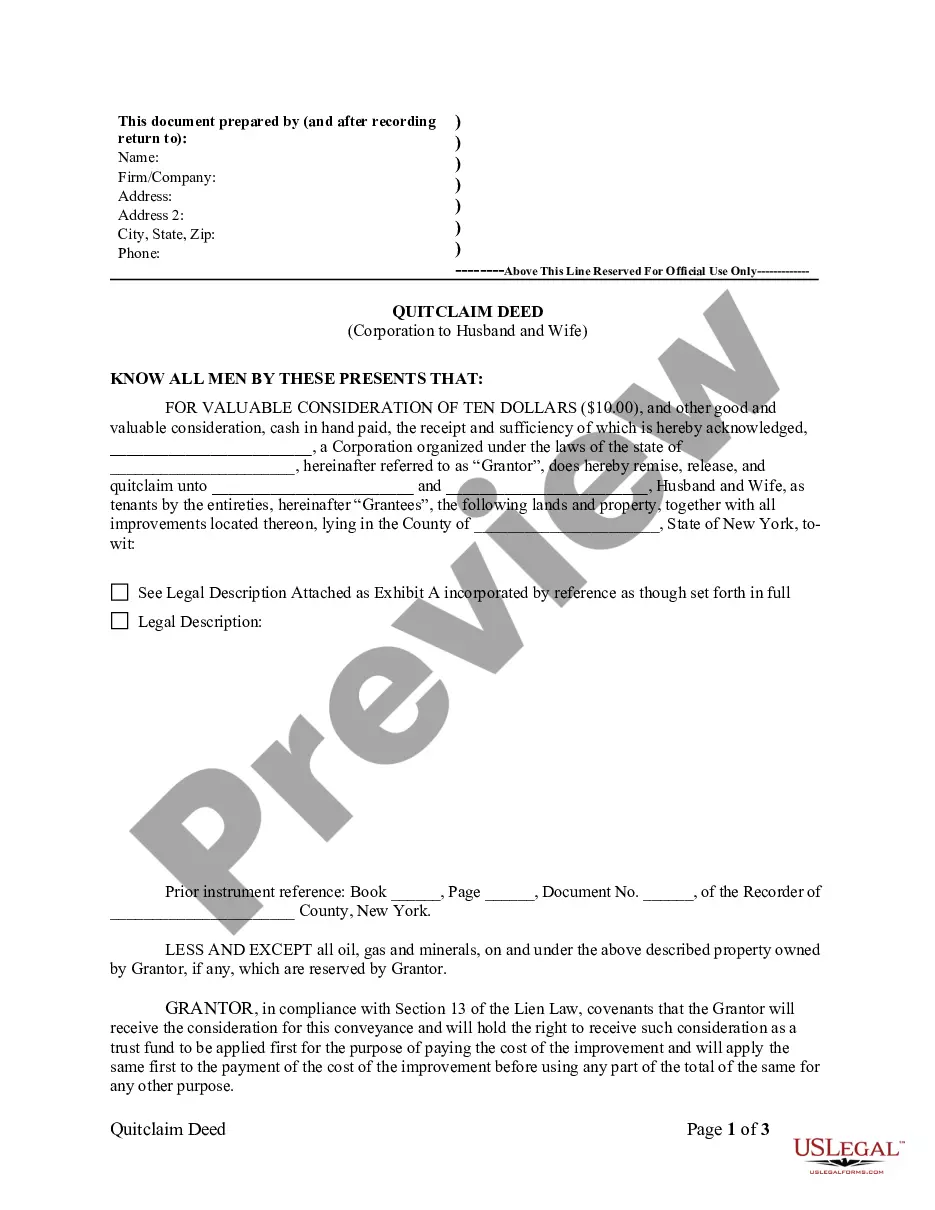

Rochester New York Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out New York Quitclaim Deed From Corporation To Husband And Wife?

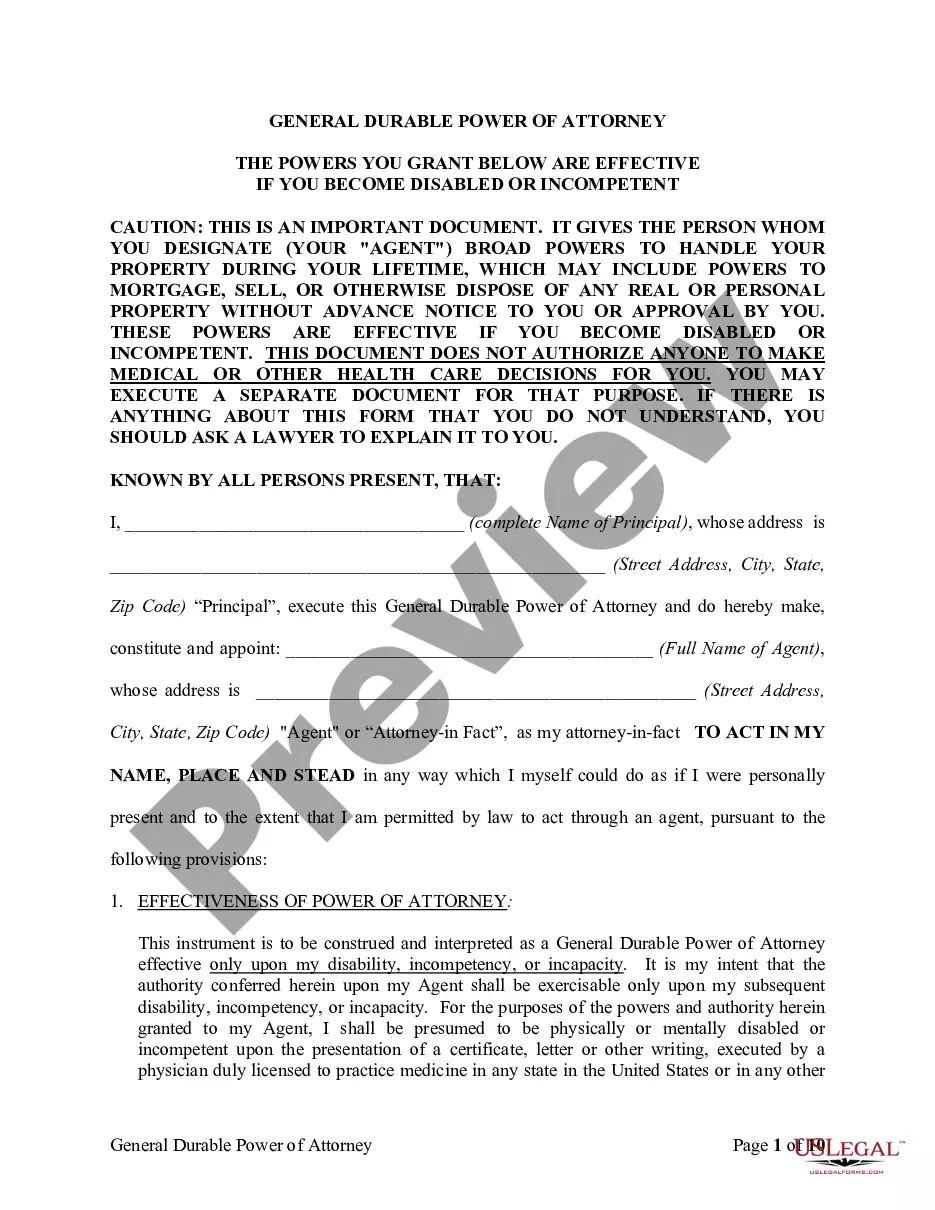

If you are looking for a pertinent form template, it’s remarkably challenging to select a more suitable platform than the US Legal Forms site – one of the most extensive online collections.

With this collection, you can discover a vast array of document samples for both business and personal objectives categorized by types and locations, or through keywords.

With the sophisticated search feature, locating the latest Rochester New York Quitclaim Deed from Corporation to Husband and Wife is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the format and save it to your device. Edit. Fill out, modify, print, and sign the acquired Rochester New York Quitclaim Deed from Corporation to Husband and Wife.

- Moreover, the pertinence of each entry is endorsed by a group of professional lawyers that consistently assess the templates on our website and refresh them in line with the most recent state and local laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Rochester New York Quitclaim Deed from Corporation to Husband and Wife is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have found the form you desire. Review its description and use the Preview option to examine its content. If it doesn’t fulfill your needs, utilize the Search function at the top of the page to find the correct record.

- Confirm your choice. Click the Buy now button. Afterward, select your desired pricing plan and provide details to create an account.

Form popularity

FAQ

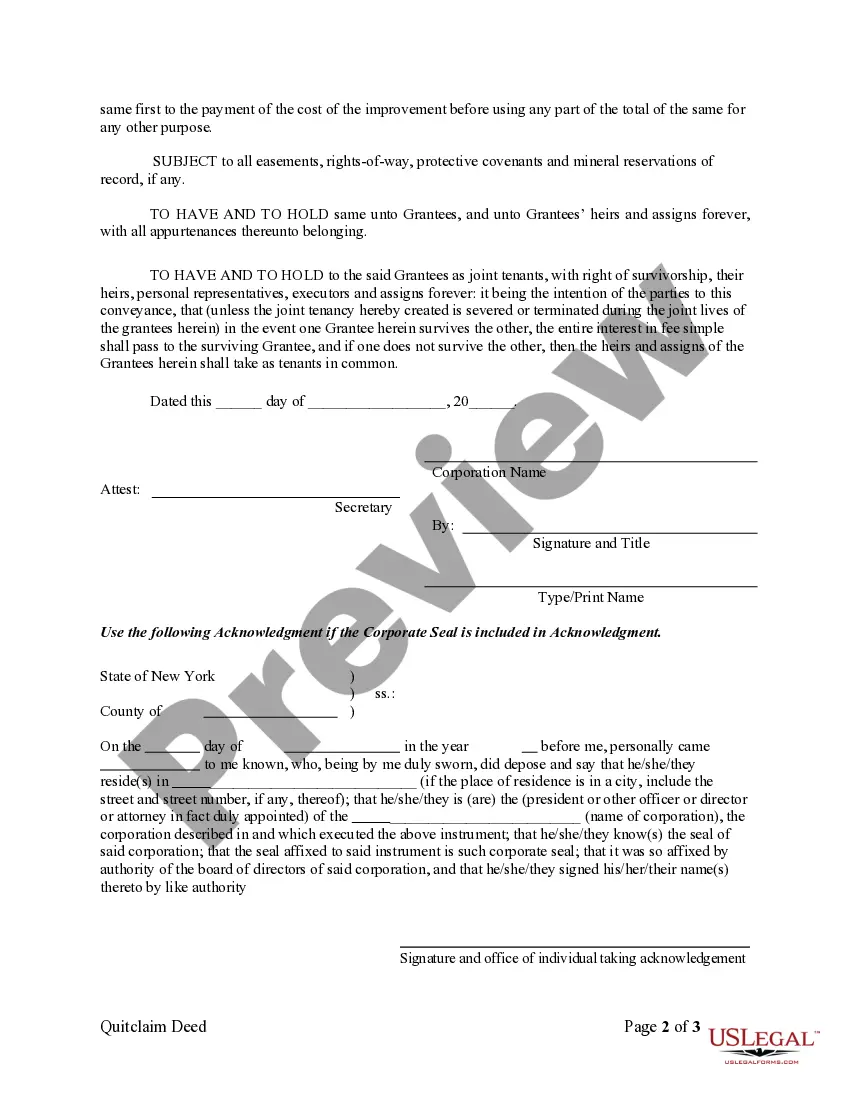

The type of deed that offers the greatest protection is usually a warranty deed. This deed guarantees that the grantor holds clear title to the property and that they will defend it against any claims. Unlike a quitclaim deed, which provides no warranties, the warranty deed offers peace of mind to the grantee, making it a safer option for significant transactions.

If one owner of a jointly owned property dies in New York, the property typically passes to the surviving owner through the right of survivorship. This means the deceased owner’s interest automatically transfers to the surviving spouse, often simplifying the process of ownership. It's essential to use legal tools such as a quitclaim deed to further clarify ownership intentions before such events occur.

The most common use of a quitclaim deed is to transfer property between family members or during marital transitions. It simplifies the process compared to other deed types, which may involve warranties and covenants. This makes it particularly useful in a Rochester New York Quitclaim Deed from Corporation to Husband and Wife context.

Adding someone to a deed in New York can have potential gift tax implications, depending on the property's value and the relationship between parties. If the value of the property exceeds a certain threshold, it may require filing a gift tax return. Consulting with a tax professional is advisable to understand the specific consequences of using a Rochester New York Quitclaim Deed from Corporation to Husband and Wife.

Quitclaim deeds are most often used for transferring property between family members or in situations where the transferor knows the recipient well. They often serve to clear up title issues or transfer property within a marriage, such as in a Rochester New York Quitclaim Deed from Corporation to Husband and Wife scenario. Its ease and speed make it popular for informal transfers.

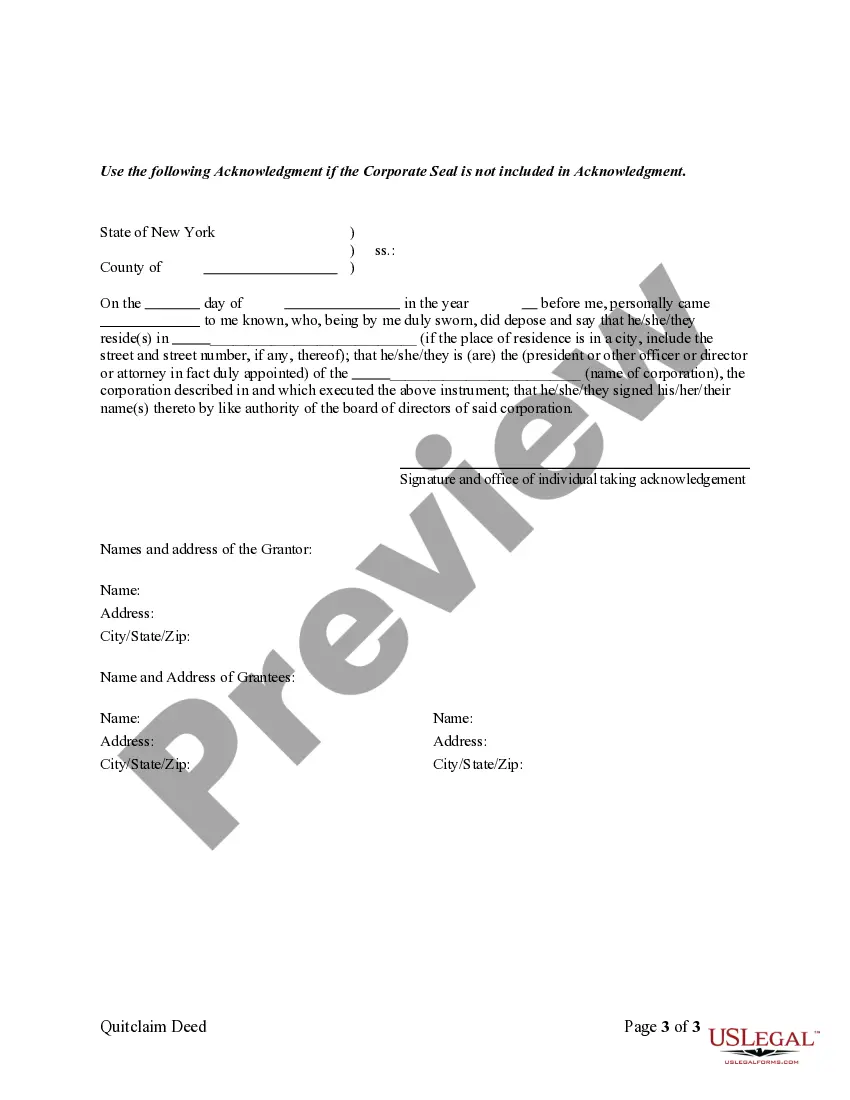

Filling out a quitclaim deed in New York requires basic information about the parties involved, the property’s legal description, and the type of transfer. Be sure to include the grantor's and grantee's names, along with notary acknowledgment. Utilize a reliable platform like uslegalforms to facilitate this process and ensure accuracy.

The most suitable deed for property transfer often depends on the circumstances involved. For informal transfers between family members or spouses, a quitclaim deed is usually preferable. It provides a simple and effective way to transfer property while avoiding the complications of more complex deeds.

The best approach to add your wife to your deed is by using a quitclaim deed. This method simplifies the process by enabling you to transfer an interest in the property without the need for complex legal procedures. By choosing a Rochester New York Quitclaim Deed from Corporation to Husband and Wife, you can ensure a smooth transition of ownership.

To add someone to your deed in New York, you will need to execute a new deed, typically a quitclaim deed. This document requires the current owner's signature and must be notarized to be legally binding. Recording the deed with the county clerk's office in Rochester is essential to ensure the changes are recognized.

A quitclaim deed primarily benefits individuals transferring property within a relationship, like a husband and wife. It allows for a quick and straightforward transfer of ownership without extensive legal formalities. In many cases, this can help couples consolidate property ownership, especially in a Rochester New York Quitclaim Deed from Corporation to Husband and Wife situation.