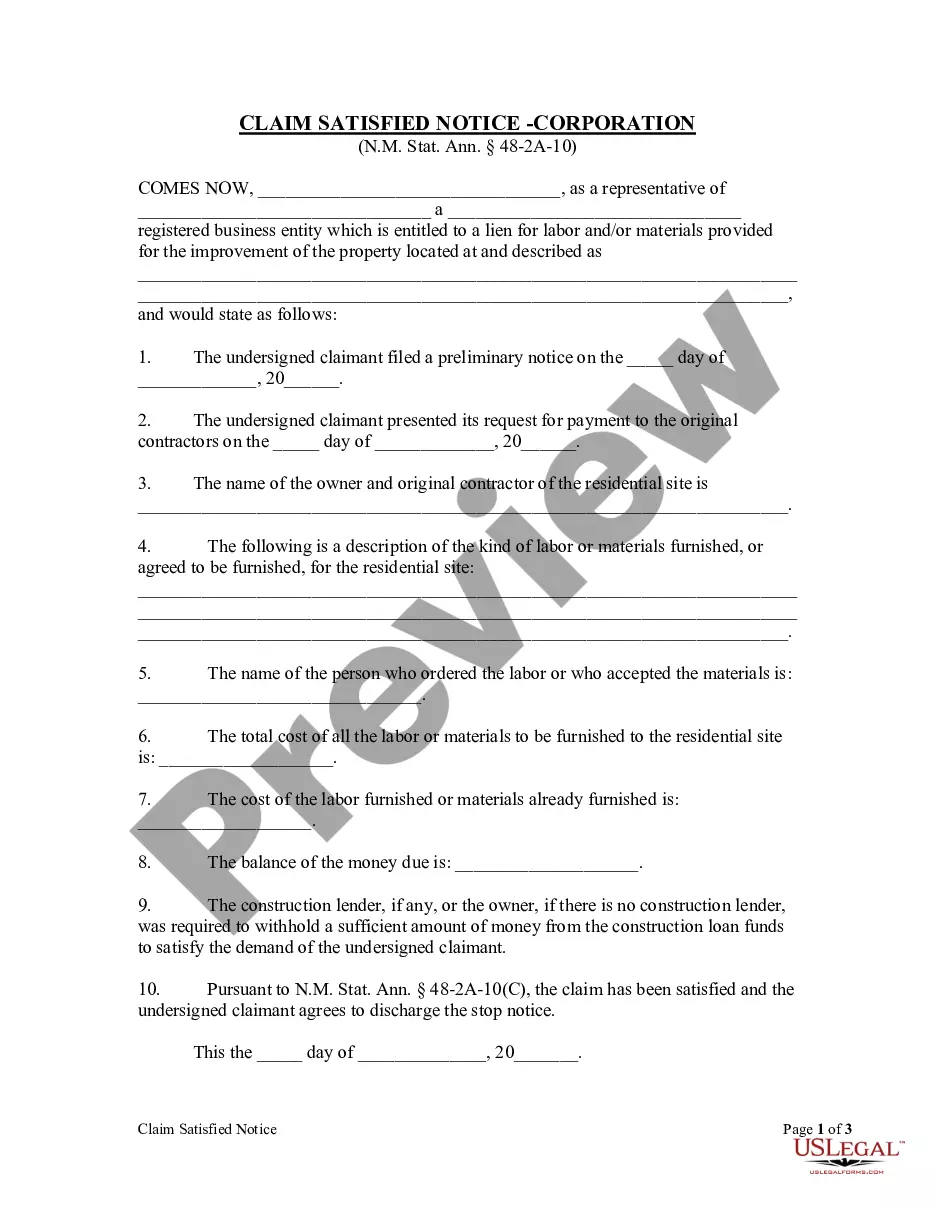

This Claim Satisfied Notice form is for use by a corporate or LLC claimant entitled to a lien for labor and/or materials provided for the improvement of the property to provide a statement that his or her claim has been satisfied and the claimant agrees to discharge the stop notice, and other information including the date of filing of the preliminary notice, the date the claimant presented his or her request for payment to the original contractors, the name of the owner and original contractor of the residential site, a description of the kind of labor or materials furnished, or agreed to be furnished, for the residential site, the name of the person who ordered the labor or who accepted the materials, the total cost of all the labor or materials to be and already furnished to the residential site, and the balance of the money due.

Albuquerque New Mexico Claim Satisfied Notice - Corporation or LLC

Description

How to fill out New Mexico Claim Satisfied Notice - Corporation Or LLC?

If you are looking for a legitimate form, it's incredibly challenging to select a more user-friendly platform than the US Legal Forms website – one of the most comprehensive online libraries.

Here you can find a vast array of document samples for business and personal purposes sorted by categories and states, or keywords.

Utilizing our sophisticated search feature, obtaining the latest Albuquerque New Mexico Claim Satisfied Notice - Corporation or LLC is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select the format and download it to your device. Edit as needed. Complete, modify, print, and sign the downloaded Albuquerque New Mexico Claim Satisfied Notice - Corporation or LLC.

- Moreover, the accuracy of each and every document is validated by a team of professional attorneys who consistently review the templates on our site and update them in line with the latest state and county regulations.

- If you are already familiar with our platform and have an account, all you need to obtain the Albuquerque New Mexico Claim Satisfied Notice - Corporation or LLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have opened the form you wish to access. Review its description and utilize the Preview function (if present) to examine its content. If it does not meet your requirements, use the Search option at the top of the page to find the desired document.

- Confirm your choice. Click the Buy now button. Then, select your preferred subscription plan and provide your details to create an account.

Form popularity

FAQ

corporations, limited liability companies and other passthrough entities doing business in the state must file a New Mexico income tax return.

It can secure your liability protection. This is crucial to understand, as it's the primary main reason that your single-member LLC needs an operating agreement. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.

New Mexico imposes its corporate income tax on the net income of every domestic corporation and every foreign corporation that: Is employed or engaged in the transaction of business in, into, or from this state, or. Has income from property or employment within this state.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

New Mexico does not require LLCs to file an annual report. New Mexico imposes a franchise tax on LLCs if they paid federal income tax. The franchise tax is filed along with the state income tax, and is due by the 15th day of the third month following the close of the tax year.

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

An LLC operating agreement is not required in New Mexico, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

LLC self-employment taxes You'll pay these taxes directly to the IRS in the form of self-employment taxes. The total self-employment tax is 15.3%, and it's broken down into several parts: 12.4% social security tax on earnings up to $137,700. 2.9% Medicare tax on all earnings.