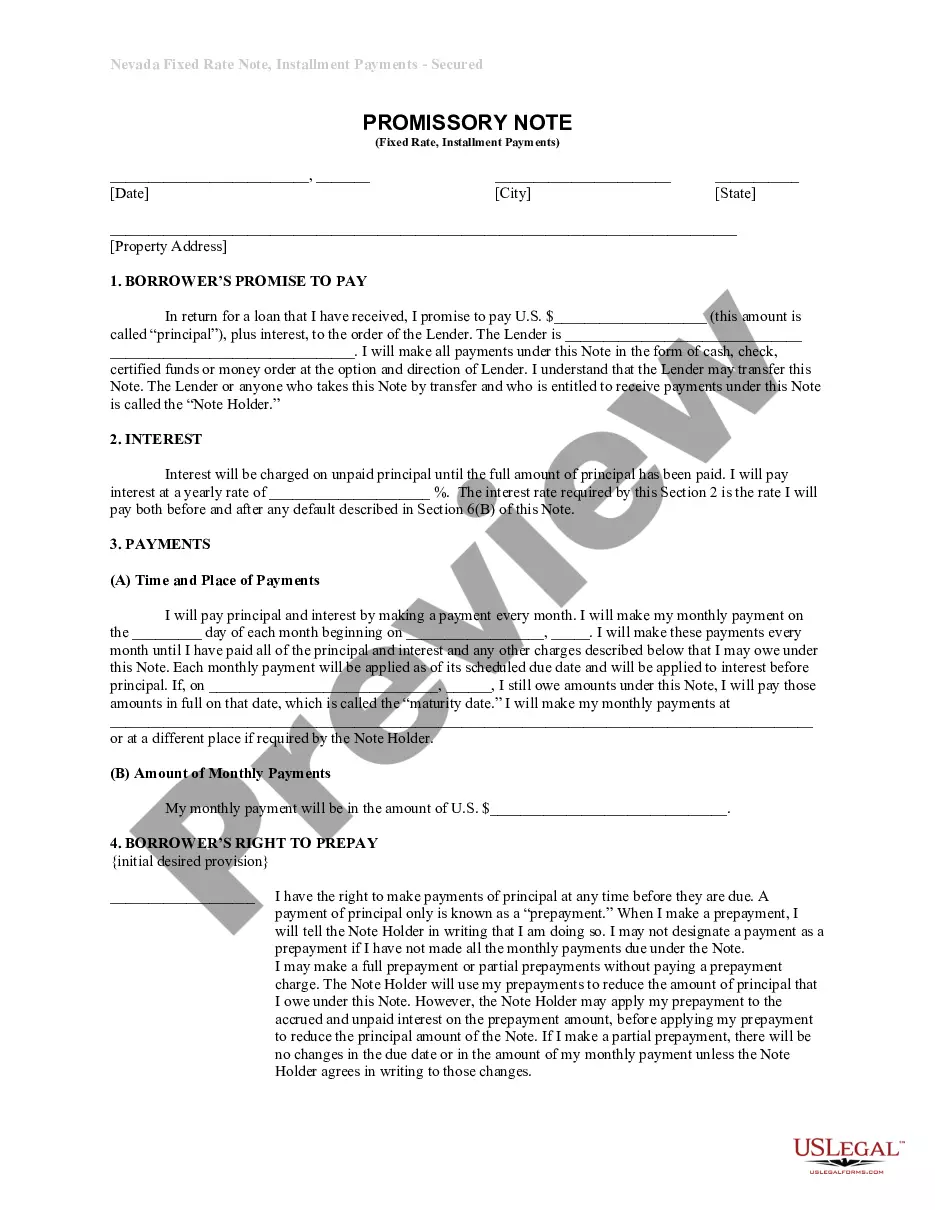

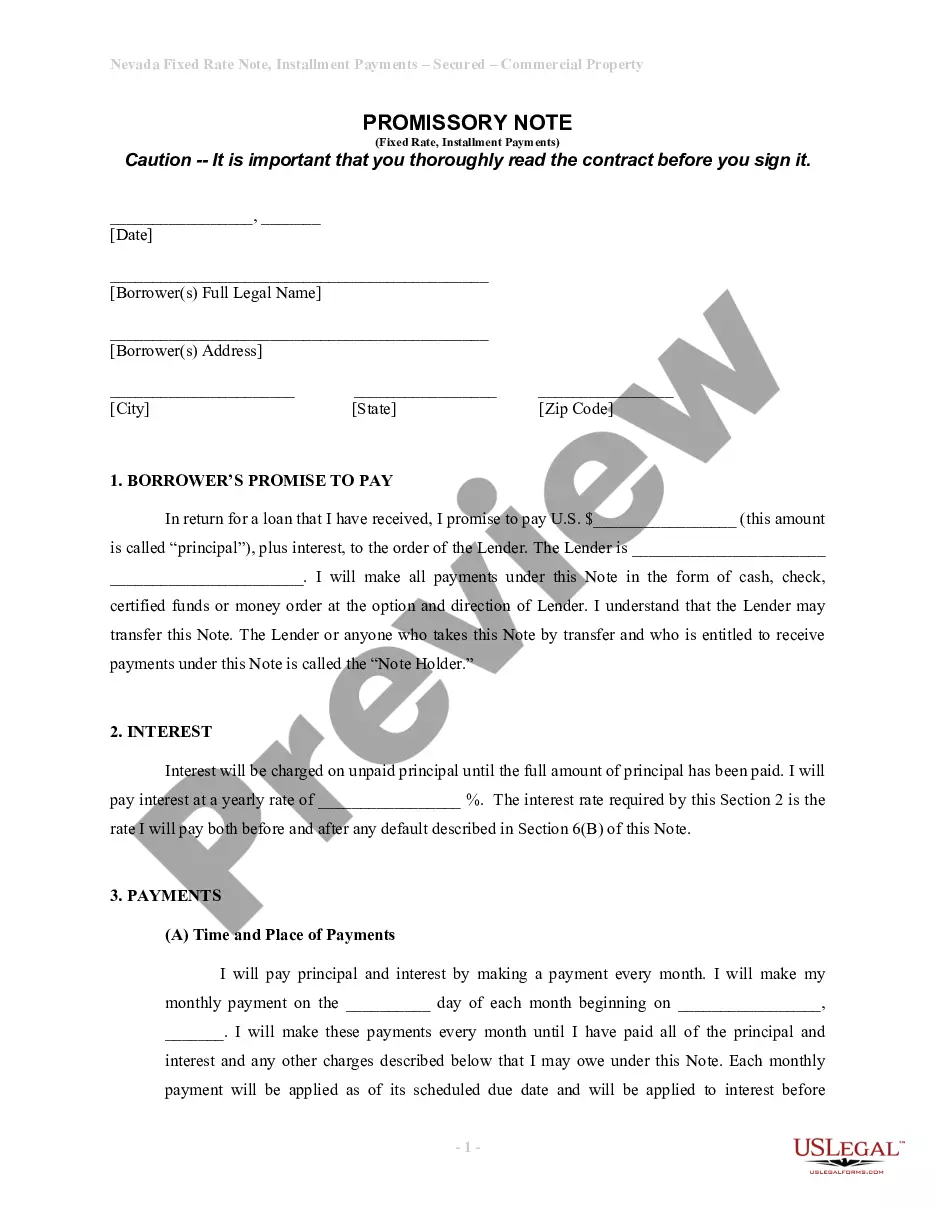

Las Vegas Nevada Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Personal Property?

Locating authenticated templates that adhere to your local regulations can be challenging unless you take advantage of the US Legal Forms library.

This is an online database of over 85,000 legal documents tailored for both personal and business purposes, covering a variety of real-world situations.

All the paperwork is effectively organized by field of application and legal jurisdiction, making it simple and quick to search for the Las Vegas Nevada Installments Fixed Rate Promissory Note Secured by Personal Property.

Maintaining organized paperwork in accordance with legal regulations is critically important. Utilize the US Legal Forms library to always have vital document templates readily available!

- Examine the Preview mode and document description.

- Ensure you have chosen the correct template that fulfills your specifications and fully aligns with your local legal standards.

- Look for an alternative template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. If the payor does not have sufficient assets, the payee is out of luck.

A secured promissory note should carefully outline its repayment, and default terms. For example, it should spell out the steps required for seizing collateral. It should also state if there are any grace periods for late payments, and name who shall pay for costs, and legal fees if there is a default.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.