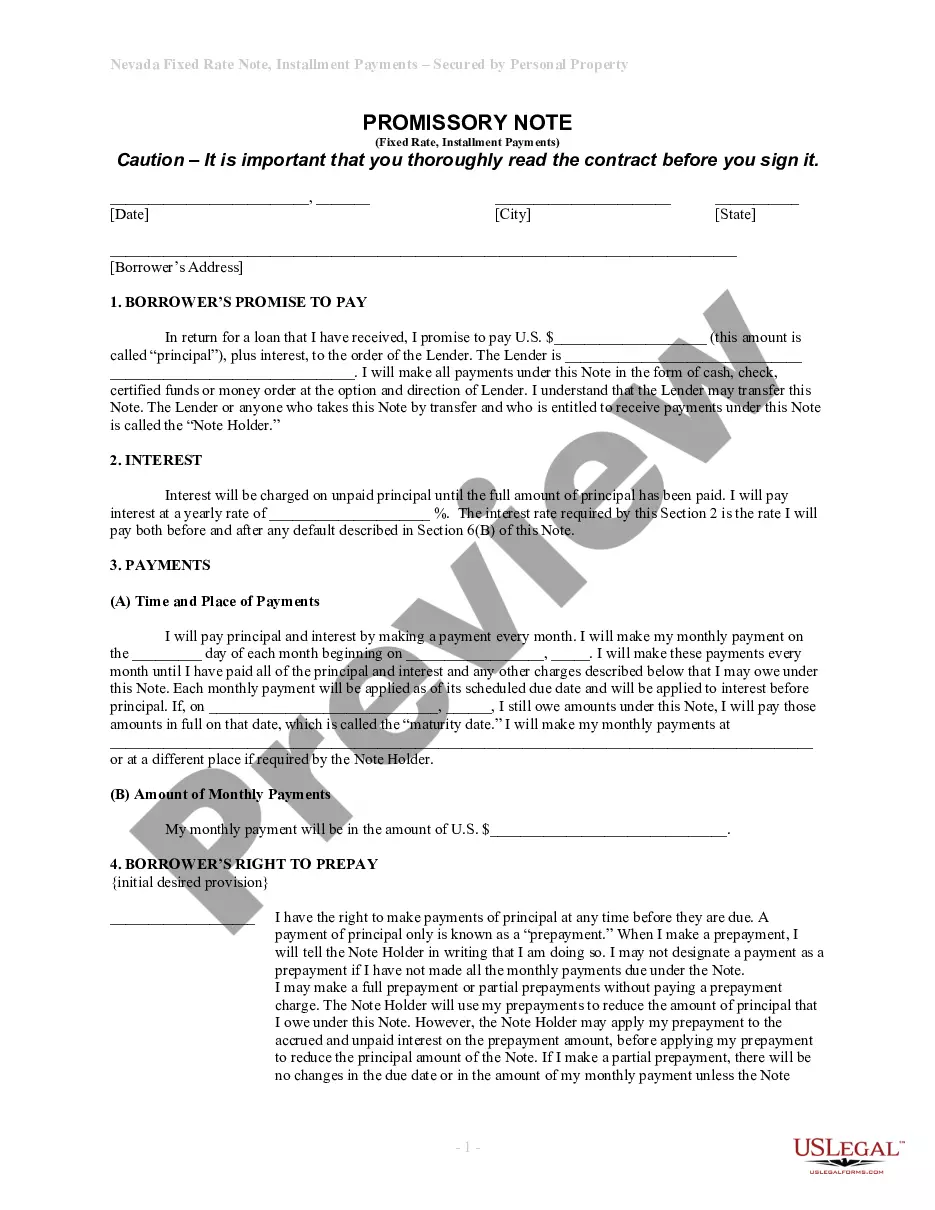

Las Vegas Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously utilized our service, sign in to your account and store the Las Vegas Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your device by clicking the Download button. Ensure your subscription is active. If not, update it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have purchased: you can find it in your profile in the My documents section whenever you need to access it again. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve chosen an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it doesn’t suit you, employ the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Enter your credit card information or the PayPal option to finish the transaction.

- Retrieve your Las Vegas Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

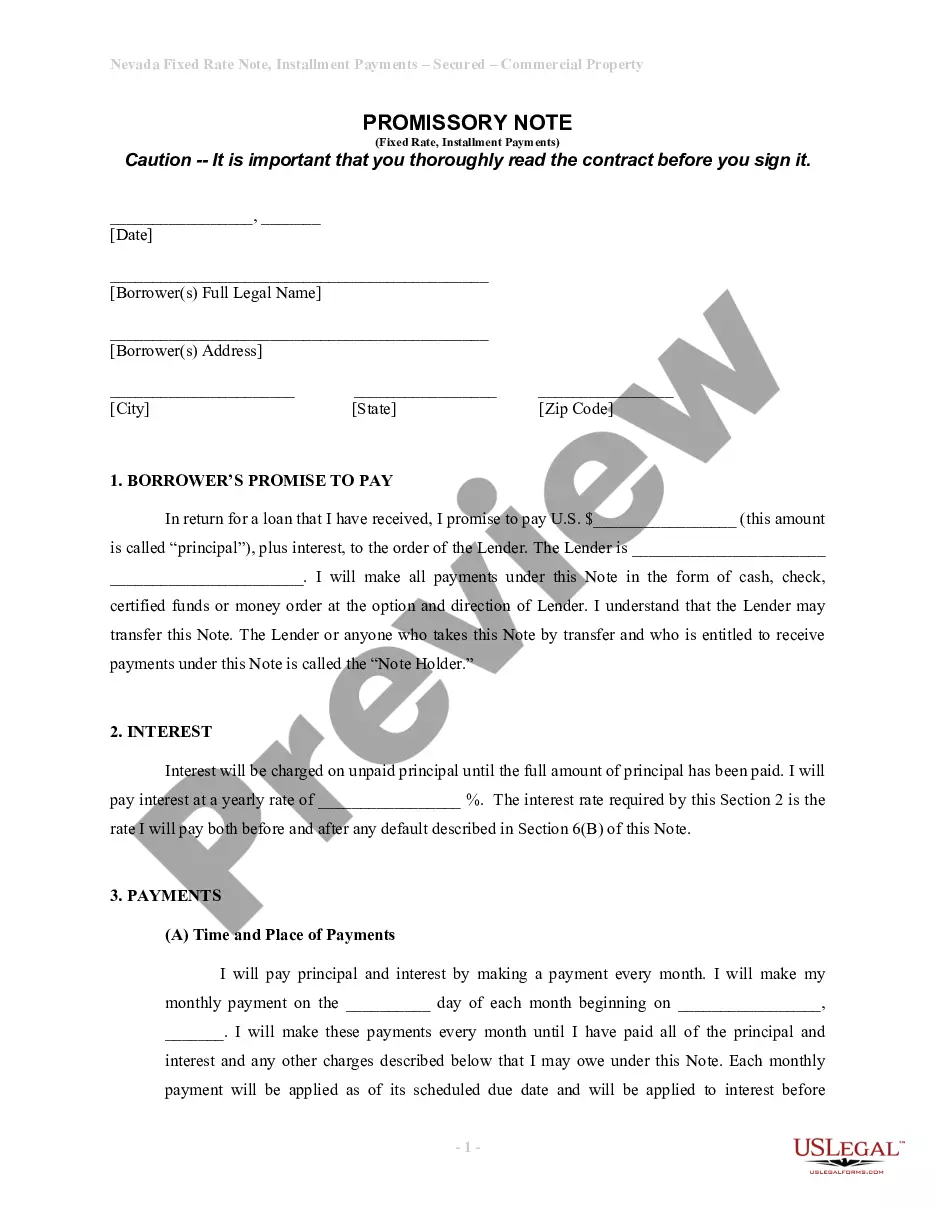

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A secured promissory note should carefully outline its repayment, and default terms. For example, it should spell out the steps required for seizing collateral. It should also state if there are any grace periods for late payments, and name who shall pay for costs, and legal fees if there is a default.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

The promissory note, a contract separate from the mortgage, is the document that creates the loan obligation. This document contains the borrower's promise to repay the amount borrowed. If you sign a promissory note, you're personally liable for repaying the loan.