Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property

Description

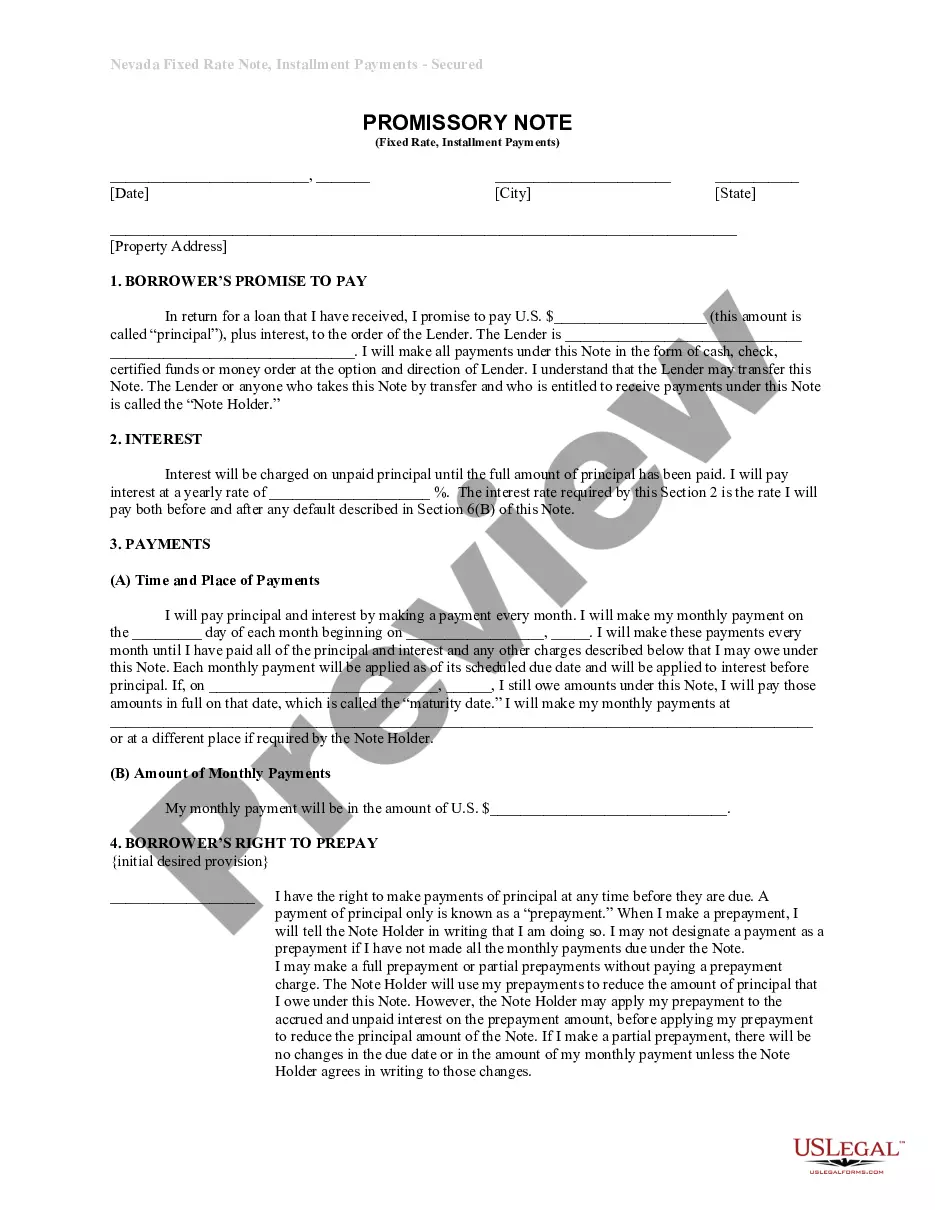

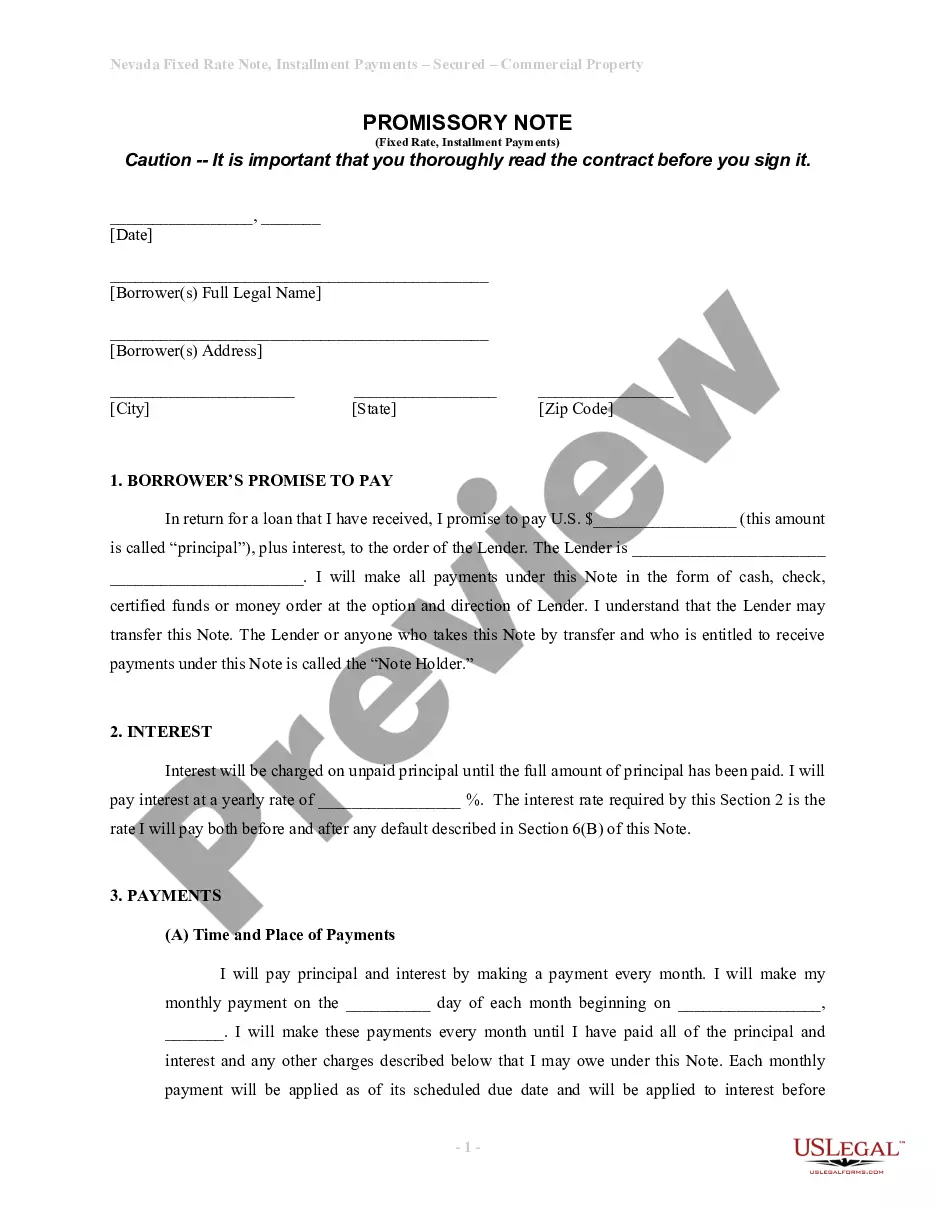

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Personal Property?

Utilize the US Legal Forms to gain immediate access to any form specimen you need.

Our advantageous site with a vast collection of templates makes it easy to locate and obtain nearly any document example you need.

You can download, fill out, and sign the Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property in just a few minutes instead of spending hours searching online for the appropriate template.

Using our library is an excellent method to enhance the security of your record submissions. Our experienced attorneys consistently examine all documents to ensure that the templates are applicable for a specific area and adhere to updated laws and regulations.

US Legal Forms is arguably one of the largest and most reputable form libraries online. We are always available to assist you in virtually any legal procedure, even if it is merely downloading the Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property.

Feel free to take advantage of our service and make your document experience as effective as possible!

- How can you obtain the Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property.

- If you have a subscription, simply Log In to your account. The Download button will be visible on all the samples you view. Furthermore, you can access all previously saved documents in the My documents section.

- If you haven’t created a profile yet, follow the steps below.

- Locate the template you need. Ensure it is the form you were looking for: verify its title and description, and take advantage of the Preview option when available. Otherwise, use the Search field to find the required one.

- Initiate the saving process. Click Buy Now and choose the pricing plan that suits you. Then, register for an account and complete your order using a credit card or PayPal.

- Store the document. Select the format to download the Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property and modify, complete, or sign it according to your needs.

Form popularity

FAQ

Yes, Las Vegas, like the rest of Clark County, does levy property taxes. Property taxes are assessed on real estate but do not extend to personal property, which can lead to significant savings for residents and businesses. If you are exploring financial products, consider how a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property can help you manage your assets effectively. This note can act as a financial tool while taking advantage of favorable tax conditions.

Nevada is one of the few states that does not impose a personal property tax. This means residents can benefit from owning personal items without additional taxation burdens. If you're considering financial options, a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property can be a strategic choice. This note allows you to leverage your personal property without the worry of personal property tax.

Yes, Nevada does impose personal property tax on vehicles. Residents need to account for this tax when budgeting for vehicle ownership. However, you can explore financial solutions such as the Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property to make your vehicle payments more manageable. This option provides structured payment plans that can alleviate some financial pressure.

Several states do not impose personal property taxes on vehicles, which can offer financial relief for car owners. States like Florida, Montana, and New Hampshire are known for this benefit. If you’re interested in financing options, consider utilizing a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property to manage your purchases effectively. This financing can help you navigate costs related to vehicle ownership.

Property taxes in Nevada are billed annually, and you typically receive your bill in the mail. The amount is determined based on the assessed value of your property and the local tax rate. When managing a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property, it's important to stay updated on your property tax billing schedule. Timely payments can help you maintain ownership and avoid penalties.

An unsecured property tax bill in Nevada refers to taxes assessed on personal property that isn't tied to real estate. This type of bill usually applies to items like vehicles, equipment, and inventory. For those looking at a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property, being aware of unsecured tax obligations is essential. Understanding how these taxes work aids in better financial planning and protects your investment.

In Nevada, property taxes can remain unpaid for several years before the county takes action. Typically, after three years of non-payment, the county can initiate foreclosure proceedings. This timeline is important for anyone considering a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property, as unpaid taxes can affect the value of your secured assets. Staying informed about your property tax obligations helps you manage your finances effectively.

In Nevada, certain individuals and organizations may qualify for exemptions from real property taxes. Common exemptions include those for veterans, active-duty military members, and some charitable organizations. Knowing these exemptions can be beneficial if you're looking to secure a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property. Taking advantage of available exemptions can significantly improve your financial situation.

A personal property declaration is a document that individuals submit to notify the county about their personal property holdings. This can include items such as vehicles, equipment, and business assets. When considering a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property, understanding how these declarations impact your obligations is crucial. By declaring your personal property correctly, you fulfill legal requirements and can enhance your financial strategies.

Yes, Nevada imposes personal property tax on vehicles, which includes cars and trucks. Vehicle owners must report their automobiles as part of their personal property declarations for tax assessments. If you are looking into a Clark Nevada Installments Fixed Rate Promissory Note Secured by Personal Property, be aware of how vehicle taxes might influence your overall financial obligations.