This form is a Quitclaim Deed where the Grantors are three individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company

Description

How to fill out New York Quitclaim Deed From Three Individuals To A Limited Liability Company?

Take advantage of the US Legal Forms and gain immediate access to any document you require.

Our user-friendly website, equipped with a vast array of documents, simplifies the process of locating and acquiring nearly any document template you need.

You can download, fill out, and sign the Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company in just a few minutes instead of scouring the internet for hours in search of the appropriate template.

Utilizing our collection is an excellent method to enhance the security of your document submissions.

Access the page with the template you need. Ensure that it is the form you are looking for: verify its title and description, and utilize the Preview feature if available. If not, utilize the Search field to locate the necessary one.

Initiate the download process. Click Buy Now and choose your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Our knowledgeable legal experts routinely review all records to guarantee that the forms are applicable to a specific region and comply with updated laws and regulations.

- How can you obtain the Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company.

- If you already possess a subscription, simply Log In to your account. The Download option will be activated for all the documents you view.

- Additionally, you can access all previously saved files in the My documents menu.

- If you haven't created a profile yet, adhere to the steps detailed below.

Form popularity

FAQ

One potential disadvantage of putting property in an LLC is the initial setup and ongoing maintenance costs. Forming an LLC involves filing fees and may require annual reports, which can add to expenses. Additionally, transferring property through a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company can trigger tax implications. Therefore, it’s essential to consider these factors in your decision.

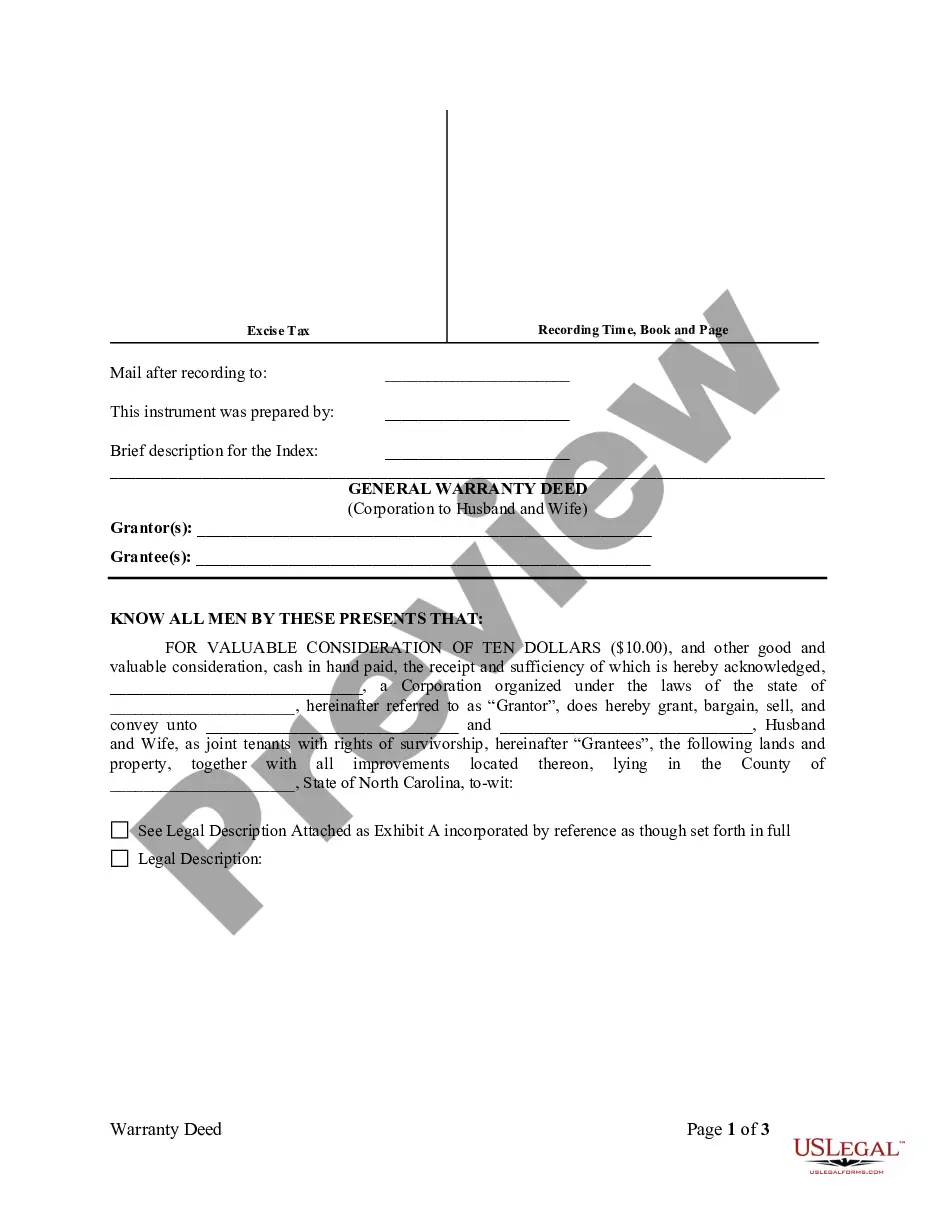

Transferring property from personal ownership to an LLC follows a simple procedure. First, prepare a Queens New York Quitclaim Deed that clearly outlines the transfer details. Afterward, you sign the deed and file it with the relevant authorities. This step establishes clear ownership under the LLC, which can help secure your investment.

To transfer property from a person to an LLC, you can use a Queens New York Quitclaim Deed. This legal document enables the individual to convey ownership of the property to the LLC. After filling out the necessary information, you must sign and file the deed with the county clerk's office. It’s a straightforward process that can significantly enhance ownership protection.

People often put their property in a Limited Liability Company for various reasons. It helps protect personal assets from lawsuits related to the property. Additionally, organizing property ownership through an LLC can simplify management and tax processes. Ultimately, a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company can offer both liability protection and operational flexibility.

There is no strict limit to how many names can appear on a deed, but it must follow local regulations. In the scenario of a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company, having three people is quite common and typically straightforward. However, more than three names can also be included, provided that the document remains legible and properly formatted. Always verify with local guidelines to ensure compliance.

Adding someone to a deed can complicate ownership rights and lead to disputes. It introduces shared control over the property, which can create issues if one party wants to sell while the other does not. Additionally, this action can affect property taxes and liability particularly relevant in the context of a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company. Therefore, weigh these disadvantages before making a change.

A quitclaim deed can include multiple individuals, allowing you to have several people on the title. In the context of a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company, it is common for three individuals to transfer their interests. However, the actual number can vary based on local regulations and property ownership needs. It is essential to correctly list all names to avoid legal complications.

To transfer a deed from personal ownership to a Limited Liability Company (LLC), you will need to complete a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company. This legal document must identify all parties involved and clearly state the property being transferred. After completing the deed, make sure to file it with the appropriate local government office. Consulting with a legal expert can ensure the process goes smoothly.

While quitclaim deeds are useful, they can present issues such as the lack of title guarantees, meaning you may inherit liabilities attached to the property. Additionally, if the original owners have outstanding debts or illegal claims, the new owners could face risks. It is crucial to assess these factors before proceeding, especially with a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company.

To quitclaim property to an LLC, start by drafting a quitclaim deed that lists the current owners and the LLC as the recipient. Follow New York's requirements for completing and signing the deed, then file it with the county clerk’s office. This process effectively transfers property using a Queens New York Quitclaim Deed from Three Individuals to a Limited Liability Company, providing a clear record of the transfer.