New Hampshire Motion for Summary Administration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

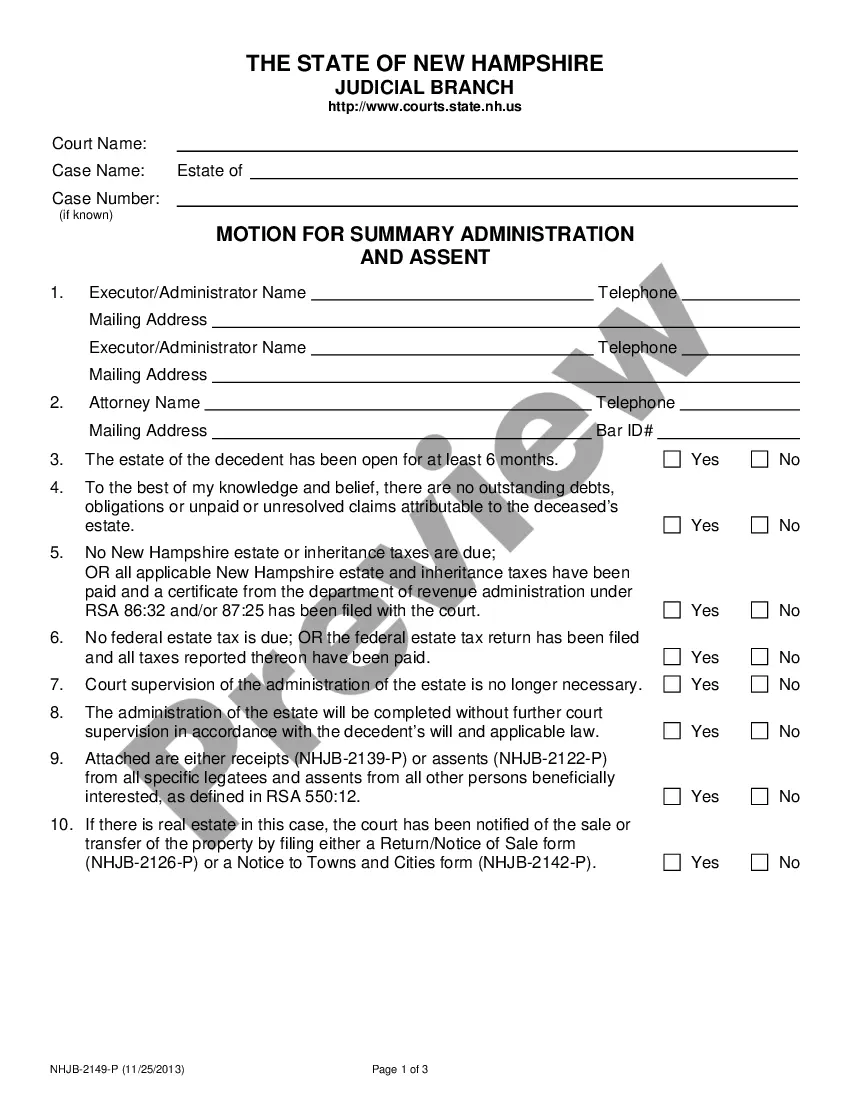

How to fill out New Hampshire Motion For Summary Administration?

Avoid expensive attorneys and find the New Hampshire Motion for Summary Administration you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to find and download legal and tax forms. Read their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms subscribers simply must log in and download the specific document they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the guidelines listed below:

- Ensure the New Hampshire Motion for Summary Administration is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the sample.

- If you are confident the document suits you, click on Buy Now.

- In case the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you are able to fill out the New Hampshire Motion for Summary Administration manually or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

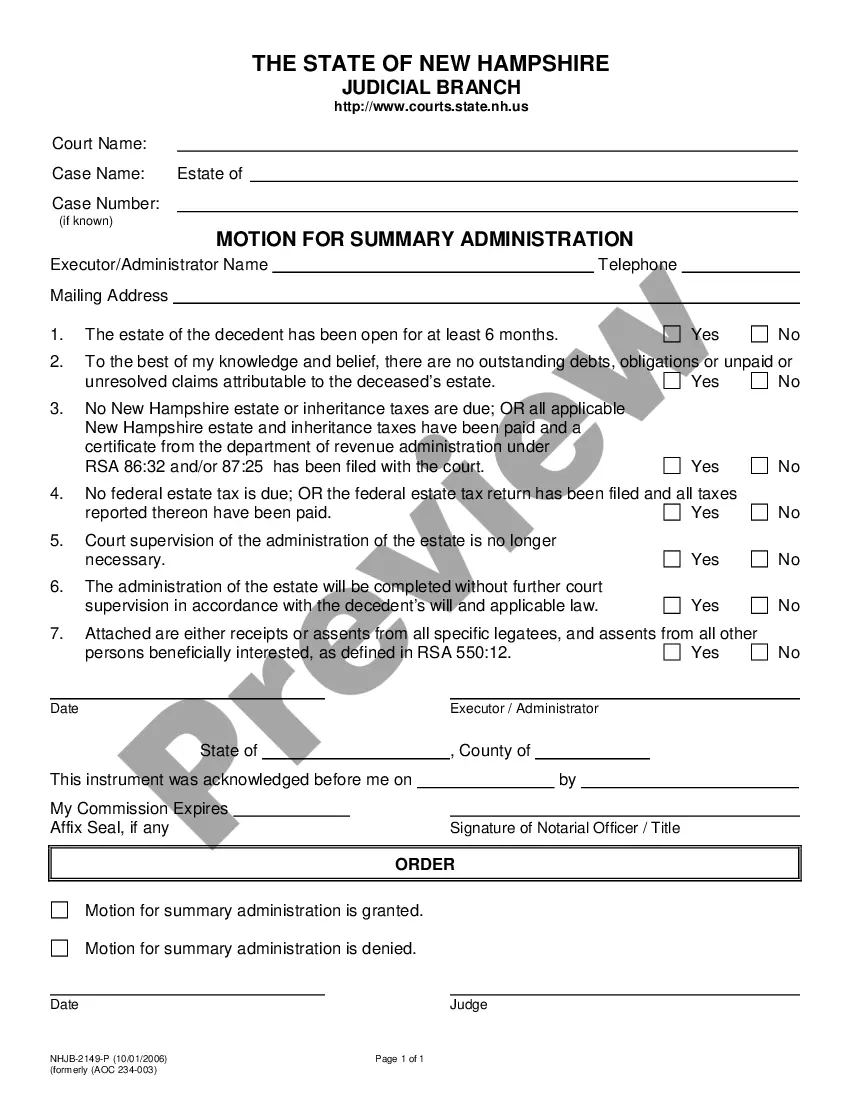

In a summary administration, you still have to go to probate court, but the process is simpler, faster, and more streamlined than an ordinary probate case. You may file for summary administration if: The estate is worth $200,000 or less, or. The decedent has been deceased for over five years, or.

Summary administration limits what you can do with the estate. This process may go faster than formal administration. No personal representative is appointed.

An Administrator Bond is a type of court bond that promises that the Administrator will properly use and disburse the estate according to law. If the Administrator uses/disburses the estate for personal gain instead of how the deceased would have wished, someone can make a make a claim on the Administrator Bond.

Small estates involving only personal property with a value of $10,000 or less are eligible for a simplified form of administration called Voluntary or Small Estate Administration, if the decedent died prior to January 1, 2006.

Formal Administration is Florida's traditional form of probate. Formal administration starts with a petition to open the estate and an appointment of a Personal Representative (or PR; known as an "executor" or "administrator" in other states).

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.