Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney solutions that are typically very expensive.

Nevertheless, not all legal issues are equally intricate; many can be handled on our own.

US Legal Forms is an online repository of current DIY legal forms encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button alongside it. If you happen to misplace the document, you can always re-download it from within the My documents section. The process is just as simple if you’re new to the platform! You can set up your account in just a few minutes. Ensure that the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate adheres to the laws and regulations of your state and area. Additionally, it’s essential to review the form’s outline (if provided), and if you find any inconsistencies with what you initially sought, look for an alternative form. Once you confirm that the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate suits your case, you can select the subscription plan and continue with the payment. Then you can download the document in any available file format. With over 24 years of experience in the market, we’ve assisted millions by providing ready-to-customize and updated legal forms. Make the most of US Legal Forms today to conserve time and resources!

- Our library empowers you to manage your affairs independently without the need for legal representation.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to locate and download the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other document swiftly and securely.

Form popularity

FAQ

Typically, the lender or financial institution holds the promissory note during the repayment period. For those utilizing the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's essential to know that the lender retains legal rights to the note until the borrower completes all required payments. This arrangement protects both parties and establishes clear expectations throughout the repayment process. After the final payment, the lender will officially release the note to the borrower.

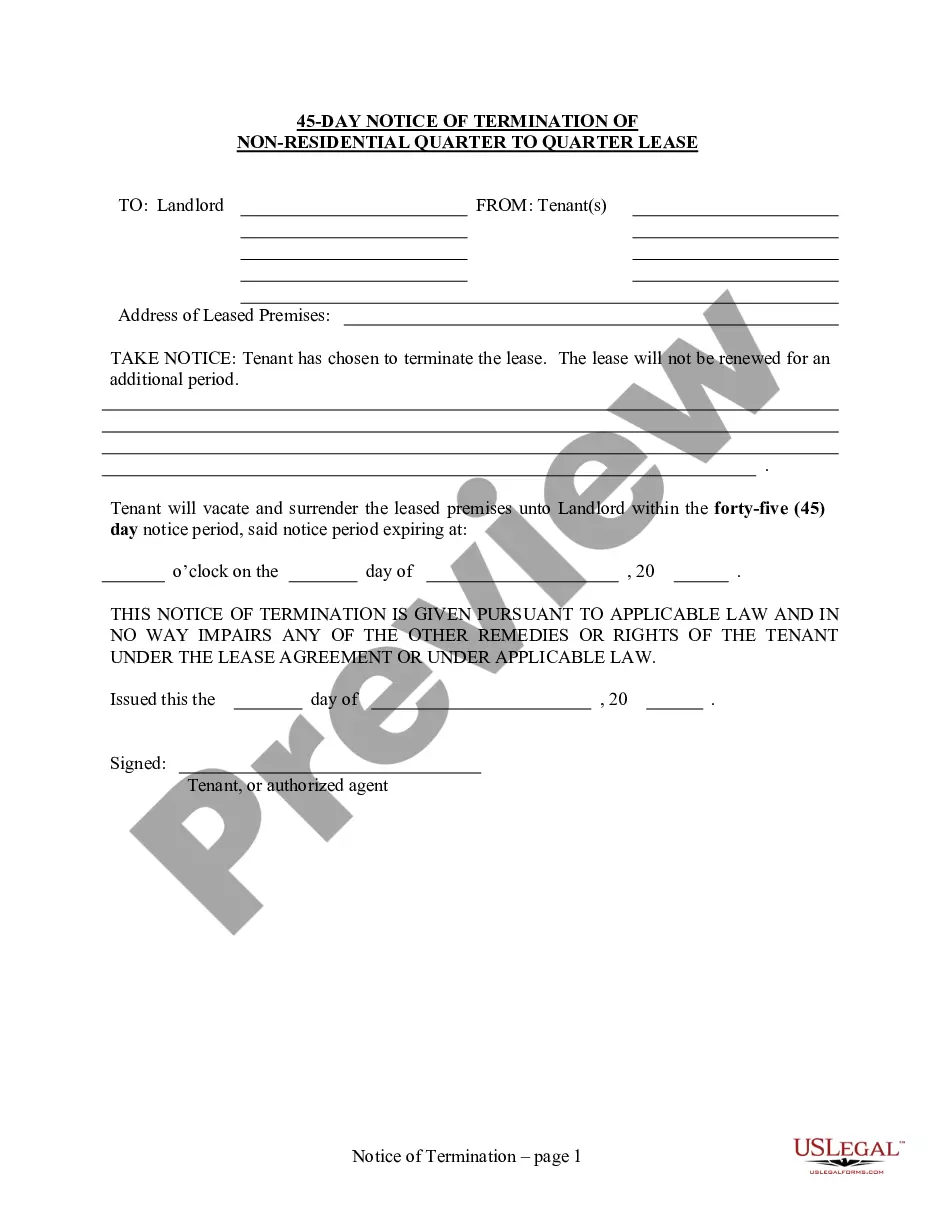

To fill out a Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, begin by entering the names of the borrower and lender at the top. Include the total amount being borrowed and the rate of interest agreed upon. Make sure to specify repayment terms, including dates and payment amounts. Lastly, secure the note with the appropriate legal signatures to ensure its validity.

In Nevada, a promissory note does not necessarily need to be notarized to be enforceable. However, having it notarized can provide an extra layer of verification and protect all parties involved, especially in a situation involving a Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. USLegalForms can help you generate a properly formatted promissory note that meets all legal requirements, ensuring your document stands strong in any legal setting.

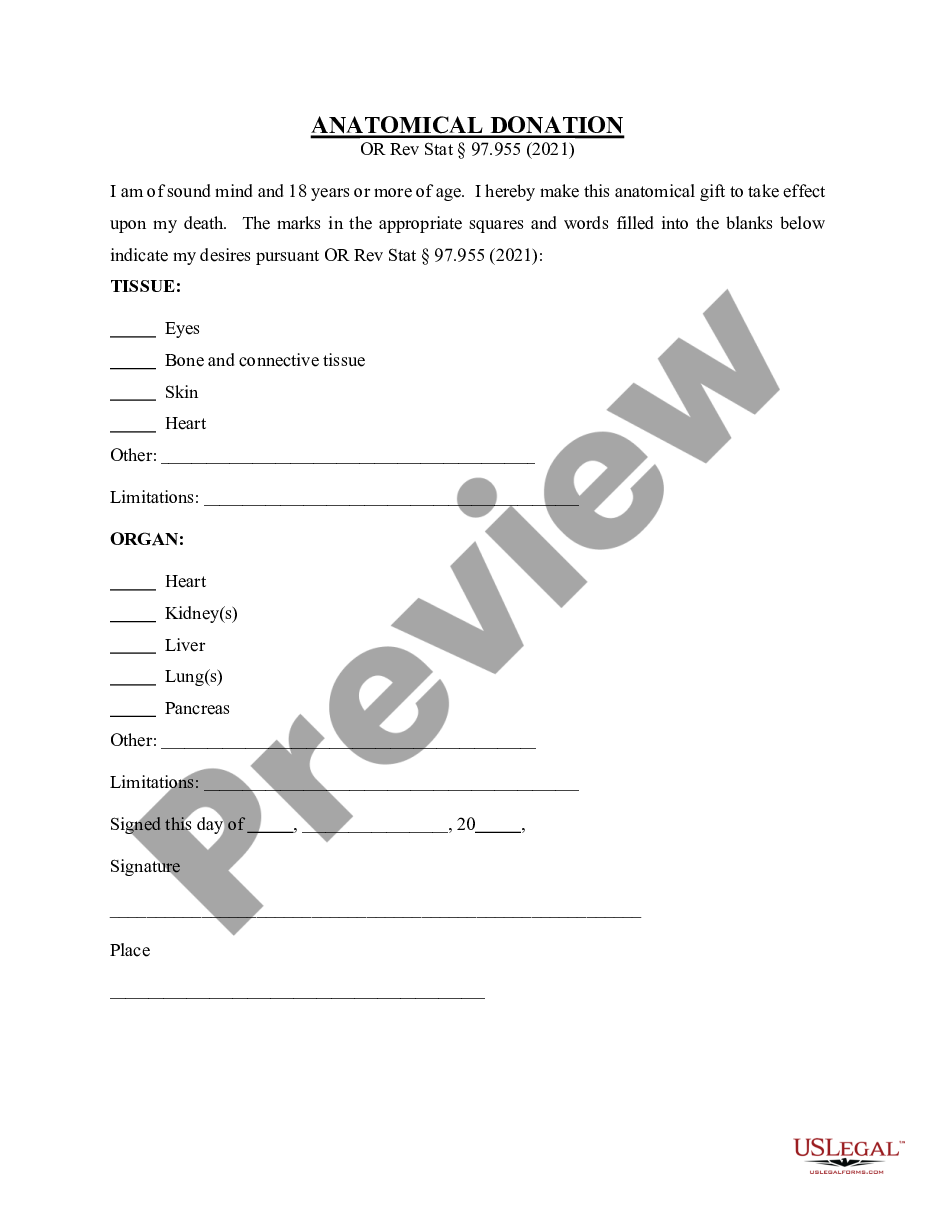

Yes, promissory notes can and often are backed by collateral to enhance security for the lender. This collateral serves as a form of protection against potential default, making the lending arrangement more favorable. When considering the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you not only have a structured repayment plan but also a reliable safety net provided by the collateral.

A promissory note is typically backed by collateral, which can be personal property or real estate. The backing provides assurance to the lender that they will have a way to recoup their investment if the borrower defaults. With the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the real estate itself acts as that backing, protecting the lender's interests while allowing the borrower to secure needed funds.

The document that secures a promissory note to real property is commonly referred to as a deed of trust or a mortgage, depending on your location. This legal instrument creates a lien on the property, which helps protect the lender's interest. By using the Clark Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you formalize this security, enhancing protection for both parties involved.

Once a note has been paid off, it's time to wrap up any loose ends and release the parties from their duties. A clean break will provide peace of mind, discharge all obligations, and lead to an amicable conclusion. A release is the definitive end of the parties' commitments under a note.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances ? if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt ? then, the contract becomes null and void.

A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan.