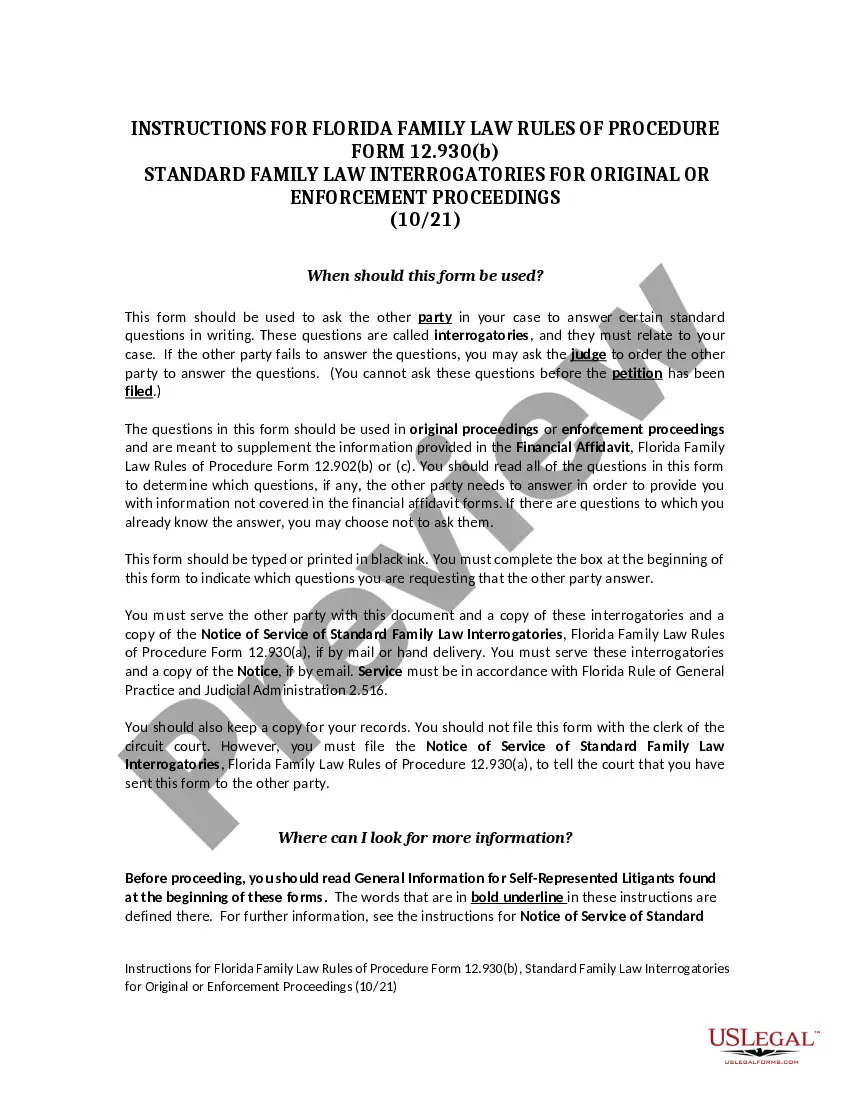

Finding validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents catering to both personal and professional demands as well as various real-world situations.

All files are appropriately sorted by category of use and jurisdiction, making it straightforward to find the Rochester New York Pay Notice for Employees Paid a Weekly Rate or Salary for a Set Number of Hours (40 or Less in a Week) - Notice and Acknowledgment of Pay Rate and Payday.

Maintaining orderly documentation that adheres to legal requirements is of utmost significance. Leverage the US Legal Forms library to always have crucial document templates accessible at your fingertips!

- For those already familiar with our collection and have previously accessed it, retrieving the Rochester New York Pay Notice for Employees Paid a Weekly Rate or Salary for a Set Number of Hours (40 or Less in a Week) - Notice and Acknowledgment of Pay Rate and Payday is accomplished in just a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- This procedure will require just a few additional steps for new users.

- Follow the instructions below to get started with the largest online form database.

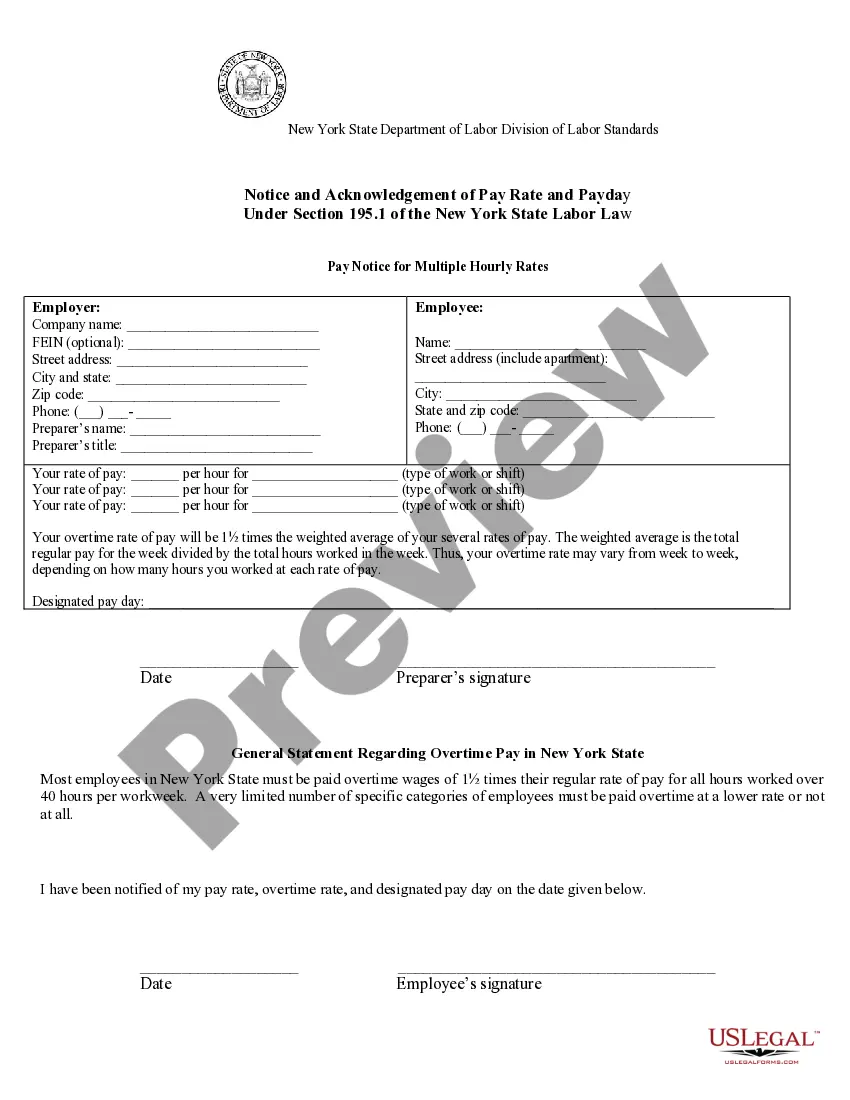

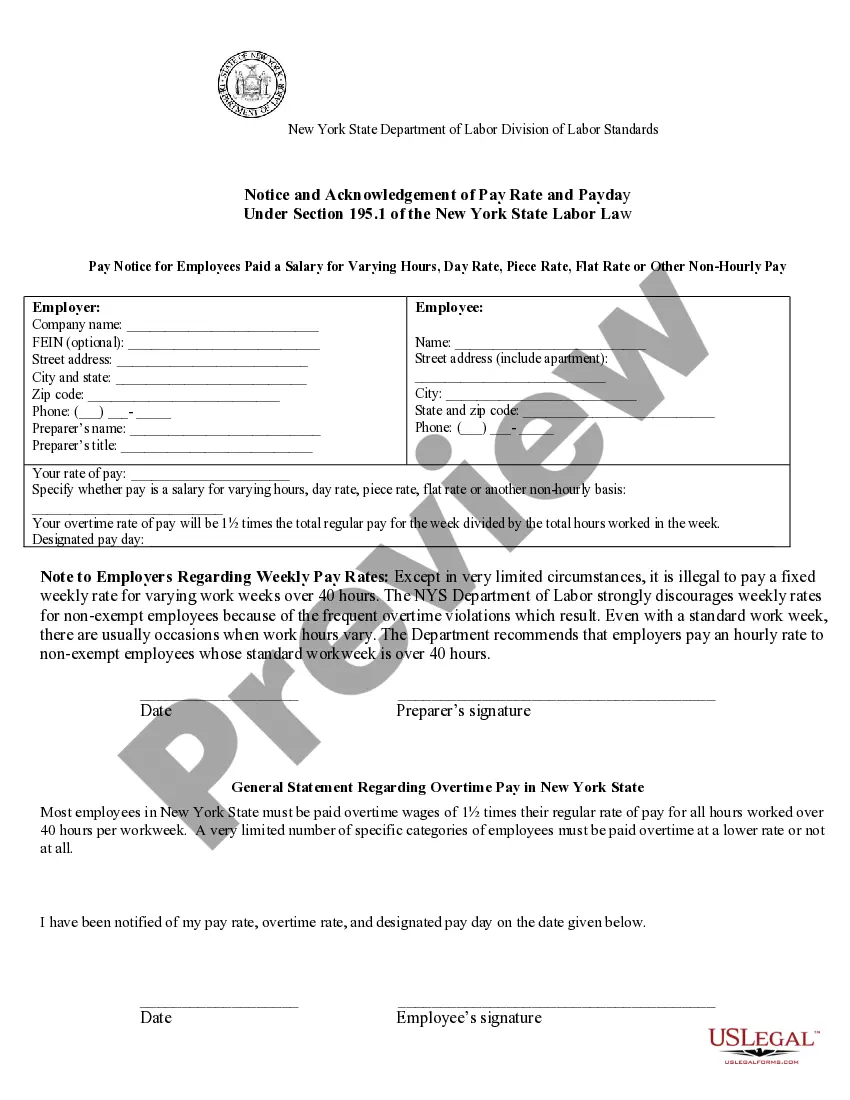

- Review the Preview mode and form description. Ensure you’ve selected the correct one that fulfills your needs and fully complies with your local jurisdiction standards.

Form popularity

FAQ

An overtime-eligible employee (paid a salary) who regularly works more than 40 hours per week, they are still entitled to overtime pay for hours worked over 40 hours. The number of hours included in the employee's regular workweek only affects the rate of overtime pay.

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.

New York State Labor Law requires manual workers to be paid weekly, and clerical and other workers at least twice per month. For more detailed information, including which employees are covered by this law, please see Frequency of Pay Frequently Asked Questions.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

Can they do this? Yes. If you are not in a union and do not have an employment contract, an employer may change the conditions of employment, including salary, provided that he or she pays at least the minimum wage and any required overtime, and continues to follow any other applicable laws.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.