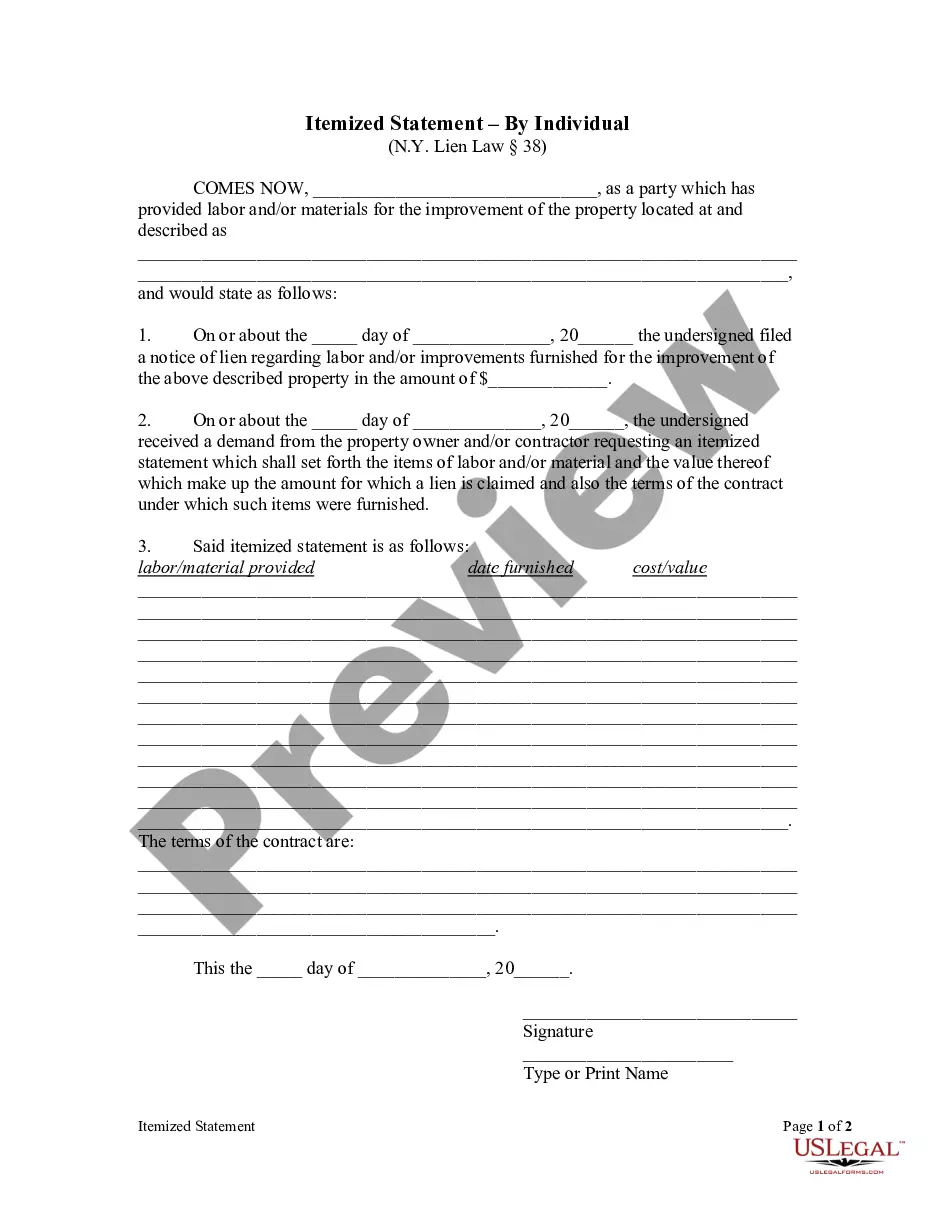

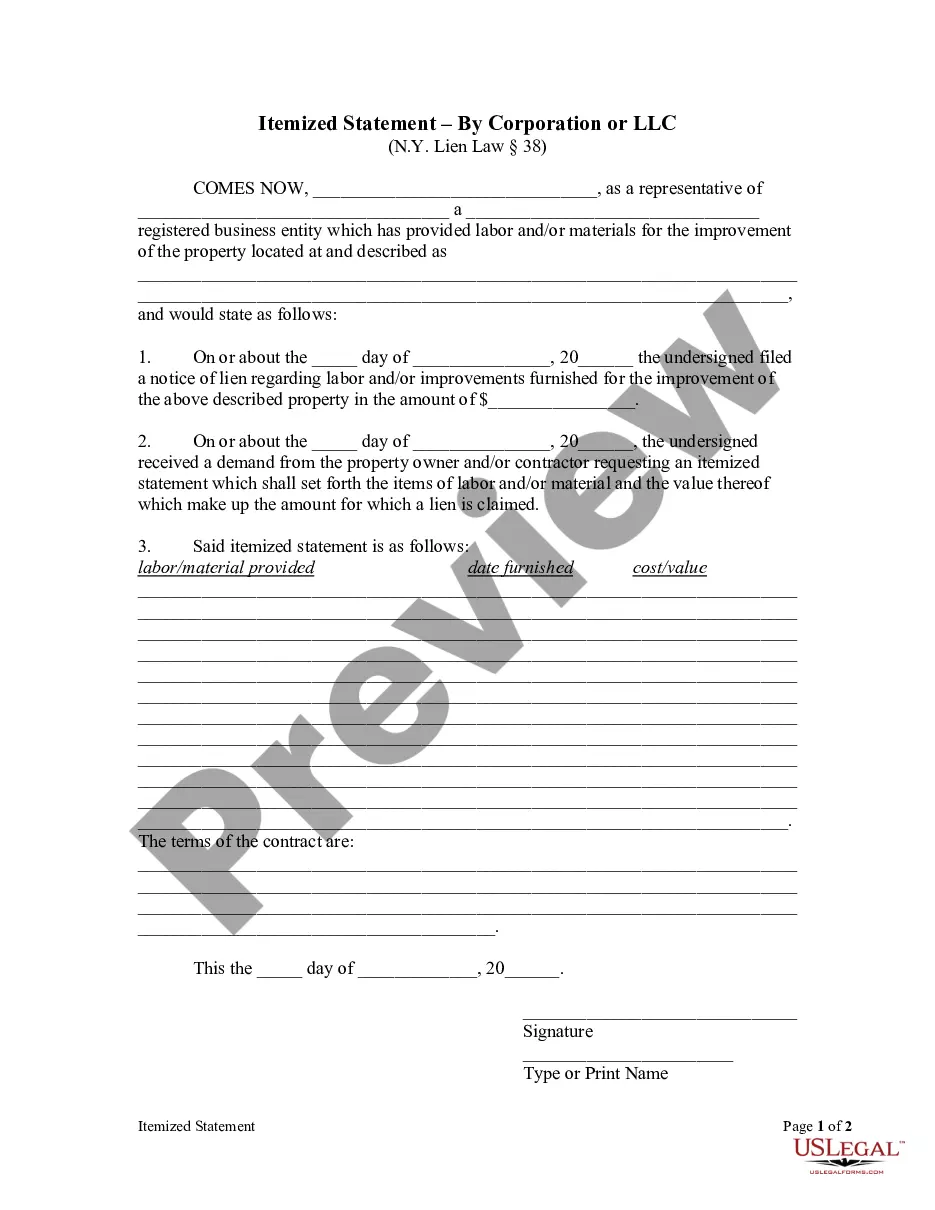

A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Syracuse New York Itemized Statement - Individual

Description

How to fill out New York Itemized Statement - Individual?

If you’ve previously utilized our service, Log In to your account and store the Syracuse New York Itemized Statement - Individual on your device by selecting the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional purposes!

- Ensure you've located the correct document. Review the description and use the Preview feature, if available, to verify if it fulfills your requirements. If it doesn’t fit, utilize the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Syracuse New York Itemized Statement - Individual. Select the file format for your document and store it on your device.

- Complete your sample. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Choosing between standard and itemized deductions depends on your financial situation. If your deductible expenses are higher than the standard deduction, the Syracuse New York Itemized Statement - Individual may provide more tax benefits. Conversely, if your deductions are lower, opting for the standard deduction simplifies your process. Evaluate your expenses carefully and seek assistance from professionals if necessary.

Qualifying for itemized deductions involves meeting certain criteria based on your expenses. Generally, if your total deductible expenses exceed the standard deduction for your category, you qualify. Expenses that commonly qualify include mortgage interest, medical expenses, and charitable contributions. The Syracuse New York Itemized Statement - Individual will be integral in tracking these costs.

To determine if you itemized deductions, check your prior year tax returns and forms. If you used the Syracuse New York Itemized Statement - Individual, you likely itemized your deductions. Compare the total itemized amount against the standard deduction available for your filing status. This will help you see whether itemizing is beneficial for you.

If you cannot prove your deductions, you may need to revise your Syracuse New York Itemized Statement - Individual. The IRS typically disallows undocumented deductions, which can lead to additional taxes owed. Consider consulting with a tax professional, who can offer insight into possible alternatives and solutions. Additionally, keeping thorough records moving forward can prevent similar issues in the future.

Filling out an itemized deduction involves collecting relevant financial information and using the right forms. Start by listing your deductible expenses on the Syracuse New York Itemized Statement - Individual, ensuring accuracy. You might consider using a service like uslegalforms to simplify the process, as they provide templates that can guide you step-by-step. This ensures you don’t miss any eligible deductions.

Yes, the IRS often requires proof for itemized deductions. When preparing your Syracuse New York Itemized Statement - Individual, keep records such as receipts and statements that clearly show your expenses. These documents can help support your claims if the IRS requests verification. Having proper documentation ensures a smoother process in case of an audit.

New York Form IT-196 is the form used to claim itemized deductions on your New York State tax return. This form allows you to list various itemized deductions, such as medical expenses and property taxes. Accurate completion of NY form 196 can lead to significant tax savings. For those using the Syracuse New York Itemized Statement - Individual, this form is essential in ensuring you capture all eligible deductions.

In New York, the form typically used for itemized deductions is the IT-201, along with the IT-196 for itemized deduction claims. These forms allow you to reflect all eligible itemized deductions effectively. It's essential to accurately complete these forms to benefit from the Syracuse New York Itemized Statement - Individual process fully.

Filing an itemized tax return involves filling out Form 1040 with the Schedule A for itemized deductions. Begin by gathering all necessary documents that reflect your deductible expenses throughout the year. Once completed, ensure that you submit the return by the tax deadline. Relying on the Syracuse New York Itemized Statement - Individual will help streamline this effort and ensure accuracy.

Yes, you can itemize your state taxes if you choose to itemize your deductions on your federal return. Each state, including New York, has its own guidelines for itemization. You will typically use a state-specific form to report your itemized deductions, which is closely related to your federal claims. The Syracuse New York Itemized Statement - Individual can guide you in documenting this process.