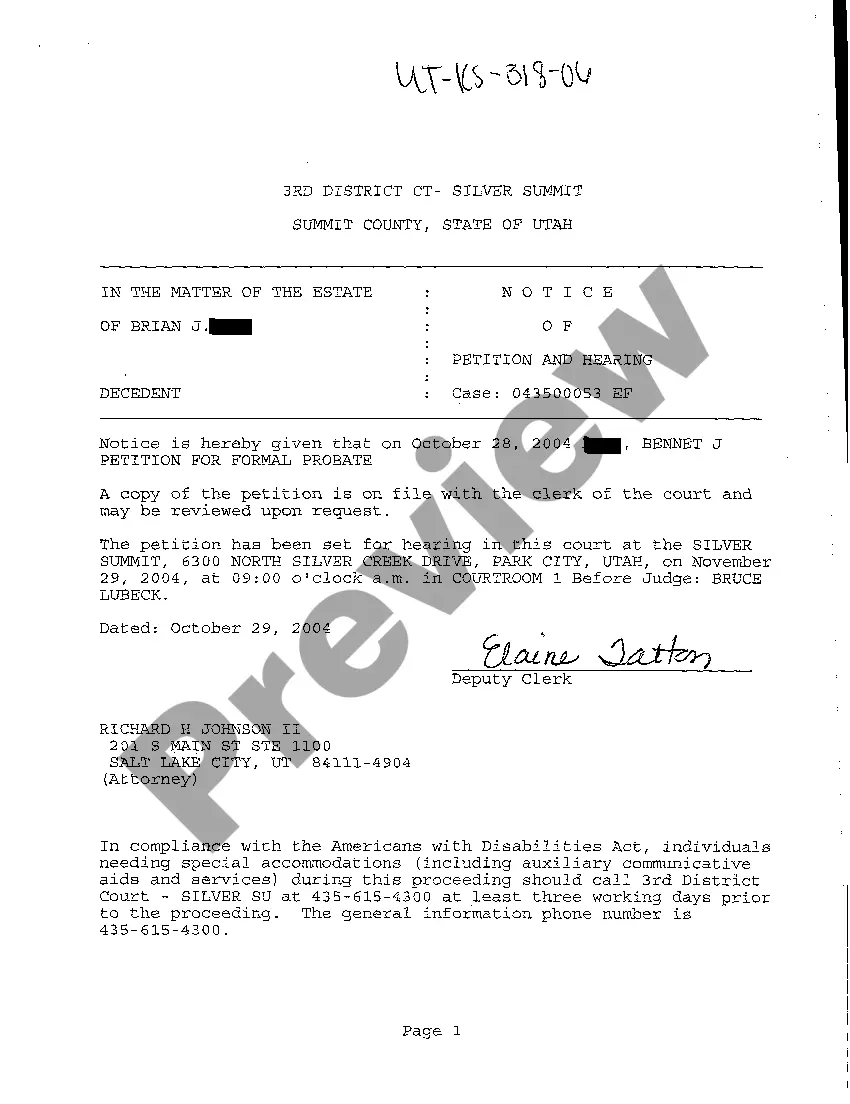

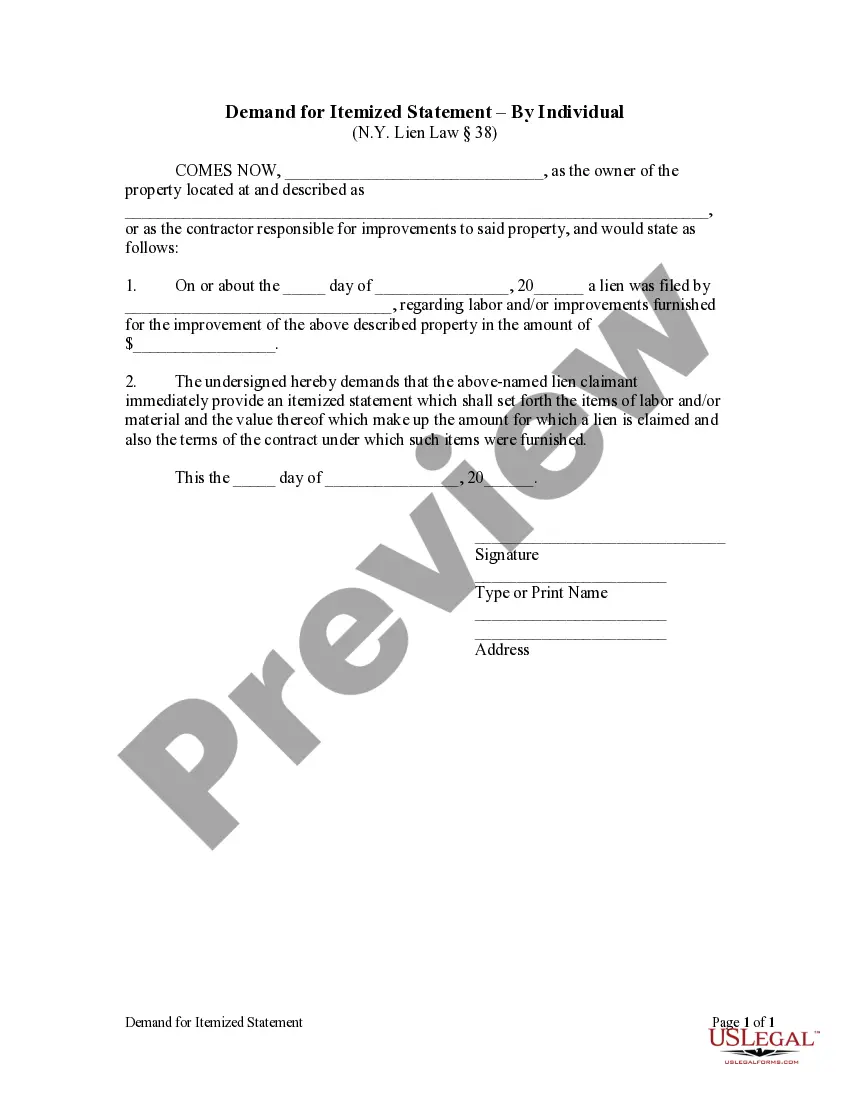

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Rochester New York Demand for Itemized Statement - Individual

Description

How to fill out New York Demand For Itemized Statement - Individual?

We consistently aim to reduce or evade legal complications when engaging with intricate legal or financial issues. To achieve this, we seek legal assistance through attorneys, which can often be quite expensive. However, not every legal situation is equally intricate. Many can be handled independently.

US Legal Forms is a digital collection of current do-it-yourself legal documents that cover everything from wills and powers of attorney to articles of incorporation and requests for dissolution. Our archive empowers you to manage your affairs without requiring a lawyer's assistance. We provide access to legal form samples that are not always available to the public. Our samples are tailored to specific states and regions, making the search process significantly easier.

Take advantage of US Legal Forms whenever you need to acquire and download the Rochester New York Demand for Itemized Statement - Individual or any other document quickly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents section.

The procedure is just as simple if you are new to the site! You can create your account in just a few minutes.

For over 24 years in the industry, we have assisted millions by offering customizable and current legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Ensure that the Rochester New York Demand for Itemized Statement - Individual complies with the laws and regulations of your state and region.

- It's essential to review the form's outline (if provided), and if you notice any inconsistencies with what you initially sought, look for an alternative form.

- Once you confirm that the Rochester New York Demand for Itemized Statement - Individual is suitable for you, you can select a subscription plan and move forward to payment.

- Then you can download the form in any preferred format.

Form popularity

FAQ

Receiving a certified letter from NYS tax could indicate several important matters related to your taxes. Often, it is a formal request for additional information or clarification regarding your tax situation, such as a Rochester New York Demand for Itemized Statement - Individual. It may also notify you of issues with your tax return or inform you of an audit. Responding promptly can help address any potential discrepancies and ensure your records are in order.

Calculating your New York State adjusted gross income involves a few straightforward steps. Start with your federal adjusted gross income, then make necessary adjustments for state-specific factors. Understanding how this interacts with the Rochester New York Demand for Itemized Statement - Individual can optimize your tax planning efforts. For precise calculations and guidance, consider leveraging resources from US Legal Forms.

Yes, New York does allow certain miscellaneous itemized deductions under specific conditions. However, you will need to track and categorize your expenses carefully to ensure compliance. When dealing with such deductions, it is wise to consider the details under the Rochester New York Demand for Itemized Statement - Individual. US Legal Forms offers resources to help you navigate these requirements seamlessly.

You can claim various state and local taxes as itemized deductions in New York. This includes state income taxes, local sales taxes, and property taxes. Understanding what qualifies under the Rochester New York Demand for Itemized Statement - Individual is crucial for maximizing your deductible amounts. Turn to US Legal Forms for assistance in organizing and reporting these taxes accurately.

New York itemized deductions include various expenses such as medical costs, mortgage interest, and charitable contributions. These deductions help reduce your taxable income and can lead to substantial savings. Familiarizing yourself with the specific guidelines under the Rochester New York Demand for Itemized Statement - Individual allows you to optimize your tax return effectively. Utilizing tools from US Legal Forms can simplify your process.

New York does recognize miscellaneous itemized deductions, but some limitations apply. While you can include certain unreimbursed expenses, specific categories may not qualify. To maximize your deductions accurately, it is beneficial to understand the requirements under the Rochester New York Demand for Itemized Statement - Individual. Using platforms like US Legal Forms can assist you in gathering the necessary documentation.

Yes, New York does permit medical expense deductions for individual taxpayers. You can claim these deductions if you itemize your expenses on your tax return. It is essential to provide detailed documentation to support your claims under the Rochester New York Demand for Itemized Statement - Individual. This can significantly reduce your taxable income and improve your financial situation.

Receiving a letter from the New York State Department of Taxation and Finance usually means they need clarification regarding your tax return or payment status. This letter could be a request for additional information or notification of a change in your account. It is essential to respond promptly to avoid complications. If you're confused, seeking assistance from professionals or platforms like US Legal Forms can clarify your situation and guide you in responding effectively.

In New York, itemized deductions are typically reported on Form IT-201, also known as the Resident Income Tax Return. This form allows taxpayers to itemize deductions such as medical expenses, home mortgage interest, and charitable contributions. Knowing how to properly fill out this form can significantly impact your taxable income. The Rochester New York Demand for Itemized Statement - Individual simplifies this process and ensures you include all eligible deductions.

New York City does not impose a personal property tax on individuals. However, there may be property taxes on real estate and certain business properties. It is essential to check specific regulations based on your situation. Understanding these taxes can help you manage your financial responsibilities more effectively.