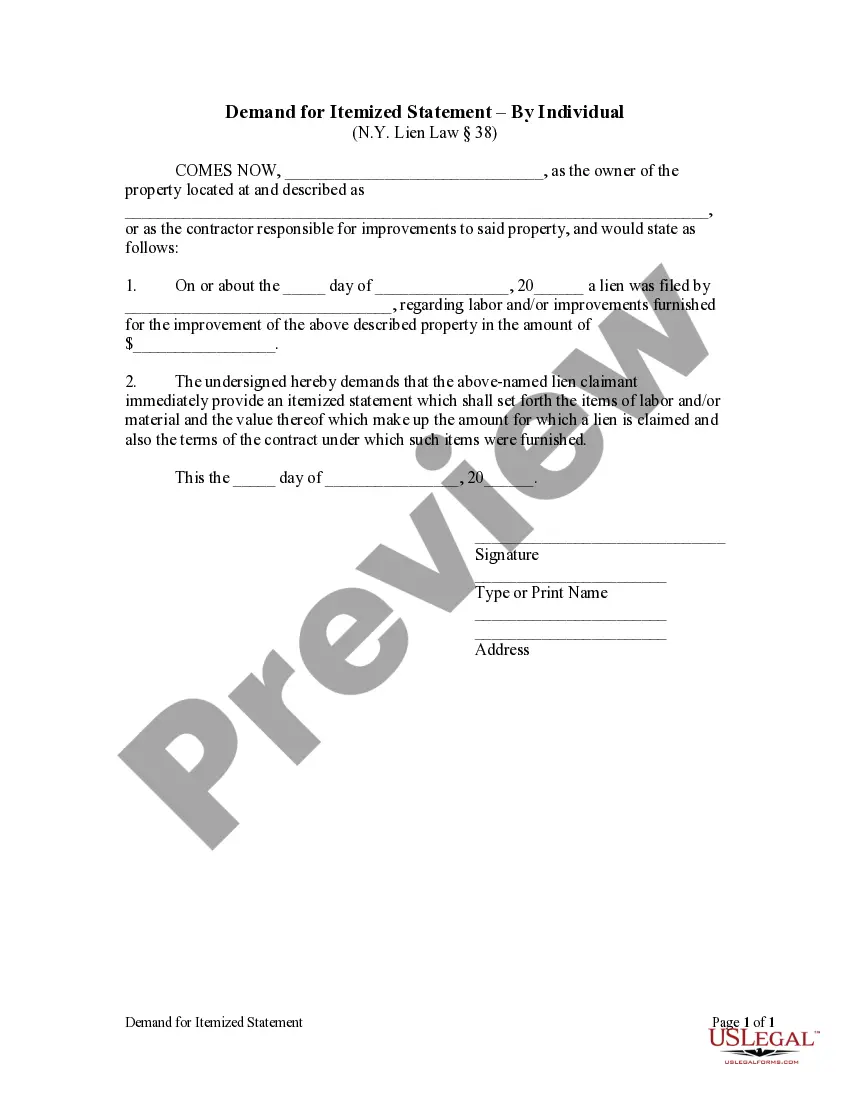

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Rochester New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

No matter the social or occupational standing, completing judicial documents is a regrettable requirement in the current professional landscape.

Often, it’s nearly unfeasible for an individual without legal education to create this type of document from the ground up, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms comes to the aid.

Confirm the form you have located is appropriate for your area since the laws of one state or region do not apply to another.

Examine the form and read a brief overview (if available) of situations the document can be applicable for.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who wish to enhance their efficiency time-wise using our DIY forms.

- If you need the Rochester New York Demand for Itemized Statement by Corporation or LLC or any other document that will be valid in your jurisdiction, with US Legal Forms, everything is at your fingertips.

- Here’s how to obtain the Rochester New York Demand for Itemized Statement by Corporation or LLC swiftly through our reliable service.

- If you are already a customer, you can proceed to Log In to your account to access the required form.

- However, if you are new to our database, ensure to follow these steps before downloading the Rochester New York Demand for Itemized Statement by Corporation or LLC.

Form popularity

FAQ

To find an agent for service of process in New York, you can search online directories or consult legal services that specialize in corporate law. Many businesses in Rochester utilize services like US Legal Forms, which can help connect you with qualified agents. Ensuring you have an established service of process agent is crucial for addressing any legal demands, including the Rochester New York Demand for Itemized Statement by Corporation.

All domestic and foreign corporations conducting business in New York must file a biennial statement. This requirement ensures that the state has up-to-date information about your corporation, which is essential for compliance. Corporations in Rochester should be aware that timely filing is vital to avoid penalties related to the Demand for Itemized Statement by Corporation.

In NYC, the maximum amount you can claim in Small Claims Court is typically $10,000. This court is designed for individuals to resolve disputes quickly and inexpensively. If you believe your claim involves financial documentation, you may want to prepare a Rochester New York Demand for Itemized Statement by Corporation to support your case.

A letter from the NYS Comptroller typically pertains to fiscal matters related to your account or specific inquiries regarding government financial procedures. This could include audits, claims, or discrepancies that need your clarification. Tackling these issues early can prevent delays, especially when preparing a Rochester New York Demand for Itemized Statement by Corporation.

To calculate your NYS adjusted gross income, start with your federal adjusted gross income and make necessary adjustments as prescribed by New York State tax regulations. These adjustments can include adding specific income types or deductions. Having an accurate income calculation is essential when preparing a Rochester New York Demand for Itemized Statement by Corporation.

You can reach the NYS Department of State Division of Corporations by visiting their official website or calling their office directly. They provide various services including guidance on filing corporation documents and addressing any inquiries about your corporation's standing. If you need to enhance your business’s paperwork or statements, consider utilizing platforms like uslegalforms.

You may receive a certified letter from the New York State Department of Taxation and Finance addressing tax issues such as missing payments or necessary clarifications on your tax return. Such letters are important since they can impact your financial standing and tax compliance. Addressing these letters can involve preparing a Rochester New York Demand for Itemized Statement by Corporation if required.

A certified letter can come from various government agencies for diverse reasons, mainly tax-related. This letter serves as documented communication, often prompting you to take action on certain matters. Understanding the context can help you prepare a Rochester New York Demand for Itemized Statement by Corporation if needed.

Receiving a certified letter from NYS tax usually indicates that there is an important issue that requires your attention. It may relate to unpaid taxes, discrepancies in your tax returns, or a request for more documentation. It is crucial to respond to such letters promptly to avoid penalties or further complications related to your Rochester New York Demand for Itemized Statement by Corporation.